ts10_Univariate TS模型_circle mark pAcf_ETS_unpack product_darts_bokeh band interval_ljungbox_AIC_BIC

In https://blog.csdn.net/Linli522362242/article/details/127737895, Exploratory Data Analysis and Diagnosis, you were introduced to several concepts to help you understand the time series process. Such recipes included Decomposing time series data, Detecting time series stationarity, Applying power transformations, and Testing for autocorrelation in time series data. These techniques will come in handy in the statistical modeling approach that will be discussed in this chapter.

When working with time series data, different methods and models can be used, depending on whether the time series is

- univariate or multivariate,

- seasonal or non-seasonal,

- stationary or non-stationary,

- and linear or nonlinear.

If you list the assumptions you need to consider and examine – for example, stationarity and autocorrelation – it will become apparent why time series data is deemed to be complex and challenging. Thus, to model such a complex system, your goal is to get a good enough approximation that captures the critical factors of interest. These factors will vary by industry domain and the study's objective, such as forecasting, analyzing a process, or detecting abnormalities.

Some popular statistical modeling methods include exponential smoothing, non-seasonal AutoRegressive Integrated Moving Average (ARIMA), Seasonal ARIMA (SARIMA), Vector AutoRegressive (VAR), and other variants of these models. Many practitioners, such as economists and data scientists, have used these models. Additionally, these models can be found in popular software packages such as EViews, MATLAB, Orange, and Alteryx, as well as libraries in Python and R.

In this chapter, you will learn how to build these statistical models in Python. In other words, I will provide a brief introduction to the theory and math since the focus is on the implementation. I will provide references where it makes sense if you are interested in diving deeper into the math and theory of such models.

In this chapter, we will cover the following recipes:

- • Plotting ACF and PACF

- • Forecasting univariate time series data with exponential smoothing

- • Forecasting univariate time series data with non-seasonal ARIMA

- • Forecasting univariate time series data with seasonal ARIMA

You will be working with two datasets throughout this chapter: Life Expectancy from Birth and Monthly Milk Production. Import these datasets, which are stored in CSV format ( life_expectancy_birth.csv , and milk_production.csv ), into pandas DataFrames. Each dataset comes from a diferent time series process, so they will contain a diferent trend or seasonality. Once you've imported the datasets, you will have two DataFrames called life and milk:

import pandas as pd

life_file='https://raw.githubusercontent.com/PacktPublishing/Time-Series-Analysis-with-Python-Cookbook/main/datasets/Ch10/life_expectancy_birth.csv'

milk_file='https://raw.githubusercontent.com/PacktPublishing/Time-Series-Analysis-with-Python-Cookbook/main/datasets/Ch10/milk_production.csv'

life = pd.read_csv( life_file,

index_col='year',

parse_dates=True,

)

life.head()life.indexfreq : Time series / date functionality — pandas 1.5.1 documentation

# https://pandas.pydata.org/pandas-docs/stable/user_guide/timeseries.html#anchored-offsets

# freq : (B)A(S)-JAN

life = life.asfreq('AS-JAN')

life.indexmilk = pd.read_csv( milk_file,

index_col='month',

parse_dates=True,

)

milk.head()# https://pandas.pydata.org/pandas-docs/stable/user_guide/timeseries.html#anchored-offsets

milk=milk.asfreq('MS')

milk.indexInspect the data visually and observe if the time series contains any trend or seasonality. You can always come back to the plots shown in this section for reference:

from bokeh.plotting import figure, show

from bokeh.models import ColumnDataSource, HoverTool

from bokeh.layouts import column

import numpy as np

import hvplot.pandas

hvplot.extension("bokeh")

source = ColumnDataSource( data={'yearOfBirth':life.index,#.year,

'Expectancy':life['value'].values,

})

p1 = figure( width=800, height=400,

title='Annual Life Expectancy',

x_axis_type='datetime',

x_axis_label='Year of Birth', y_axis_label='Life Expectancy'

)

# https://docs.bokeh.org/en/test/docs/user_guide/styling.html

p1.xaxis.axis_label_text_font_style='normal'

p1.yaxis.axis_label_text_font_style='bold'

p1.xaxis.major_label_orientation=np.pi/4 # rotation

p1.title.align='center'

p1.title.text_font_size = '1.5em' #'16px'

# p1.circle https://docs.bokeh.org/en/test/docs/user_guide/annotations.html

p1.line( x='yearOfBirth', y='Expectancy', source=source,

line_width=2, color='blue',

legend_label='Life_Expectancy'

)

p1.legend.location = "top_left"

p1.legend.label_text_font = "times"

p1.add_tools( HoverTool( tooltips=[('Year of Birth', '@yearOfBirth{%Y}'),

('Life Expectancy', '@Expectancy{0.000}')

],

formatters={'@yearOfBirth':'datetime',

'@Expectancy':'numeral'

},

mode='vline'

)

)

source = ColumnDataSource( data={'productionMonth':milk.index,

'production':milk['production'].values,

})

# def datetime(x):

# return np.array(x, dtype=datetime64)

p2 = figure( width=800, height=400,

title='Monthly Milk Production',

x_axis_type='datetime',

x_axis_label='Month', y_axis_label='Milk Production'

)

p2.xaxis.axis_label_text_font_style='normal'

p2.yaxis.axis_label_text_font_style='bold'

p2.xaxis.major_label_orientation=np.pi/4 # rotation

p2.title.align='center'

p2.title.text_font_size = '1.5em'

p2.line( x='productionMonth', y='production', source=source,

line_width=2, color='blue',

legend_label='Milk Production'

)

# https://docs.bokeh.org/en/latest/docs/first_steps/first_steps_3.html

p2.legend.location = "top_left"

p2.legend.label_text_font = "times"

p2.legend.label_text_font_style = "italic"

p2.add_tools( HoverTool( tooltips=[('Production Month', '@productionMonth{%Y-%m}'),

('Production', '@production{0}')

],

formatters={'@productionMonth':'datetime',

'@production':'numeral'

},

mode='vline'

)

)

show(column([p1,p2]))Figure 10.1 – Time series plots for Annual Life Expectancy and Monthly Milk Production

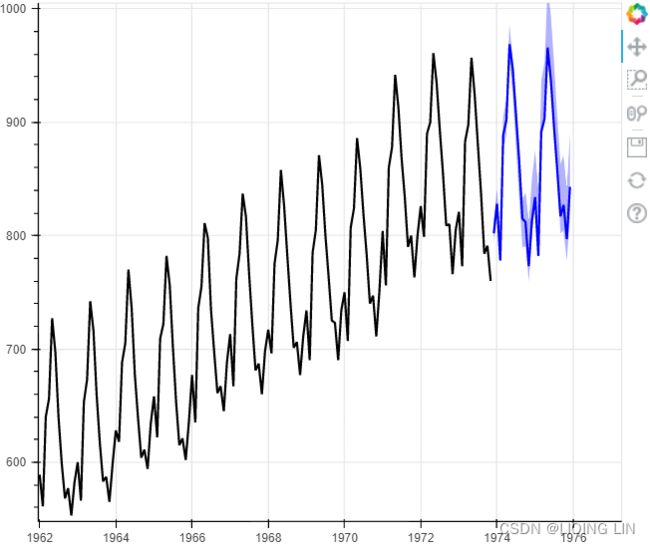

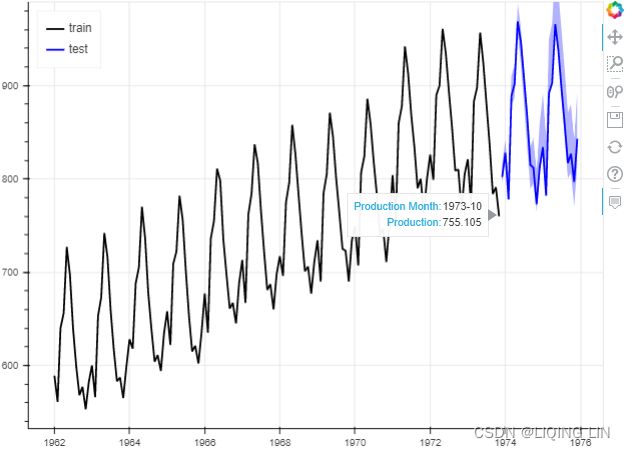

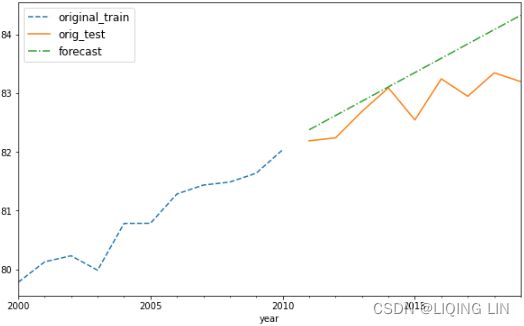

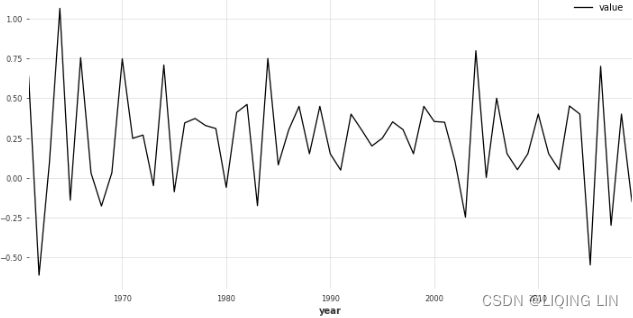

- The preceding figure shows a time series plot for the life DataFrame showing a positive (upward) trend and no seasonality. The life expectancy预期寿命 data contains annual life expectancy records at birth from 1960 to 2019 (60 years). The original dataset contained records for each country, but you will be working with world records in this chapter.

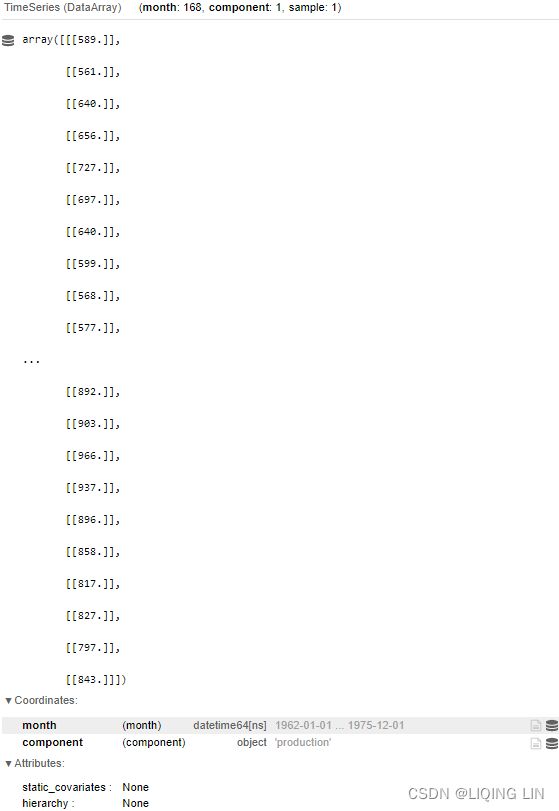

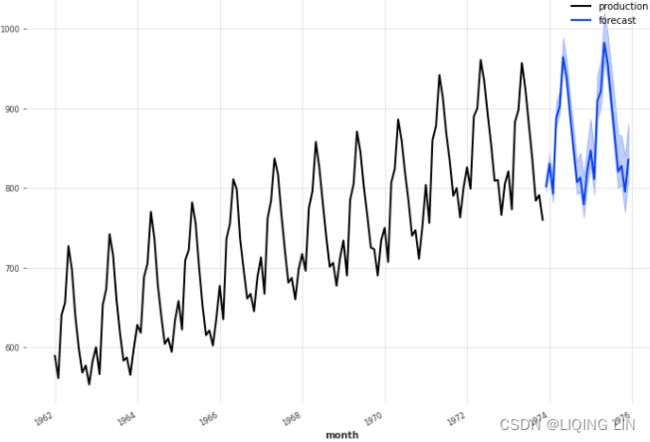

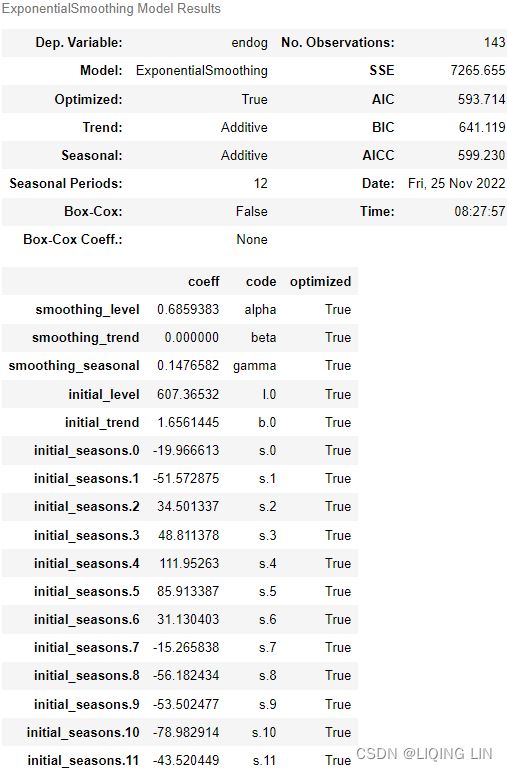

- The time series plot for the milk DataFrame shows a positive (upward) trend and a repeating seasonality (every summer). The milk production data is recorded monthly from January 1962 to December 1975 (168 months). The seasonal magnitudes and variations over time seem to be steady, indicating an additive nature. Having a seasonal decomposition that specifes the level, trend, and season of an additive model will reflect this as well. For more insight on seasonal decomposition, please review the Decomposing time series data recipe in https://blog.csdn.net/Linli522362242/article/details/127737895, Exploratory Data Analysis and Diagnosis.

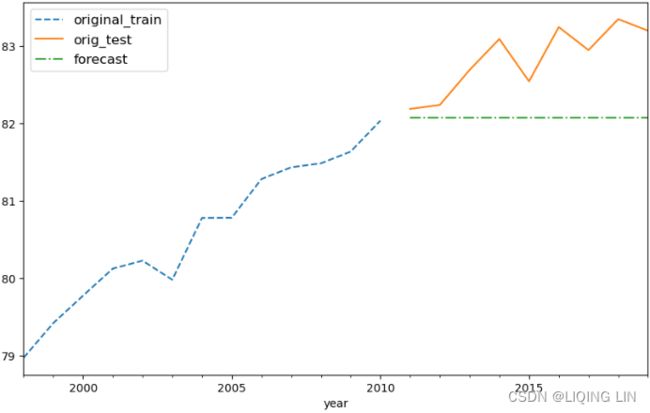

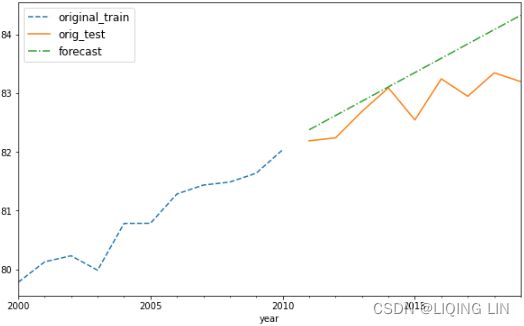

You will need to split the data into test and train datasets. Then, you must train the models (fitting) on the training dataset and use the test dataset to evaluate the model and compare your predictions. A forecast that's created for the data that will be used in training is called an in-sample forecast, while forecasting for unseen data such as a test set is called an out-of-sample forecast. When you're evaluating the different models, you will be using the out-of-sample or test sets.

