欧奈尔的RPS指标如何使用到股票预测

前言

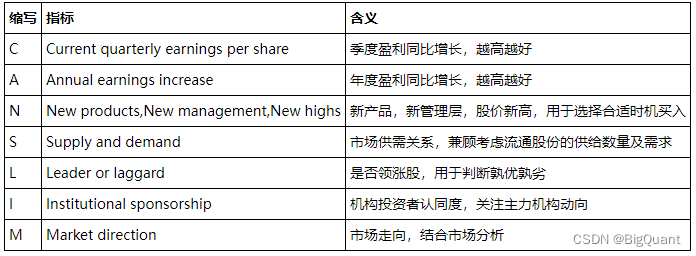

1988年,欧奈尔将他的投资理念写成了《笑傲股市How to Make Money in Stocks》。书中总结了选股模式CANSLIM模型,每一个字母都代表一种尚未发动大涨势的潜在优质股的特征。

视频讲解

如何结合欧奈尔的RPS指标开发策略

代码示例

# 回测引擎:初始化函数,只执行一次

def m19_initialize_bigquant_run(context):

# 加载预测数据

context.ranker_prediction = context.options['data'].read_df()

# 系统已经设置了默认的交易手续费和滑点,要修改手续费可使用如下函数

context.set_commission(PerOrder(buy_cost=0.0003, sell_cost=0.0013, min_cost=5))

# 预测数据,通过options传入进来,使用 read_df 函数,加载到内存 (DataFrame)

# 设置买入的股票数量,这里买入预测股票列表排名靠前的5只

stock_count = 5

# 每只的股票的权重,如下的权重分配会使得靠前的股票分配多一点的资金,[0.339160, 0.213986, 0.169580, ..]

context.stock_weights = T.norm([1 / math.log(i + 2) for i in range(0, stock_count)])

# 设置每只股票占用的最大资金比例

context.max_cash_per_instrument = 0.2

context.options['hold_days'] = 5

# 回测引擎:每日数据处理函数,每天执行一次

def m19_handle_data_bigquant_run(context, data):

# 按日期过滤得到今日的预测数据

today = data.current_dt.strftime('%Y-%m-%d')

ranker_prediction = context.ranker_prediction[

context.ranker_prediction.date == today]

# 1. 资金分配

# 平均持仓时间是hold_days,每日都将买入股票,每日预期使用 1/hold_days 的资金

# 实际操作中,会存在一定的买入误差,所以在前hold_days天,等量使用资金;之后,尽量使用剩余资金(这里设置最多用等量的1.5倍)

is_staging = context.trading_day_index < context.options['hold_days'] # 是否在建仓期间(前 hold_days 天)

cash_avg = context.portfolio.portfolio_value / context.options['hold_days']

cash_for_buy = min(context.portfolio.cash, (1 if is_staging else 1.5) * cash_avg)

cash_for_sell = cash_avg - (context.portfolio.cash - cash_for_buy)

positions = {e.symbol: p.amount * p.last_sale_price

for e, p in context.portfolio.positions.items()}

#--------------------------START:持有固定天数卖出(不含建仓期)-----------

current_stopdays_stock = []

positions_lastdate = {e.symbol:p.last_sale_date for e,p in context.portfolio.positions.items()}

# 不是建仓期(在前hold_days属于建仓期)

if not is_staging:

for instrument in positions.keys():

#使用交易天数

dt = pd.to_datetime(D.trading_days(end_date = today).iloc[-context.options['hold_days']].values[0])

if pd.to_datetime(positions_lastdate[instrument].strftime('%Y-%m-%d')) <= dt and data.can_trade(context.symbol(instrument)):

context.order_target_percent(context.symbol(instrument), 0)

cash_for_sell -= positions[instrument]

#------------------------- END:持有固定天数卖出-----------------------

# 2. 生成卖出订单:hold_days天之后才开始卖出;对持仓的股票,按机器学习算法预测的排序末位淘汰

if not is_staging and cash_for_sell > 0:

equities = {e.symbol: e for e, p in context.portfolio.positions.items()}

instruments = list(reversed(list(ranker_prediction.instrument[ranker_prediction.instrument.apply(

lambda x: x in equities)])))

for instrument in instruments:

context.order_target(context.symbol(instrument), 0)

cash_for_sell -= positions[instrument]

if cash_for_sell <= 0:

break

# 3. 生成买入订单:按机器学习算法预测的排序,买入前面的stock_count只股票

buy_cash_weights = context.stock_weights

buy_instruments = list(ranker_prediction.instrument[:len(buy_cash_weights)])

max_cash_per_instrument = context.portfolio.portfolio_value * context.max_cash_per_instrument

for i, instrument in enumerate(buy_instruments):

cash = cash_for_buy * buy_cash_weights[i]

if cash > max_cash_per_instrument - positions.get(instrument, 0):

# 确保股票持仓量不会超过每次股票最大的占用资金量

cash = max_cash_per_instrument - positions.get(instrument, 0)

if cash > 0:

context.order_value(context.symbol(instrument), cash)

