策略验证_指标买点分析技法_运用MACD确定最佳买点

写在前面:

1. 本文中提到的“股票策略校验工具”的具体使用操作请查看该博文;

2. 文中知识内容来自书籍《同花顺炒股软件从入门到精通》

3. 本系列文章是用来学习技法,文中所得内容都仅仅只是作为演示功能使用

目录

解说

策略代码

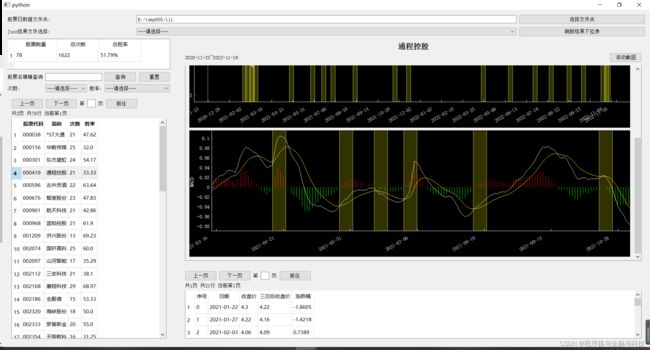

结果

解说

平滑异同移动平均线(Moving Average Convergence Divergence,简称MACD指标),也称移动平均聚散指标。MACD是查拉尔·阿佩尔于1979年提出的,它是一项利用短期(常用为12日)移动平均线与长期(常用为26日)移动平均线之间的聚合与分离状况,对买进、卖出时机做出研判的技术指标。

MACD就是用快速和慢速的两条均线的交叉换位、合并分离的特征,来分析研究股市的走势,从而正确引导投资者合理地判断股票的买点和卖点。

MACD指标对买点的应用原则如下。【下文中提到的MACD线在本文策略中表达为DEA线】

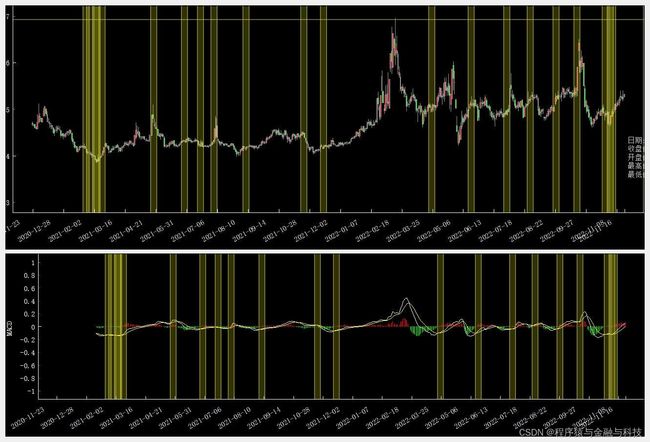

1)MACD线的交叉具有一定的中期提示作用。如果处于0轴以下,并出现两次交叉,则是明显的买进信号。

2)当DIF与MACD都在0轴以上,而DIF向上突破MACD时,表明股市处于一种强势之中,股价将再次上涨,可以继续买进股票或持续待涨,这就是MACD指标“黄金交叉”的另一种形式。

3)当红柱持续放大时,表明股市处于牛市行情中,股价将继续上涨,这时应持股待涨或短线买入股票,直到红柱无法再放大时才可以考虑卖出。

4)当绿柱开始消失、红柱开始放出时,这也是股市转市信号之一,表明股市的下跌行情已经结束,股价将开始加速上升,这时应开始继续买入股票或持股待涨。

策略代码

def excute_strategy(base_data,data_dir):

'''

指标买点分析技法 - 运用MACD确定最佳买点

解析:

1. 处于0轴以下,并出现两次交叉,是明显的买进信号。

2. DIF和DEA在0轴以上,DIF上穿DEA

3. 红柱持续放大

4. 绿柱开始消失,红柱开始放出

自定义:

1. 红柱持续放大 =》 连续三日涨跌幅为正

2. 买入时点 =》 走势确定后下一交易日

3. 胜 =》 买入后第三个交易日收盘价上升,为胜

只计算最近两年的数据

:param base_data:股票代码与股票简称 键值对

:param data_dir:股票日数据文件所在目录

:return:

'''

import pandas as pd

import numpy as np

import talib,os

from datetime import datetime

from dateutil.relativedelta import relativedelta

from tools import stock_factor_caculate

def res_pre_two_year_first_day():

pre_year_day = (datetime.now() - relativedelta(years=2)).strftime('%Y-%m-%d')

return pre_year_day

caculate_start_date_str = res_pre_two_year_first_day()

dailydata_file_list = os.listdir(data_dir)

total_count = 0

total_win = 0

check_count = 0

list_list = []

detail_map = {}

factor_list = ['MACD']

ma_list = []

for item in dailydata_file_list:

item_arr = item.split('.')

ticker = item_arr[0]

secName = base_data[ticker]

file_path = data_dir + item

df = pd.read_csv(file_path,encoding='utf-8')