Create a generalized function, split_data , which splits the data based on a test split factor. This way, you can experiment on different splits as well. We will be referencing this function throughout this chapter:

def split_data(data, test_split):

length = len(data)

t_idx = round( length*(1-test_split) )

train, test = data[:t_idx], data[t_idx:]

print( f'train: {len(train)}, test: {len(test)}' )

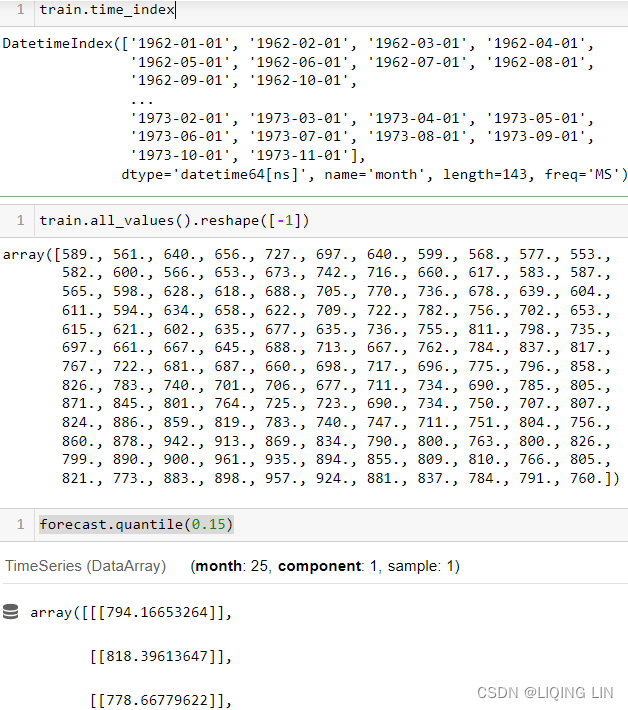

return train,testCall the split_data function to split the two DataFrames into test and train datasets (start with 15% test and 85% train). You can always experiment with diferent split factors:

test_split = 0.15

milk_train, milk_test = split_data( milk, test_split )

life_train, life_test = split_data( life, test_split )![]()

You will be checking for stationarity often since it is an essential assumption for many of the models you will build.

import matplotlib.pyplot as plt

fig, ax = plt.subplots( 2,1, figsize=(10,8) )

life.plot( ax=ax[0], title='Annual Life Expectancy' )

ax[0].set_xlabel('Year of Birth')

ax[0].set_ylabel('Life Expectancy')

ax[0].legend()

# using first order differencing (detrending)

life_diff = life.diff().dropna()

life_diff.plot( ax=ax[1], title='First Order Differencing' )

ax[1].set_xlabel('Year of Birth')

plt.subplots_adjust(hspace = 0.3)

plt.show()adfuller(life_diff)-8.510099757338308, The test statistic.

1.1737760312328758e-13, MacKinnon’s approximate p-value based on MacKinnon

1, The number of lags used.

57, The number of observations used for the ADF regression and calculation of the critical values.

{'1%': -3.5506699942762414, Critical values for the test statistic at the 1 %

'5%': -2.913766394626147, Critical values for the test statistic at the 5 %

'10%': -2.5946240473991997}, Critical values for the test statistic at the 10 %

-5.12107228858611) The maximized information criterion if autolag is not None.(default autolag='AIC', )

from statsmodels.tsa.api import adfuller

def check_stationary( df ):

results = adfuller(df)[1:3] #

s = 'Non-Stationary'

if results[0] < 0.05: # p-value < 0.05

s = 'Stationary'

print( f"{s}\t p-value:{results[0]} \t lags:{results[1]}" )

return (s, results[0])

adfuller(life_diff) An autoregressive model or AR(p) is a linear model that uses observations from previous time steps as inputs into a regression equation to determine the predicted value of the next step. Hence, the auto part in autoregression indicates self and can be described as the regression of a variable on a past version of itself. A typical linear regression model will have this equation: ![]()

Here,

or

or  is the predicted variable,

is the predicted variable, or

or  is the intercept,

is the intercept,  are the features or independent variables, and

are the features or independent variables, and or

or  are the coefficients for each of the independent variables.

are the coefficients for each of the independent variables.

In regression, your goal is to solve these coefficients, including the intercept (think of them as weights), since they are later used to make predictions. The error term, ![]() , denotes the residual or noise (the unexplained portion of the model).

, denotes the residual or noise (the unexplained portion of the model).

Compare that with the autoregressive equation and you will see the similarities:![]()

This is an AR model of order p written as AR(p) . The main difference between an autoregressive and regression model is that the predicted variable is ![]() , which is

, which is ![]() at the

at the

current time, ![]() , and that the

, and that the ![]() variables are lagged (previous) versions

variables are lagged (previous) versions

of ![]() . In this recipe, you used an ARIMA(0,1,1), which translates into an AR(0), indicating

. In this recipe, you used an ARIMA(0,1,1), which translates into an AR(0), indicating

no autoregressive model being used.

Unlike an autoregressive model that uses past values, the moving average or MA(q) uses past errors (from past estimates) to make a prediction:![]()

Combining the AR(p) and MA(q) models would produce an ARMA(p,q) model (autoregressive moving average). Both the AR and ARMA processes assume a stationary time series. However, suppose the time series is not stationary due to the presence of a trend. In that case, you cannot use the AR or ARMA models on non-stationary data, unless you perform some transformations, such as differencing. This was the case with the life data.

In the first recipe, you will be introduced to the ACF Corr(![]() ,

,![]() ,

,![]() ,...,

,...,![]() ,

,![]() ) and PACF: Corr(

) and PACF: Corr(![]() ,

, ![]() )plots, which are used to determine the orders (parameters) for some of the models that will be used in this chapter, such as the ARIMA model.

)plots, which are used to determine the orders (parameters) for some of the models that will be used in this chapter, such as the ARIMA model.

One of the reasons ARIMA is popular is because it generalizes to other simpler models, as follows:

- • ARIMA(1, 0, 0) is a first-order autoregressive or AR(1) model

- • ARIMA(1, 1, 0) is a differenced first-order autoregressive model

- • ARIMA(0, 0, 1) is a first-order moving average or MA(1) model

- • ARIMA(1, 0, 1) is an ARMA (1,1) model

- • ARIMA(0, 1, 1) is a simple exponential smoothing model. This method is suitable for forecasting data with no clear trend or seasonal pattern

Plotting ACF and PACF

When building statistical forecasting models such as AR, MA, ARMA, ARIMA, or SARIMA, you will need to determine the type of time series model that is most suitable for your data and the values for some of the required parameters, called orders. More specifcally, these are called the lag orders for the autoregressive (AR![]() ) or moving average (MA

) or moving average (MA ) components. This will be explored further in the Forecasting univariate time series data with non-seasonal ARIMA recipe of this chapter.

) components. This will be explored further in the Forecasting univariate time series data with non-seasonal ARIMA recipe of this chapter.

To demonstrate this, for example, an AutoRegressive Moving Average (ARMA) model can be written as ARMA(p, q), where p is the autoregressive order or AR(p) component, and q is the moving average order or MA(q) component. Hence, an ARMA model combines an AR(p) and an MA(q) model.

The core idea behind these models is built on the assumption that the current value of a particular variable, ![]() , can be estimated from past values of itself. For example, in an autoregressive model of order p or AR(p) , we assume that the current value,

, can be estimated from past values of itself. For example, in an autoregressive model of order p or AR(p) , we assume that the current value, ![]() , at time

, at time ![]() can be estimated from its past values

can be estimated from its past values![]() up to p, where p determines how many lags (steps back) we need to go. If p = 2 , this means we must use two previous periods

up to p, where p determines how many lags (steps back) we need to go. If p = 2 , this means we must use two previous periods ![]() to predict

to predict ![]() . Depending on the granularity of your time series data, p=2 can be 2 hours, 2 days, 2 months, or 2 quarters.

. Depending on the granularity of your time series data, p=2 can be 2 hours, 2 days, 2 months, or 2 quarters.

To build an ARMA model, you will need to provide values for the p and q orders (known as lags). These are considered hyperparameters since they are supplied by you to influence the model.

The terms parameters and hyperparameters are sometimes used interchangeably. However, they have different interpretations and you need to understand the distinction.

The ACF and PACF plots can help you understand the strength of the linear relationship between past observations and their significance at different lags.

The ACF and PACF plots show significant autocorrelation or partial autocorrelation above the confidence interval. The shaded portion represents the confidence interval, which is controlled by the alpha parameter in both pacf_plot and acf_plot functions. The default value for alpha in statsmodels is 0.05 (or a 95% confidence interval). Being significant could be in either direction; strongly positive the closer to 1 (above) or strongly negative the closer to -1 (below).

If there is a strong correlation between past observations at lags 1, 2, 3, and 4, this means that the correlation measure at lag 1 is influenced by the correlation with lag 2, lag 2 is infuenced by the correlation with lag 3, and so on.ACF (![]() ,

,![]() ,

,![]() ,...,

,...,![]() ,

,![]() )

)

The ACF measure at lag 1 will include these influences of prior lags if they are correlated. In contrast, a PACF at lag 1 will remove these influences to measure the pure relationship at lag 1 with the current observation. PACF(![]() ,

,![]() )

)

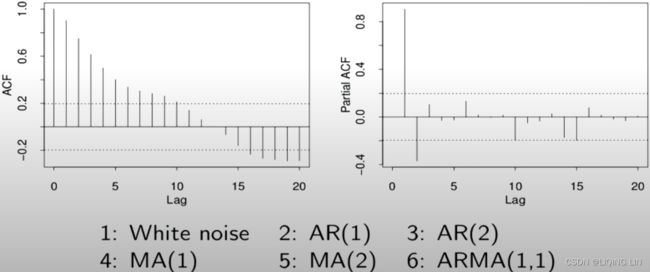

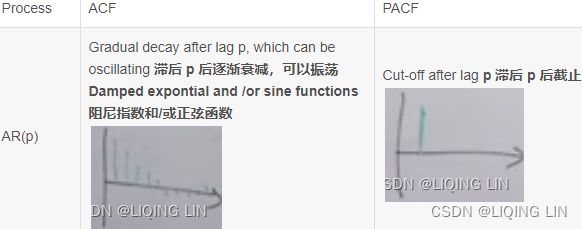

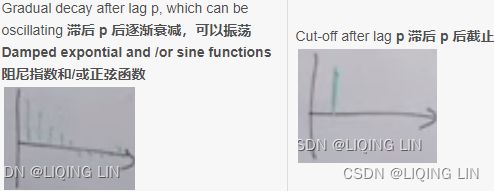

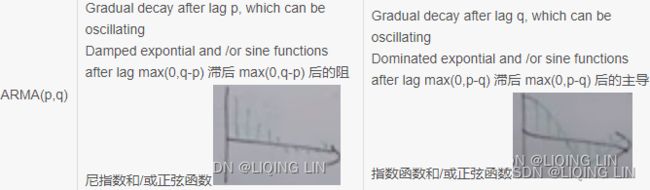

The following table shows an example guide for identifying the stationary AR and MA orders from PACF and ACF plots:

Table 10.1 – Identifying the AR, MA, and ARMA models using ACF and PACF plots

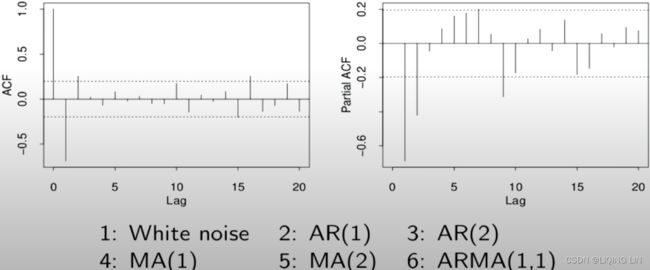

Example1 White noise :

Ans: White noise : no spike or nothing is above or below the shaded area

Example2 AR(1):

Ans: AR(1) : Cut-off after lag p=1(Partial ACF), and ACF Gradual decay after lag p, which can be oscillating

Ans: AR(1) : Cut-off after lag p=1(Partial ACF), and ACF Gradual decay after lag p, which can be oscillating

Example3 AR(2):

Ans: AR(2) : Cut-off after lag p=2(Partial ACF)

Example4 Seasonal AR(1) S=5:

Ans: Seasonal AR(1) S=5 : (Partial ACF:p=5/S=1) and (ACF:5,10,...==> S=5, and ACF Gradual decay after lag p=5, which can be oscillating)

Ans: Seasonal AR(1) S=5 : (Partial ACF:p=5/S=1) and (ACF:5,10,...==> S=5, and ACF Gradual decay after lag p=5, which can be oscillating)

Example5 MA(2):

Ans: it hard to say AR(2) or MA(2), but the Partial ACF looks like expontial decay(oscillating, after lag q=2) when ACF: signal lag at 2(q=2), so MA(2)

Ans: it hard to say AR(2) or MA(2), but the Partial ACF looks like expontial decay(oscillating, after lag q=2) when ACF: signal lag at 2(q=2), so MA(2)

Example6 ARMA(2,2) and there exists seasonal:

Ans: ARMA(2,2) : (Partial ACF: p=2, and ACF Gradual decay after lag p, which can be oscillating) , (ACF:q=2, and Partial ACF Gradual decay after lag q, which can be oscillating) and there exists seasonal, it is best go back to improve your model one step by step

Ans: ARMA(2,2) : (Partial ACF: p=2, and ACF Gradual decay after lag p, which can be oscillating) , (ACF:q=2, and Partial ACF Gradual decay after lag q, which can be oscillating) and there exists seasonal, it is best go back to improve your model one step by step