# 回测引擎:准备数据,只执行一次

def m19_prepare_bigquant_run(context):

pass

m1 = M.instruments.v2(

start_date='2019-01-01',

end_date='2021-12-31',

market='CN_STOCK_A',

instrument_list='',

max_count=0

)

m2 = M.advanced_auto_labeler.v2(

instruments=m1.data,

label_expr="""# #号开始的表示注释

# 0. 每行一个,顺序执行,从第二个开始,可以使用label字段

# 1. 可用数据字段见 https://bigquant.com/docs/develop/datasource/deprecated/history_data.html

# 添加benchmark_前缀,可使用对应的benchmark数据

# 2. 可用操作符和函数见 `表达式引擎 `_

# 计算收益:5日收盘价(作为卖出价格)除以明日开盘价(作为买入价格)

shift(close, -5) / shift(open, -1)

# 极值处理:用1%和99%分位的值做clip

clip(label, all_quantile(label, 0.01), all_quantile(label, 0.99))

# 将分数映射到分类,这里使用20个分类

all_wbins(label, 20)

# 过滤掉一字涨停的情况 (设置label为NaN,在后续处理和训练中会忽略NaN的label)

where(shift(high, -1) == shift(low, -1), NaN, label)

""" ,

start_date='',

end_date='',

benchmark='000300.HIX',

drop_na_label=True,

cast_label_int=True

)

m3 = M.input_features.v1(

features="""# #号开始的表示注释

# 多个特征,每行一个,可以包含基础特征和衍生特征

return_5

return_10

return_20

avg_amount_0/avg_amount_5

avg_amount_5/avg_amount_20

rank_avg_amount_0/rank_avg_amount_5

rank_avg_amount_5/rank_avg_amount_10

rank_return_0

rank_return_5

rank_return_10

rank_return_0/rank_return_5

rank_return_5/rank_return_10

pe_ttm_0

"""

)

m4 = M.input_features.v1(

features_ds=m3.data,

features="""# _PRS250=(close_0-shift(close_0,250))/shift(close_0,250)

# PRS250=rank(_PRS250)

# _PRS120=(close_0-shift(close_0,120))/shift(close_0,120)

# PRS120=rank(_PRS120)

# t1=where(PRS250<0.1,1,0)

# t2=where(PRS120<0.1,1,0)

# flag=where(max(t1,t2)==1,1,0)

PRS10=rank(return_10)

PRS20=rank(return_20)

PRS60=rank(return_60)

t1=where(PRS10<0.1,1,0)

t2=where(PRS20<0.1,1,0)

t3=where(PRS60<0.1,1,0)

flag=where(max(t1,t2,t3)==1,1,0)

rank_fs_roe_ttm_0"""

)

m15 = M.general_feature_extractor.v7(

instruments=m1.data,

features=m3.data,

start_date='',

end_date='',

before_start_days=90

)

m16 = M.derived_feature_extractor.v3(

input_data=m15.data,

features=m3.data,

date_col='date',

instrument_col='instrument',

drop_na=False,

remove_extra_columns=False

)

m7 = M.join.v3(

data1=m2.data,

data2=m16.data,

on='date,instrument',

how='inner',

sort=False

)

m13 = M.dropnan.v1(

input_data=m7.data

)

m6 = M.stock_ranker_train.v6(

training_ds=m13.data,

features=m3.data,

learning_algorithm='排序',

number_of_leaves=30,

minimum_docs_per_leaf=1000,

number_of_trees=20,

learning_rate=0.1,

max_bins=1023,

feature_fraction=1,

data_row_fraction=1,

plot_charts=True,

ndcg_discount_base=1,

m_lazy_run=False

)

m9 = M.instruments.v2(

start_date=T.live_run_param('trading_date', '2022-01-01'),

end_date=T.live_run_param('trading_date', '2022-11-02'),

market='CN_STOCK_A',

instrument_list='',

max_count=0

)

m17 = M.general_feature_extractor.v7(

instruments=m9.data,

features=m4.data,

start_date='',

end_date='',

before_start_days=400

)

m18 = M.derived_feature_extractor.v3(

input_data=m17.data,

features=m4.data,

date_col='date',

instrument_col='instrument',

drop_na=False,

remove_extra_columns=False

)

m10 = M.filter.v3(

input_data=m18.data,

expr='flag!=1 and rank_fs_roe_ttm_0>0.1',

output_left_data=False

)

m14 = M.dropnan.v1(

input_data=m10.data

)

m8 = M.stock_ranker_predict.v5(

model=m6.model,

data=m14.data,

m_lazy_run=False

)

m19 = M.trade.v4(

instruments=m9.data,

options_data=m8.predictions,

start_date='',

end_date='',

initialize=m19_initialize_bigquant_run,

handle_data=m19_handle_data_bigquant_run,

prepare=m19_prepare_bigquant_run,

volume_limit=0.025,

order_price_field_buy='open',

order_price_field_sell='close',

capital_base=1000000,

auto_cancel_non_tradable_orders=True,

data_frequency='daily',

price_type='真实价格',

product_type='股票',

plot_charts=True,

backtest_only=False,

benchmark='000300.HIX'

可直接拷贝到BigQuant平台上运行