ts9_annot_arrow_hvplot PyViz interacti_bokeh_STL_seasonal_decomp_HodrickP_KPSS_F-stati_Box-Cox_Ljung

So far, we have covered techniques to extract data from various sources. Tis was covered in Chapter 2, Reading Time Series Data from Files, and Chapter 3, Reading Time Series Data from Databases. Chapter 6, Working with Date and Time in Python, and Chapter 7, Handling Missing Data, covered several techniques to help prepare, clean, and adjust data.

You will continue to explore additional techniques to better understand the time series process behind the data. Before modeling the data or doing any further analysis, an important step is to inspect the data at hand. More specifcally, there are specifc time series characteristics that you need to check for, such as stationarity, effects of trend and seasonality, and autocorrelation, to name a few. These characteristics that describe the time series process you are working with need to be combined with domain knowledge behind the process itself.

Tis chapter will build on what you have learned from previous chapters to prepare you for creating and evaluating forecasting models starting from Chapter 10, Building Univariate Time Series Models Using Statistical Methods.

In this chapter, you will learn how to visualize time series data, decompose a time series into its components (trend, seasonality, and residuals), test for different assumptions that your models may rely on (such as stationarity, normality, and homoscedasticity/ ˈhoʊməsɪdæsˈtɪsəti /同方差性,[数] 方差齐性), and explore techniques to transform the data to satisfy some of these assumptions.

Te recipes that you will encounter in this chapter are as follows:

- • Plotting time series data using pandas

- • Plotting time series data with interactive visualizations using hvPlot

- • Decomposing time series data

- • Detecting time series stationarity

- • Applying power transformations

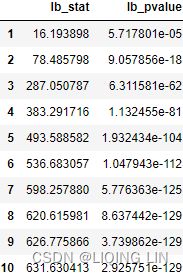

- • Testing for autocorrelation in time series data

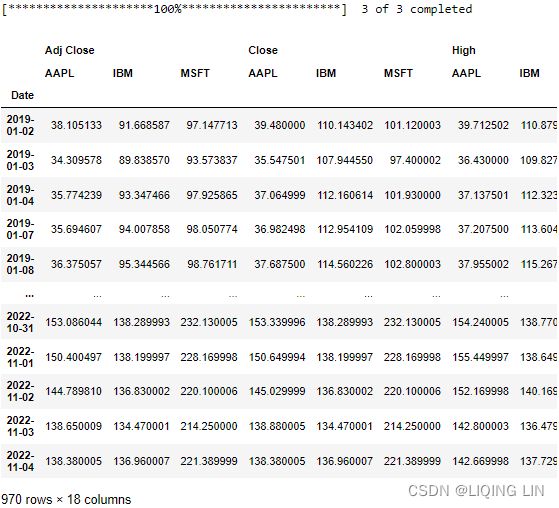

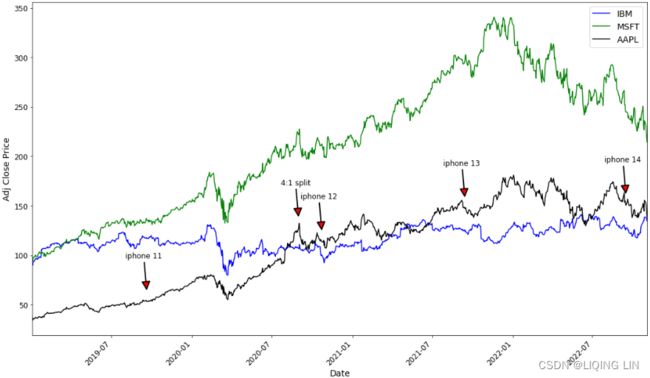

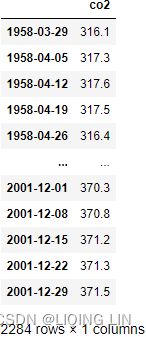

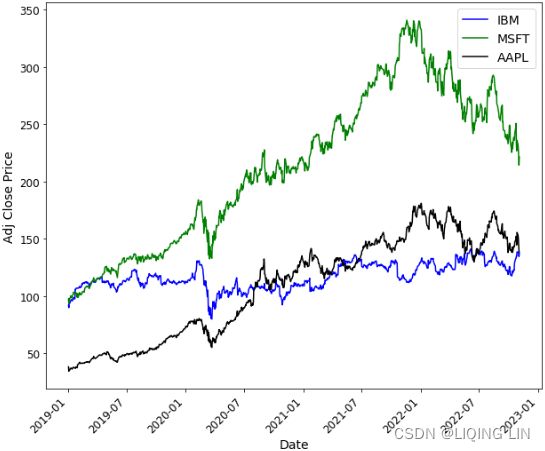

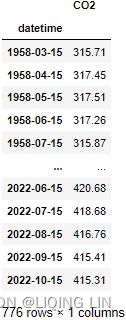

Troughout this chapter, you will be using three datasets (Closing Price Stock Data, CO2, and Air Passengers). The CO2 and Air Passengers datasets are provided with the statsmodels library. Thee Air Passengers dataset contains monthly airline passenger numbers from 1949 to 1960. Te CO2 dataset contains weekly atmospheric/ˌætməsˈfɪrɪk /大气(层)的 carbon/ˈkɑːrbən/碳 dioxide/daɪˈɑːksaɪd/二氧化物 levels on Mauna Loa. The Closing Price Stock Data dataset includes Microsoft, Apple, and IBM stock prices from November 2019 to November 2021.

Plotting time series data using pandas

The pandas library ofers built-in plotting capabilities for visualizing data stored in a DataFrame or Series data structure. In the backend, these visualizations are powered by the Matplotlib library, which is also the default option.

The pandas library offers many convenient methods to plot data. Simply calling DataFrame. plot() or Series.plot() will generate a line plot by default. You can change the type of the plot in two ways:

- • Using the .plot(kind="

") parameter to specify the type of plot by replacing with a chart type. For example, - .plot(kind="hist") will plot a histogram

- while .plot(kind="bar") will produce a bar plot.

- • Alternatively, you can extend .plot() . Tips can be achieved by chaining a specifc plot function, such as .hist() or .scatter() , for example, using .plot.hist() or .plot.line()

Tips recipe will use the standard pandas .plot() method with Matplotlib backend support.

You will be using the stock data for Microsoft, Apple, and IBM, which you can find in the closing_price.csv fle.

import yfinance as yf

df = yf.download('AAPL MSFT IBM',

start='2019-01-01')

dfimport matplotlib.pyplot as plt

fig, ax = plt.subplots( 1,1, figsize=(10,8) )

# df['Adj Close'].plot(kind='line', ax=ax)

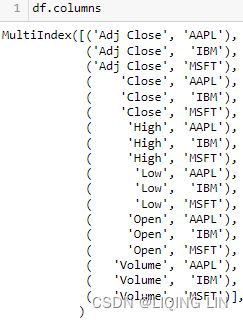

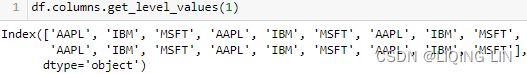

symbols = list( set( df.columns.get_level_values(1) ) )

color_list=['b','g','k']

for idx, tick in enumerate(symbols):

ax.plot( df.index,

df['Adj Close'][tick],

label=tick,

color=color_list[idx],

)

ax.set_xlabel('Date', fontsize=14)

ax.set_ylabel('Adj Close Price', fontsize=14)

plt.setp( ax.get_xticklabels(), rotation=45,

horizontalalignment='right', fontsize=12 )

plt.setp( ax.get_yticklabels(), #rotation=45,

horizontalalignment='right', fontsize=12 )

plt.legend( loc='best', fontsize=14)

plt.show()

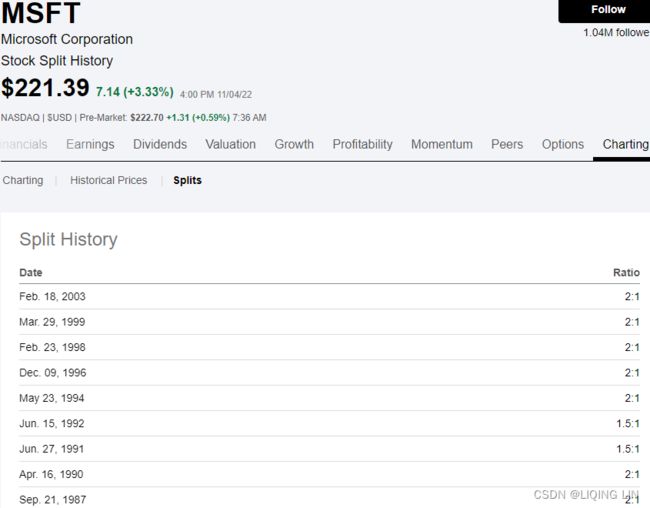

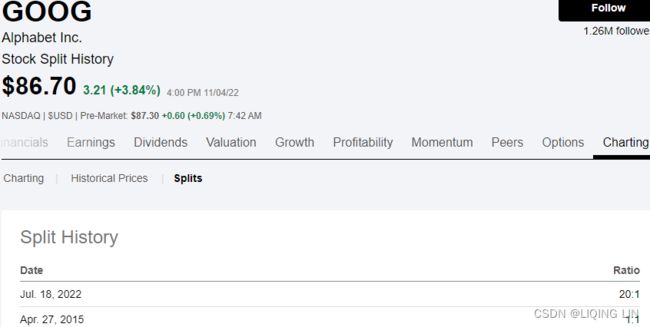

https://seekingalpha.com/symbol/GOOG/splits

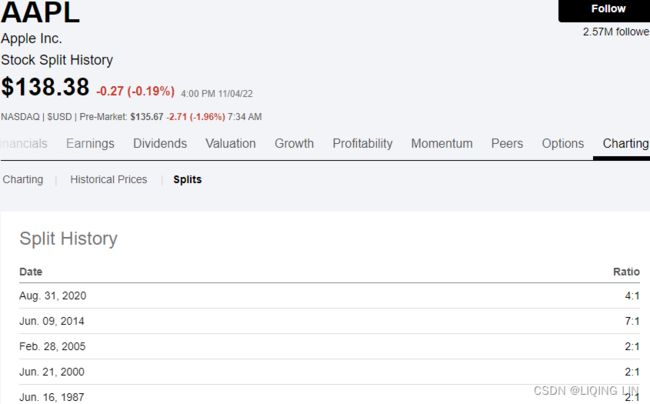

Apple Inc. (AAPL) Stock Split History | Seeking Alpha

import matplotlib.pyplot as plt

fig, ax = plt.subplots( 1,1, figsize=(18,10) )

# df['Adj Close'].plot(kind='line', ax=ax)

symbols = list( set( df.columns.get_level_values(1) ) )

color_list=['b','g','k']

aapl_event={"2020-08-31": "4:1 split",

"2022-09-16" : "iphone 14",

"2021-09-14" : "iphone 13",

"2020-10-23" : "iphone 12",

"2019-09-20" : "iphone 11",

}

for idx, tick in enumerate(symbols):

ax.plot( df.index,

df['Adj Close'][tick],

label=tick,

color=color_list[idx],

)

from datetime import datetime, timedelta

for date, label in aapl_event.items():

ax.annotate(label,

ha='center',

va='top',

# String to date object

xytext=( datetime.strptime(date, '%Y-%m-%d') -timedelta(days=7) ,

df['Adj Close']['AAPL'].loc[date] +50), #The xytext parameter specifies the text position

xy=( datetime.strptime(date, '%Y-%m-%d'),

df['Adj Close']['AAPL'].loc[date]+10), #The xy parameter specifies the arrow's destination

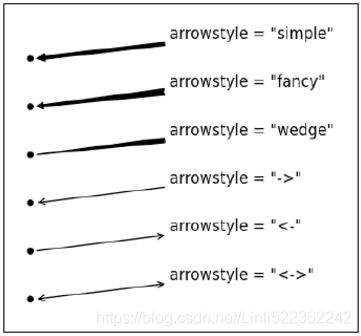

arrowprops=dict( arrowstyle="-|>,head_width=0.5, head_length=1",

facecolor='r',

linewidth=2, edgecolor='k' ),

#arrowprops={'facecolor':'blue', 'headwidth':10, 'headlength':4, 'width':2} #OR

fontsize=12

)

ax.set_xlabel('Date', fontsize=14)

ax.set_ylabel('Adj Close Price', fontsize=14)

plt.setp( ax.get_xticklabels(), rotation=45,

horizontalalignment='right', fontsize=12 )

plt.setp( ax.get_yticklabels(), #rotation=45,

horizontalalignment='right', fontsize=12 )

ax.autoscale(enable=True, axis='x', tight=True) # move all curves to left(touch y-axis)

plt.legend( loc='best', fontsize=14)

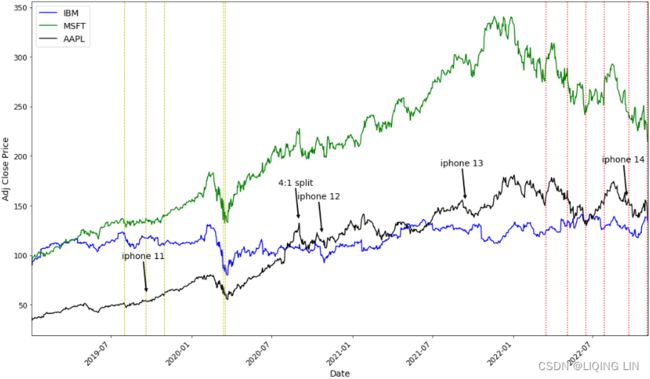

plt.show()Apple stock price rises for a short period before Apple releases a new phone, then falls after the phone is released, then rises; similar to stock splits.

import matplotlib.pyplot as plt

fig, ax = plt.subplots( 1,1, figsize=(18,10) )

# df['Adj Close'].plot(kind='line', ax=ax)

symbols = list( set( df.columns.get_level_values(1) ) )

color_list=['b','g','k']

aapl_event={"2020-08-31": "4:1 split",

"2022-09-16" : "iphone 14",

"2021-09-14" : "iphone 13",

"2020-10-23" : "iphone 12",

"2019-09-20" : "iphone 11",

}

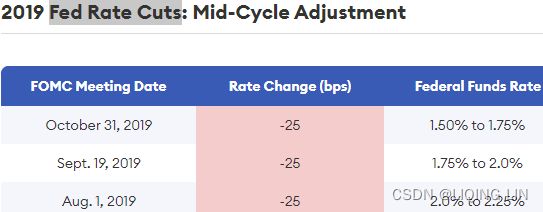

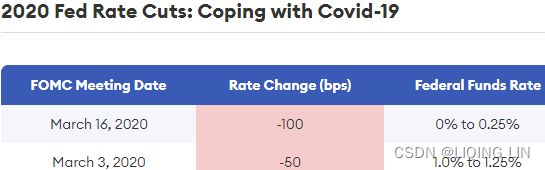

hike_dates=['2022-11-2', '2022-09-21', '2022-07-27', '2022-06-16', '2022-05-05', '2022-03-17']

cuts_dates=['2019-10-31', '2019-09-19', '2019-08-01',

'2020-03-16', '2020-03-13']

for idx, tick in enumerate(symbols):

ax.plot( df.index,

df['Adj Close'][tick],

label=tick,

color=color_list[idx],

)

from datetime import datetime, timedelta

for date, label in aapl_event.items():

ax.annotate(label,

ha='center',

va='top',

# String to date object

xytext=( datetime.strptime(date, '%Y-%m-%d') -timedelta(days=7) ,

df['Adj Close']['AAPL'].loc[date] +50), #The xytext parameter specifies the text position

xy=( datetime.strptime(date, '%Y-%m-%d'),

df['Adj Close']['AAPL'].loc[date]+10), #The xy parameter specifies the arrow's destination

arrowprops=dict(facecolor='k', headwidth=5, headlength=5, width=1 ),

#arrowprops={'facecolor':'blue', 'headwidth':10, 'headlength':4, 'width':2} #OR

fontsize=14

)

for date in hike_dates:

ax.axvline( datetime.strptime(date, '%Y-%m-%d'),

ls=':',

color='r')

for date in cuts_dates:

ax.axvline( datetime.strptime(date, '%Y-%m-%d'),

ls='--',

lw=0.9,

color='y')

ax.set_xlabel('Date', fontsize=14)

ax.set_ylabel('Adj Close Price', fontsize=14)

plt.setp( ax.get_xticklabels(), rotation=45,

horizontalalignment='right', fontsize=12 )

plt.setp( ax.get_yticklabels(), #rotation=45,

horizontalalignment='right', fontsize=12 )

ax.autoscale(enable=True, axis='x', tight=True) # move all curves to left(touch y-axis)

plt.legend( loc='best', fontsize=14)

plt.show()The Fed's rate cuts and rate hikes have a certain impact on stock prices

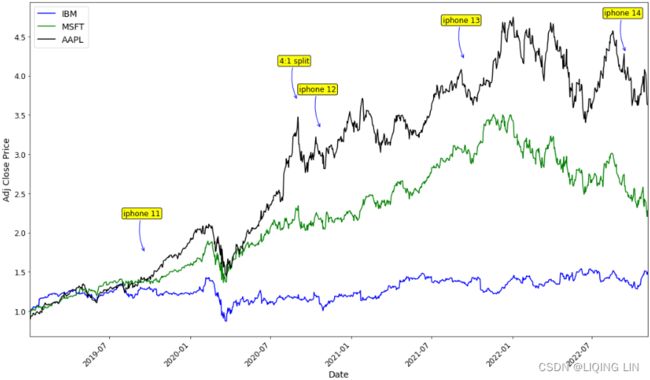

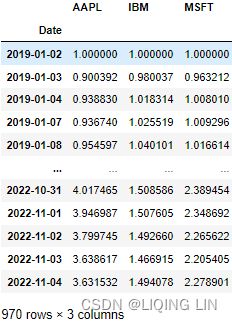

2. If you want to see how the prices fluctuate (up or down) in comparison to each other, one easy approach is to normalize the data. To accomplish this, just divide the stock prices by the first-day price (first row) for each stock. Tis will make all the stocks have the same starting point:

closing_price_n=df['Adj Close'].div(df['Adj Close'].iloc[0])

import matplotlib.pyplot as plt

fig, ax = plt.subplots( 1,1, figsize=(18,10) )