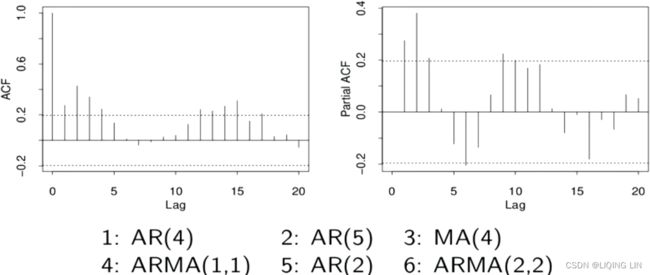

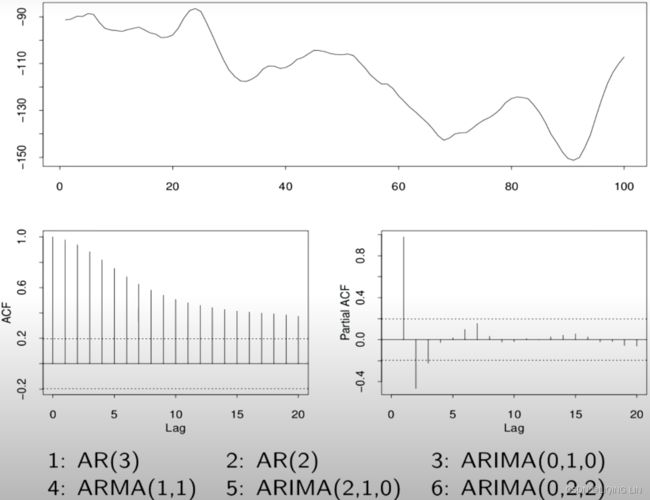

Example7 ARIMA(2,1,0):

Ans: ?==> solution

Ans: ?==> solution PACF ==> AR(2) since signal lag at p=2 ACF :looks like expontial decay ==> MA(0)

PACF ==> AR(2) since signal lag at p=2 ACF :looks like expontial decay ==> MA(0)

ANS: ARIMA(p, d, q) = ARIMA(2,1,0) <==![]() first order differencing

first order differencing

First-order difference(detrend): ![]()

Second-order differences:![]()

a dth-order difference can be written as : ![]()

a seasonal difference followed by a first difference: ![]()

Example8 AR(3):

![]()

![]()

ANS: AR(3):Cut-off after lag p=3(Partial ACF), and ACF Gradual decay after lag p, which can be oscillating

Example10 MA(1) :

ANS: MA(1) <=Cut-off after lag q=1(ACF) and partial ACF looks like expontial decay(oscillating)

ANS: MA(1) <=Cut-off after lag q=1(ACF) and partial ACF looks like expontial decay(oscillating)

Example11: SARIMA (0, 1, 1) (0, 1, 1, 12)

the plot is based on milk_diff_12_1 = milk.diff(12).diff(1).dropna() ==> S=12, d=1

- Starting with the ACF plot,

- there is a signifcant spike at lag 1, which represents the non-seasonal order for the MA process as q=1 .

- The spike at lag 12 represents the seasonal order for the MA process as Q=1=12/S.

- Notice that there is a cut-off right after lag 1, then a spike at lag 12, followed by a cut-off (no other signifcant lags afterward) + exponential decay in the PACF plot==> MA

- These indicate a moving average model: an MA(1) for the non-seasonal component and an MA(1) for the seasonal component.

- The PACF plot : an exponential decay at lags 12, 24, and 36 indicates an MA model. So, the SARIMA model would be ARIMA (0, 1, 1) (0, 1, 1, 12) .

- SARIMA(p, d, q) (P, D, Q, S)

![]()

a seasonal difference followed by a first difference: ![]()

Parameters versus Hyperparameters

When training an ARIMA(AutoRegressive Integrated Moving Average) model, the outcome will produce a set of parameters called coeffcients – for example, a coeffcient value for AR Lag 1 or sigma –that are estimated by the algorithm during the model training process and are used for making predictions. They are referred to as the model's parameters.

On the other hand, the (p, d, q) parameters are the ARIMA(p, q, d) orders for AR, differencing, and MA, respectively. These are called hyperparameters. They are set manually and influence the model parameters that are produced (for example, the coefcients). These hyperparameters, as we have seen previously can be tuned using grid search, for example, to find the best set of values that produce the best model.

Now, you might be asking yourself, how do I find the significant lag values for AR and MA models?

This is where the AutoCorrelation Function (ACF) and the Partial AutoCorrelation Function (PACF) and their plots come into play. The ACF and PACF can be plotted to help you identify if the time series process is an AR, MA, or an ARMA process (if both are present) and the signifcant lag values (for p and q ). Both ACF and PACF plots are referred to as correlograms since the plots represent the correlation statistics.

The difference between an ARMA and ARIMA, written as ARIMA(p, d, q) , is in the stationarity assumption. The d parameter in ARIMA is for the differencing order. An ARMA model assumes a stationary process, while an ARIMA model does not since it handles differencing. An ARIMA model is a more generalized model since it can satisfy an ARMA model by making the differencing factor d=0 . Hence, ARIMA(1, 0, 1) is ARMA(1, 1) .![]()

AR Order versus MA Order

You will use the PACF plot to estimate the AR order and the ACF plot to estimate the MA order. Both the ACF and PACF plots show values that range from -1 to 1 on the vertical axis (y-axis), while the horizontal axis (x-axis) indicates the size of the lag. A signifcant lag is any lag that goes outside the shaded confidence interval, as you shall see from the plots.

The statsmodels library provides two functions: acf_plot(for ma(q)) and pacf_plot(for ar(p)) . The correlation (for both ACF and PACF) at lag zero is always one (since it represents autocorrelation of the first observation on itself). Hence, both functions provide the zero parameter, which takes a Boolean. Therefore, to exclude the zero lag in the visualization, you can pass zero=False instead.

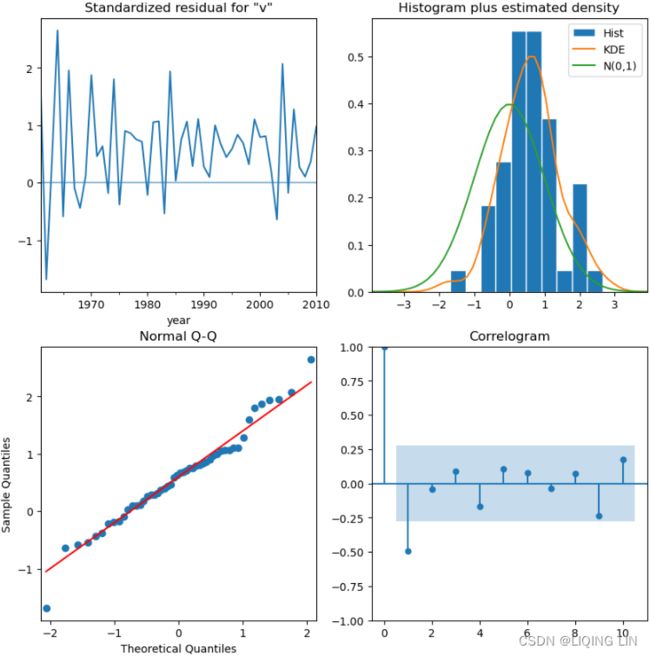

In https://blog.csdn.net/Linli522362242/article/details/127737895, Exploratory Data Analysis and Diagnosis, in the Testing autocorrelation in time series data recipe, you used the Ljung-Box test to evaluate autocorrelation on the residuals. In this recipe, you will learn how to use the ACF plot to examine residual autocorrelation visually as well.

You will use the life expectancy data in this recipe. As shown in Figure 10.1, the data is not stationary due to the presence of a long-term trend. In such a case, you will need to difference (detrend) the time series to make it stationary before applying the ACF and PACF plots.

import statsmodels.tsa.api as smt

fig, ax = plt.subplots( 2,1, figsize=(12,8) )

# using first order differencing (detrending)

# life_diff = life.diff().dropna()

smt.graphics.plot_acf( life_diff, zero=False, ax=ax[0], auto_ylims=True, )

smt.graphics.plot_pacf( life_diff, zero=False, ax=ax[1], auto_ylims=True,)

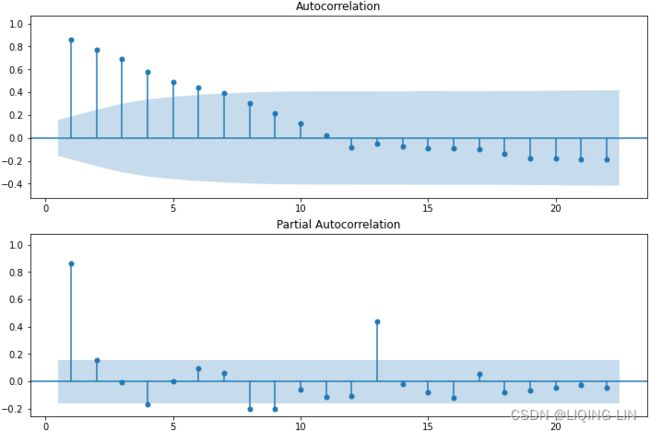

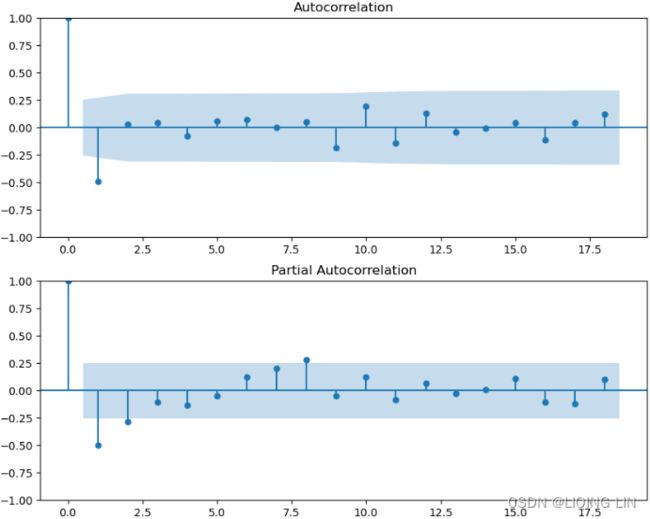

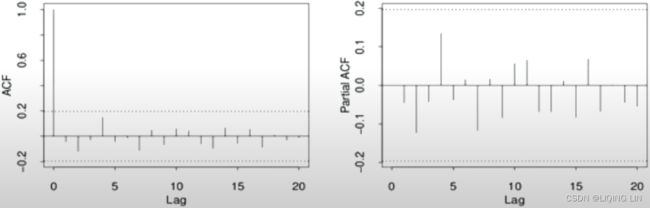

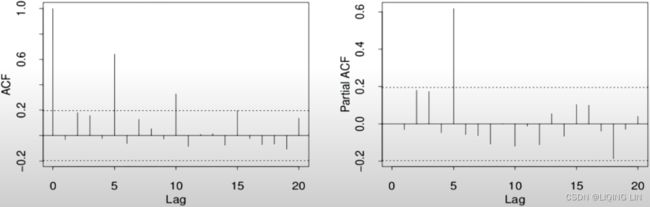

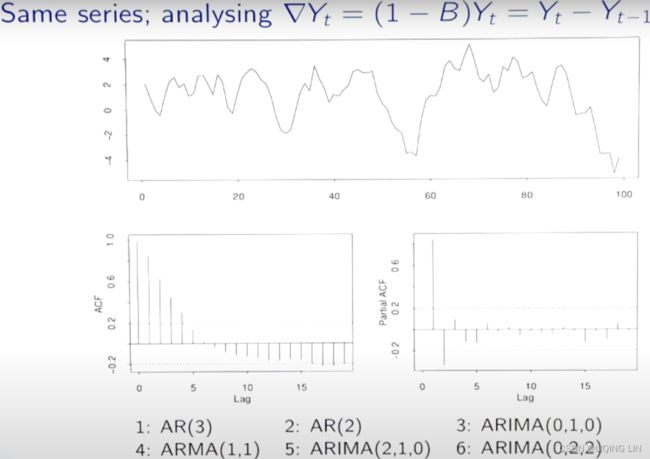

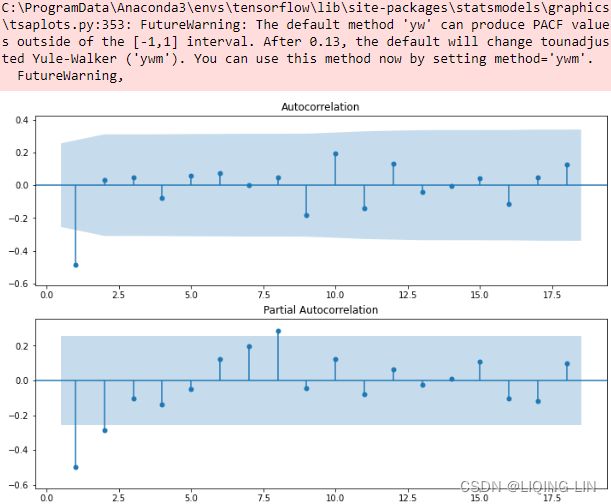

plt.show() Figure 10.2 – The ACF and PACF plots for the life expectancy data after differencing(d=1)

Figure 10.2 – The ACF and PACF plots for the life expectancy data after differencing(d=1)

The ACF plot shows a signifIcant spike at lag (order) 1. Signifcance is represented when a lag (vertical line) goes above or below the shaded area. The shaded area represents the confidence interval, which is set to 95% by default. In the ACF plot, only the first lag is significant, which is below the lower confidence interval, and then cuts off right after. All the remaining lags are not significant. This indicates a moving average of order one or MA(1).

The PACF plot shows a gradual decay with oscillation逐渐衰减和振荡. Generally, if PACF shows a gradual decay(with oscillation), it indicates a moving average model.

For example, if you are using an ARMA or ARIMA model, it would be represented as ARMA(0, 1) once the data has been differenced to make it stationary, or ARIMA(p, d, q)=ARIMA(0, 1, 1) , indicating a first-order differencing with d=1 . In both ARMA and ARIMA, the AR order is p=0 , and the MA order is q=1.

