季节效应序列分析

一、导入数据

analy <- read.csv("D:\\季节效应.csv",header = T,row.names = 1,encoding = "UTF-8")

analy

二、时序图

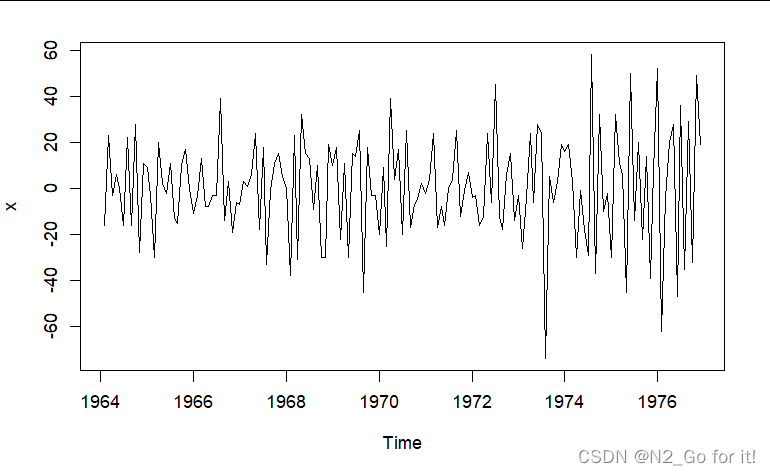

analy1 <- ts(analy,start = c(1963,1),end = c(1976,12),frequency = 12)

plot(analy1)

根据时序图,该序列存在长期向上的趋势、季节性变化和随机波动的影响。随着趋势的递增,序列呈现出和季节变化相关的稳定周期性波动,应采用乘法模型。

三、趋势效应与季节效应的提取

Result1=decompose(analy1,type = "multiplicative") #乘法模型

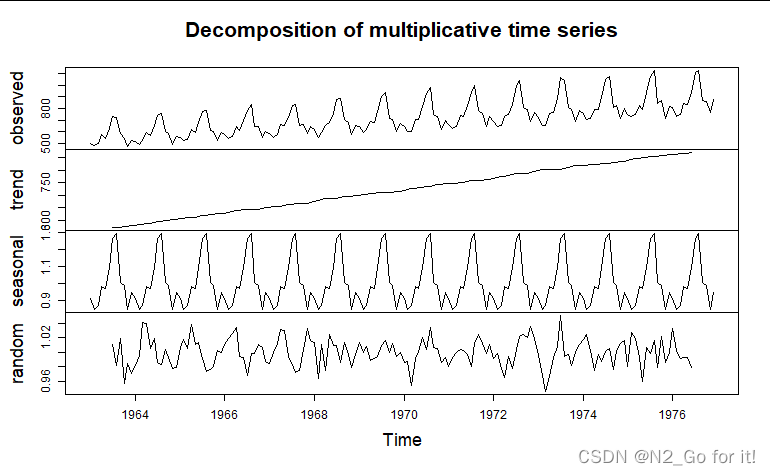

plot(Result1)

# 提取趋势效应

plot(Result1$trend)

abline(lm(Result1$trend~time(analy1)),col="2") #选择2号颜色为趋势线标线

# 提取季节效应

sea=as.vector(Result1$seasonal)

sea=sea[1:12]

plot(sea,type = 'l')

结论:如图所示,2月份为最低点,6、7、8月份达到高峰值,存在明显季节性。

因此指数平滑模型选择Holt-Winters三参数指数平滑。

四、Holt-Winters三参数指数平滑

(加法模型)

H=HoltWinters(analy1,seasonal = "additive") #seasonal = "additive"可省略,默认加法模型

H

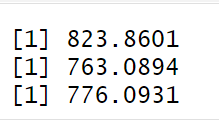

结论:Xt+k=875.583001+1.971655k+Sj,k>=1

#手动预测:

xx1977.1=875.583001+1.971655*1-53.694536

xx1977.2=875.583001+1.971655*2-116.436891

xx1977.3=875.583001+1.971655*3-105.404840

xx1977.1

xx1977.2

xx1977.3

#系统预测

fore_H=forecast(H1, h=36)

fore_H

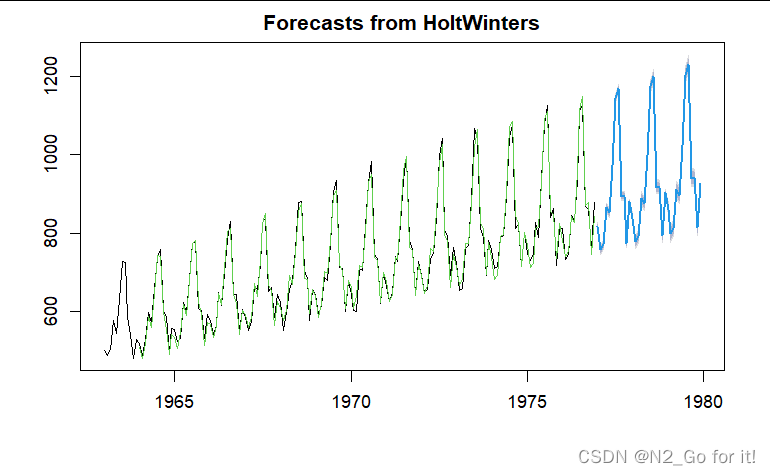

(乘法模型)