# df['Adj Close'].plot(kind='line', ax=ax)

symbols = list( set( df.columns.get_level_values(1) ) )

color_list=['b','g','k']

aapl_event={"2020-08-31": "4:1 split",

"2022-09-16" : "iphone 14",

"2021-09-14" : "iphone 13",

"2020-10-23" : "iphone 12",

"2019-09-20" : "iphone 11",

}

for idx, tick in enumerate(symbols):

ax.plot( df.index,

closing_price_n[tick],

label=tick,

color=color_list[idx],

)

from datetime import datetime, timedelta

for date, label in aapl_event.items():

ax.annotate(label,

ha='center',

va='top',

# String to date object

xytext=( datetime.strptime(date, '%Y-%m-%d') -timedelta(days=7) ,

closing_price_n['AAPL'].loc[date] +0.9), #The xytext parameter specifies the text position

xy=( datetime.strptime(date, '%Y-%m-%d'),

closing_price_n['AAPL'].loc[date]+0.35), #The xy parameter specifies the arrow's destination

# arrowprops=dict( arrowstyle="-|>,head_width=1, head_length=1",

# facecolor='b',

# linewidth=4, edgecolor='k' ),

arrowprops=dict(arrowstyle='->', connectionstyle='arc3,rad=0.2',

color='b',),

bbox=dict(boxstyle='round,pad=0.2', fc='yellow', alpha=0.95),

fontsize=12

)

ax.set_xlabel('Date', fontsize=14)

ax.set_ylabel('Adj Close Price', fontsize=14)

plt.setp( ax.get_xticklabels(), rotation=45,

horizontalalignment='right', fontsize=12 )

plt.setp( ax.get_yticklabels(), #rotation=45,

horizontalalignment='right', fontsize=12 )

ax.autoscale(enable=True, axis='x', tight=True) # move all curves to left(touch y-axis)

plt.legend( loc='best', fontsize=14)

plt.show()From the normalization output, you can observe that the lines now have the same starting point (origin), set to 1. Te plot shows how the prices in the time series plot deviate from each other:

closing_price_n  Figure 9.3 – Output of normalized time series with a common starting point at 1

Figure 9.3 – Output of normalized time series with a common starting point at 1

3. Additionally, Matplotlib allows you to change the style of the plots. To do that, you can use the style. use function. You can specify a style name from an existing template or use a custom style. For example, the following code shows how you can change from the default style to the ggplot style:

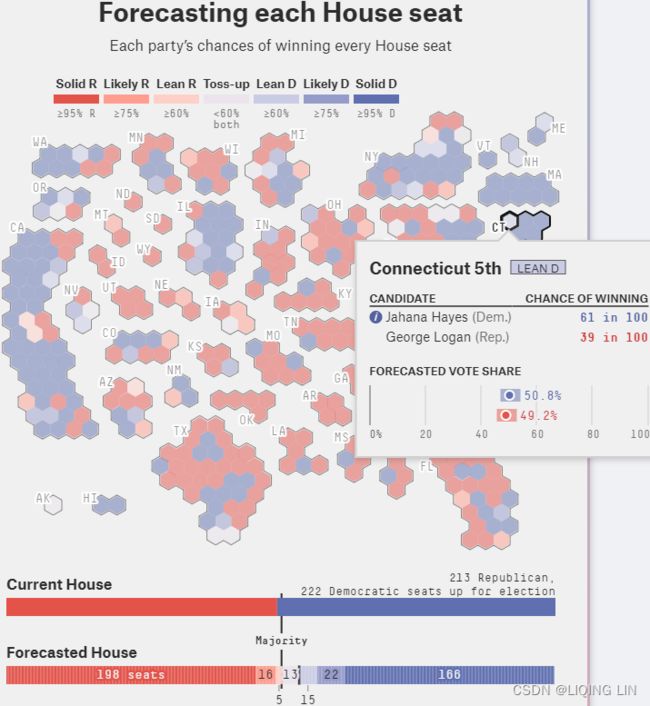

You can explore other attractive styles: fivethirtyeight , which is inspired by https://fivethirtyeight.com/, dark_background, seaborn-dark, and tableau-colorblind10. For a comprehensive list of available style sheets, you can reference the Matplotlib documentation here: https://matplotlib.org/stable/gallery/style_sheets/style_sheets_reference.html

dark_background, seaborn-dark, and tableau-colorblind10. For a comprehensive list of available style sheets, you can reference the Matplotlib documentation here: https://matplotlib.org/stable/gallery/style_sheets/style_sheets_reference.html

If you want to revert to the original theme, you specify

plt.style.use("default")https://blog.csdn.net/Linli522362242/article/details/121045744 (Adjusting the resolution: dpi)

You can customize the plot further by adding a title, updating the axes labels, and customizing the x ticks and y ticks, to name a few.

Add a title and a label to the y axis, then save it as a .jpg fle:

start_date = '2019'

end_date = '2022'

plt.style.use('ggplot' )

plot = closing_price_n.plot( figsize=(10,8),

title=f'Stock Prices from {start_date} - {end_date}',

ylabel='Norm. Price'

)

# plot.get_figure().savefig('plot_1.jpg')There is good collaboration between pandas and Matplotlib, with an ambition to integrate and add more plotting capabilities within pandas.

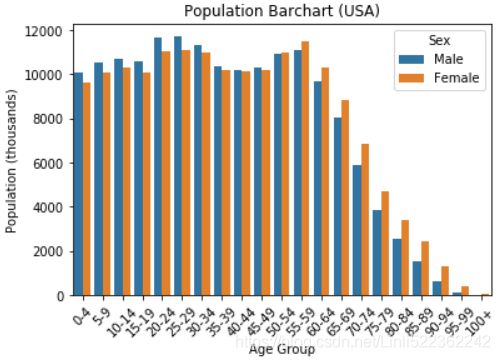

There are many plotting styles that you can use within pandas simply by providing a value to the kind argument. For example, you can specify the following:

- • line for line charts commonly used to display time series

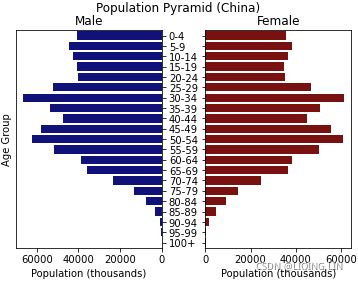

- • bar or barh (horizontal) for bar plots

constrictive populations have a lower proportion of young people, so the pyramid base appears to be constrictedhttps://blog.csdn.net/Linli522362242/article/details/93617948

constrictive populations have a lower proportion of young people, so the pyramid base appears to be constrictedhttps://blog.csdn.net/Linli522362242/article/details/93617948

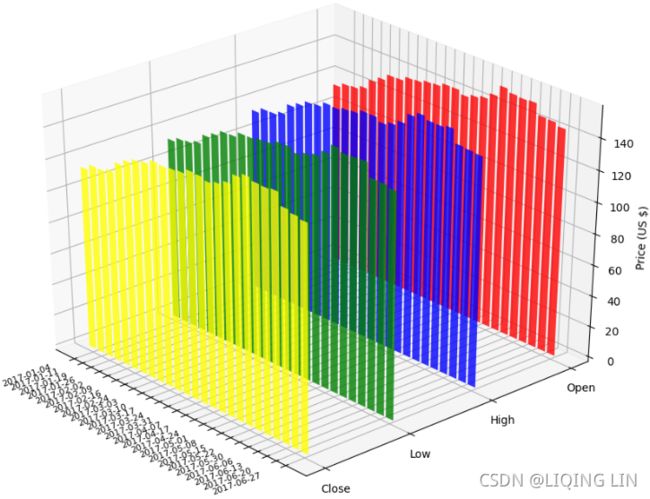

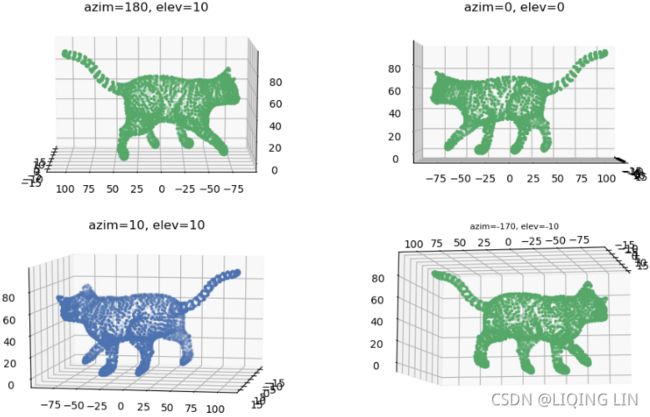

3D bar chart

https://blog.csdn.net/Linli522362242/article/details/111307026 - • hist for histogram plots

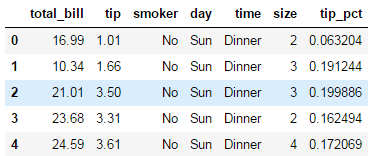

https://blog.csdn.net/Linli522362242/article/details/87891370tips['tip_pct'] = tips['tip'] / (tips['total_bill'] - tips['tip']) tips.head()

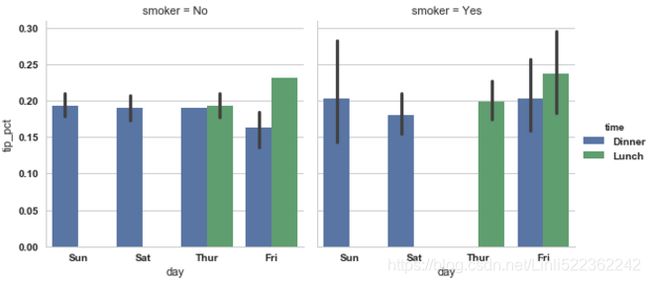

sns.factorplot(x='day', y='tip_pct', hue='time', col='smoker', kind='bar', data=tips[tips.tip_pct <1]) sns.factorplot(x='day', y='tip_pct', row='time', col='smoker', kind='bar', data=tips[tips.tip_pct <1])

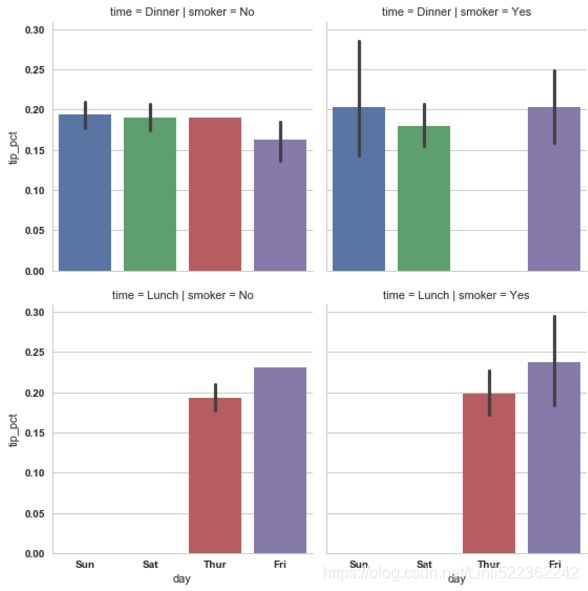

sns.factorplot(x='day', y='tip_pct', row='time', col='smoker', kind='bar', data=tips[tips.tip_pct <1])

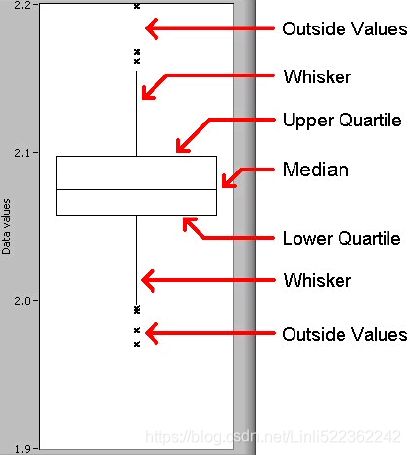

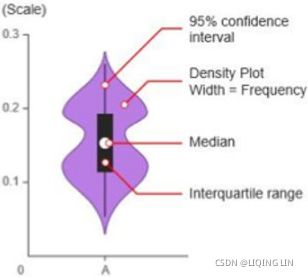

- • box for boxplots violin plot

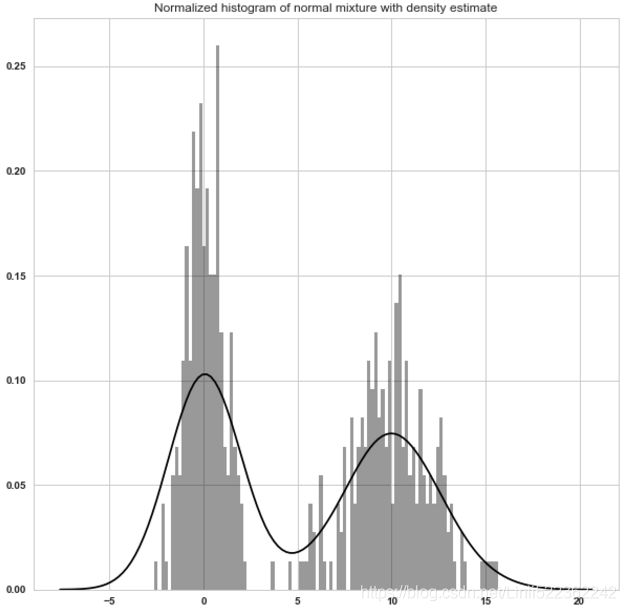

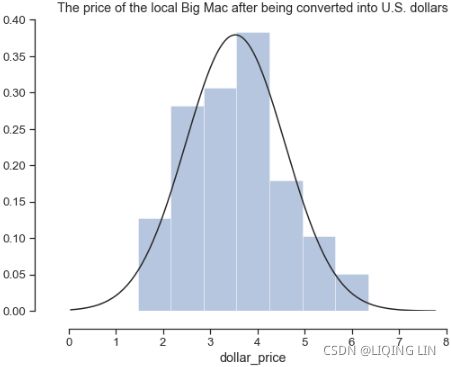

- • kde or density for kernel density estimation plots(which is formed by computing an estimate of a continuous probability distribution that might have generated the observed data. The usual procedure is to approximate this distribution as a mixture of “kernels”. KDE is a non-parametric method used to estimate the distribution of a variable. We can also supply a parametric distribution, such as beta, gamma, or normal distribution, to the fit argument.) https://blog.csdn.net/Linli522362242/article/details/121172551

fits(curve) a kernel density estimate (KDE) over the histogram vs normal distribution

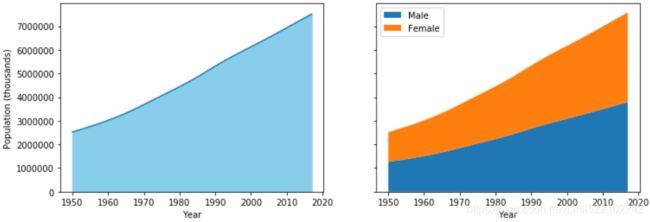

- • area for area plots

- • pie for pie plots

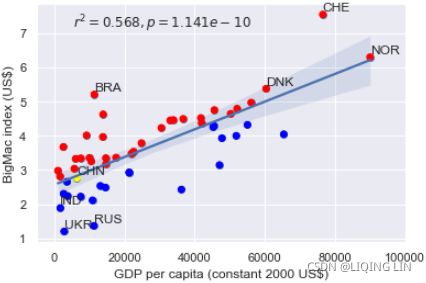

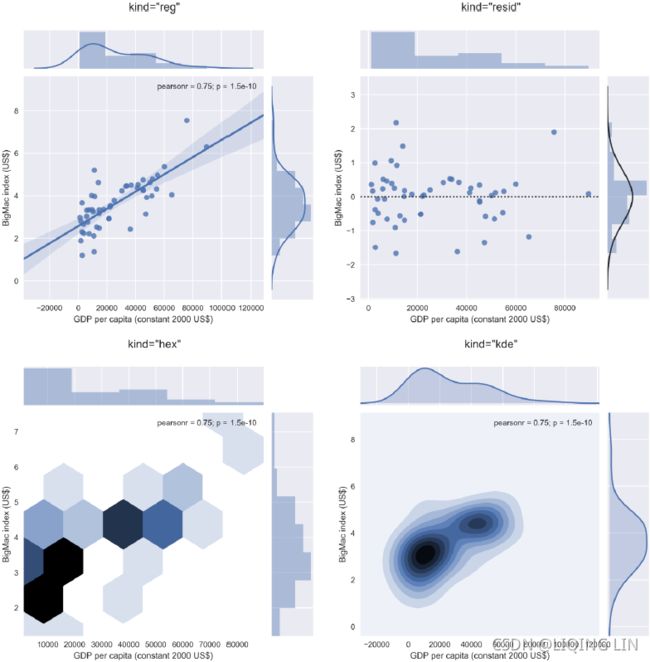

- • scatter for scatter plots

Contrary to popular belief, it looks like China's currency was not significantly under-valued in 2015 since its marker lies well within the 95% confidence interval of the regression line.

Contrary to popular belief, it looks like China's currency was not significantly under-valued in 2015 since its marker lies well within the 95% confidence interval of the regression line.

3D scatter plot

- • hexbin for hexagonal bin plots

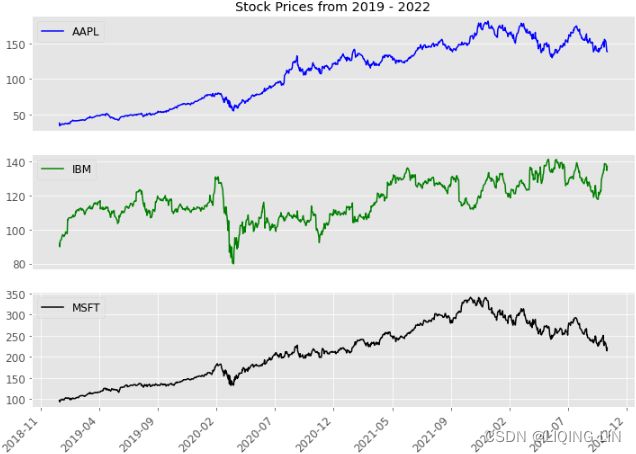

As observed in the previous section, we plotted all three columns in the time series in one plot (three line charts in the same plot). What if you want each symbol (column) plotted separately?