Now, let's see how PACF and ACF can be used with a more complex dataset containing strong trends and seasonality. In Figure 10.1, the Monthly Milk Production plot shows an annual seasonal effect and a positive upward trend indicating a non-stationary time series. It is more suitable with a SARIMA model. In a SARIMA model, you have two components: a non-seasonal and a seasonal component. For example, in addition to the AR and MA processes for the non-seasonal components represented by lower case p and q , which you saw earlier, you will have AR and MA orders for the seasonal component, which are represented by upper case P and Q , respectively. Tis can be written as SARIMA(p, d, q) (P, D, Q, S) . You will learn more about the SARIMA model in the Forecasting univariate time series data with seasonal ARIMA recipe.

the Monthly Milk Production plot shows an annual seasonal effect and a positive upward trend indicating a non-stationary time series. It is more suitable with a SARIMA model. In a SARIMA model, you have two components: a non-seasonal and a seasonal component. For example, in addition to the AR and MA processes for the non-seasonal components represented by lower case p and q , which you saw earlier, you will have AR and MA orders for the seasonal component, which are represented by upper case P and Q , respectively. Tis can be written as SARIMA(p, d, q) (P, D, Q, S) . You will learn more about the SARIMA model in the Forecasting univariate time series data with seasonal ARIMA recipe.

import statsmodels.tsa.api as smt

fig, ax = plt.subplots( 2,1, figsize=(12,8) )

# using first order differencing (detrending)

# life_diff = life.diff().dropna()

smt.graphics.plot_acf( milk, zero=False, ax=ax[0], auto_ylims=True, )

smt.graphics.plot_pacf( milk, zero=False, ax=ax[1], auto_ylims=True,)

plt.show()seasonal s=12

To make such time series stationary, you must start with seasonal differencing to remove the seasonal effect. Since the observations are taken monthly, the seasonal effects are observed annually (every 12 months or period):

# disseasonalize : differencing to remove seasonality

milk_diff_12 = milk.diff(12).dropna()

import statsmodels.tsa.api as smt

fig, ax = plt.subplots( 2,1, figsize=(12,8) )

# using first order differencing (detrending)

# life_diff = life.diff().dropna()

smt.graphics.plot_acf( milk_diff_12, zero=False, ax=ax[0], auto_ylims=True, )

smt.graphics.plot_pacf( milk_diff_12, zero=False, ax=ax[1], auto_ylims=True,)

plt.show()AR(p=1) and with seasonal s=12 P=(13-1)/s =1

Use the check_stationarity function that you created earlier in this chapter to perform an Augmented Dickey-Fuller test to check for stationarity:

check_stationary( milk_diff_12 )The differenced time series is still not stationary, so you still need to perform a second differencing. This time, you must perform first-order differencing (detrend). When the time series data contains seasonality and trend, you may need to difference it twice to make it stationary. Store the resulting DataFrame in the milk_diff_12_1 variable and run check_stationarity again:

milk_diff_12_1 = milk.diff(12).diff(1).dropna()

check_stationary( milk_diff_12_1 )Great – now, you have a stationary process.

Plot ADF and PACF for the stationary time series in milk_diff_12_1 :

import statsmodels.tsa.api as smt

from statsmodels.tsa.stattools import acf, pacf

from matplotlib.collections import PolyCollection

fig, ax = plt.subplots( 2,1, figsize=(12,8) )

# using first order differencing (detrending)

# life_diff = life.diff().dropna()

lags=np.array(range(37))

acf_x=acf( milk_diff_12_1, nlags=36,alpha=0.05,

fft=False, qstat=False,

bartlett_confint=True,

adjusted=False,

missing='none',

)

acf_x, confint =acf_x[:2]

pacf_x=pacf( milk_diff_12_1, nlags=36,alpha=0.05,

)

pacf_x, pconfint =pacf_x[:2]

smt.graphics.plot_acf( milk_diff_12_1, zero=False, ax=ax[0], auto_ylims=False, lags=36 )

for lag in [1,12]:

ax[0].scatter( lag, acf_x[lag] , s=500 , facecolors='none', edgecolors='red' )

ax[0].text( lag-1.3, acf_x[lag]-0.3, 'Lag '+str(lag), color='red', fontsize='x-large')

smt.graphics.plot_pacf( milk_diff_12_1, zero=False, ax=ax[1], auto_ylims=False, lags=36)

for lag in [1,12,24,36]:

ax[1].scatter( lag, pacf_x[lag] , s=500 , facecolors='none', edgecolors='red' )

ax[1].text( lag-1.3, pacf_x[lag]-0.3, 'Lag '+str(lag), color='red', fontsize='x-large')

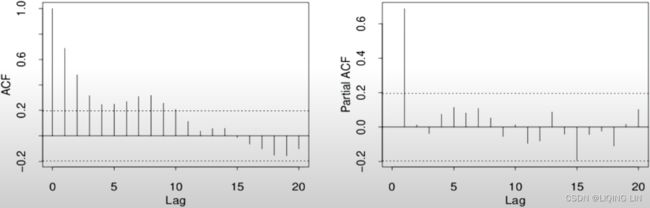

plt.show() Figure 10.3 – PACF and ACF for Monthly Milk Production after differencing twice

Figure 10.3 – PACF and ACF for Monthly Milk Production after differencing twice

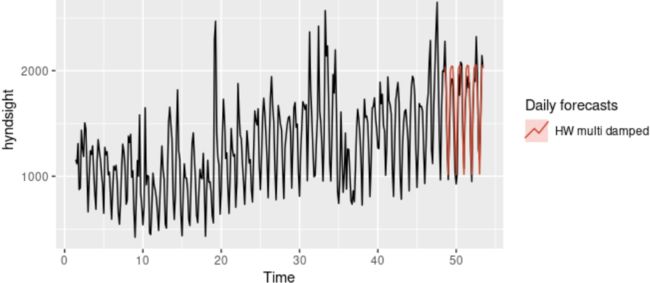

For the seasonal orders, P and Q , you should diagnose spikes or behaviors at lags 1s , 2s , 3s , and so on, where s is the number of periods in a season. For example, in the milk production data, s=12 (since there are 12 monthly periods in a season). Then, we observe for significance at 12 (s), 24 (2s), 36 (3s), and so on.

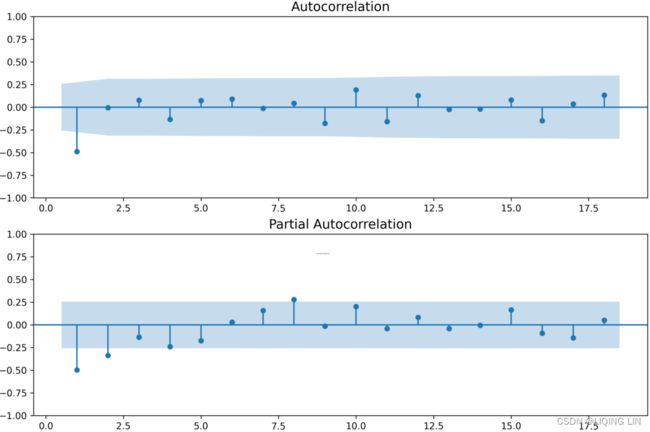

- Starting with the ACF plot,

- there is a signifcant spike at lag 1, which represents the non-seasonal order for the MA process as q=1 .

- The spike at lag 12 represents the seasonal order for the MA process as Q=1=12/S.

- Notice that there is a cut-off right after lag 1, then a spike at lag 12, followed by a cut-off (no other signifcant lags afterward) + exponential decay in the PACF plot==> MA

- These indicate a moving average model: an MA(1) for the non-seasonal component and an MA(1) for the seasonal component.

- The PACF plot : an exponential decay at lags 12, 24, and 36 indicates an MA model. So, the SARIMA model would be ARIMA (0, 1, 1) (0, 1, 1, 12) .

- SARIMA(p, d, q) (P, D, Q, S)

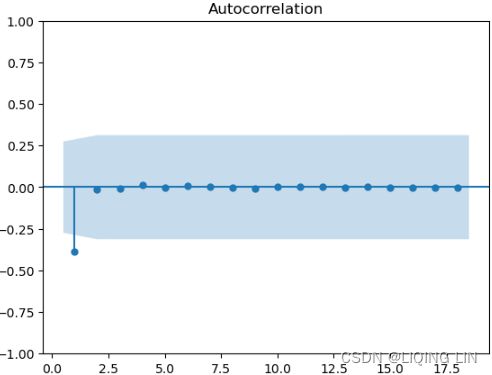

In this recipe, you used ACF and PACF plots to understand what order values (lags) to use for the seasonal and non-seasonal ARIMA models. Let's see how ACF plots can be used to diagnose the model's residuals. Let's

- build the seasonal ARIMA model we identifed earlier in this recipe as SARIMA(0, 1, 1) (0, 1, 1, 12) ,

- then use the ACF to diagnose the residuals.

- If the model captured all the information that's been embedded within the time series, you would expect the residuals to have no autocorrelation:

from statsmodels.tsa.statespace.sarimax import SARIMAX

model = SARIMAX( milk, order = (0,1,1),

seasonal_order=(0,1,1,12)

).fit(disp=False)# Set to True to print convergence messages.

fig, ax = plt.subplots( 1,1, figsize=(12,4) )

smt.graphics.plot_acf( model.resid[1:], ax=ax, zero=False, auto_ylims=True )

plt.show()

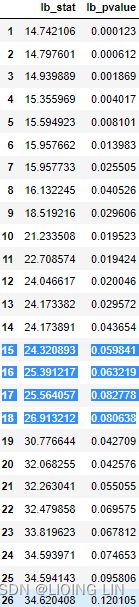

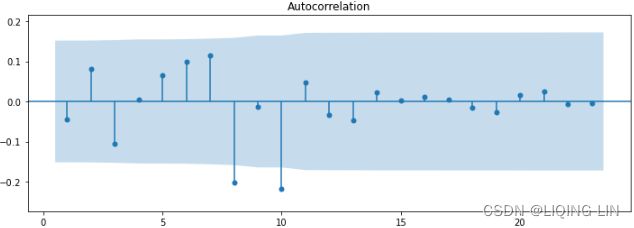

Overall, there are a couple of slightly significant lags, indicating the existence of some autocorrelation in the residuals. When the residuals show autocorrelation, this can mean that the model did not capture all the information, and there is potential for further improvement.

You can further tune the model and experiment with other values for the seasonal and non-seasonal orders. In this chapter and later recipes, you will explore a grid search method for selecting the best hyperparameters to find the best model.

Chapter 8 Exponential smoothing https://otexts.com/fpp3/expsmooth.html

Exponential smoothing was proposed in the late 1950s (Brown, 1959; Holt, 1957; Winters, 1960), and has motivated some of the most successful forecasting methods. Forecasts produced using exponential smoothing methods are weighted averages of past observations, with the weights decaying exponentially as the observations get older. In other words, the more recent the observation the higher the associated weight. This framework generates reliable forecasts quickly and for a wide range of time series, which is a great advantage and of major importance to applications in industry.

This chapter is divided into two parts. In the first part (Sections 8.1–8.4) we present the mechanics of the most important exponential smoothing methods, and their application in forecasting time series with various characteristics. This helps us develop an intuition to how these methods work. In this setting, selecting and using a forecasting method may appear to be somewhat ad hoc. The selection of the method is generally based on recognising/ˈrekəɡnaɪz/识别 key components of the time series (trend and seasonal) and the way in which these enter the smoothing method (e.g., in an additive, damped or multiplicative manner). 方法的选择通常基于识别时间序列的关键组成部分(趋势和季节性)以及这些组成部分进入平滑方法的方式(例如,以加法、阻尼或乘法方式)。

In the second part of the chapter (Sections 8.5–8.7) we present the statistical models that underlie exponential smoothing methods. These models generate identical point forecasts to the methods discussed in the first part of the chapter, but also generate prediction intervals. Furthermore, this statistical framework allows for genuine model selection between competing models.

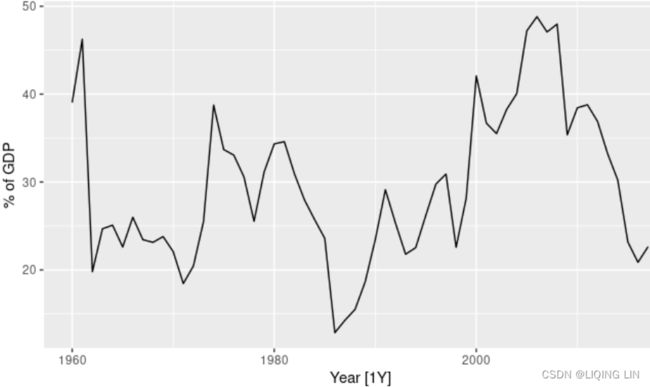

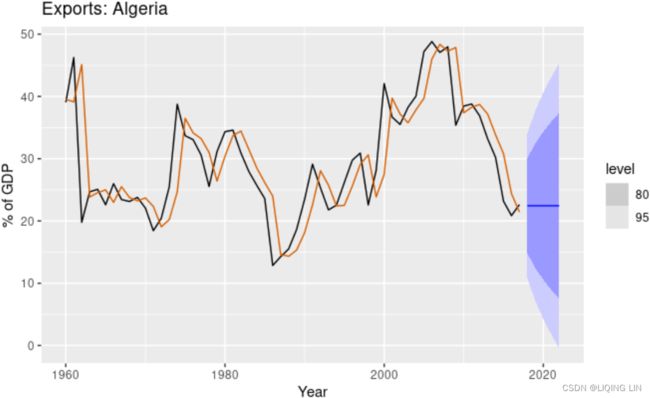

8.1 Simple exponential smoothing

The simplest of the exponentially smoothing methods is naturally called simple exponential smoothing (SES)13. This method is suitable for forecasting data with no clear trend or seasonal pattern. For example, the data in Figure 8.1 Exports of goods and services from Algeria from 1960 to 2017.8.1  do not display any clear trending behaviour or any seasonality. (There is a decline in the last few years, which might suggest a trend. We will consider whether a trended method would be better for this series later in this chapter.) We have already considered the naïve and the average as possible methods for forecasting such data (Section 5.2).

do not display any clear trending behaviour or any seasonality. (There is a decline in the last few years, which might suggest a trend. We will consider whether a trended method would be better for this series later in this chapter.) We have already considered the naïve and the average as possible methods for forecasting such data (Section 5.2).

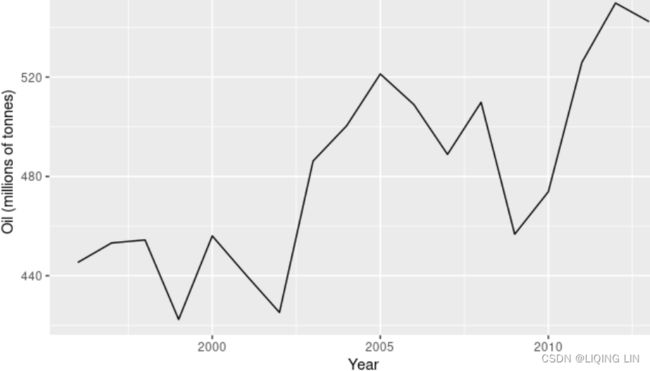

For example, the data in Figure 7.1 : Oil production in Saudi Arabia from 1996 to 2013. do not display any clear trending behaviour or any seasonality. (There is a rise in the last few years, which might suggest a trend. We will consider whether a trended method would be better for this series later in this chapter.)

do not display any clear trending behaviour or any seasonality. (There is a rise in the last few years, which might suggest a trend. We will consider whether a trended method would be better for this series later in this chapter.)

Using the naïve method, all forecasts for the future![]() at time

at time ![]() are equal to the last observed value

are equal to the last observed value![]() of the series对未来的所有预测都等于序列的最后一个观察值,

of the series对未来的所有预测都等于序列的最后一个观察值,![]()

for h=1,2,… Hence, the naïve method assumes that the most recent observation is the only important one, and all previous observations provide no information for the future. This can be thought of as a weighted average where all of the weight is given to the last observation.

Using the average method, all future forecasts are equal to a simple average of the observed data,

for h=1,2,… Hence, the average method assumes that all observations are of equal importance, and gives them equal weights when generating forecasts.