H1=HoltWinters(analy1,seasonal = "multiplicative") #乘法模型

H1

结论:xt+k=(875.5123349+1.9568538k)Sj

#手动预测

x1977.1=(875.5123349+1.9568538*1)*0.9301067

x1977.2=(875.5123349+1.9568538*2)*0.8613974

x1977.3=(875.5123349+1.9568538*3)*0.8741871

x1977.1

x1977.2

x1977.3

#系统预测

fore_H1=forecast(H1, h=36)

fore_H1

plot(fore_H1)

lines(fore_H1$fitted,col=3)

五、ARIMA模型

5.1差分平稳化:

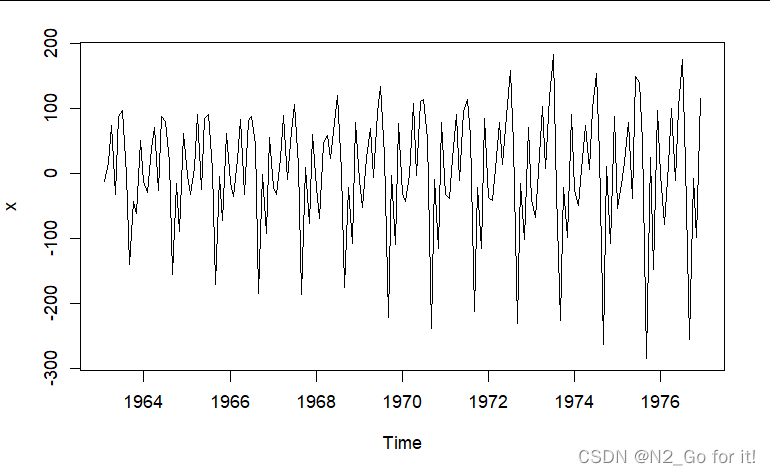

因原序列存在季节性和趋势性,对原序列做差分平稳化,使其转为平稳性模型。

Difference1=diff(analy1) #一阶差分

plot(Difference1)

D=diff(diff(analy1),12) #一阶十二步差分

plot(D)

5.2对差分后序列作平稳性检验

adf.test(D,nlag=3)

故用ARMA(1,1)模型提取差分后序列的短期自相关信息 自相关系数1阶截尾,故用 ARMA(0,1)12 拟合季节自相关信息 偏自相关系数1阶截尾,故用 ARMA(1,0)12 拟合季节自相关信息 故模型识别为:ARIMA(1,1,1)X(0,1,1)12 和 ARIMA(1,1,1)X(1,1,0)12 或者ARIMA(0,1,6)X(0,1,1)12 ∇ ∇ 12 ∇∇_{12} ∇∇12 X t X_t Xt = 1 − 1.7905 B + 0.7905 B 2 1 − 0.8229 B − 0.0030 B 2 + 0.3107 B 3 \frac{1-1.7905B+0.7905B^2}{1-0.8229B-0.0030B^2+0.3107B^3} 1−0.8229B−0.0030B2+0.3107B31−1.7905B+0.7905B2*( 1 − 0.4073 B 1-{0.4073B} 1−0.4073B) e t e_t et

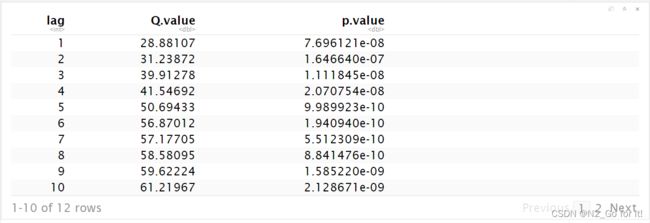

结论:p=0.015.3对差分后序列作白噪声检验

lag = c()

Q.value = c()

p.value = c()

for(i in 1:12){

test = Box.test(D,lag=i,type="Ljung-Box")

lag[i] = i

Q.value[i] = test$statistic

p.value[i] = test$p.value

}

data.frame(lag=lag,Q.value=Q.value,p.value=p.value)