The preceding code will generate a subplot for each column in the DataFrame. For the closing_price DataFrame, this will generate three subplots.

fig, axes = plt.subplots( 3,1, figsize=(12,8) )

symbols = list( set( df.columns.get_level_values(1) ) )

color_list=['b','g','k']

for idx in range( len(axes) ):

axes[idx].plot( df.index, df['Adj Close'][df['Adj Close'].columns[idx]],

label=df['Adj Close'].columns[idx],

color=color_list[idx]

)

plt.setp( axes[idx].get_yticklabels(), fontsize=12 )

axes[idx].set_xticks([])

axes[idx].legend(fontsize=12)

from matplotlib.dates import DateFormatter

import matplotlib.ticker as ticker

axes[-1].set_xticks(closing_price_n.index)

axes[-1].xaxis.set_major_locator(ticker.MaxNLocator(12))

axes[-1].xaxis.set_major_formatter( DateFormatter('%Y-%m') )

axes[0].set_title(f'Stock Prices from {start_date} - {end_date}')

plt.setp( axes[-1].get_xticklabels(), rotation=45, horizontalalignment='right', fontsize=12 )

plt.show() To learn more about pandas charting and plotting capabilities, please visit the ofcial

documentation here: Chart visualization — pandas 1.5.1 documentation .

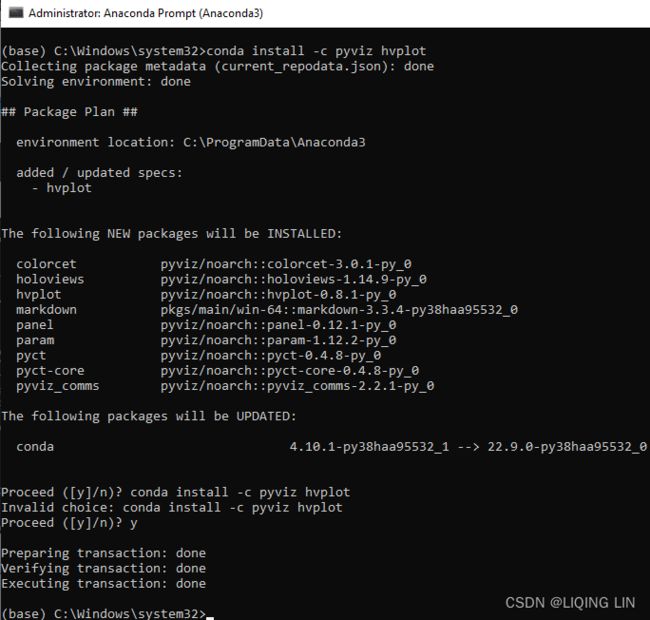

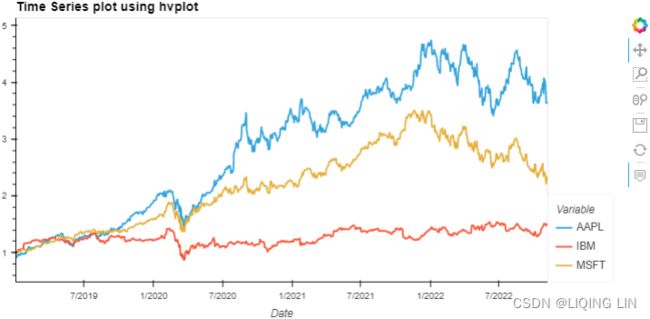

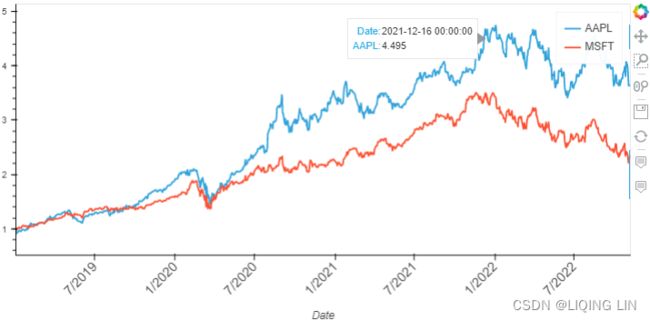

Plotting time series data with interactive visualizations using hvPlot

In this recipe, you will explore the hvPlot library to create interactive visualizations. hvPlot works well with pandas DataFrames to render interactive visualizations with minimal effort. You will be using the same closing_price.csv dataset to explore the library.

hvplot and PyViz

conda install -c pyviz hvplotOR in jupyter notebook:

!pip install hvplot1. Start by importing the libraries needed. Notice that hvPlot has a pandas extension, which makes it more convenient. Tis will allow you to use the same syntax as in the previous recipe:

import hvplot.pandas

# normalize the data :

# divide the stock prices by the first-day price (first row)

# closing_price_n=df['Adj Close'].div( df['Adj Close'].iloc[0] )

closing_price_n.hvplot( title='Time Series plot using hvplot',

width=800, height=400 ) Figure 9.6 – hvPlot interactive visualization

Figure 9.6 – hvPlot interactive visualization

The same result could be accomplished simply by switching the pandas plotting backend. Te default backend is matplotlib . To switch it to hvPlot, you can just update backend=' hvplot' :

closing_price_n.plot( backend='hvplot',

title='Time Series plot using hvplot', width=800, height=400

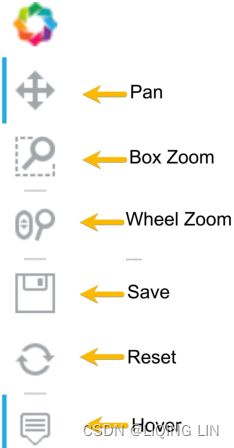

) Notice the widget bar to the right, which has a set of modes for interaction, including pan平移, box zoom框缩放, wheel zoom滚轮缩放, save, reset, and hover. Figure 9.7 – Widget bar with six modes of interaction

Figure 9.7 – Widget bar with six modes of interaction

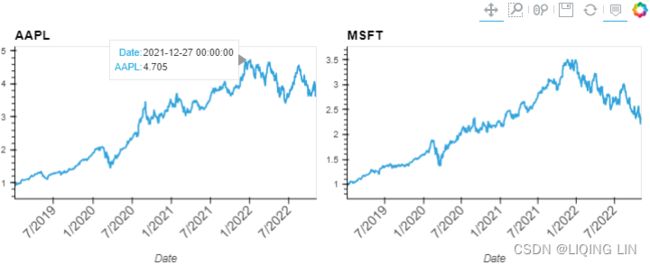

2. You can split each time series into separate plots per symbol (column). For example, to split into three columns one for each symbol (or ticker): MSFT, AAPL, and IBM. Subplotting can be done by specifying subplots=True

You can use the .cols() method for more control over the layout. The method allows you to control the number of plots per row. For example, .cols(1) means one plot per row, whereas . cols(2) indicates two plots per line:

# fontsize={

# 'title': '200%',

# 'labels': '200%',

# 'ticks': '200%',

# }

closing_price_n.hvplot( width=300, height=400,

subplots=True,

rot=45,

fontsize={ 'title': 14,

'labels': 14,

'xticks': 12,

'yticks': 10,

}

).cols(2)Keep in mind that the .cols() method only works if the subplots parameter is set to True. Otherwise, you will get an error.

hvPlot ofers convenient options for plotting your DataFrame: switching the backend, extending pandas with DataFrame.hvplot(), or using hvPlot's native API.

hvPlot allows you to use two arithmetic operators, + and * , to confgure the layout of the plots.

The plus sign ( + ) allows you to add two charts side by side, while multiply ( * ) will enable you to combine charts (merge one graph with another). In the following example, we will add two plots, so they are aligned side by side on the same row:

( closing_price_n['AAPL'].hvplot( width=400, rot=45, fontsize={'xticks': 12} ) +

closing_price_n['MSFT'].hvplot( width=400, rot=45, fontsize={'xticks': 12} )

)Notice that the two plots will share the same widget bar. If you fllter or zoom into one of the charts, the other chart will have the same action applied.

Now, let's see how multiplication will combine the two plots into one:

( closing_price_n['AAPL'].hvplot( width=800, height=400, rot=45, fontsize={'xticks': 12} ) *

closing_price_n['MSFT'].hvplot()

) Figure 9.11 – Two plots combined into one using the multiplication operator

For more information on hvPlot, please visit their ofcial page here: hvPlot — hvPlot 0.8.1 documentation

Decomposing time series data

When performing time series analysis, one of your objectives may be forecasting, where you build a model to make a future prediction. Before starting the modeling process, you will need to extract the components of the time series process for analysis. Tis will help you make informed decisions during the modeling process. In addition, there are three major components for any time series process: trend, seasonality, and residual.

- Trend gives a sense of the long-term direction of the time series and can be either upward, downward, or horizontal. For example, a time series of sales data can show an upward (increasing) trend. Sometimes we will refer to a trend as “changing direction”, when it might go from an increasing trend to a decreasing trend.

- Seasonality is repeated patterns over time. For example, a time series of sales data might show an increase in sales around Christmas time. Tips phenomenon can be observed every year (annually) as we approach Christmas.

(A seasonal pattern occurs when a time series is affected by seasonal factors such as the time of the year or the day of the week. Seasonality is always of a fixed and known frequency. The monthly sales of antidiabetic drugs above shows seasonality which is induced partly by the change in the cost of the drugs at the end of the calendar year.

(A seasonal pattern occurs when a time series is affected by seasonal factors such as the time of the year or the day of the week. Seasonality is always of a fixed and known frequency. The monthly sales of antidiabetic drugs above shows seasonality which is induced partly by the change in the cost of the drugs at the end of the calendar year.

- The residual is simply the remaining or unexplained portion once we extract trend and seasonality.

- A stationary time series is one whose statistical properties, such as mean, variance, and autocorrelation, are constant over time.

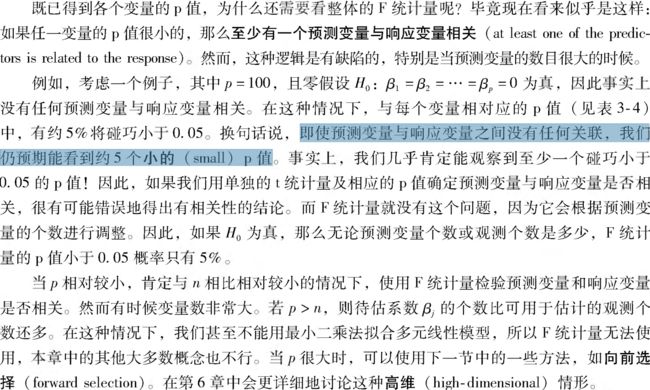

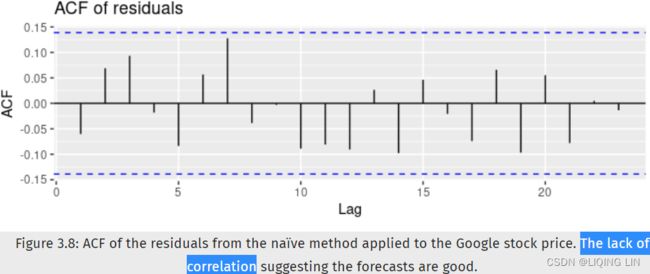

The daily change in the Google closing stock price has no trend, seasonality or cyclic behaviour(In general, the average length of cycles is longer than the length of a seasonal pattern, and the magnitudes of cycles tend to be more variable than the magnitudes of seasonal patterns.). There are random fluctuations which do not appear to be very predictable, and no strong patterns that would help with developing a forecasting model.

The daily change in the Google closing stock price has no trend, seasonality or cyclic behaviour(In general, the average length of cycles is longer than the length of a seasonal pattern, and the magnitudes of cycles tend to be more variable than the magnitudes of seasonal patterns.). There are random fluctuations which do not appear to be very predictable, and no strong patterns that would help with developing a forecasting model.

The decomposition of a time series is the process of extracting the three components and representing them as their models. The modeling of the decomposed components can be either additive or multiplicative.

- You have an additive model when the original time series can be reconstructed by adding all three components:

OR Y[t] = T[t] + S[t] + e[t]

OR Y[t] = T[t] + S[t] + e[t]

The additive decomposition is the most appropriate if the magnitude of the seasonal fluctuations季节性波动的幅度, or the variation around the trend-cycle,围绕趋势周期的变化 does not vary with the level of the time series. - On the other hand, if the time series can be reconstructed by multiplying all three components, you have a multiplicative model:

OR Y[t] = T[t] * S[t] * e[t]

OR Y[t] = T[t] * S[t] * e[t]

A multiplicative model is suitable when the seasonal variation fuctuates over time.When the variation in the seasonal pattern, or the variation around the trend-cycle, appears to be proportional to the level of the time series与时间序列的水平成正比时, then a multiplicative decomposition is more appropriate.

Furthermore, you can group these into predictable versus non-predictable components.

- Predictable components are consistent, repeating patterns that can be captured and modeled. Seasonality and trend are examples.

- On the other hand, every time series has an unpredictable component that shows irregularity, often called noise, though it is referred to as residual in the context of decomposition.

In this recipe, you will explore different techniques for decomposing your time series using the seasonal_decompose, Seasonal-Trend decomposition with LOESS (STL), and hp_filter methods available in the statsmodels library.

seasonal_decompose

You will start with statsmodels' seasonal_decompose approach:

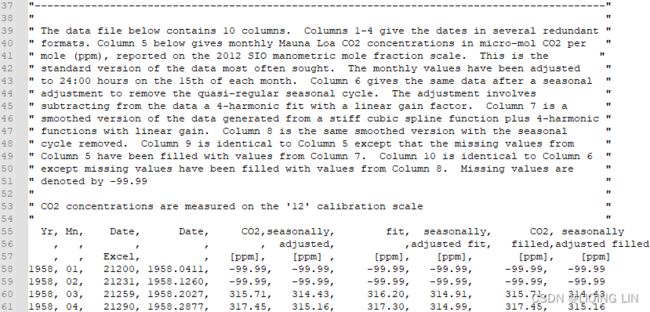

https://scrippsco2.ucsd.edu/data/atmospheric_co2/primary_mlo_co2_record.html

"The data file below contains 10 columns. Columns 1-4 give the dates in several redundant formats.

- Column 5(CO2_[ppm]) below gives monthly Mauna Loa CO2 concentrations in micro-mol CO2 per mole (ppm), reported on the 2012 SIO manometric mole fraction scale. This is the standard version of the data most often sought. The monthly values have been adjusted to 24:00 hours on the 15th of each month.

- Column 6(seasonally_adjusted_[ppm]) gives the same data after a seasonal adjustment to remove the quasi-regular seasonal cycle. 给出了相同的数据季节性调整以消除准规则的季节性周期。The adjustment involves subtracting from the data a 4-harmonic fit with a linear gain factor.调整涉及从数据中减去具有线性增益因子的 4 次谐波拟合

- Column 7(fit_[ppm]) is a smoothed version of the data generated from a stiff cubic spline function plus 4-harmonic functions with linear gain. 第 7 列是从刚性三次样条函数加上4次谐波生成的数据的平滑版本具有线性增益的函数。

- Column 8(seasonally_adjusted_fit_[ppm]) is the same smoothed version with the seasonal cycle removed.

- Column 9(CO2_filled_[ppm]) is identical to Column 5 except that the missing values from Column 5 have been filled with values from Column 7.

- Column 10(seasonally_adjusted_filled_[ppm]) is identical to Column 6 except missing values have been filled with values from Column 8.

- Missing values are denoted by -99.99

import numpy as np

import pandas as pd

source='https://scrippsco2.ucsd.edu/assets/data/atmospheric/stations/in_situ_co2/monthly/monthly_in_situ_co2_mlo.csv'

co2_ds = pd.read_csv( source,

comment='"',

header=[0,1,2],

sep=',',

na_values='-99.99'

)

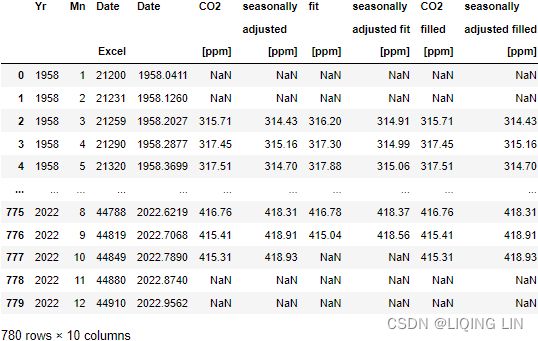

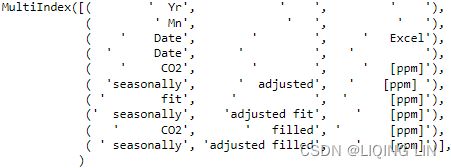

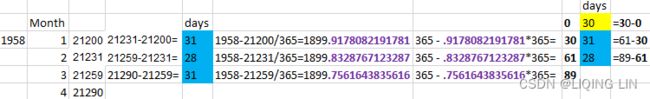

co2_dsco2_ds.columnscols = [ '_'.join( ' '.join(col).strip().split() )

for col in co2_ds.columns.values

]

co2_ds.set_axis(cols, axis = 1, inplace = True)

co2_dsco2_ds.columnsThe monthly values have been adjusted to 24:00 hours on the 15th of each month

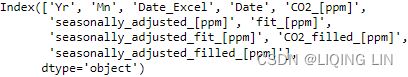

# Converting Excel date format to datetime

# 1958-21200/365=1899.9178082191781

# 365-.9178082191781*365 = 29.99999999999352 = 30

co2_ds['datetime'] = pd.to_datetime( co2_ds['Date_Excel'], # 1958-21200/365=1899.9178082191781

origin = pd.Timestamp('1899-12-30'), # before 1890

unit = 'D'

)

co2_ds# and setting as dataframe index

co2_ds.set_index('datetime', inplace = True)

co2_dsColumn 5(CO2_[ppm]) below gives monthly Mauna Loa CO2 concentrations in micro-mol CO2 per mole (ppm), reported on the 2012 SIO manometric mole fraction scale. This is the standard version of the data most often sought. The monthly values have been adjusted to 24:00 hours on the 15th of each month.