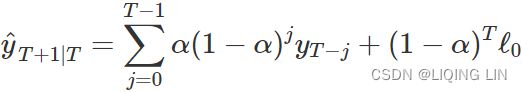

We often want something between these two extremes. For example, it may be sensible to attach larger weights to more recent observations than to observations from the distant past. This is exactly the concept behind simple exponential smoothing. Forecasts are calculated using weighted averages, where the weights decrease exponentially as observations come from further in the past — the smallest weights are associated with the oldest observations:

![]() (8.1)

(8.1)

OR![]()

where 0≤α≤1 is the smoothing parameter. The one-step-ahead forecast for time T+1 is a weighted average of all of the observations in the series ![]() ,…,

,…,![]() . The rate at which the weights decrease is controlled by the parameter α.

. The rate at which the weights decrease is controlled by the parameter α.

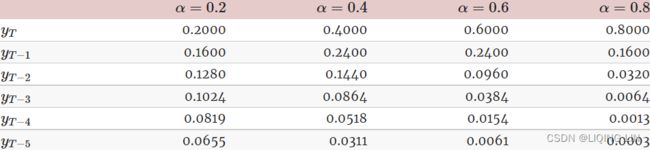

The table below shows the weights attached to observations for four different values of α when forecasting using simple exponential smoothing. Note that the sum of the weights even for a small value of α will be approximately one for any reasonable sample size.

A higher![]() discounts older observations faster.

discounts older observations faster.

For any α between 0 and 1, the weights attached to the observations decrease exponentially as we go back in time, hence the name “exponential smoothing”.

- If α is small (i.e., close to 0), more weight is given to observations from the more distant past.

- If α is large (i.e., close to 1), more weight is given to the more recent observations.

- For the extreme case where α=1,

, and the forecasts are equal to the naïve forecasts(all forecasts for the future

, and the forecasts are equal to the naïve forecasts(all forecasts for the future at time

at time  are equal to the last observed value

are equal to the last observed value of the series: all of the weight is given to the last observation).

of the series: all of the weight is given to the last observation).

We present two equivalent forms of simple exponential smoothing, each of which leads to the forecast Equation(![]() ).

).

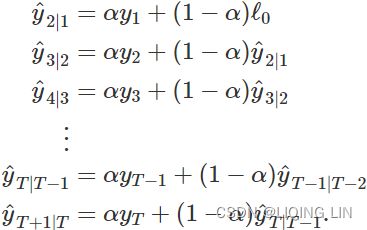

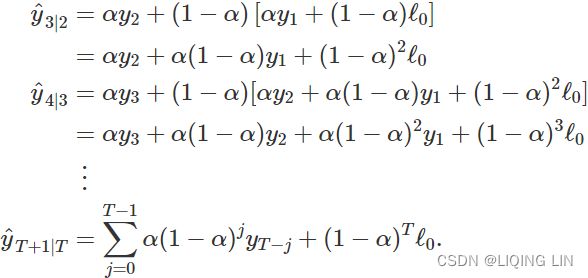

Weighted average form

The forecast at time T+1 is equal to a weighted average between the most recent observation ![]() and the previous forecast

and the previous forecast ![]() :

:

![]()

where 0≤α≤1 is the smoothing parameter. Similarly, we can write the fitted values as ![]()

for t=1,…,T. (Recall that fitted values are simply one-step forecasts of the training data.)

The process has to start somewhere, so we let the first fitted value at time 1 be denoted by ![]() (which we will have to estimate). Then

(which we will have to estimate). Then

Substituting each equation into the following equation, we obtain

The last term![]() becomes tiny for large T. So, the weighted average form leads to the same forecast Equation (8.1

becomes tiny for large T. So, the weighted average form leads to the same forecast Equation (8.1![]() ) .

) .

#######

The EMA for a series![]() may be calculated recursively

may be calculated recursively![]()

#######

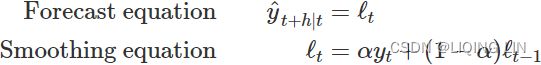

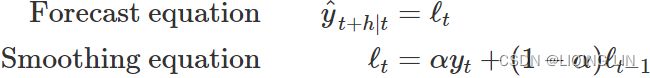

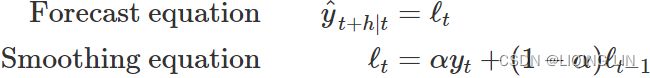

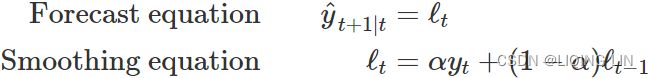

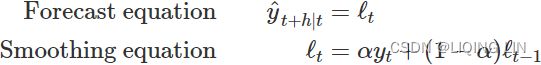

Component form

An alternative representation is the component form. For simple exponential smoothing, the only component included is the level, ![]() . (Other methods which are considered later in this chapter may also include a trend

. (Other methods which are considered later in this chapter may also include a trend ![]() and a seasonal component

and a seasonal component ![]() .) Component form representations of exponential smoothing methods comprise a forecast equation and a smoothing equation for each of the components included in the method. The component form of simple exponential smoothing is given by:

.) Component form representations of exponential smoothing methods comprise a forecast equation and a smoothing equation for each of the components included in the method. The component form of simple exponential smoothing is given by:

where ![]() is the level (or the smoothed value) of the series at time t. Setting h=1 gives the fitted values, while setting t=T gives the true forecasts beyond the training data. Te ExponentialSmoothing class is finding the optimal value for alpha ( α )

is the level (or the smoothed value) of the series at time t. Setting h=1 gives the fitted values, while setting t=T gives the true forecasts beyond the training data. Te ExponentialSmoothing class is finding the optimal value for alpha ( α )

- The forecast equation shows that the forecast value at time t+1=t+h is the estimated level at time t.

- The smoothing equation for the level (usually referred to as the level equation) gives the estimated level of the series at each period t. OR

is the expected (smoothed) level at the current time, t,

is the expected (smoothed) level at the current time, t,  is the previous smoothed level value at time t−1 ,

is the previous smoothed level value at time t−1 , is the observed value at the current time, t.

is the observed value at the current time, t.

If we replace ![]() with

with ![]() and

and ![]() with

with ![]() in the smoothing equation, we will recover the weighted average form of simple exponential smoothing

in the smoothing equation, we will recover the weighted average form of simple exponential smoothing![]() .

.

The alpha (α) parameter is the level smoothing parameter and plays a vital role in determining whether the model should trust the past or ![]() versus the present or

versus the present or ![]() . Hence,

. Hence,

- as α gets closer to zero, the first term,

, gets closer to zero, and more weight is put on the past or

, gets closer to zero, and more weight is put on the past or  .

. - And as α gets closer to one, then the

term gets closer to zero and more emphasis or weight is put on the present or

term gets closer to zero and more emphasis or weight is put on the present or  .

.

Some of the influencing factors depend on how much randomness is in the system. The output value for the coefficient, α , is the weight to determine how the model uses current and past observations to forecast future events or ![]() .

.

The component form of simple exponential smoothing is not particularly useful on its own, but it will be the easiest form to use when we start adding other components.

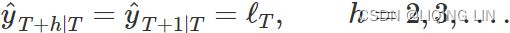

Flat forecasts

Simple exponential smoothing has a “flat” forecast function(vs naïve method ![]() ):

): ![]()

That is, all forecasts take the same value, equal to the last level component. Remember that these forecasts will only be suitable if the time series has no trend or seasonal component.

Optimisation优化

The application of every exponential smoothing method requires the smoothing parameters and the initial values to be chosen. In particular, for simple exponential smoothing, we need to select the values of α and ![]() . All forecasts can be computed from the data once we know those values. For the methods that follow there is usually more than one smoothing parameter and more than one initial component to be chosen.

. All forecasts can be computed from the data once we know those values. For the methods that follow there is usually more than one smoothing parameter and more than one initial component to be chosen.

In some cases, the smoothing parameters may be chosen in a subjective manner — the forecaster specifies the value of the smoothing parameters based on previous experience. However, a more reliable and objective way to obtain values for the unknown parameters is to estimate them from the observed data.

In Section 7.2, we estimated the coefficients of a regression model by minimizing the sum of the squared residuals (usually known as SSE or “sum of squared errors”). Similarly, the unknown parameters and the initial values for any exponential smoothing method can be estimated by minimizing the SSE. The residuals are specified as ![]() for t=1,…,T. Hence, we find the values of the unknown parameters and the initial values that minimize

for t=1,…,T. Hence, we find the values of the unknown parameters and the initial values that minimize

Unlike the regression case (where we have formulas which return the values of the regression coefficients that minimise the SSE), this involves a non-linear minimization problem, and we need to use an optimization tool to solve it.

Example: Algerian exports

In this example, simple exponential smoothing is applied to forecast exports of goods and services from Algeria.

# Estimate parameters

fit <- algeria_economy %>%

model(ETS(Exports ~ error("A") + trend("N") + season("N")))

fc <- fit %>%

forecast(h = 5) This gives parameter estimates

This gives parameter estimates ![]() =0.84 and

=0.84 and ![]() =39.54, obtained by minimizing SSE over periods t=1,2,…,58, subject to the restriction that 0≤α≤1.

=39.54, obtained by minimizing SSE over periods t=1,2,…,58, subject to the restriction that 0≤α≤1.

In Table 8.1 we demonstrate the calculation using these parameters.

- The second last column shows the estimated level for times t=0 to t=58;

- the last few rows of the last column show the forecasts for h=1 to 5-steps ahead.

Table 8.1: Forecasting goods and services exports from Algeria using simple exponential smoothing.

![]() ==>

==> ![]()

![]()

The black line in Figure 8.2 shows the data, which has a changing level over time.

Figure 8.2: Simple exponential smoothing applied to exports from Algeria (1960–2017). The orange curve shows the one-step-ahead fitted values.

The forecasts for the period 2018–2022 are plotted in Figure 8.2. Also plotted are one-step-ahead fitted values alongside the data over the period 1960–2017.

- The large value of α in this example is reflected in the large adjustment that takes place in the estimated level

at each time.

at each time. - A smaller value of α would lead to smaller changes over time, and so the series of fitted values would be smoother.

The prediction intervals shown here are calculated using the methods described in Section 8.7. The prediction intervals show that there is considerable uncertainty相当大的不确定性 in the future exports over the five-year forecast period. So interpreting the point forecasts without accounting for the large uncertainty can be very misleading在不考虑较大不确定性的情况下解释点预测可能会产生误导.

Simple Exponential Smoothing: Component form

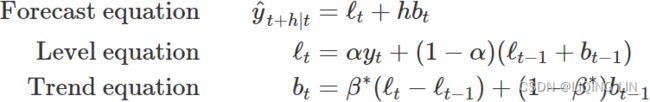

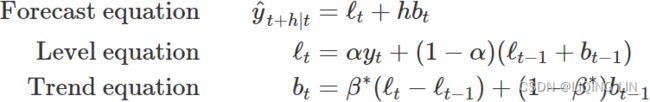

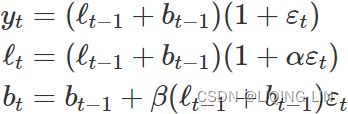

8.2 Methods with trend

Holt’s linear trend method

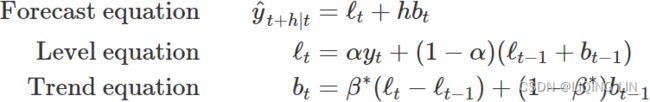

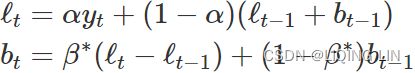

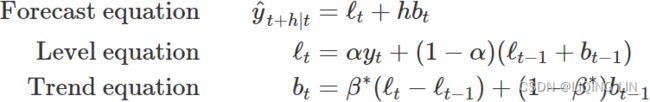

Holt (1957) extended simple exponential smoothing to allow the forecasting of data with a trend. This method involves a forecast equation and two(double) smoothing equations (one for the level and one for the trend):

The formula for Holt's exponential smoothing (double) incorporates the addition of the

trend (b) and its smoothing parameter, beta (![]() ). Hence, once a trend is included, the model will output the values for both coefficients – that is, alpha and beta ( α,

). Hence, once a trend is included, the model will output the values for both coefficients – that is, alpha and beta ( α,![]() ), Setting h=1 gives the fitted values:

), Setting h=1 gives the fitted values: where

where

denotes an estimate of the level of the series at time t,

denotes an estimate of the level of the series at time t,  denotes an estimate of the trend (slope) of the series at time t,

denotes an estimate of the trend (slope) of the series at time t, - α is the smoothing parameter for the estimated level, 0≤α≤1, and

is the smoothing parameter for the trend, 0≤

is the smoothing parameter for the trend, 0≤ ≤1. (We denote this as

≤1. (We denote this as  instead of β for reasons that will be explained in Section 8.5.)

instead of β for reasons that will be explained in Section 8.5.)

As with simple exponential smoothing,

- the level equation here shows that

is a weighted average of observation

is a weighted average of observation  and

and- the one-step-ahead training forecast for time t, here given by

.

.

- The trend equation shows that

-

is a weighted average of the estimated trend at time t

is a weighted average of the estimated trend at time t - based on

and

and  , the previous estimate of the trend.

, the previous estimate of the trend.

-

- The forecast equation is no longer flat("flat" forecast:

) but trending. The h-step-ahead(t+h) forecast is equal to the last estimated level

) but trending. The h-step-ahead(t+h) forecast is equal to the last estimated level plus h times the last estimated trend value. Hence the forecasts are a linear function of h.

plus h times the last estimated trend value. Hence the forecasts are a linear function of h.

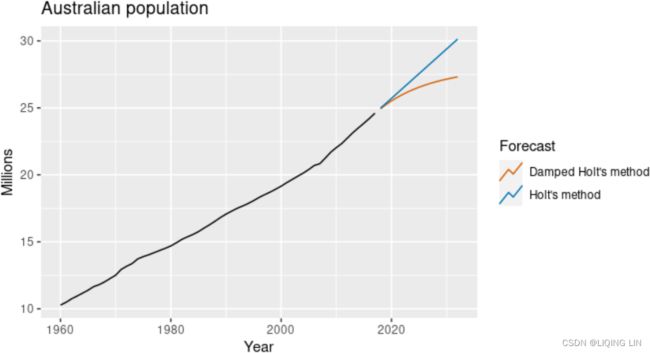

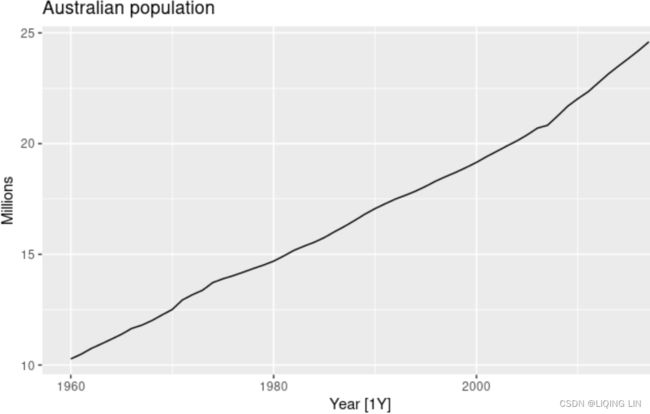

Figure 8.3: Australia’s population, 1960-2017.