5.4模型识别

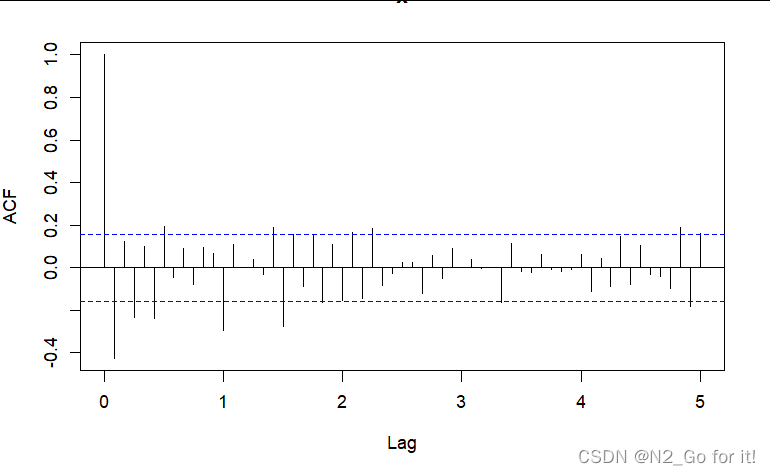

acf(D,lag.max=60)

pacf(D,lag.max=60)

结论:acf拖尾,pacf拖尾,12阶以内的ACF和PACF均不截尾,5.5模型拟合与检验

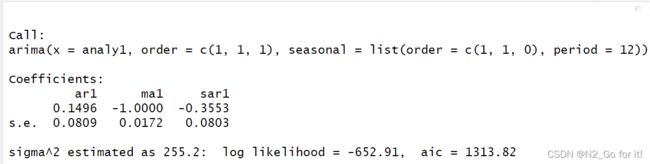

(1)拟合ARIMA(1,1,1)X(0,1,1)12

fit_1<-arima(analy1,order=c(1,1,1),seasonal = list(order=c(0,1,1),period=12))

fit_1

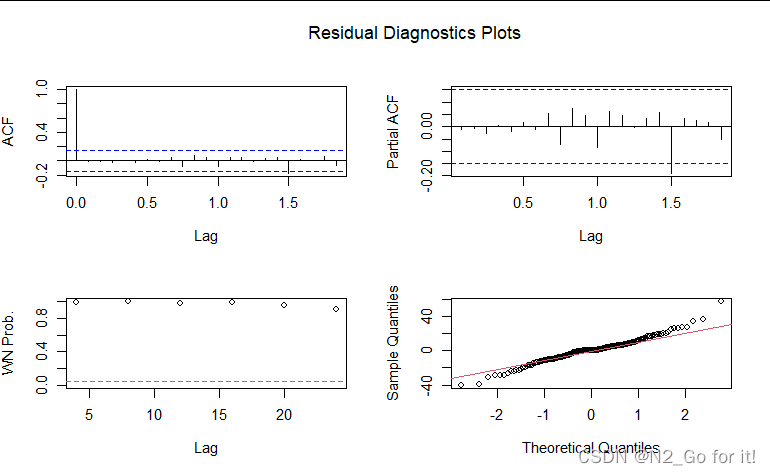

检验模型ARIMA(1,1,1)X(0,1,1)12

ts.diag(fit_1)

(2)拟合模型ARIMA(1,1,1)X(1,1,0)12

fit_2=arima(analy1,order = c(1,1,1),seasonal=list(order=c(1,1,0),period=12))

fit_2

检验模型ARIMA(1,1,1)X(1,1,0)12

ts.diag(fit_2)

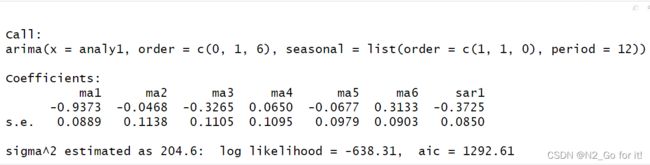

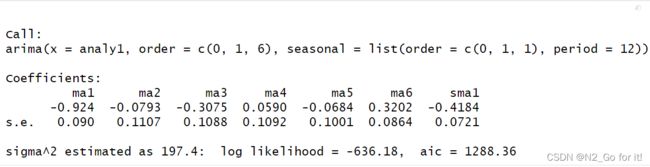

(3)拟合模型ARIMA(0,1,6)X(0,1,1)12

fit_3=arima(analy1,order = c(0,1,6),seasonal=list(order=c(0,1,1),period=12))

fit_3

∇ ∇ 12 ∇∇_{12} ∇∇12 X t X_t Xt =

(1-0.924B -0.0793 B 2 B^{2} B2 -0.3075 B 3 B^{3} B3 + 0.0590 B 4 B^{4} B4 - 0.0684 B 5 B^{5} B5 + 0.3202 B 6 B^{6} B6) * (1 - 0.4184 B 12 B^{12} B12) e t e_t et检验模型ARIMA(0,1,6)X(0,1,1)12

ts.diag(fit_3)

(4)拟合模型ARIMA(0,1,6)X(1,1,0)

fit_4=arima(analy1,order = c(0,1,6),seasonal=list(order=c(1,1,0),period=12))

fit_4

检验模型ARIMA(0,1,6)X(1,1,0)

ts.diag(fit_4)

(5)拟合模型ARIMA(3,1,2)X(1,1,0)

x4_fit<-arima(analy1,order=c(3,1,2),seasonal = list(order=c(1,1,0),period=12))

x4_fit

六、评判模型的相对优劣

data.frame(AIC(fit_1), AIC(fit_4), BIC(fit_1), BIC(fit_4))