Column 9(CO2_filled_[ppm]) is identical to Column 5 except that the missing values from Column 5 have been filled with values from Column 7.

co2_df = pd.DataFrame( co2_ds[ 'CO2_filled_[ppm]' ] )

co2_df.rename( columns={'CO2_filled_[ppm]':'CO2'},

inplace=True

)

co2_df.dropna( inplace=True )

co2_df = co2_df.resample('M').sum()

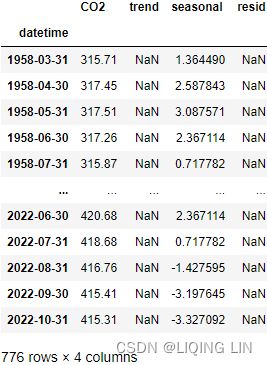

co2_df

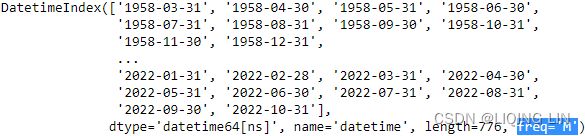

##############

why resample('M').sum() ?

because we are going to use seasonal_decompose() , which requires the "x must be a pandas object with a PeriodIndex or a DatetimeIndex with a freq not set to None"

co2_df = co2_df.resample('M').sum()

co2_df.indexhvplot.extension("bokeh")

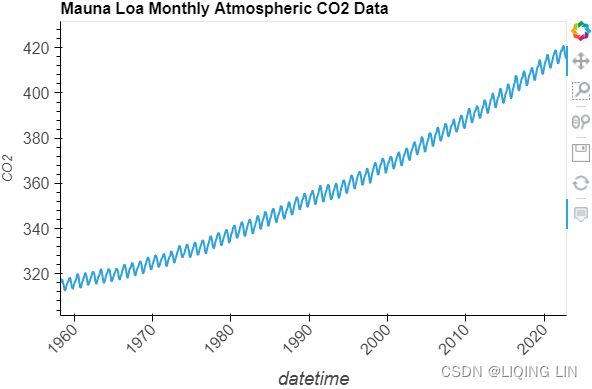

co2_df.hvplot( title='Mauna Loa Weekly Atmospheric CO2 Data',

width=600, height=400,

rot=45, fontsize={'xticks':12, 'yticks':12, 'xlabel':14}

)

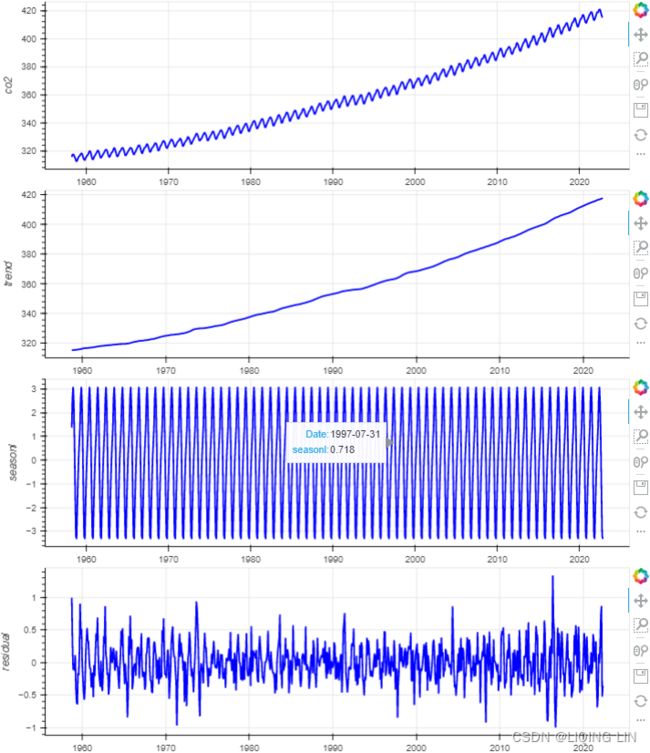

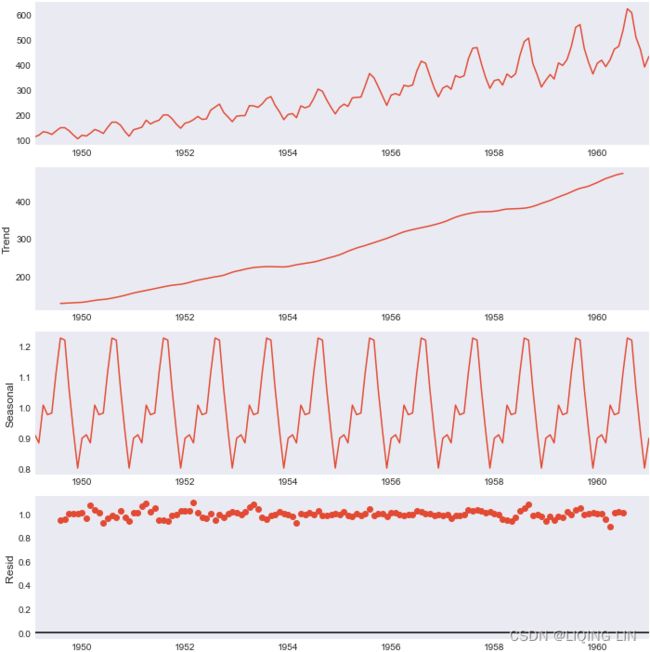

Figure 9.12 – Te CO2 dataset showing an upward trend and constant seasonal variation

The co2_df data shows a long-term linear (upward) trend, with a repeated seasonal pattern at a constant rate (seasonal variation).

![]()

![]()

This indicates that the CO2 dataset is an additive model( The additive decomposition is the most appropriate if the magnitude of the seasonal fluctuations季节性波动的幅度, or the variation around the trend-cycle,围绕趋势周期的变化 does not vary with the level of the time series.).

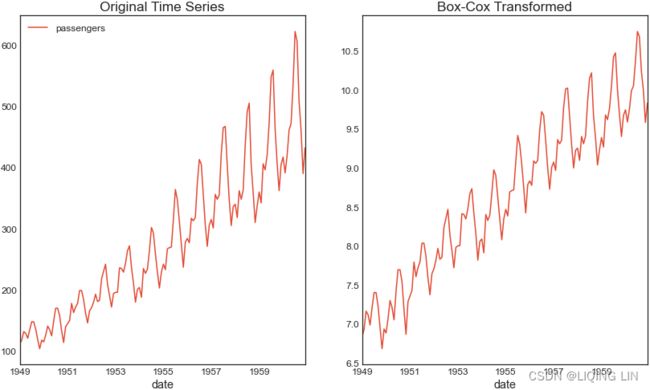

Similarly, you can explore the airp_df DataFrame for the Air Passengers dataset to observe whether the seasonality shows multiplicative or additive behavior:

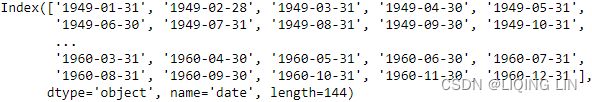

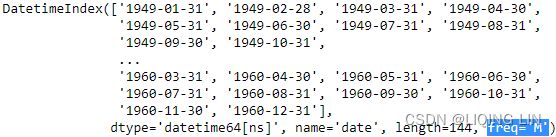

airp_df = pd.read_csv('air_passenger.csv')

# and setting as dataframe index

airp_df.set_index('date', inplace = True)

airp_dfairp_df.indexairp_df.index = pd.to_datetime( airp_df.index )

airp_df = airp_df.resample('M').sum()

airp_df.indexwhy resample('M').sum() ?

because we are going to use seasonal_decompose() , which requires the "x must be a pandas object with a PeriodIndex or a DatetimeIndex with a freq not set to None"

hvplot.extension('plotly') # 'matplotlib' # 'bokeh' # holoviews

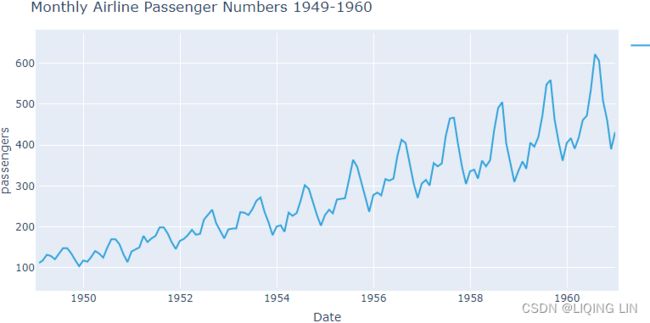

start = pd.DatetimeIndex( airp_df.index ).year[0]

end = pd.DatetimeIndex( airp_df.index ).year[-1]

airp_df.plot( backend='hvplot',

title=f'Monthly Airline Passenger Numbers {start}-{end}',

xlabel='Date',

width=800, height=400,

)

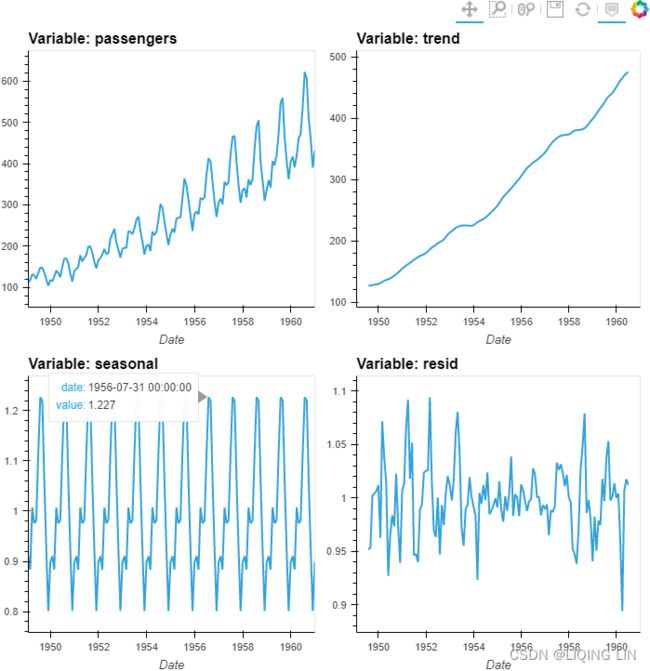

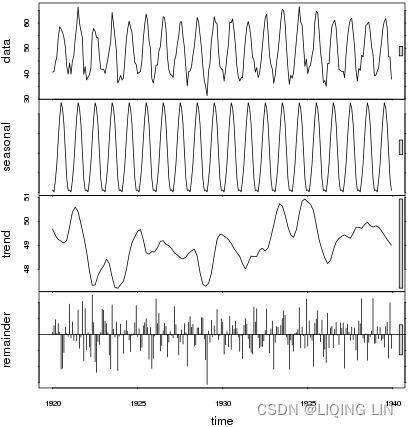

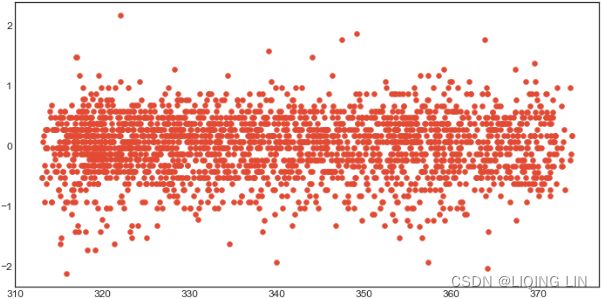

Figure 9.13 – The Air Passengers dataset showing trend and increasing seasonal variation

The airp_df data shows a long-term linear (upward) trend and seasonality. However, the seasonality fuctuations seem to be increasing as well, indicating a multiplicative model(A multiplicative model is suitable when the seasonal variation fuctuates over time. OR When the variation in the seasonal pattern, or the variation around the trend-cycle, appears to be proportional to the level of the time series与时间序列的水平成正比时, then a multiplicative decomposition is more appropriate. ). ==>

==>![]()

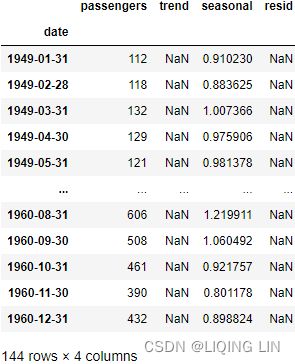

3. Use seasonal_decompose on the two datasets. For the CO2 data, use an additive model and a multiplicative model for the air passenger data:

from statsmodels.tsa.seasonal import seasonal_decompose

co2_decomposed = seasonal_decompose( co2_df['CO2'], model='additive' )

air_decomposed = seasonal_decompose( airp_df, model='multiplicative' )Both co2_decomposed and air_decomposed have access to several methods, including

- .trend, : co2_trend=co2_decomposed.trend

- .seasonal, and

- .resid.

air_dec_df = airp_df

air_dec_df['trend']=air_decomposed.trend

air_dec_df['seasonal']=air_decomposed.seasonal

air_dec_df['resid']=air_decomposed.resid

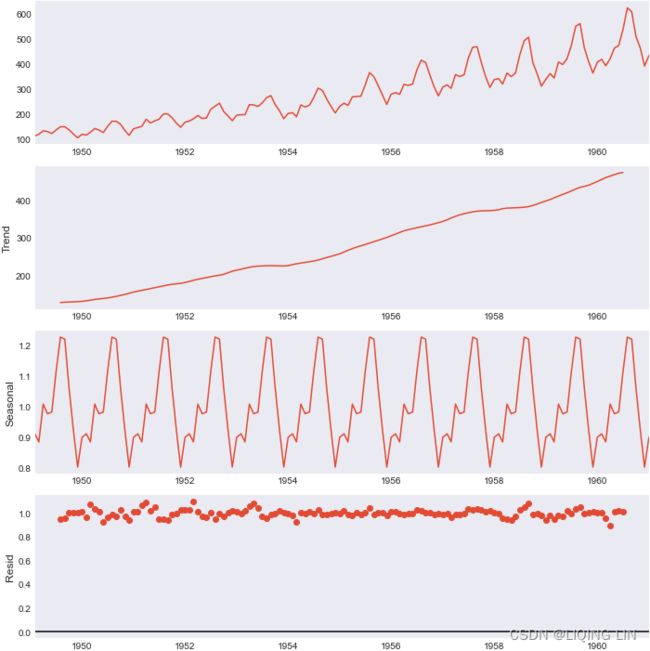

air_dec_dfYou can plot all three components by using the .plot() method:

plt.rcParams['figure.figsize'] = (10,10)

#https://matplotlib.org/stable/tutorials/introductory/customizing.html

plt.style.use('seaborn-dark')

air_decomposed.plot()

plt.show()hvplot.extension("bokeh")

air_dec_df.hvplot( width=350, height=350,

xlabel='Date',

subplots=True, shared_axes=False

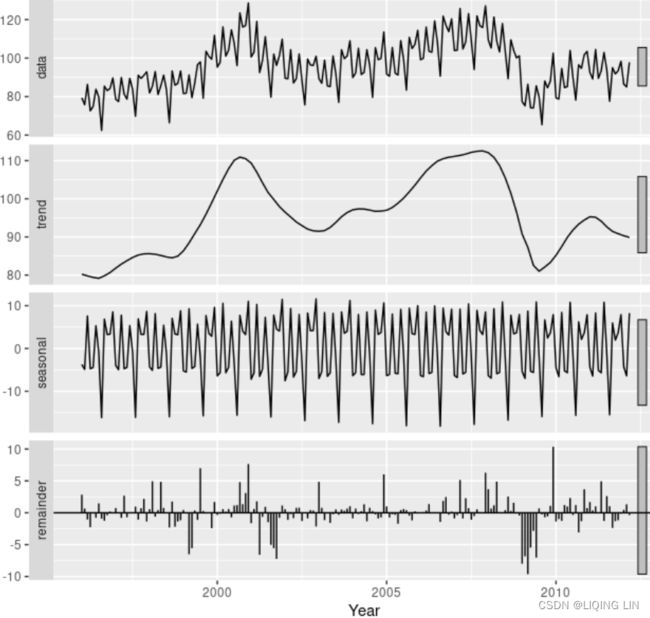

).cols(2) Figure 9.14 – Air Passengers multiplicative decomposed into trend, seasonality, and residual

Let's break down the resulting plot into four parts:

- 1. This is the original observed data that we are decomposing.

- 2. The trend component shows an upward direction. The trend indicates whether there is

- positive (increasing or upward),

- negative (decreasing or downward), or

- constant (no trend or horizontal) long-term movement.

- 3. The seasonal component shows the seasonality effect and the repeating pattern of highs and lows.

- 4. Finally, the residual (noise) component shows the random variation in the data after applying the model. In this case, a multiplicative model was used.