Figure 8.3: Australia’s population, 1960-2017.

Figure 8.3 shows Australia’s annual population from 1960 to 2017. We will apply Holt’s method to this series. The smoothing parameters, α and ![]() , and the initial values

, and the initial values ![]() and

and ![]() are estimated by minimizing the SSE for the one-step training errors as in Section 8.1.

are estimated by minimizing the SSE for the one-step training errors as in Section 8.1.

fit <- aus_economy %>%

model(

AAN = ETS(Pop ~ error("A") + trend("A") + season("N"))

)

fc <- fit %>% forecast(h = 10)- The estimated smoothing coefficient for the level is

=0.9999. The very high value shows that the level changes rapidly in order to capture the highly trended series.

=0.9999. The very high value shows that the level changes rapidly in order to capture the highly trended series. - The estimated smoothing coefficient for the slope is

=0.3267. This is relatively large suggesting that the trend also changes often (even if the changes are slight).

=0.3267. This is relatively large suggesting that the trend also changes often (even if the changes are slight).

- if

: The very small value of

: The very small value of  means that the slope hardly changes over time意味着斜率几乎不随时间变化.

means that the slope hardly changes over time意味着斜率几乎不随时间变化.

- if

In Table 8.2 we use these values to demonstrate the application of Holt’s method.

0.9999*10.28 + (1-0.9999)*(10.05+0.22)=10.28

0.3267*(10.28-10.05) + (1-0.3267)*0.22 =0.2233 ==> 0.22

10.28 + 1*0.22 = 10.50

0.9999*10.48 + (1-0.9999)*(10.28+0.2233)=10.48

0.3267*(10.48-10.28) + (1-0.3267)*0.2233 =0.2157 ==> 0.22

10.48 + 1*0.22 = 10.70

Damped trend methods

The forecasts generated by Holt’s linear method display a constant trend (increasing or decreasing) indefinitely into the future. Empirical evidence indicates that these methods tend to over-forecast过度预测, especially for longer forecast horizons. Motivated by this observation, Gardner & McKenzie (1985) introduced a parameter that “dampens” the trend to a flat line将趋势“抑制”成一条平坦的线 some time in the future. Methods that include a damped trend have proven to be very successful, and are arguably the most popular individual methods when forecasts are required automatically for many series.

In conjunction with the smoothing parameters α and ![]() (with values between 0 and 1 as in Holt’s method), this method also includes a damping parameter 0<

(with values between 0 and 1 as in Holt’s method), this method also includes a damping parameter 0<![]() <1:

<1:

If ϕ=1, the method is identical to Holt’s linear method. For values between 0 and 1, ϕ dampens the trend so that it approaches a constant some time in the future. In fact, the forecasts converge to ![]() as h→∞ for any value 0<ϕ<1. This means that short-run forecasts are trended while long-run forecasts are constant.

as h→∞ for any value 0<ϕ<1. This means that short-run forecasts are trended while long-run forecasts are constant.

In practice,

- ϕ is rarely less than 0.8 as the damping has a very strong effect for smaller values.

- Values of ϕ close to 1 will mean that a damped model is not able to be distinguished from a non-damped model.

- For these reasons, we usually restrict ϕ to a minimum of 0.8 and a maximum of 0.98.

Example: Australian Population (continued)

Figure 8.4: Forecasting annual Australian population (millions) over 2018-2032. For the damped trend method, ϕ=0.90.

We have set the damping parameter to a relatively low number (ϕ=0.90) to exaggerate the effect of damping for comparison夸大阻尼的影响以进行比较. Usually, we would estimate ϕ along with the other parameters. We have also used a rather large forecast horizon (h=15) to highlight the difference between a damped trend and a linear trend.

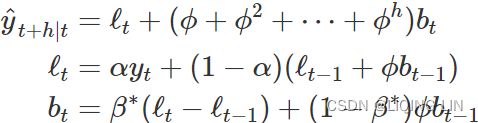

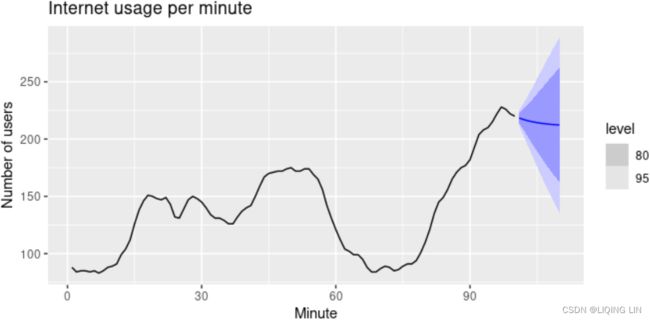

Example: Internet usage

In this example, we compare the forecasting performance of the three exponential smoothing methods that we have considered so far in forecasting the number of users connected to the internet via a server. The data is observed over 100 minutes and is shown in Figure 8.5. Figure 8.5: Users connected to the internet through a server

We will use time series cross-validation to compare the one-step forecast accuracy of the three methods.

www_usage %>%

stretch_tsibble(.init = 10) %>%

model(

SES = ETS(value ~ error("A") + trend("N") + season("N")),

Holt = ETS(value ~ error("A") + trend("A") + season("N")),

Damped = ETS(value ~ error("A") + trend("Ad") +

season("N"))

) %>%

forecast(h = 1) %>%

accuracy(www_usage)

#> # A tibble: 3 × 10

#> .model .type ME RMSE MAE MPE MAPE MASE RMSSE ACF1

#>

#> 1 Damped Test 0.288 3.69 3.00 0.347 2.26 0.663 0.636 0.336

#> 2 Holt Test 0.0610 3.87 3.17 0.244 2.38 0.701 0.668 0.296

#> 3 SES Test 1.46 6.05 4.81 0.904 3.55 1.06 1.04 0.803 Damped Holt’s method is best whether you compare MAE or RMSE values. So we will proceed with using the damped Holt’s method and apply it to the whole data set to get forecasts for future minutes.

fit <- www_usage %>%

model(

Damped = ETS(value ~ error("A") + trend("Ad") +

season("N"))

)

# Estimated parameters:

tidy(fit)

#> # A tibble: 5 × 3

#> .model term estimate

#>

#> 1 Damped alpha 1.00

#> 2 Damped beta 0.997

#> 3 Damped phi 0.815

#> 4 Damped l[0] 90.4

#> 5 Damped b[0] -0.0173 - The smoothing parameter

for the slope

for the slope is estimated to be almost one, indicating that the trend changes to mostly reflect the slope between the last two minutes

is estimated to be almost one, indicating that the trend changes to mostly reflect the slope between the last two minutes of internet usage.

of internet usage. - The value of α is very close to one, showing that the level

reacts strongly to each new observation

reacts strongly to each new observation .

.

Figure 8.6: Forecasting internet usage: comparing forecasting performance of non-seasonal methods.

Figure 8.6: Forecasting internet usage: comparing forecasting performance of non-seasonal methods.

The resulting forecasts look sensible with decreasing trend预测看起来很合理,呈下降趋势, which flattens out due to the low value of the damping parameter (0.815), and relatively wide prediction intervals reflecting the variation in the historical data. The prediction intervals are calculated using the methods described in Section 8.7.

In this example, the process of selecting a method was relatively easy as both MSE and MAE comparisons suggested the same method (damped Holt’s). However, sometimes different accuracy measures will suggest different forecasting methods, and then a decision is required as to which forecasting method we prefer to use. As forecasting tasks can vary by many dimensions (length of forecast horizon, size of test set, forecast error measures, frequency of data, etc.), it is unlikely that one method will be better than all others for all forecasting scenarios. What we require from a forecasting method are consistently sensible forecasts预测方法的要求是始终如一的合理预测, and these should be frequently evaluated against the task at hand并且应该根据手头的任务经常评估这些预测.

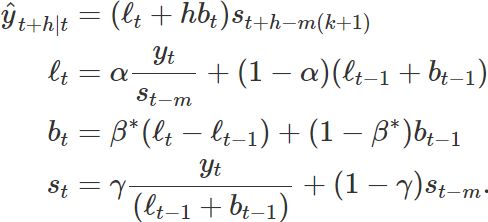

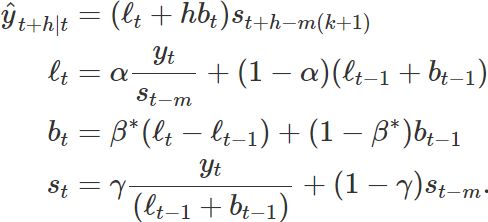

8.3 Methods with seasonality

Holt (1957) and Winters (1960) extended Holt’s method to capture seasonality. The Holt-Winters seasonal method comprises the forecast equation and three smoothing equations — one for the level ![]() , one for the trend

, one for the trend ![]() , and one for the seasonal component

, and one for the seasonal component ![]() , with corresponding smoothing parameters α,

, with corresponding smoothing parameters α, ![]() and

and ![]() . We use m to denote the period of the seasonality, i.e., the number of seasons in a year. For example, for quarterly data m=4, and for monthly data m=12.

. We use m to denote the period of the seasonality, i.e., the number of seasons in a year. For example, for quarterly data m=4, and for monthly data m=12.

There are two variations to this method that differ in the nature of the seasonal component.

- The additive method is preferred when the seasonal variations are roughly constant through the series, OR The additive decomposition is the most appropriate if the magnitude of the seasonal fluctuations季节性波动的幅度, or the variation around the trend-cycle,围绕趋势周期的变化 does not vary with the level of the time series

- while the multiplicative method is preferred when the seasonal variations are changing proportional to the level of the series. OR A multiplicative model is suitable when the seasonal variation fluctuates over time.

==>

==> https://blog.csdn.net/Linli522362242/article/details/127737895

https://blog.csdn.net/Linli522362242/article/details/127737895 - With the additive method, the seasonal component is expressed in absolute terms in the scale of the observed series, and in the level equation the series is seasonally adjusted by subtracting the seasonal component. Within each year, the seasonal component will add up to approximately zero.

- With the multiplicative method, the seasonal component is expressed in relative terms (percentages), and the series is seasonally adjusted by dividing through by the seasonal component. Within each year, the seasonal component will sum up to approximately m(We use m to denote the period of the seasonality).

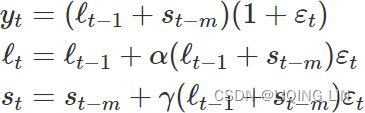

Holt-Winters’ additive method

The component form for the additive method is:

where k is the integer part of ![]() , which ensures that the estimates of the seasonal indices used for forecasting come from the final year of the sample.

, which ensures that the estimates of the seasonal indices used for forecasting come from the final year of the sample.

- The level equation shows a weighted average between

- the seasonally adjusted observation

and

and - the non-seasonal forecast

for time t.

for time t.

- the seasonally adjusted observation

- The trend equation is identical to Holt’s linear method.

-

is a weighted average of the estimated trend at time t

is a weighted average of the estimated trend at time t - based on

and

and  , the previous estimate of the trend.

, the previous estimate of the trend.

-

- The seasonal equation shows a weighted average between

- the current seasonal index,

, and

, and - the seasonal index of the same season last year (i.e., m time periods ago).

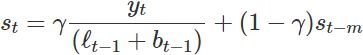

The equation for the seasonal component is often expressed as ![]()

If we substitute![]() from the smoothing equation for the level of the component form above

from the smoothing equation for the level of the component form above![]() , we get

, we get ![]()

which is identical to the smoothing equation for the seasonal component we specify here, with ![]() The usual parameter restriction is 0≤

The usual parameter restriction is 0≤![]() ≤1, which translates to 0≤γ≤1−α.

≤1, which translates to 0≤γ≤1−α.

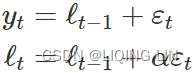

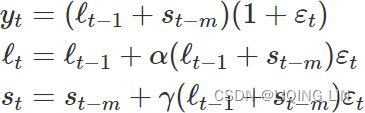

Holt-Winters’ multiplicative method

The Holt-Winters exponential smoothing (triple) formula incorporates both trend (![]() ) and seasonality (

) and seasonality (![]() ). The following equation shows multiplicative seasonality as an example:

). The following equation shows multiplicative seasonality as an example:

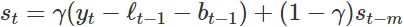

The component form for the multiplicative method is: Setting h=1 gives the fitted values:

where k is the integer part of ![]()

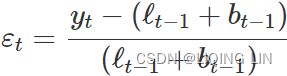

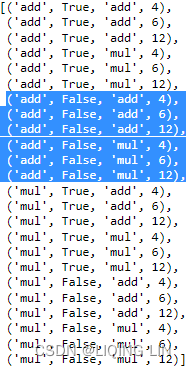

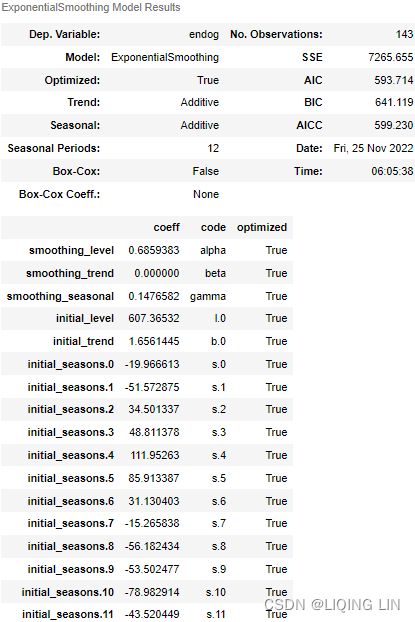

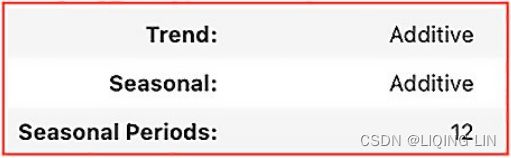

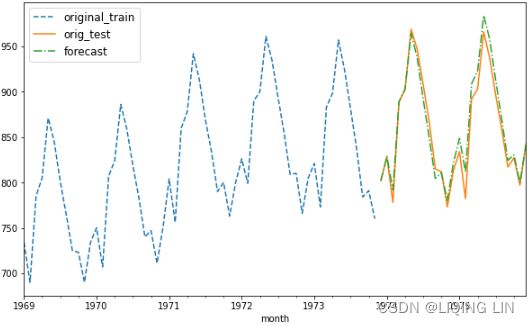

When using ExponentialSmoothing to find the best ![]() ,

, ![]() ,

, ![]() parameter values, it does so by minimizing the error rate (the sum of squared error or SSE). So, every time in the loop you were passing new parameters values (for example, damped as either True or False ), the model was solving for the optimal set of values for the

parameter values, it does so by minimizing the error rate (the sum of squared error or SSE). So, every time in the loop you were passing new parameters values (for example, damped as either True or False ), the model was solving for the optimal set of values for the ![]() ,