# 删除停牌的数据

df = df.loc[df['openPrice'] > 0].copy()

df['o_date'] = df['tradeDate']

df['o_date'] = pd.to_datetime(df['o_date'])

df = df.loc[df['o_date'] >= caculate_start_date_str].copy()

# 保存未复权收盘价数据

df['close'] = df['closePrice']

# 计算前复权数据

df['openPrice'] = df['openPrice'] * df['accumAdjFactor']

df['closePrice'] = df['closePrice'] * df['accumAdjFactor']

df['highestPrice'] = df['highestPrice'] * df['accumAdjFactor']

df['lowestPrice'] = df['lowestPrice'] * df['accumAdjFactor']

if len(df)<=0:

continue

# 开始计算

for item in factor_list:

df = stock_factor_caculate.caculate_factor(df,item)

for item in ma_list:

df = stock_factor_caculate.caculate_factor(df,item)

df.reset_index(inplace=True)

df['i_row'] = [i for i in range(len(df))]

df['three_chg'] = round(((df['close'].shift(-3) - df['close']) / df['close']) * 100, 4)

df['three_after_close'] = df['close'].shift(-3)

# DIFF DEA MACD

df['one_yeah'] = 0

df.loc[(df['DIFF']<0) & (df['DEA']<0) & (df['DIFF'].shift(1)>df['DEA'].shift(1)) & (df['DIFF']<=df['DEA']),'one_yeah'] = 1

df.loc[(df['DIFF']<0) & (df['DEA']<0) & (df['DIFF'].shift(1)=df['DEA']),'one_yeah'] = 1

df['two_yeah'] = 0

df.loc[(df['DIFF'].shift(1)>0) & (df['DIFF']<=0),'two_yeah'] = 1

df.loc[(df['DIFF'].shift(1)<0) & (df['DIFF']>=0),'two_yeah'] = 1

df.loc[(df['DEA'].shift(1)>0) & (df['DEA']<=0),'two_yeah'] = 1

df.loc[(df['DEA'].shift(1)<0) & (df['DEA']>=0),'two_yeah'] = 1

zero_list = df.loc[df['two_yeah']==1]['i_row'].values.tolist()

one_list = df.loc[df['one_yeah']==1]['i_row'].values.tolist()

target_one_list = []

for i in range(0,len(one_list)-2):

pre_node = one_list[i]

after_node = one_list[i+1]

enter_yeah = True

for i0 in zero_list:

if i0>after_node:

break

if i0>pre_node and i00:

df.loc[df['i_row'].isin(target_one_list),'target_yeah'] = 1

df.loc[(df['DIFF']>0) & (df['DEA']>0) & (df['DIFF'].shift(1)=df['DEA']),'target_yeah'] = 1

df['macd_chg'] = df['MACD'] - df['MACD'].shift(1)

df['three_yeah'] = 0

df.loc[(df['MACD'].shift(2)>0) & (df['MACD'].shift(1)>0) & (df['MACD']>0) & (df['macd_chg'].shift(2)>0) & (df['macd_chg'].shift(1)>0) & (df['macd_chg']>0),'three_yeah'] = 1

df['four_yeah'] = 0

df.loc[(df['MACD'].shift(1)<0) & (df['MACD']>=0),'four_yeah'] = 1

four_list = df.loc[df['four_yeah']==1]['i_row'].values.tolist()

three_list = df.loc[df['three_yeah']==1]['i_row'].values.tolist()

target_three_list = []

two_list = four_list + three_list

two_list.sort()

for item in four_list:

i = two_list.index(item)

if i < len(two_list)-1:

target_three_list.append(two_list[i+1])

df.loc[df['MACD'].isin(target_three_list),'target_yeah'] = 1

df.loc[(df['MACD'].shift(1)<0) & (df['MACD']>0),'target_yeah'] = 1

i_row_list = df.loc[df['target_yeah']==1]['i_row'].values.tolist()

node_count = 0

node_win = 0

duration_list = []

table_list = []

for i,row0 in enumerate(i_row_list):

row = row0 + 1

if row >= len(df):

continue

date_str = df.iloc[row]['tradeDate']

cur_close = df.iloc[row]['close']

three_after_close = df.iloc[row]['three_after_close']

three_chg = df.iloc[row]['three_chg']

table_list.append([

i,date_str,cur_close,three_after_close,three_chg

])

duration_list.append([row-2,row+3])

node_count += 1

if three_chg<0:

node_win +=1

pass

list_list.append({

'ticker':ticker,

'secName':secName,

'count':node_count,

'win':0 if node_count<=0 else round((node_win/node_count)*100,2)

})

detail_map[ticker] = {

'table_list': table_list,

'duration_list': duration_list

}

total_count += node_count

total_win += node_win

check_count += 1

pass

df = pd.DataFrame(list_list)

results_data = {

'check_count':check_count,

'total_count':total_count,

'total_win':0 if total_count<=0 else round((total_win/total_count)*100,2),

'start_date_str':caculate_start_date_str,

'df':df,

'detail_map':detail_map,

'factor_list':factor_list,

'ma_list':ma_list

}

return results_data 结果

本文校验的数据是随机抽取的81个股票