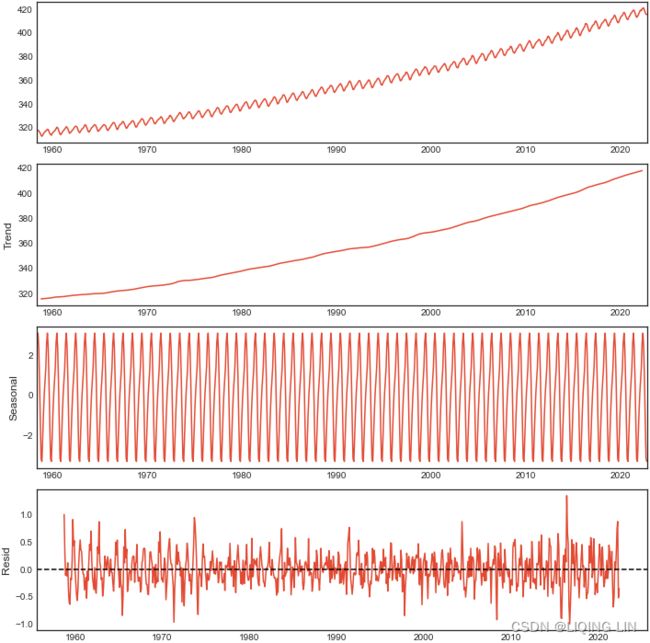

Similarly, you can plot the decomposition of the CO2 dataset:

plt.rcParams['figure.figsize'] = (10,10)

# https://matplotlib.org/stable/tutorials/introductory/customizing.html

plt.style.use('seaborn-white')

fig=co2_decomposed.plot()

axs = fig.get_axes()

axs[3].clear()

axs[3].plot(co2_decomposed.resid)

axs[3].axhline(y=0, color='k', linestyle='--')

axs[3].set_ylabel('Resid')

plt.show()co2_dec_df = co2_df.copy(deep=True)

co2_dec_df['trend']=co2_decomposed.trend

co2_dec_df['seasonal']=co2_decomposed.seasonal

co2_dec_df['resid']=co2_decomposed.resid

co2_dec_dfhvplot.extension("bokeh")

co2_dec_df.hvplot(width=800, height=240,

xlabel='Date',

subplots=True, shared_axes=False

).cols(1)Creating layouts — Bokeh 2.4.3 Documentation

from bokeh.layouts import column # row,

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

# bokeh.__version__ : '2.4.3'

source = ColumnDataSource(data={ 'date': co2_decomposed.observed.index,

'co2' : co2_decomposed.observed,

'trend': co2_decomposed.trend,

'seasonl': co2_decomposed.seasonal,

'residual': co2_decomposed.resid

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

ps = []

# source.data.keys() : dict_keys(['date', 'co2', 'trend', 'seasonl', 'residual'])

for col in list( source.data.keys() )[1:]:

p = figure( width=800, height=230, #background_fill_color="#fafafa"

x_axis_type="datetime",

# x_axis_label='Date',

y_axis_label=col,

)

p.line( x='date', y=col, source=source, line_width=2, color='blue'

# legend_label=col

)

p.add_tools( HoverTool( # key

tooltips=[ ( 'Date', '@date{%F}'),

( col, '@%s{0.000}' % col ), # use @{ } for field names with spaces

],

formatters={ '@date' : "datetime", # use 'datetime' formatter for 'date' field

'@%s{0.000}' % col : 'numeral', # use default 'numeral' formatter

},

# display a tooltip whenever the cursor is vertically in line with a glyph

mode='vline'

)

)

ps.append(p)

show(column(ps))from bokeh.layouts import column # row,

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

# bokeh.__version__ : '2.4.3'

source = ColumnDataSource(data={ 'date': co2_decomposed.observed.index,

'co2' : co2_decomposed.observed,

'trend': co2_decomposed.trend,

'seasonl': co2_decomposed.seasonal,

'residual': co2_decomposed.resid

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

ps = []

# source.data.keys() : dict_keys(['date', 'co2', 'trend', 'seasonl', 'residual'])

for col in list( source.data.keys() )[1:]:

p = figure( width=800, height=230, #background_fill_color="#fafafa"

x_axis_type="datetime",

# x_axis_label='Date',

y_axis_label=col,

)

p.line( x='date', y=col, source=source, line_width=2, color='blue'

# legend_label=col

)

p.add_tools( HoverTool( # key

tooltips=[ ( 'Date', '@date{%F}' ),

( 'co2', '@co2{0.000}' ), # use @{ } for field names with spaces

( 'trend', '@trend{0.000}' ),

( 'seasonl', '@seasonl{0.000}' ),

( 'residual', '@residual{0.000}'),

],

formatters={ '@date' : "datetime", # use 'datetime' formatter for 'date' field

'@co2{0.000}': 'numeral', # use default 'numeral' formatter

},

# display a tooltip whenever the cursor is vertically in line with a glyph

mode='vline'

)

)

ps.append(p)

# https://docs.bokeh.org/en/2.4.2/docs/reference/models/tools.html

# https://docs.bokeh.org/en/latest/docs/reference/colors.html

from bokeh.models import CrosshairTool

def addLinkedCrosshairs(plots):

crosshair = CrosshairTool(dimensions="height", line_color='green')

for p in plots:

p.add_tools(crosshair)

addLinkedCrosshairs(ps)

show(column(ps))Figure 9.15 – CO2 additive decomposed into trend, seasonality, and residual

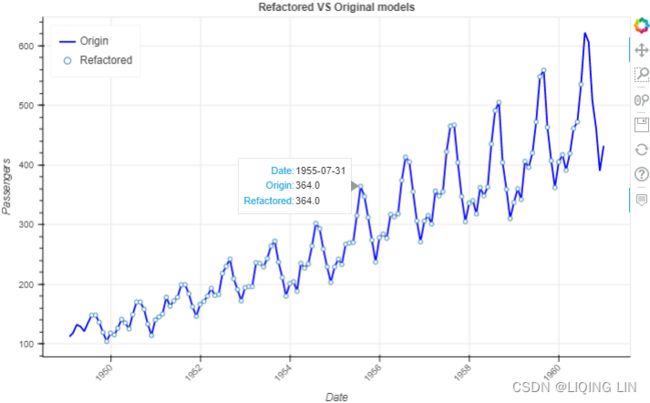

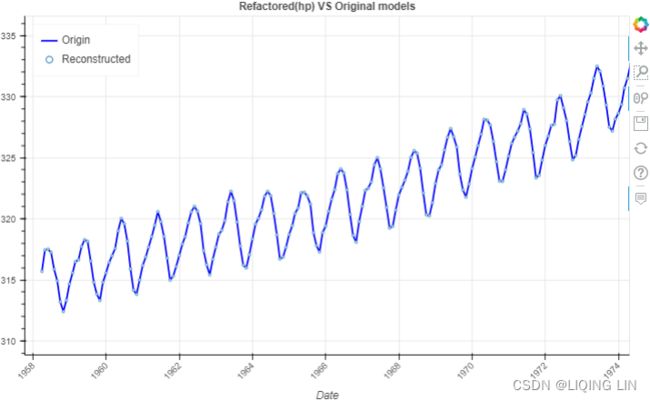

5. When reconstructing the time series, for example, in a multiplicative model(![]() ), you will be multiplying the three components. To demonstrate this concept, use air_decomposed, an instance of the DecomposeResult class. The class provides the seasonal, trend, and resid attributes as well as the .plot() method.

), you will be multiplying the three components. To demonstrate this concept, use air_decomposed, an instance of the DecomposeResult class. The class provides the seasonal, trend, and resid attributes as well as the .plot() method.

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

import numpy as np

rec_model=air_decomposed.trend * air_decomposed.seasonal * air_decomposed.resid

source = ColumnDataSource(data={ 'date': air_decomposed.observed.index,

'origin': air_decomposed.observed,

'refactored': rec_model,

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

p = figure( width=800, height=500,

title='Refactored VS Original models',

x_axis_type='datetime',

x_axis_label='Date',

y_axis_label='Passengers',

)

p.title.align = "center"

p.xaxis.major_label_orientation=np.pi/4 # rotation

p.line( x='date', y='origin', source=source, legend_label='Origin',

line_width=2, color='blue'

)

p.circle( x='date', y='refactored', source=source, legend_label='Refactored',

fill_color='white', size=5

)

p.legend.location = "top_left"

p.add_tools( HoverTool(

tooltips=[ ('Date', '@date{%F}'),

('Origin', '@origin{0.0}'),

('Refactored', '@refactored{0.0}' ),

],

formatters={'@date':'datetime',},

#model='vline'

)

)

show(p)Note : There are missing points in some locations

STL decomposition

STL is a versatile/ ˈvɜːrsət(ə)l /多功能的 and robust method for decomposing time series. STL is an acronym/ ˈækrənɪm /首字母缩略词 for “Seasonal and Trend decomposition using Loess”, while Loess is a method for estimating nonlinear relationships. The STL method was developed by R. B. Cleveland, Cleveland, McRae, & Terpenning (1990).

The STL class uses the LOESS seasonal smoother, which stands for Locally Estimated Scatterplot Smoothing. STL is more robust than seasonal_decompose for measuring non-linear relationships. On the other hand, STL assumes additive composition, so you do not need to indicate a model, unlike with seasonal_decompose.

STL has several advantages over the classical, SEATS and X11 decomposition methods:

-

Unlike SEATS and X11, STL will handle any type of seasonality, not only monthly and quarterly data.

-

The seasonal component is allowed to change over time, and the rate of change can be controlled by the user.

-

The smoothness of the trend-cycle can also be controlled by the user.

-

It can be robust to outliers对异常值具有鲁棒性 (i.e., the user can specify a robust decomposition, Setting robust=True helps remove the impact of outliers on seasonal and trend components when calculated), so that occasional unusual observations will not affect the estimates of the trend-cycle and seasonal components偶尔的异常观测值不会影响趋势周期和季节性分量的估计. They will, however, affect the remainder component会影响其余组成分.

On the other hand, STL has some disadvantages. In particular,

- it does not handle trading day or calendar variation automatically,

- and it only provides facilities for additive decompositions只提供用于加法分解的工具.

It is possible to obtain a multiplicative decomposition by

- first taking logs of the data,

- then back-transforming the components. Decompositions between additive and multiplicative can be obtained using a Box-Cox transformation of the data with 0<λ<1.

- A value of λ=0 corresponds to the multiplicative decomposition

- while λ=1 is equivalent to an additive decomposition.

We will look at several methods for obtaining the components ![]() ,

, ![]() and

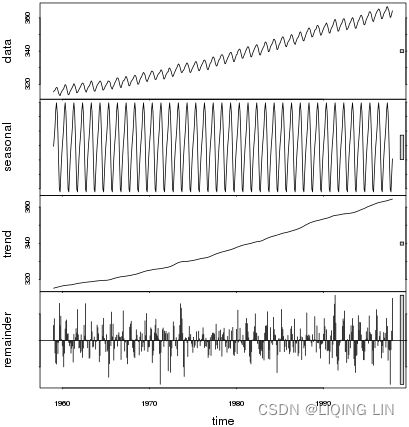

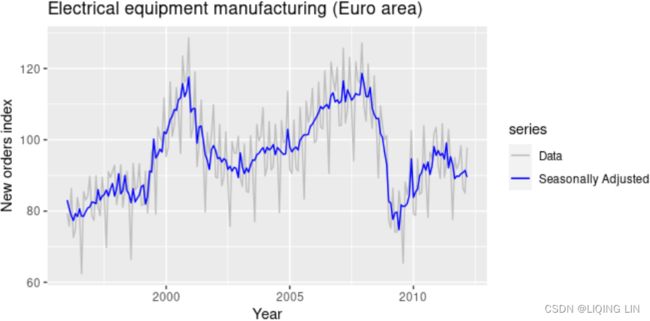

and ![]() later in this chapter, but first, it is helpful to see an example. We will decompose the new orders index for electrical equipment shown in Figure 6.1. The data show the number of new orders for electrical equipment (computer, electronic and optical products) in the Euro area (16 countries). The data have been adjusted by working days and normalised so that a value of 100 corresponds to 2005.

later in this chapter, but first, it is helpful to see an example. We will decompose the new orders index for electrical equipment shown in Figure 6.1. The data show the number of new orders for electrical equipment (computer, electronic and optical products) in the Euro area (16 countries). The data have been adjusted by working days and normalised so that a value of 100 corresponds to 2005.

Figure 6.1 shows the trend-cycle component, ![]() , in red and the original data,

, in red and the original data, ![]() , in grey. The trend-cycle shows the overall movement in the series, ignoring the seasonality and any small random fluctuations.

, in grey. The trend-cycle shows the overall movement in the series, ignoring the seasonality and any small random fluctuations.

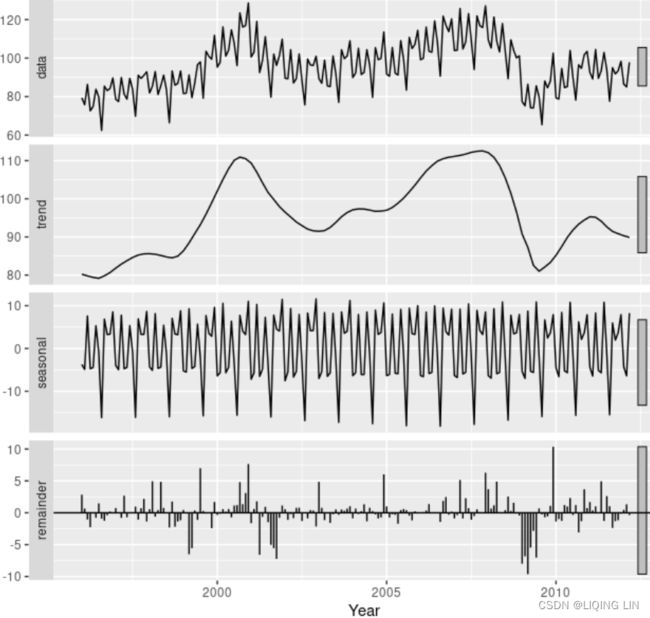

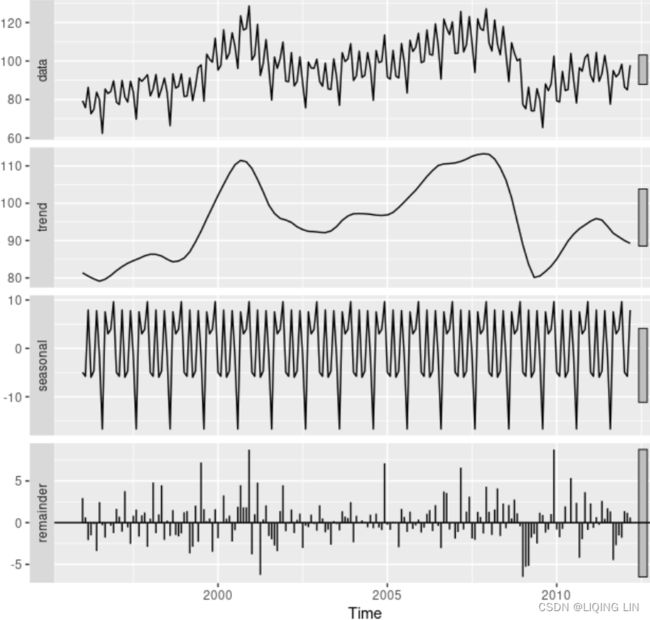

Figure 6.2 shows an additive decomposition of these data. The method used for estimating components in this example is STL.

Figure 6.2 shows an additive decomposition of these data. The method used for estimating components in this example is STL.

The electrical equipment orders (top). The three additive components are shown separately in the bottom three panels of Figure 6.2. These components can be added together to reconstruct the data shown in the top panel. Notice that the seasonal component changes slowly over time, vs

vs so that any two consecutive years have similar patterns, but years far apart may have different seasonal patterns. The remainder component shown in the bottom panel is what is left over when the seasonal and trend-cycle components have been subtracted from the data.

so that any two consecutive years have similar patterns, but years far apart may have different seasonal patterns. The remainder component shown in the bottom panel is what is left over when the seasonal and trend-cycle components have been subtracted from the data.

The grey bars to the right of each panel show the relative scales of the components组件的相对比例. Each grey bar represents the same length but because the plots are on different scales, the bars vary in length. The longest grey bar in the bottom panel shows that the variation in the remainder component is small compared to the variation in the data, which has a bar about one quarter the size. If we shrunk the bottom three panels until their bars became the same size as that in the data panel, then all the panels would be on the same scale.

########## So on the upper panel, we might consider the bar as 1 unit of variation.

So on the upper panel, we might consider the bar as 1 unit of variation.

- The bar on the seasonal panel is only slightly longer than that on the data panel, indicating that the seasonal signal is large relative to the variation in the data.

- In other words, if we shrunk the seasonal panel such that the box became the same size as that in the data panel(ytick_labels are same), the range of variation on the shrunk seasonal panel would be similar to but slightly smaller than that on the data panel.

Now consider the trend panel;

- the grey bar is now much longer than either of the ones on the data or seasonal panel, indicating the variation attributed to the trend is much smaller than the seasonal component and consequently only a small part of the variation in the data series.

- The variation attributed to the trend is considerably smaller than the stochastic component (the remainders).

- As such, we can deduce that these data do not exhibit a trend.我们可以推断这些数据没有表现出趋势。

If we look at the relative sizes of the bars on this plot,

If we look at the relative sizes of the bars on this plot,

- we note that the trend dominates the data series and consequently the grey bars are of similar length(both of them are very short).

- Of next greatest importance is variation at the seasonal scale, although variation at this scale is a much smaller component of the variation exhibited in the original data.

- The residuals (remainder) represent only small stochastic fluctuations as the grey bar is very long relative to the other panels.

So the general idea is that if you scaled all the panels such that the grey bars were all the same length, you would be able to determine the relative magnitude of the variations in each of the components and how much of the variation in the original data they contained.您将能够确定每个组件中变化的相对幅度以及原始数据中有多少变化 他们包含 But because the plot draws each component on it's own scale, we need the bars to give us a relative scale for comparison.

##########

Seasonally adjusted data

If the seasonal component is removed from the original data, the resulting values are the “seasonally adjusted” data. For an additive decomposition, the seasonally adjusted data are given by ![]() , and for multiplicative data, the seasonally adjusted values are obtained using

, and for multiplicative data, the seasonally adjusted values are obtained using ![]() .

.

If the variation due to seasonality is not of primary interest(longer grey bar), the seasonally adjusted series can be useful. For example, monthly unemployment data are usually seasonally adjusted(the seasonal component is removed from the original data) in order to highlight variation due to the underlying state of the economy rather than the seasonal variation每月失业数据通常会进行季节性调整,以突出由于潜在经济状况而不是季节性变化引起的变化.

If the variation due to seasonality is not of primary interest(longer grey bar), the seasonally adjusted series can be useful. For example, monthly unemployment data are usually seasonally adjusted(the seasonal component is removed from the original data) in order to highlight variation due to the underlying state of the economy rather than the seasonal variation每月失业数据通常会进行季节性调整,以突出由于潜在经济状况而不是季节性变化引起的变化.

- An increase in unemployment due to school leavers seeking work is seasonal variation,

- while an increase in unemployment due to an economic recession is non-seasonal.

- Most economic analysts who study unemployment data are more interested in the non-seasonal variation. Consequently, employment data (and many other economic series) are usually seasonally adjusted.

Seasonally adjusted series contain the remainder component as well as the trend-cycle. Therefore, they are not “smooth”(不“平稳” or Non-stationary), and “downturns” or “upturns” can be misleading. If the purpose is to look for turning points in a series, and interpret any changes in direction, then it is better to use the trend-cycle component rather than the seasonally adjusted data.

Figure 6.2 shows an additive decomposition of these data. The method used for estimating components in this example is STL. Notice that the seasonal component changes slowly over time,

Figure 6.2 shows an additive decomposition of these data. The method used for estimating components in this example is STL. Notice that the seasonal component changes slowly over time, vs

vs so that any two consecutive years have similar patterns, but years far apart may have different seasonal patterns.

so that any two consecutive years have similar patterns, but years far apart may have different seasonal patterns.