, ![]() ,

, ![]() coefficients by minimizing for SSE. This can be written as follows:

coefficients by minimizing for SSE. This can be written as follows: ![]()

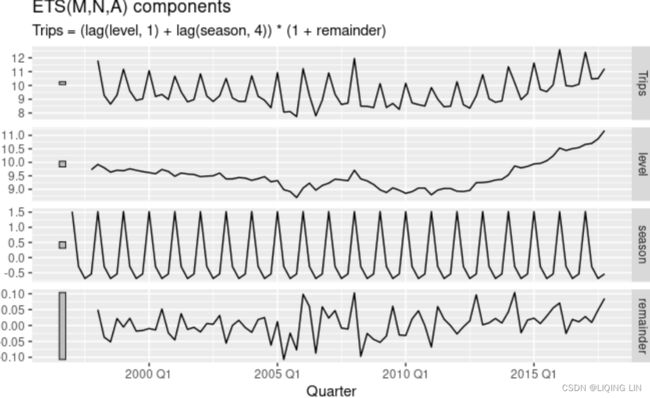

Example: Domestic overnight trips in Australia

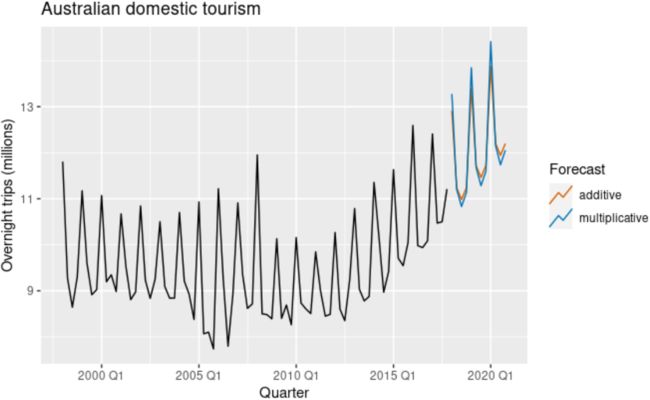

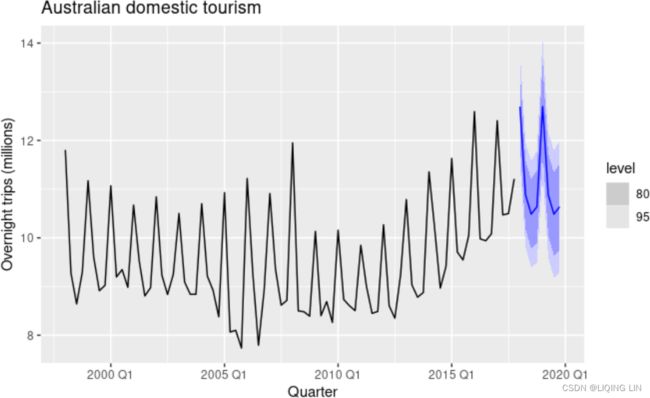

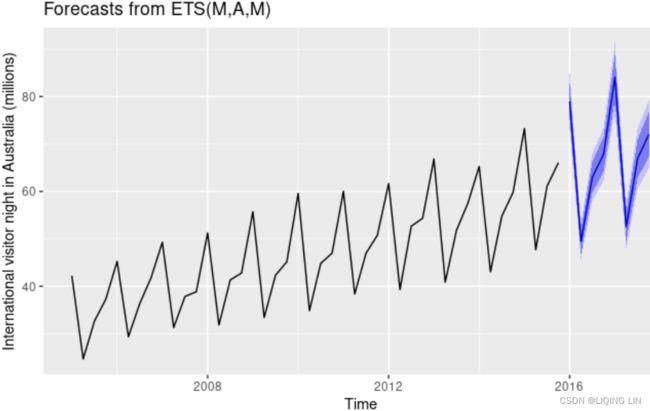

We apply Holt-Winters’ method with both additive and multiplicative seasonality to forecast quarterly visitor nights in Australia spent by domestic tourists. Figure 8.7 shows the data from 1998–2017, and the forecasts for 2018–2020(h=3 years). The data show an obvious seasonal pattern, with peaks observed in the March quarter of each year, corresponding to the Australian summer.

Figure 8.7: Forecasting domestic overnight trips in Australia using the Holt-Winters method with both additive and multiplicative seasonality.

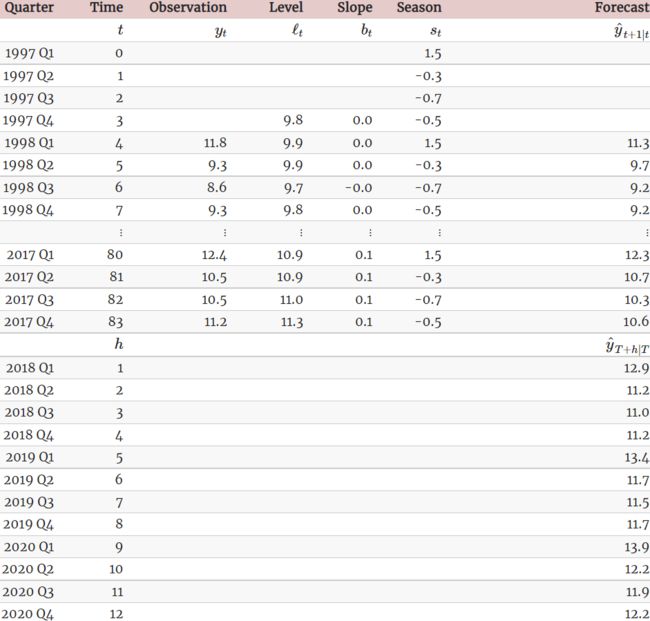

Table 8.3: Applying Holt-Winters’ method with additive seasonality for forecasting domestic tourism in Australia. Notice that the additive seasonal component sums to approximately zero. The smoothing parameters are α=0.2620, ![]() =0.1646,

=0.1646, ![]() =0.0001 and RMSE =0.4169.

=0.0001 and RMSE =0.4169.

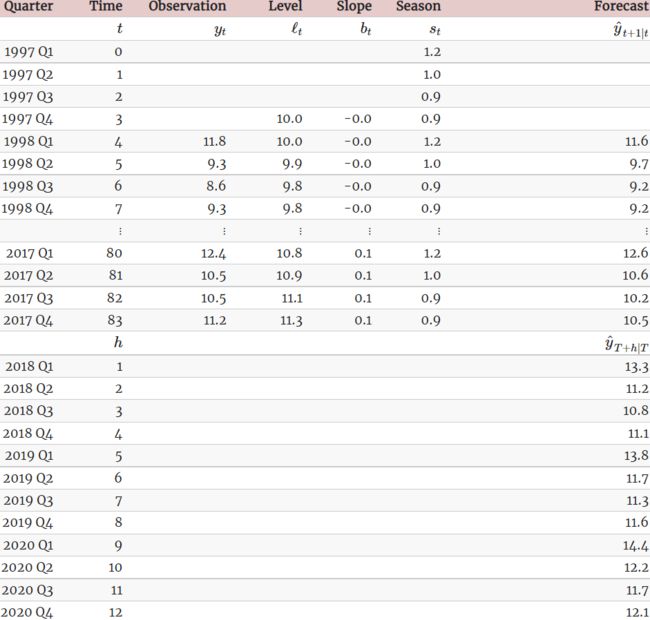

Table 8.4: Applying Holt-Winters’ method with multiplicative seasonality for forecasting domestic tourism in Australia. Notice that the multiplicative seasonal component sums to approximately m=4. The smoothing parameters are α=0.2237, ![]() =0.1360,

=0.1360, ![]() =0.0001 and RMSE =0.4122(<RMSE =0.4169 from additive seasonality)

=0.0001 and RMSE =0.4122(<RMSE =0.4169 from additive seasonality)

The applications of both methods (with additive and multiplicative seasonality) are presented in Tables 8.3 and 8.4 respectively. Because both methods have exactly the same number of parameters to estimate, we can compare the training RMSE from both models. In this case, the method with multiplicative seasonality fits the data slightly better.

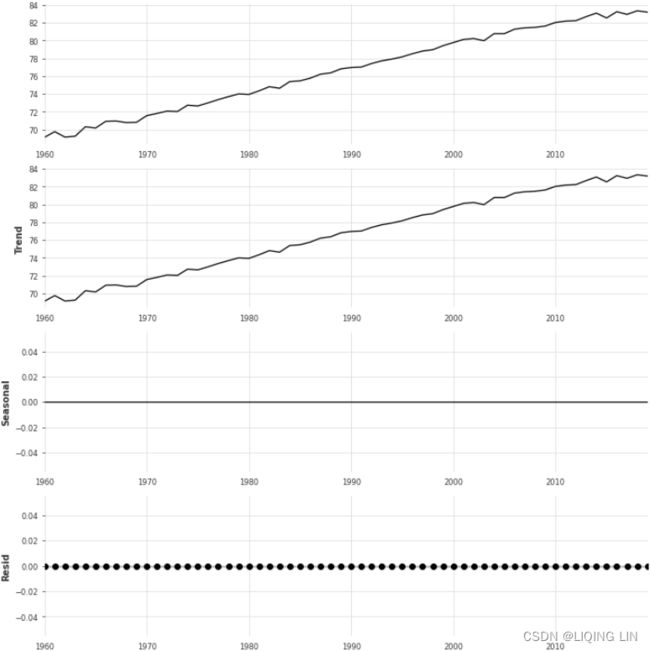

The grey bars to the left of each panel show the relative scales of the components组件的相对比例. Each grey bar represents the same length but because the plots are on different scales, the bars vary in length. The longest grey bar in the bottom panel shows that the variation in the remainder component is small compared to the variation in the data, which has a bar about one quarter the size. If we shrunk the bottom three panels until their bars became the same size as that in the data panel, then all the panels would be on the same scale. https://blog.csdn.net/Linli522362242/article/details/127737895

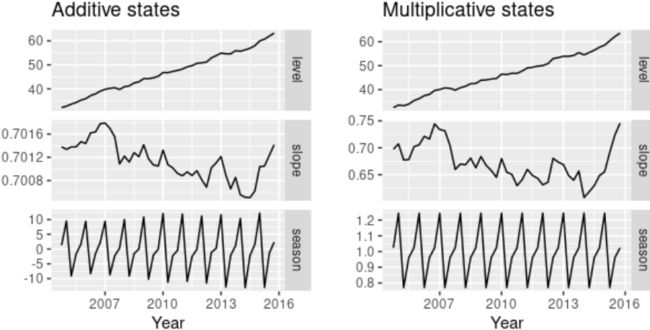

The estimated components for both models are plotted in Figure 8.8.

- The small value of

for the multiplicative model(better

for the multiplicative model(better ) means that the seasonal component hardly changes over time几乎不随时间变化.

) means that the seasonal component hardly changes over time几乎不随时间变化.

(The relative longer grey bar in the seasonal pannel shows that the variation in the seasonal component is small compared to the variation in the data) OR(check the vertical scale)

- The small value of

(multiplicative seasonality

(multiplicative seasonality :

: =0.1360) means the slope component hardly changes over time几乎不随时间变化

=0.1360) means the slope component hardly changes over time几乎不随时间变化

(compare the vertical scales of the slope and level components).

Figure 8.8: Estimated components for the Holt-Winters method with additive and multiplicative seasonal components(better).

Figure 8.8: Estimated components for the Holt-Winters method with additive and multiplicative seasonal components(better).

Figure 7.7: Estimated components for the Holt-Winters method with additive and multiplicative seasonal components. The estimated states for both models are plotted in Figure 7.7.

The estimated states for both models are plotted in Figure 7.7.

- The small value of

(multiplicative model γ=0.002

(multiplicative model γ=0.002  vs additive model γ=0.426

vs additive model γ=0.426 ) for the multiplicative model means that the seasonal component hardly changes over time(check the vertical scale).

) for the multiplicative model means that the seasonal component hardly changes over time(check the vertical scale). - The small value of β∗ for the additive model(

multiplicative model β∗=0.030 vs additive model β∗=0.0003

vs additive model β∗=0.0003 ) means the slope component hardly changes over time (check the vertical scale).

) means the slope component hardly changes over time (check the vertical scale). - The increasing size of the seasonal component for the additive model suggests that the model is less appropriate than the multiplicative model (better).

- https://otexts.com/fpp2/holt-winters.html

multiplicative model RMSE=1.576 (better) vs additive model RMSE=1.763

Holt-Winters’ damped method阻尼法

Damping is possible with both additive and multiplicative Holt-Winters’ methods. A method that often provides accurate and robust forecasts for seasonal data is the Holt-Winters method with a damped trend and multiplicative seasonality:

Example: Holt-Winters method with daily data

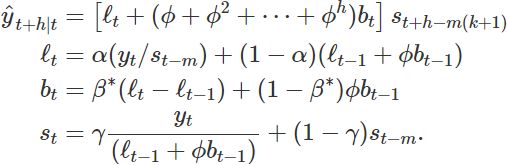

The Holt-Winters method can also be used for daily type of data, where the seasonal period is m=7, and the appropriate unit of time for h is in days. Here we forecast pedestrian traffic at a busy Melbourne train station in July 2016.

sth_cross_ped <- pedestrian %>%

filter(Date >= "2016-07-01",

Sensor == "Southern Cross Station") %>%

index_by(Date) %>%

summarise(Count = sum(Count)/1000)

sth_cross_ped %>%

filter(Date <= "2016-07-31") %>%

model(

hw = ETS(Count ~ error("M") + trend("Ad") + season("M"))

) %>%

forecast(h = "2 weeks") %>%

autoplot(sth_cross_ped %>% filter(Date <= "2016-08-14")) +

labs(title = "Daily traffic: Southern Cross",

y="Pedestrians ('000)") Figure 8.9: Forecasts of daily pedestrian traffic at the Southern Cross railway station, Melbourne.

Clearly the model has identified the weekly seasonal pattern and the increasing trend at the end of the data, and the forecasts are a close match to the test data.

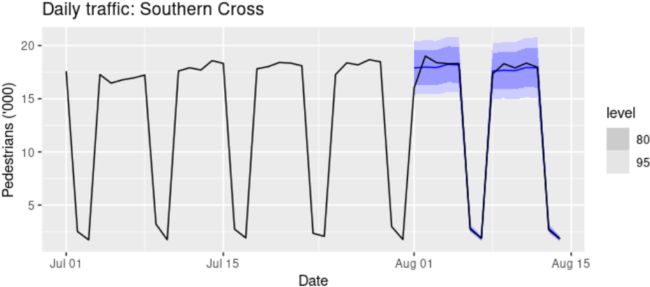

Example: Holt-Winters method with daily data

The Holt-Winters method can also be used for daily type of data, where the seasonal period is m=7, and the appropriate unit of time for h is in days. Here, we generate daily forecasts for the last five weeks for the hyndsight data, which contains the daily pageviews on the Hyndsight blog for one year starting April 30, 2014.

fc <- hw(subset(hyndsight,end=length(hyndsight)-35),

damped = TRUE, seasonal="multiplicative", h=35)

autoplot(hyndsight) +

autolayer(fc, series="HW multi damped", PI=FALSE)+

guides(colour=guide_legend(title="Daily forecasts")) Figure 7.8: Forecasts of daily pageviews on the Hyndsight blog. Clearly the model has identified the weekly seasonal pattern and the increasing trend at the end of the data, and the forecasts are a close match to the test data.