The best way to begin learning how to use STL is to see some examples and experiment with the settings. Figure 6.2 showed an example of STL applied to the electrical equipment orders data. Figure 6.13 shows an alternative STL decomposition where the trend-cycle is more flexible, the seasonal component does not change over time, and the robust option has been used. Here, it is more obvious that there has been a down-turn at the end of the series, and that the orders in 2009 were unusually low (corresponding to some large negative values(e.g. : -10) in the remainder component). 在这里,更明显的是,系列末期出现了下滑,2009年的订单异常低(对应于剩余部分的一些较大的负值)。

Figure 6.13: The electrical equipment orders (top) and its three additive components obtained from a robust STL decomposition with flexible trend-cycle and fixed seasonality.

The two main parameters to be chosen when using STL are

- the trend-cycle window (

t.window)

t.windowis the number of consecutive observations to be used when estimating the trend-cycle- Specifying

t.windowis optional, and a default value will be used if it is omitted.

- the seasonal window (

s.window).

s.windowis the number of consecutive years to be used in estimating each value in the seasonal component- The user must specify

s.windowas there is no default. Setting it to be infinite is equivalent to forcing the seasonal component to be periodic (i.e., identical across years).

- These control how rapidly the trend-cycle and seasonal components can change. Smaller values allow for more rapid changes. Both

t.windowands.windowshould be odd numbers;

The mstl()function provides a convenient automated STL decomposition using s.window=13, and t.window also chosen automatically. This usually gives a good balance between overfitting the seasonality and allowing it to slowly change over time. But, as with any automated procedure, the default settings will need adjusting for some time series.

As with the other decomposition methods discussed in this book, to obtain the separate components plotted in Figure 6.8, use the seasonal() function for the seasonal component, the trendcycle() function for trend-cycle component, and the remainder() function for the remainder component. The seasadj() function can be used to compute the seasonally adjusted series.

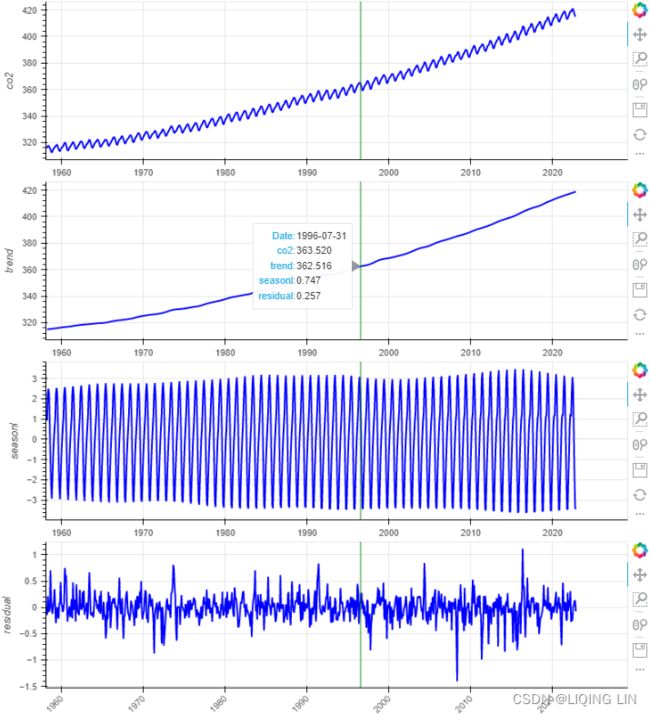

6. Another decomposition option within statsmodels is STL, which is a more advanced decomposition technique. In statsmodels, the STL class requires additional parameters than the seasonal_decompose function. Thee two other parameters you will use are seasonal and robust.

- The seasonal parameter is for the seasonal smoother and can only take odd integer values greater than or equal to 7. Similarly, the STL function has a trend smoother (the trend parameter).

- The second parameter is robust, which takes a Boolean value ( True or False ). Setting robust=True helps remove the impact of outliers on seasonal and trend components when calculated.

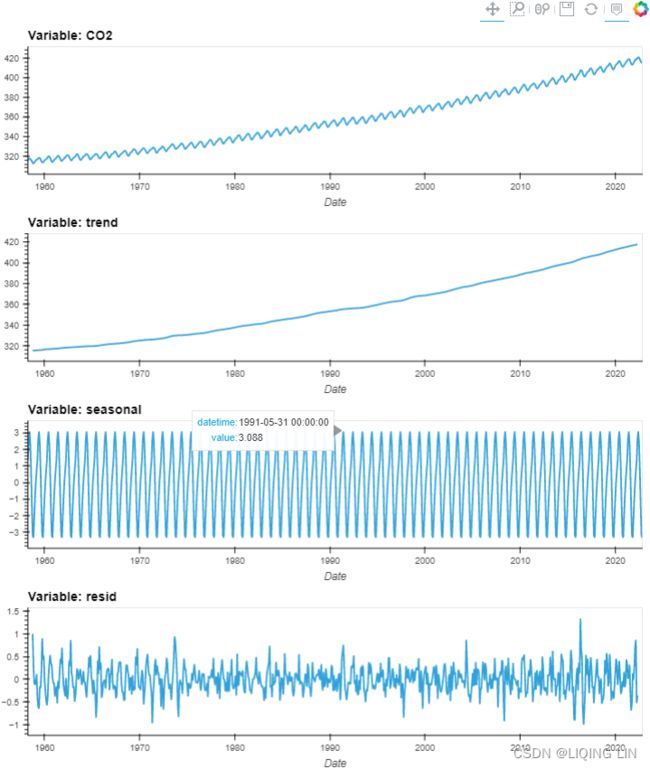

You will use STL to decompose the co2_df DataFrame:

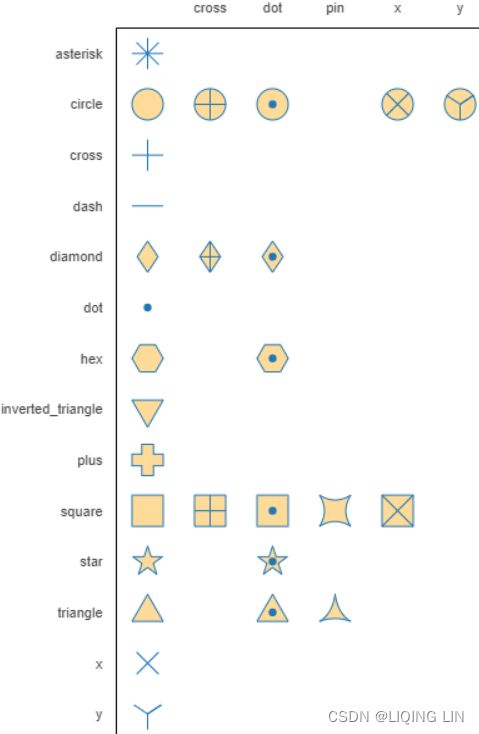

https://docs.bokeh.org/en/2.4.2/docs/reference/models/glyphs/scatter.html

Linking behavior — Bokeh 2.4.3 Documentation

It’s often desired to link pan or zooming actions across many plots. All that is needed to enable this feature is to share range objects between figure() calls.

When you used STL , you provided seasonal=13 because the data has an annual seasonal effect.

from statsmodels.tsa.seasonal import STL

plt.style.use('seaborn-white')

#plt.style.use('ggplot' )

# robust : Flag indicating whether to use a weighted version that

# is robust to some forms of outliers.

co2_stl = STL( co2_df, seasonal=13, robust=True ).fit()

# co2_stl.plot()

# plt.show()

from bokeh.layouts import column # row,

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

# bokeh.__version__ : '2.4.3'

source = ColumnDataSource(data={ 'date': co2_stl.observed.index,

'co2' : co2_stl.observed['CO2'], # co2_stl.observed is a dataframe

'trend': co2_stl.trend,

'seasonl': co2_stl.seasonal,

'residual': co2_stl.resid

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

ps = []

# source.data.keys() : dict_keys(['date', 'co2', 'trend', 'seasonl', 'residual'])

for col in list( source.data.keys() )[1:]:

p = figure( width=800, height=220, #background_fill_color="#fafafa"

x_axis_type="datetime",

# x_axis_label='Date',

y_axis_label=col,

x_range=ps[0].x_range if len(ps)>0 else None, ###########

y_range=ps[0].y_range if len(ps)==1 else None, ###########

)

# if col != 'residual':

p.line( x='date', y=col, source=source, line_width=2, color='blue'

# legend_label=col

)

# else:

# p.scatter( x='date', y=col, source=source, line_width=2, color='blue',

# marker='circle'

# # legend_label=col

# )

p.add_tools( HoverTool( # key

tooltips=[ ( 'Date', '@date{%F}' ),

( 'co2', '@co2{0.000}' ), # use @{ } for field names with spaces

( 'trend', '@trend{0.000}' ),

( 'seasonl', '@seasonl{0.000}' ),

( 'residual', '@residual{0.000}'),

],

formatters={ '@date' : "datetime", # use 'datetime' formatter for 'date' field

'@co2{0.000}': 'numeral', # use default 'numeral' formatter

},

# display a tooltip whenever the cursor is vertically in line with a glyph

mode='vline'

)

)

ps.append(p)

ps[3].xaxis.major_label_orientation=np.pi/4 # rotation

# https://docs.bokeh.org/en/2.4.2/docs/reference/models/tools.html

# https://docs.bokeh.org/en/latest/docs/reference/colors.html

from bokeh.models import CrosshairTool

def addLinkedCrosshairs(plots):

crosshair = CrosshairTool(dimensions="height", line_color='green', line_alpha=1)

for p in plots:

p.add_tools(crosshair)

addLinkedCrosshairs(ps)

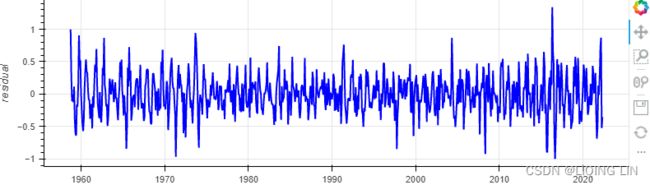

show(column(ps)) Figure 9.17 – Decomposing the CO2 dataset with STL

Figure 9.17 – Decomposing the CO2 dataset with STL

Compare the output in Figure 9.16 to that in Figure 9.15. You will notice that the residual plots look diferent, indicating that both methods capture similar information using distinct mechanisms. When you used STL , you provided seasonal=13 because the data has an annual seasonal effect.

You used two diferent approaches for time series decomposition. Both methods decompose a time series into trend, seasonal, and residual components.

The STL class uses the LOESS seasonal smoother, which stands for Locally Estimated Scatterplot Smoothing. STL is more robust than seasonal_decompose for measuring non-linear relationships. On the other hand, STL assumes additive composition, so you do not need to indicate a model, unlike with seasonal_decompose.

Both approaches can extract seasonality from time series to better observe the overall trend in the data.

########### STL is more robust than seasonal_decompose for measuring non-linear relationships Proved!

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

import numpy as np

rec_co2_stl=co2_stl.trend + co2_stl.seasonal + co2_stl.resid

source = ColumnDataSource(data={ 'date': co2_stl.observed.index,

'origin': co2_stl.observed['CO2'],

'reconstructed': rec_co2_stl,

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

p = figure( width=800, height=500,

title='Refactored(STL) VS Original models',

x_axis_type='datetime',

x_axis_label='Date',

)

# https://docs.bokeh.org/en/1.1.0/docs/user_guide/annotations.html

p.title.align = "center"

p.xaxis.major_label_orientation=np.pi/4 # rotation

p.line( x='date', y='origin', source=source, legend_label='Origin',

line_width=2, color='blue'

)

p.circle( x='date', y='reconstructed', source=source, legend_label='Reconstructed',

fill_color='white', size=3

)

p.legend.location = "top_left"

p.add_tools( HoverTool(

tooltips=[ ('Date', '@date{%F}'),

('Origin', '@origin{0.0}'),

('Refactored', '@refactored{0.0}' ),

],

formatters={'@date':'datetime',},

#model='vline'

)

)

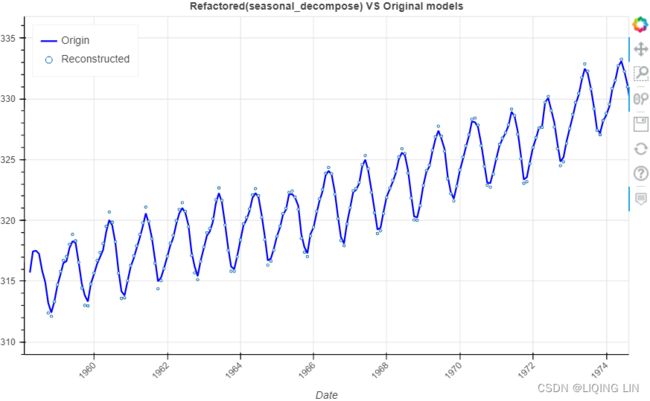

show(p)from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

import numpy as np

rec_co2_dec=co2_decomposed.trend + co2_decomposed.seasonal + co2_stl.resid

source = ColumnDataSource(data={ 'date': co2_decomposed.observed.index,

'origin': co2_decomposed.observed,

'reconstructed': rec_co2_dec,

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

p = figure( width=800, height=500,

title='Refactored(seasonal_decompose) VS Original models',

x_axis_type='datetime',

x_axis_label='Date',

)

# https://docs.bokeh.org/en/1.1.0/docs/user_guide/annotations.html

p.title.align = "center"

p.xaxis.major_label_orientation=np.pi/4 # rotation

p.line( x='date', y='origin', source=source, legend_label='Origin',

line_width=2, color='blue'

)

p.circle( x='date', y='reconstructed', source=source, legend_label='Reconstructed',

fill_color='white', size=3

)

p.legend.location = "top_left"

p.add_tools( HoverTool(

tooltips=[ ('Date', '@date{%F}'),

('Origin', '@origin{0.0}'),

('Refactored', '@refactored{0.0}' ),

],

formatters={'@date':'datetime',},

#model='vline'

)

)

show(p)Note : There are missing points in some locations

###########

6.7 Measuring strength of trend and seasonality

A time series decomposition can be used to measure the strength of trend and seasonality in a time series (Wang, Smith, & Hyndman, 2006). Recall that the decomposition is written as![]()

where ![]() is the smoothed trend component,

is the smoothed trend component, ![]() is the seasonal component and

is the seasonal component and ![]() is a remainder component.

is a remainder component.

- For strongly trended data, the seasonally adjusted data

( If the seasonal component is removed from the original data, the resulting values are the “seasonally adjusted” data

) should have much more variation than the remainder component. Therefore should be relatively small.

should be relatively small.

- But for data with little or no trend, the two variances should be approximately the same. So we define the strength of trend as:

This will give a measure of the strength of the trend between 0 and 1. Because the variance of the remainder might occasionally be even larger than the variance of the seasonally adjusted data, we set the minimal possible value of

This will give a measure of the strength of the trend between 0 and 1. Because the variance of the remainder might occasionally be even larger than the variance of the seasonally adjusted data, we set the minimal possible value of  equal to zero.

equal to zero.

- But for data with little or no trend, the two variances should be approximately the same. So we define the strength of trend as:

- The strength of seasonality is defined similarly, but with respect to the detrended data rather than the seasonally adjusted data:

- A series with seasonal strength

close to 0 exhibits almost no seasonality,

close to 0 exhibits almost no seasonality, - while a series with strong seasonality will have

close to 1 because

close to 1 because  will be much smaller than

will be much smaller than  .

.

- A series with seasonal strength

Hodrick-Prescott filter

The Hodrick-Prescott filter is a smoothing filter that can be used to separate short-term

fuctuations (cyclic variations周期性变化) from long-term trends. This is implemented as hp_filter in the statsmodels library.

Recall that STL and seasonal_decompose returned three components (trend, seasonal, and residual). On the other hand, hp_filter returns two components:

- a cyclical component and

- a trend component.

Start by importing the hpfilter function from the statsmodels library:

lamb : float

The Hodrick-Prescott smoothing parameter. A value of 1600 is suggested for quarterly data. Ravn and Uhlig suggest using a value of 6.25 (1600/4**4) for annual data and 129600 (1600*3**4) for monthly data.

The reasoning for the methodology uses ideas related to the decomposition of time series. Let ![]() for

for ![]() denote the logarithms of a time series variable. The series

denote the logarithms of a time series variable. The series ![]() is made up of a trend component

is made up of a trend component ![]() , a cyclical component

, a cyclical component ![]() , and an error component

, and an error component ![]() such that

such that ![]() Given an adequately chosen, positive value of

Given an adequately chosen, positive value of ![]() , there is a trend component that will solve(The HP filter removes a smooth trend,

, there is a trend component that will solve(The HP filter removes a smooth trend, ![]() , from the data

, from the data ![]() by solving)

by solving)![\large \underset{T_t}{min} (\sum_{t=1}^{T}(Y_t - T_t)^2 + \lambda\sum_{t=2}^{T-1}[(T_{t+1}-T_t)-(T_t - T_{t-1})]^2)](http://img.e-com-net.com/image/info8/4588450fb8814ae198c553fa1d6da3d3.gif)

- The first term of the equation is the sum of the squared deviations

, which penalizes the cyclical component.

, which penalizes the cyclical component. - The second term is a multiple

of the sum of the squares of the trend component's second differences. This second term penalizes variations in the growth rate of the trend component.

of the sum of the squares of the trend component's second differences. This second term penalizes variations in the growth rate of the trend component.

- The larger the value of

, the higher is the penalty.

, the higher is the penalty. - Hodrick and Prescott suggest 1600 as a value for

for quarterly data.

for quarterly data. - Ravn and Uhlig (2002) state that

should vary by the fourth power of the frequency observation ratio; thus,

should vary by the fourth power of the frequency observation ratio; thus,  should equal 6.25 (

should equal 6.25 ( ) for annual data and 129,600 (

) for annual data and 129,600 ( ) for monthly data;[4]

) for monthly data;[4] - in practice,

for yearly data and

for yearly data and  for monthly data are commonly used, however.

for monthly data are commonly used, however.

- The larger the value of

Here we implemented the HP filter as a ridge-regression rule using scipy.sparse.statsmodels.tsa.filters.hp_filter — statsmodels In this sense, the solution can be written as ![]()

![]() : the number of observations

: the number of observations

where ![]() is a

is a ![]() identity matrix, and K is a

identity matrix, and K is a ![]() ) matrix such that

) matrix such that

K[i,j] = 1 if i == j or i == j + 2

K[i,j] = -2 if i == j + 1

K[i,j] = 0 otherwiseThe Hodrick–Prescott filter is explicitly given by![]()

where ![]() denotes the lag operator, as can seen from the first-order condition for the minimization problem.

denotes the lag operator, as can seen from the first-order condition for the minimization problem.

from statsmodels.tsa.filters.hp_filter import hpfilter

plt.rcParams["figure.figsize"] = (20, 3)

plt.rcParams['font.size']=12

# co2_df = pd.DataFrame( co2_ds[ 'CO2_filled_[ppm]' ] )

# co2_df.rename( columns={'CO2_filled_[ppm]':'CO2'},

# inplace=True

# )

# co2_df.dropna( inplace=True )

# co2_df = co2_df.resample('M').sum()

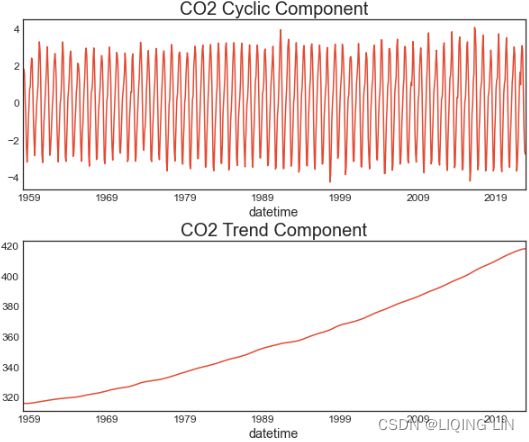

co2_cyclic, co2_trend = hpfilter(co2_df)The hpfilter function returns two pandas Series: the first Series is for the cycle and the second Series is for the trend. Plot co2_cyclic and co2_trend side by side to gain a better idea of what information the Hodrick-Prescott filter was able to extract from the data:

fig, ax = plt.subplots(2, 1, figsize=(10,8))

co2_cyclic.plot( ax=ax[0], title='CO2 Cyclic Component' )

co2_trend.plot( ax=ax[1] , title='CO2 Trend Component' )

ax[0].title.set_size(20)

ax[1].title.set_size(20)

plt.subplots_adjust(hspace = 0.3)Note that the two components from hp_filter are additive. In other words, to reconstruct the original time series, you would add co2_cyclic and co2_trend.

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

import numpy as np

rec_co2_hp= co2_trend + co2_cyclic

source = ColumnDataSource(data={ 'date': co2_df.index,

'origin': co2_df['CO2'],

'reconstructed': rec_co2_hp,

}

)

def datetime(x):

return np.array(x, dtype=np.datetime64)

p = figure( width=800, height=500,

title='Refactored(hp) VS Original models',

x_axis_type='datetime',

x_axis_label='Date',

)

# https://docs.bokeh.org/en/1.1.0/docs/user_guide/annotations.html

p.title.align = "center"

p.xaxis.major_label_orientation=np.pi/4 # rotation

p.line( x='date', y='origin', source=source, legend_label='Origin',

line_width=2, color='blue'

)

p.circle( x='date', y='reconstructed', source=source, legend_label='Reconstructed',

fill_color='white', size=3

)

p.legend.location = "top_left"

p.add_tools( HoverTool(

tooltips=[ ('Date', '@date{%F}'),

('Origin', '@origin{0.0}'),

('Refactored', '@refactored{0.0}' ),

],

formatters={'@date':'datetime',},

#model='vline'

)

)

show(p)To learn more about hpfilter(), please visit the ofcial documentation page here: https://www.statsmodels.org/0.8.0/generated/statsmodels.tsa.filters.hp_filter.hpfilter.htmlstatsmodels.tsa.filters.hp_filter.hpfilter — statsmodelshttps://www.statsmodels.org/0.8.0/generated/statsmodels.tsa.filters.hp_filter.hpfilter.html

Detecting time series stationarity

Several time series forecasting techniques assume stationarity. Tips makes it essential to understand whether the time series you are working with is stationary or non-stationary.

- A stationary time series implies that specifc statistical properties do not vary over time and remain steady, making the processes easier to model and predict.

- On the other hand, a non-stationary process is more complex to model due to the dynamic nature and variations over time (for example, in the presence of trend or seasonality).

There are diferent approaches for defning stationarity; some are strict and may not be possible to observe in real-world data, referred to as strong stationarity. In contrast, other defnitions are more modest in their criteria and can be observed in (or transformed into) real-world data, known as weak stationarity.

Stationarity is an essential concept in time series forecasting, and more relevant when working with financial or economic data. The mean is considered stable and constant if the time series is stationary. In other words, there is an equilibrium存在一个平衡 as values may deviate from the mean (above or below), but eventually, it always returns to the mean. Some trading strategies rely on this core assumption, formally called a mean reversion strategyhttps://blog.csdn.net/Linli522362242/article/details/121896073https://blog.csdn.net/Linli522362242/article/details/126353102.

Types of stationary processes

These are a number of definitions of stationarity that you may come across in time series studies:

- Stationary process: A process that generates a stationary series of observations.

- Trend stationary: A process that does not exhibit a trend.

- Seasonal stationary: A process that does not exhibit seasonality.

- Strictly stationary: Also known as strongly stationary. A process whose unconditional joint probability distribution of random variables does not change when shifted in time (or along the x axis).

- Weakly stationary: Also known as covariance-stationary, or second-order stationary. A process whose mean, variance, and correlation of random variables doesn't change when shifted in time.

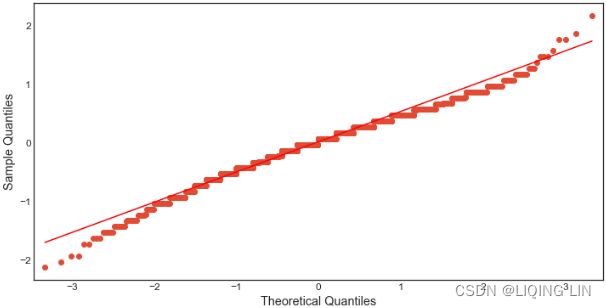

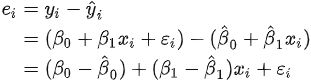

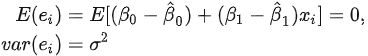

In this recipe, and for practical reasons, a stationary time series is defned as a time series with a constant mean(μ), a constant variance(![]() ), and a consistent covariance (or autocorrelation) between identical distanced periods (lags). Having the mean and variance as constants simplifes modeling since you are not solving for them as functions of time.

), and a consistent covariance (or autocorrelation) between identical distanced periods (lags). Having the mean and variance as constants simplifes modeling since you are not solving for them as functions of time.

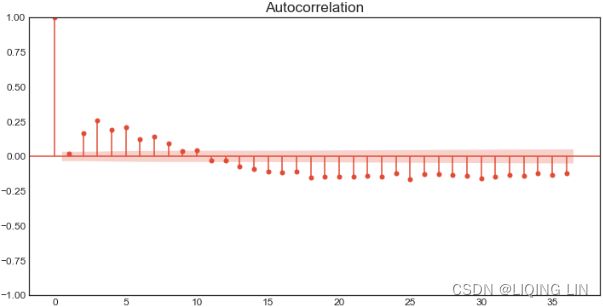

Generally, a time series with trend or seasonality can be considered non-stationary. Usually, spotting trends or seasonality visually in a plot can help you determine whether the time series is stationary or not. In such cases, a simple line plot would suffice. But in this recipe, you will explore statistical tests to help you identify a stationary or non-stationary time series numerically. You will explore testing for stationarity and techniques for making a time series stationary.

The statsmodels library ofers stationarity tests, such as the adfuller and kpss functions. Both are considered unit root tests and are used to determine whether differencing or other transformations are needed to make the time series stationary.

You will explore two statistical tests, the Augmented Dickey-Fuller (ADF) test and the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test, using the statsmodels library. Both ADF and KPSS test for unit roots in a univariate time series process. Note that unit roots are just one cause for a time series to be non-stationary, but generally, the presence of unit roots indicates non-stationarity.

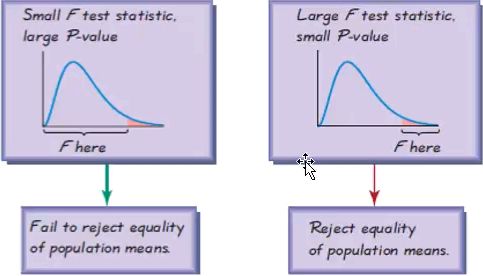

Both ADF and KPSS are based on linear regression and are a type of statistical hypothesis test. For example,

- the null hypothesis

for ADF states that there is a unit root in the time series, and thus, it is non-stationary.

for ADF states that there is a unit root in the time series, and thus, it is non-stationary. - On the other hand, KPSS has the opposite null hypothesis

, which assumes the time series is stationary.

, which assumes the time series is stationary.

Therefore, you will need to interpret the test results to determine whether you can reject or fail to reject the null hypothesis. Generally, you can rely on the p-values returned to decide whether you reject or fail to reject the null hypothesis. Remember, the interpretation for ADF and KPSS results is different given their opposite null hypotheses.

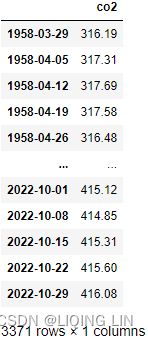

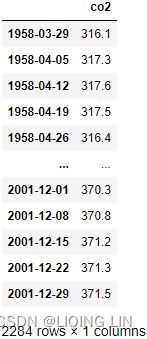

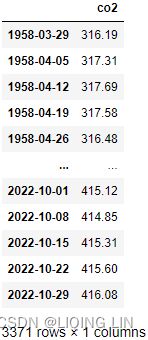

In this recipe, you will be using the CO2 dataset, which was previously loaded as a pandas DataFrame under the Technical requirements section of this chapter.

In addition to the visual interpretation of a time series plot to determine stationarity, a more concrete method would be to use one of the unit root tests, such as the ADF KPSS test.

In Figure 9.13, you can spot an upward trend and a reoccurring seasonal pattern (annual). However, when trend or seasonality exists (in this case, both), it makes the time series non-stationary. It's not always this easy to identify stationarity or lack of it visually, and therefore, you will rely on statistical tests.

You will use both the adfuller and KPSS tests from the statsmodels library and interpret their results knowing they have opposite null hypotheses:

from datetime import datetime

source='https://scrippsco2.ucsd.edu/assets/data/atmospheric/stations/in_situ_co2/weekly/weekly_in_situ_co2_mlo.csv'

co2_df = pd.read_csv( source,

comment='"',

sep=',',

names=['co2'],# as second column name

index_col=0, # use first column as index

parse_dates=True ,

na_values='-99.99'

)

#co2_df.set_index('Date', inplace=True,)

#co2_df.index.name=None

co2_df.dropna( inplace=True )

co2_df=co2_df.asfreq('W-SAT', 'ffill')#ffill()

#co2_df=co2_df.loc['1958-03-29':'2001-12-30']

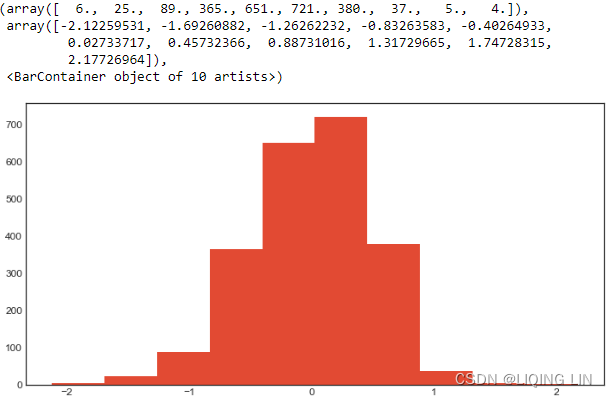

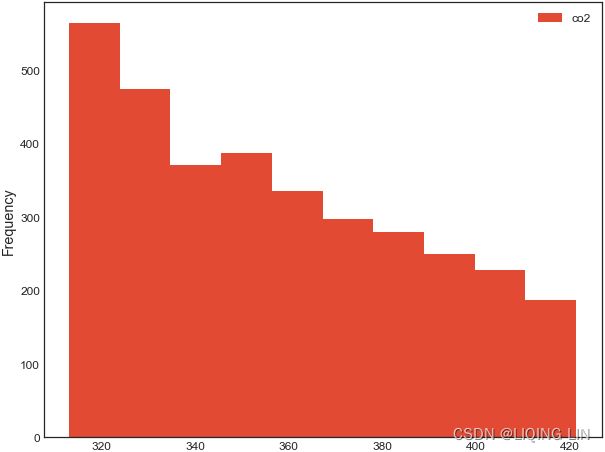

co2_dfco2_df.plot(kind='hist', figsize=(10,8))

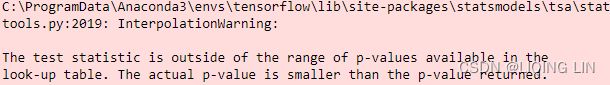

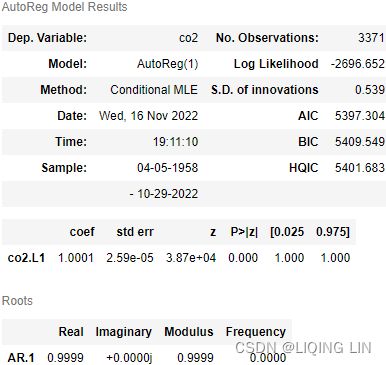

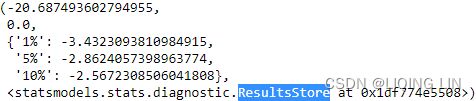

Run both the kpss and adfuller tests. Use the default parameter values for both functions:

from statsmodels.tsa.stattools import adfuller, kpss

adf_output = adfuller( co2_df )

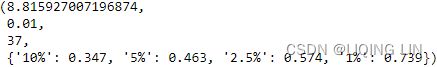

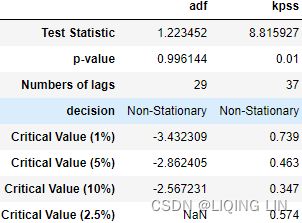

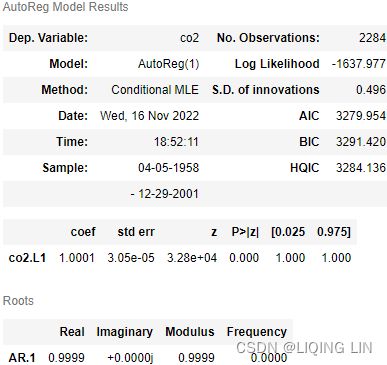

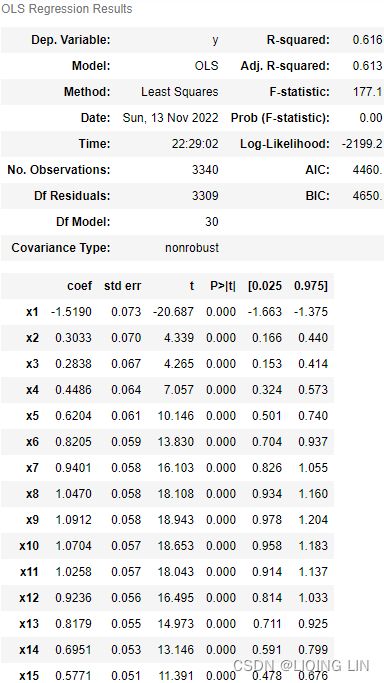

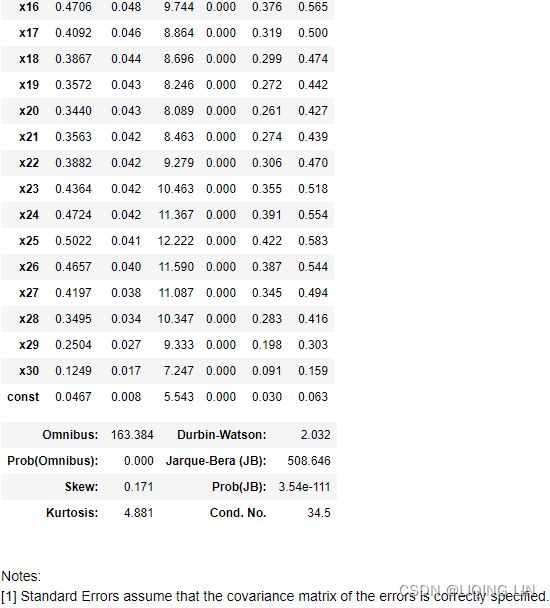

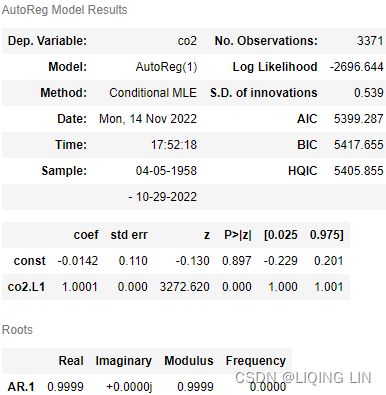

kpss_output = kpss( co2_df)adf_output| 1.2234524495363004, | The test statistic. |

| 0.9961439788365943, | MacKinnon’s approximate p-value based on MacKinnon |

| 29, | The number of lags used. |

| 3341, | The number of observations used for the ADF regression and calculation of the critical values. |

| {'1%': -3.4323087941815134, | Critical values for the test statistic at the 1 % |

| '5%': -2.8624054806561885, | Critical values for the test statistic at the 5 % |

| '10%': -2.5672307125909124}, | Critical values for the test statistic at the 10 % |

| 4511.855869092864) | The maximized information criterion if autolag is not None.(default autolag='AIC', ) |

kpss_outputTo simplify the interpretation of the test results, create a function that outputs the results in a user-friendly way. Let's call the function print_results :

def print_results( output, test='adf' ):

test_score = output[0]

pval = output[1]

lags = output[2]

decision = 'Non-Stationary'

if test == 'adf':

critical = output[4]

if pval < 0.05:

decision = 'Stationary'

elif test =='kpss':

critical = output[3]

if pval >= 0.05:

decision='Stationary'

output_dict = { 'Test Statistic': test_score,

'p-value': pval,

'Numbers of lags': lags,

'decision': decision

}

for key, value in critical.items():

output_dict['Critical Value (%s)' % key] = value

return pd.Series(output_dict, name=test) Pass both outputs to the print_results function and concatenate them into a pandas DataFrame for easier comparison:

pd.concat([ print_results(adf_output, 'adf'),

print_results(kpss_output, 'kpss')

],

axis=1

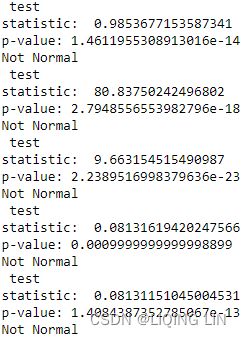

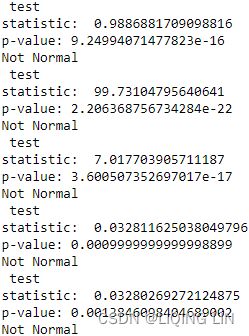

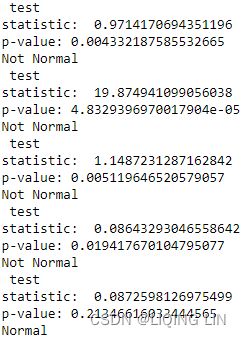

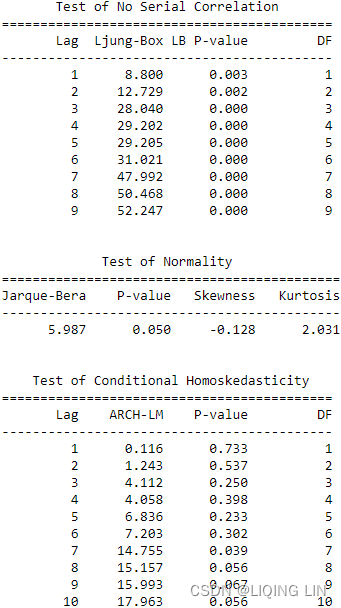

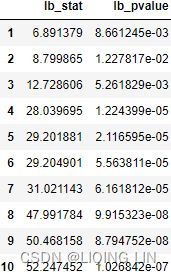

)- For ADF, the p-value is at 0.996144, which is greater than 0.05, so you cannot reject the null hypothesis(

: there is a unit root in the time series, and thus, it is non-stationary), and therefore, the time series is non-stationary.