Clearly the model has identified the weekly seasonal pattern and the increasing trend at the end of the data, and the forecasts are a close match to the test data.

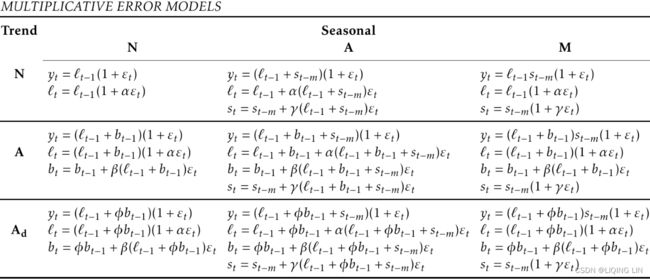

8.4 A taxonomy of exponential smoothing methods

Exponential smoothing methods are not restricted to those we have presented so far. By considering variations in the combinations of the trend and seasonal components, 9 exponential smoothing methods are possible, listed in Table 8.5. Each method is labelled by a pair of letters (T,S) defining the type of ‘Trend’ and ‘Seasonal’ components. For example, (A,M) is the method with an Additive trend and Multiplicative seasonality; (![]() ,N) is the method with Damped trend and No seasonality; and so on.

,N) is the method with Damped trend and No seasonality; and so on.

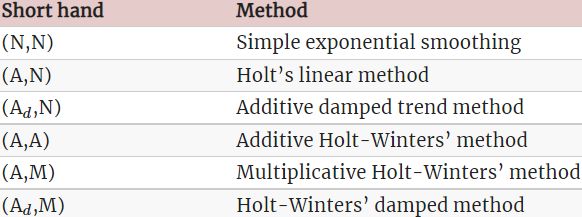

Table 8.5: A two-way classification of exponential smoothing methods

Some of these methods we have already seen using other names:

This type of classification was first proposed by Pegels (1969), who also included a method with a multiplicative trend. It was later extended by Gardner (1985) to include methods with an additive damped trend and by J. W. Taylor (2003) to include methods with a multiplicative damped trend. We do not consider the multiplicative trend methods in this book as they tend to produce poor forecasts. See Hyndman et al. (2008) for a more thorough discussion of all exponential smoothing methods.

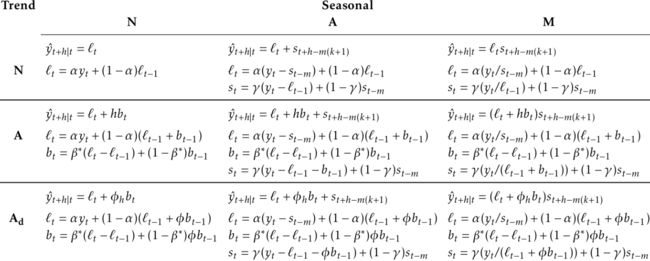

Table 8.6 gives the recursive formulas for applying the 9 exponential smoothing methods in Table 8.5. Each cell includes the forecast equation for generating h-step-ahead forecasts, and the smoothing equations for applying the method.

Table 8.6: Formulas for recursive calculations and point forecasts. In each case, ![]() denotes the series level at time t,

denotes the series level at time t, ![]() denotes the slope at time t,

denotes the slope at time t, ![]() denotes the seasonal component of the series at time t, and m denotes the number of seasons in a year; α,

denotes the seasonal component of the series at time t, and m denotes the number of seasons in a year; α, ![]() ,

, ![]() and

and ![]() are smoothing parameters,

are smoothing parameters, ![]() , and k is the integer part of

, and k is the integer part of ![]() .

.

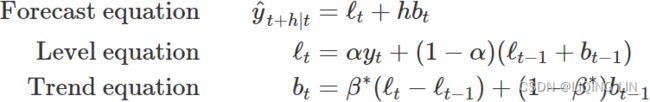

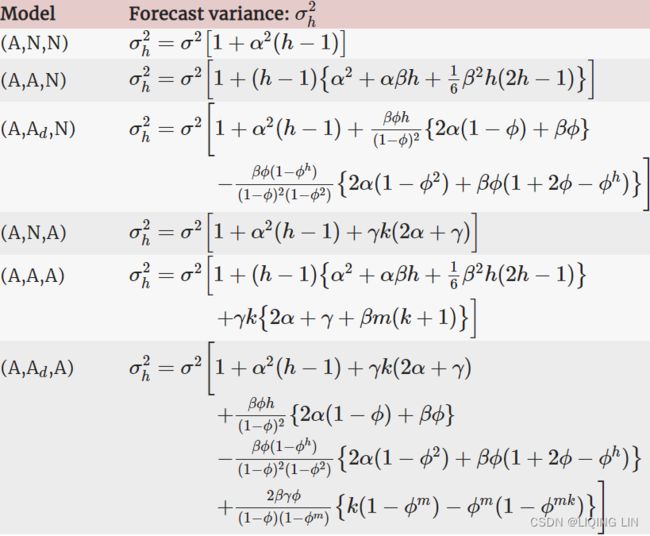

8.5 Innovations state space models for exponential smoothing

In the rest of this chapter, we study the statistical models that underlie the exponential smoothing methods we have considered so far. The exponential smoothing methods presented in Table 8.6 are algorithms which generate point forecasts. The statistical models in this section generate the same point forecasts, but can also generate prediction (or forecast) intervals. A statistical model is a stochastic (or random) data generating process that can produce an entire forecast distribution. We will also describe how to use the model selection criteria introduced in Chapter 7 to choose the model in an objective manner.

Each model consists of

- a measurement equation that describes the observed data, and

- some state equations that describe how the unobserved components or states (level, trend, seasonal) change over time.

- Hence, these are referred to as state space models.

For each method there exist two models: one with additive errors and one with multiplicative errors. The point forecasts produced by the models are identical if they use the same smoothing parameter values.如果模型使用相同的平滑参数值,则它们产生的点预测是相同的。 They will, however, generate different prediction intervals它们将生成不同的预测区间.

To distinguish between a model with additive errors and one with multiplicative errors (and also to distinguish the models from the methods), we add a third letter to the classification of Table 8.5. We label each state space model as ETS(⋅,⋅,⋅⋅,⋅,⋅) for (Error, Trend, Seasonal). This label can also be thought of as ExponenTial Smoothing. Using the same notation as in Table 8.5, the possibilities for each component (or state) are:

- Error ={A,M},

- Trend ={

} and

} and - Seasonal ={N,A,M}.

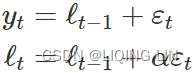

ETS(A,N,N)~(Error, Trend, Seasonal): simple exponential smoothing with additive errors

Recall the component form of simple exponential smoothing:

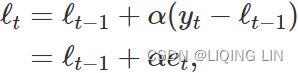

If we re-arrange the smoothing equation for the level, we get the “error correction” form,  where

where ![]() is the residual at time t.

is the residual at time t.

The training data errors lead to the adjustment of the estimated level throughout the smoothing process for t=1,…,T. For example, if the error at time t is negative ![]() , then

, then ![]() and so the level

and so the level![]() at time t−1 has been over-estimated. The new level

at time t−1 has been over-estimated. The new level ![]() is then the previous level

is then the previous level ![]() adjusted downwards新水平是之前水平向下调整的水平. The closer α is to one, the “rougher” the estimate of the level (large adjustments take place). The smaller the α, the “smoother” the level (small adjustments take place).

adjusted downwards新水平是之前水平向下调整的水平. The closer α is to one, the “rougher” the estimate of the level (large adjustments take place). The smaller the α, the “smoother” the level (small adjustments take place).

We can also write ![]() , so that each observation

, so that each observation![]() can be represented by the previous level plus an error. To make this into an innovations state space model, all we need to do is specify the probability distribution for

can be represented by the previous level plus an error. To make this into an innovations state space model, all we need to do is specify the probability distribution for ![]() . For a model with additive errors, we assume that residuals (the one-step training errors)

. For a model with additive errors, we assume that residuals (the one-step training errors) ![]() are normally distributed white noise with mean 0 and variance

are normally distributed white noise with mean 0 and variance ![]() . A short-hand notation for this is

. A short-hand notation for this is ![]() ; NID stands for “Normally and Independently Distributed”.

; NID stands for “Normally and Independently Distributed”.

Then the equations of the model can be written as  (8.3) and (8.4)

(8.3) and (8.4)

We refer to (8.3) as the measurement (or observation) equation and (8.4) as the state (or transition) equation. These two equations, together with the statistical distribution of the errors, form a fully specified statistical model(The statistical models in this section generate the same point forecasts, but can also generate prediction (or forecast) intervals). Specifically, these constitute an innovations state space model underlying simple exponential smoothing.

The term “innovations” comes from the fact that all equations use the same random error process, ![]() . For the same reason, this formulation is also referred to as a “single source of error” model. There are alternative multiple source of error formulations which we do not present here.

. For the same reason, this formulation is also referred to as a “single source of error” model. There are alternative multiple source of error formulations which we do not present here.

The measurement (or observation) equation shows the relationship between the observations ![]() and the unobserved states

and the unobserved states ![]() . In this case, observation

. In this case, observation ![]() is a linear function of

is a linear function of

- the level

, the predictable part of

, the predictable part of  ,

, - and the error

, the unpredictable part of

, the unpredictable part of  .

. - For other innovations state space models, this relationship may be nonlinear.

The state (or transition) equation shows the evolution of the state through time. The influence of the smoothing parameter α is the same as for the methods discussed earlier. For example, α governs the amount of change in successive levels:

- high values of α allow rapid changes in the level;

- low values of α lead to smooth changes.

- If α=0, the level of the series does not change over time;

- if α=1, the model reduces to a random walk model,

. (See Section 9.1 for a discussion of this model.)

. (See Section 9.1 for a discussion of this model.)

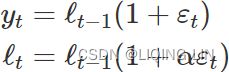

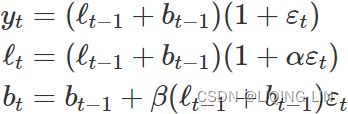

ETS(M,N,N)~~(Error, Trend, Seasonal): simple exponential smoothing with multiplicative errors

In a similar fashion, we can specify models with multiplicative errors by writing the one-step-ahead training errors as relative errors

where ![]() . Substituting

. Substituting ![]() gives

gives ![]() and

and ![]() .

.

Then we can write the multiplicative form of the state space model as  <==

<==![]()

ETS(A,A,N)~(Error, Trend, Seasonal): Holt’s linear trend method with additive errors

#####################

Holt’s linear trend method

![]() ==>h=1 and t=t-1 ==>

==>h=1 and t=t-1 ==>

#####################

For this model, we assume that the one-step-ahead training errors are given by ![]() . Substituting this into the error correction equations for Holt’s linear trend method we obtain

. Substituting this into the error correction equations for Holt’s linear trend method we obtain

<==

<==

where for simplicity we have set ![]() .

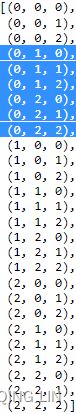

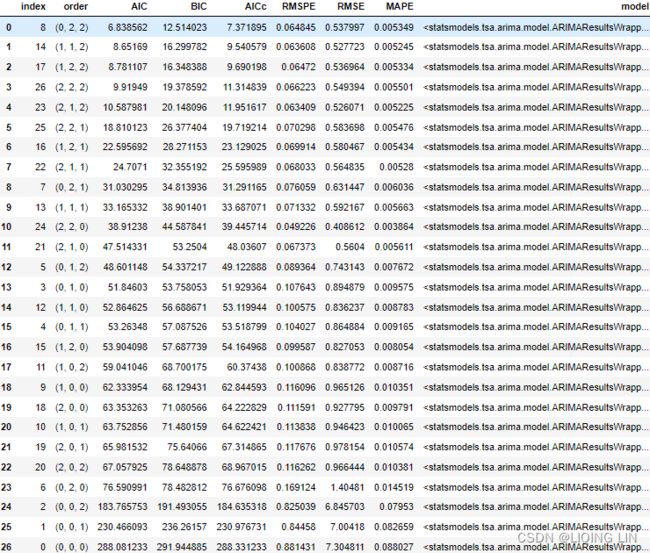

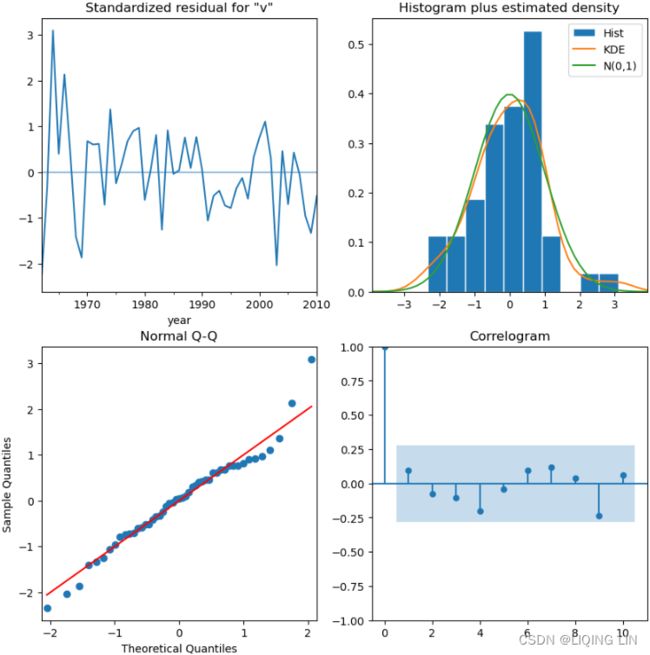

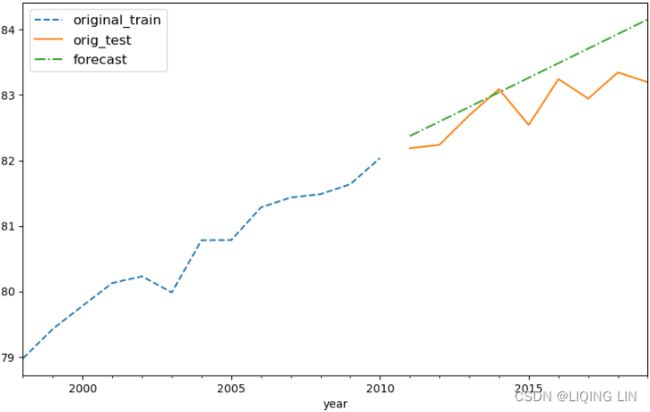

.  <== Trend <==