: there is a unit root in the time series, and thus, it is non-stationary), and therefore, the time series is non-stationary.

- p-value > 0.05: We fail to reject the null hypothesis

and conclude that the data has a unit root and is non-stationary

and conclude that the data has a unit root and is non-stationary - p-value ≤ 0.05: We reject the null hypothesis

and conclude that the data does not contain a unit root and is stationary

and conclude that the data does not contain a unit root and is stationary

- p-value > 0.05: We fail to reject the null hypothesis

- For KPSS, the p-value is at 0.01, which is less than 0.05, so you reject the null hypothesis(

: assumes the time series is stationary), and therefore, the time series is non-stationary.

: assumes the time series is stationary), and therefore, the time series is non-stationary. - The Test Statistic value is 1.223452 for ADF(which are above the 1% critical value threshold) and 8.815927 for KPSS(which are above the 1% critical value threshold) . This indicates that the time series is non-stationary. It confirms that you cannot reject the null hypothesis of ADF and can reject the null hypothesis of KPSS. The critical values for ADF come from a Dickey-Fuller table. Luckily, you do not have to reference the Dickey-Fuller table since all statistical sofware/libraries that offer the ADF test use the table internally. The same applies to KPSS.

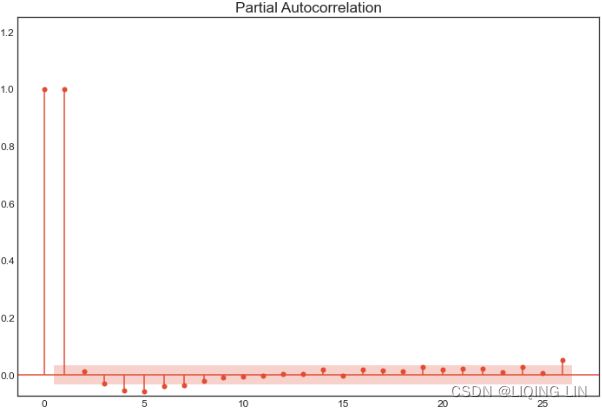

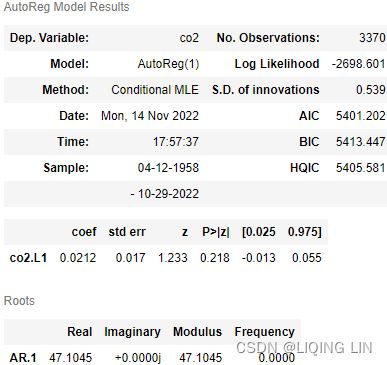

- Number of lags represents the number of lags used in the autoregressive process in the test (ADF and KPSS). In our tests, 29 lags were used for ADF and 37 lags were used for KPSS. Since our CO2 data is weekly, a lag represents 1 week back. So, 29 lags represent 29 weeks and 37 lags represent 37 weeks in our data.

- The number of observations used is the number of data points, excluding the number of lags.

- The maximized info criteria are based on the autolag parameter. The default is autolag="aic" for the Akaike information criterion. Other acceptable autolag parameter values are bic for the Bayesian information criterion and t-stat .

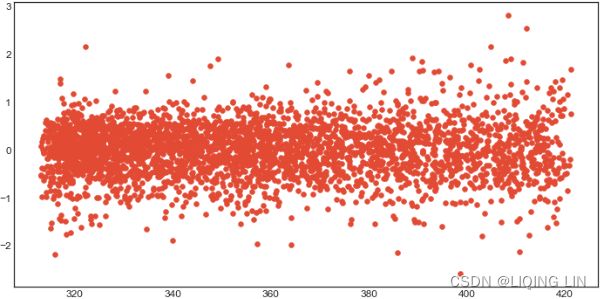

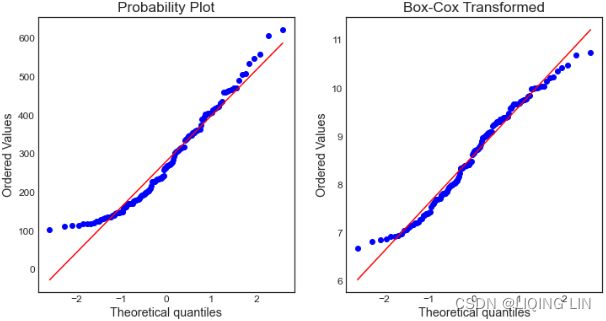

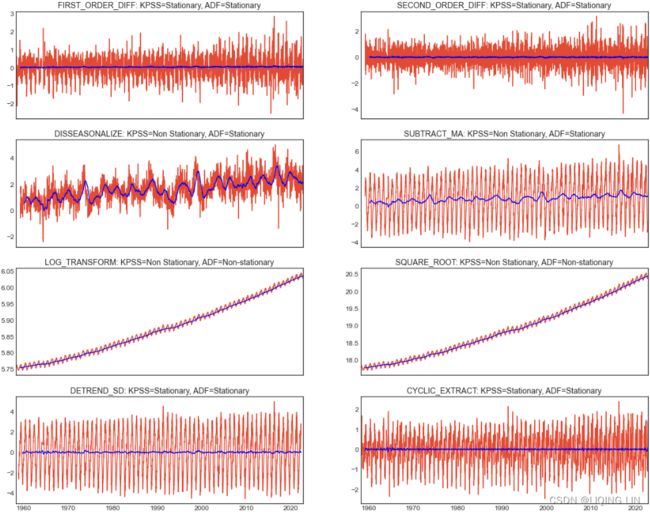

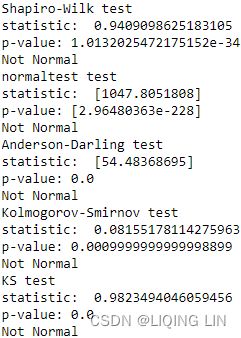

You will explore six techniques for making the time series stationary, such as transformations and differencing. The techniques covered are

- first-order differencing(detrending),

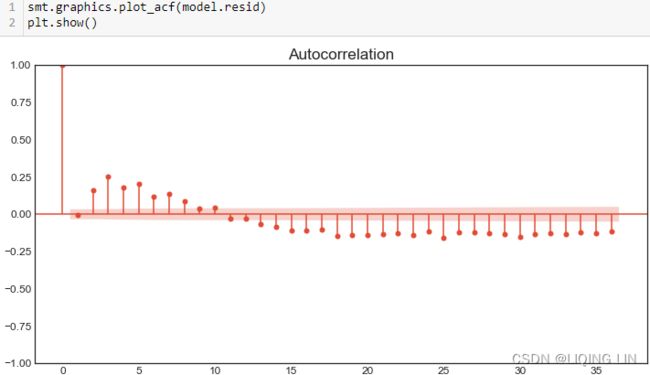

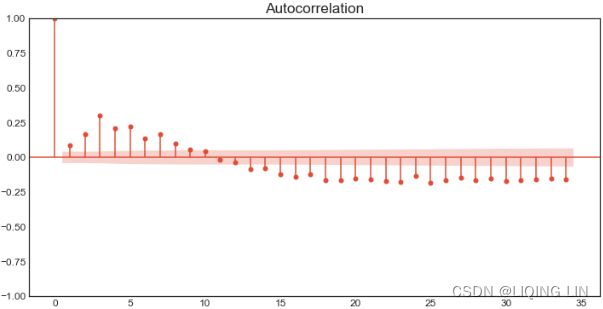

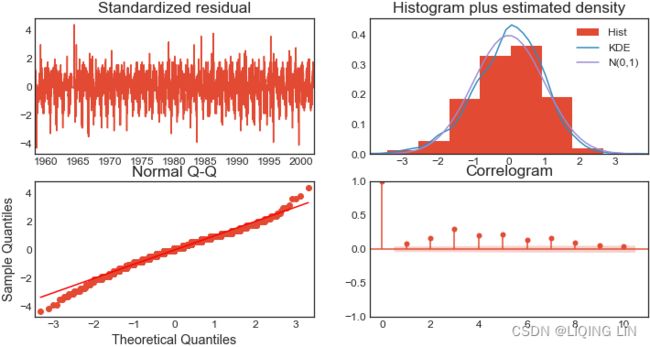

- second-order differencing,

- subtracting moving average,

- log transformation(to stabilize the variance in a time series and sometimes enough to make the time series stationary),

- decomposition, and

- Hodrick-Prescott filter.

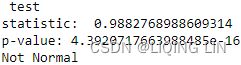

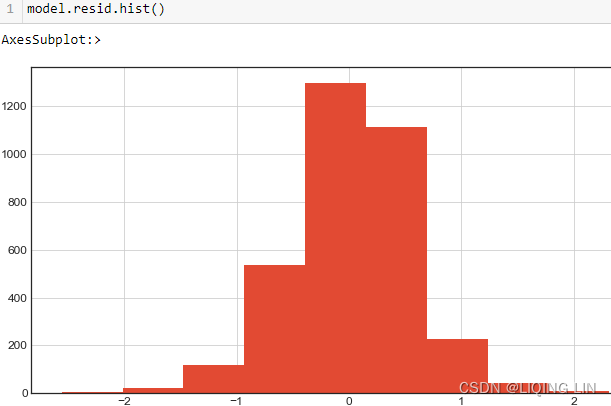

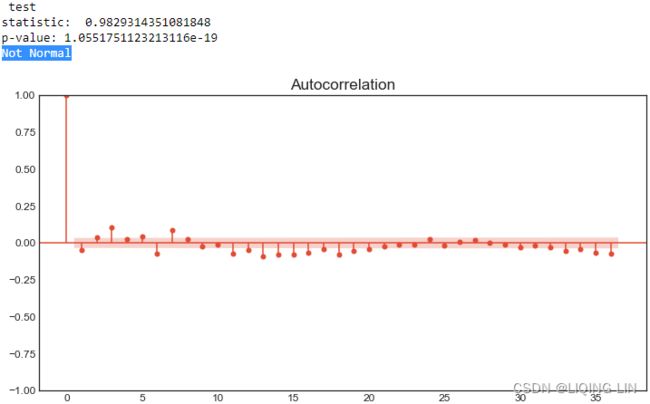

Essentially, stationarity can be achieved by removing trend (detrending) and seasonality effects. For each transformation, you will run the stationarity tests and compare the results between the different techniques. To simplify the interpretation and comparison, you will create two functions:

- check_stationarity takes a DataFrame, performs both KPSS and ADF tests, and returns the outcome.

- plot_comparison takes a list of methods and compares their plots. The function takes plot_type , so you can explore a line chart and a histogram. The function calls the check_stationarity function to capture the results for the subplot titles.

Create the check_stationarity function, which is a simplifed rewrite of the print_results function used earlier:

def check_stationarity( df ):

kps = kpss(df)

adf = adfuller(df)

kpss_pv, adf_pv = kps[1], adf[1]

kpss_h0, adf_h0 = 'Stationary', 'Non-stationary'

if adf_pv < 0.05:

# Reject ADF Null Hypothesis

adf_h0 = 'Stationary'

if kpss_pv < 0.05:

kpss_h0 = 'Non Stationary'

return (kpss_h0, adf_h0)#plt.rc('text', usetex=False)

def plot_comparison( methods, plot_type='line' ):

n = len(methods) // 2

fig, ax = plt.subplots( n,2, sharex=True, figsize=(20,16) )

for i, method in enumerate(methods):

method.dropna( inplace=True )

name = [n for n in globals()

if globals()[n] is method

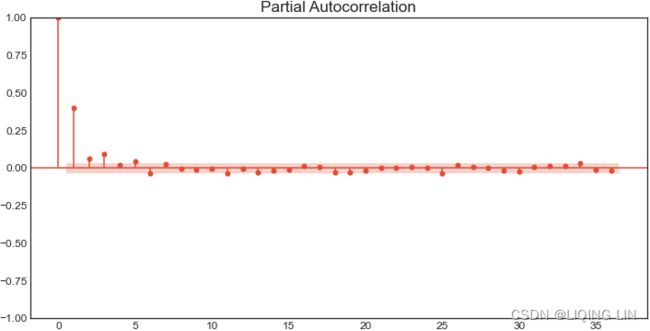

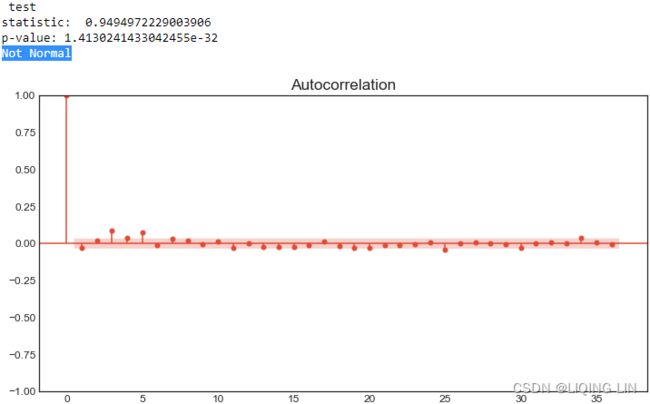

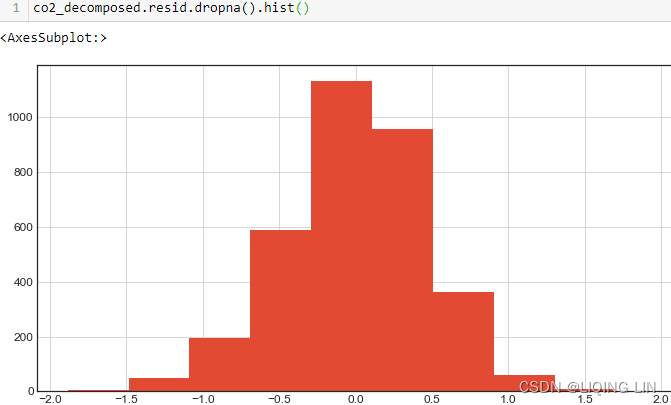

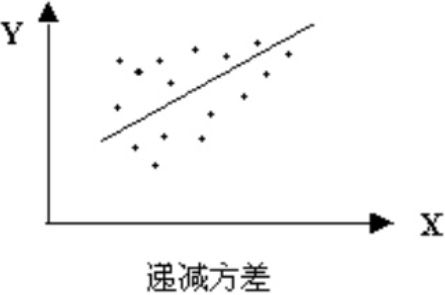

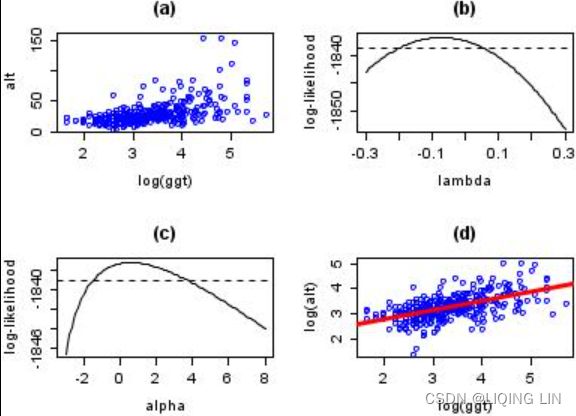

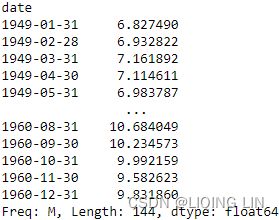

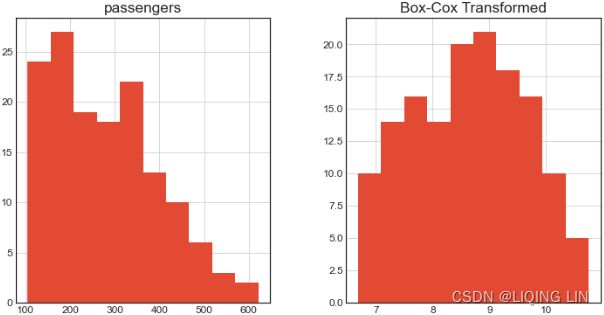

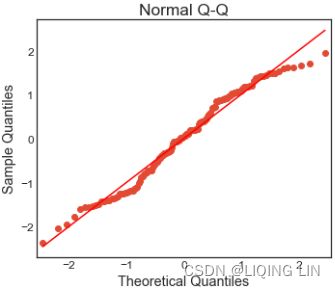

]