Python量化交易10——资产组合比例优化(CAMP,VAR,CVAR)

案例背景

本科的金融或者投资学都会学到CAMP模型,资本资产定价模型,可是怎么用代码实现却一直没人教。

本期用Python代码案例配置一个资产组合,并且做CAMP模型,计算VAR和CVAR等指标。

(本期案例中涉及到的公司仅用于案例研究,不构成任何建议。)

数据获取

用证券宝获取gu票数据,先导入要用的包:

import baostock as bs

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import scipy.optimize as optimization

import scipy.stats as stats

plt.rcParams ['font.sans-serif'] ='SimHei' #显示中文

plt.rcParams ['axes.unicode_minus']=False #显示负号定义获取日K数据的函数:

def get_stocks_daily(stocks=['sh.601318'],start_date='2022-04-01',end_date='2023-03-29'):

lg = bs.login()

df_results=pd.DataFrame()

for stock in stocks:

rs_result = bs.query_history_k_data_plus(stock,fields="date,code,open,high,low,close,preclose,volume,amount,adjustflag,turn,tradestatus,pctChg,isST"\

, start_date=start_date,end_date=end_date, frequency="d", adjustflag="3")

df_result = rs_result.get_data()

#df_result=df_result.set_index('date')

df_results=pd.concat([df_results,df_result],ignore_index=True)

print(f"{stock}获取完成")

bs.logout()

cols_to_convert = [col for col in df_results.columns if col != 'code' and col!='date']

df_results['date']=pd.to_datetime(df_results['date'])

df_results[cols_to_convert] = df_results[cols_to_convert].astype('float64')

return df_results定义获取gu票的代码列表:

stocks_lst=['sh.601318','sh.600519','sz.300750','sz.002714','sz.002603','sz.000681','sh.000300'] #中国平安,贵州茅台,宁德时代,牧原股份,以岭药业,视觉中国,最后的沪深300作为市场基础回报率。

为什么选这个几公司呢?因为他们有的是金融权重股,有的是消费白酒,还有这两年疫情炒得很热的医药,新能源,人工智能等等代表性的gu票。

获取:

data=get_stocks_daily(stocks=stocks_lst,start_date='2021-04-01',end_date='2023-03-29')数据处理一下:

data=data[['code','date','close']].pivot(index='date',columns='code', values='close')[stocks_lst]\

.set_axis(['中国平安','贵州茅台','宁德时代','牧原股份','以岭药业','视觉中国','沪深300'],axis='columns')

data

描述性统计

画出他们的价格走势:

colors=['c', 'b', 'g', 'tomato', 'm', 'y', 'lime', 'k','orange','pink','grey','tan','purple']

fig, ax = plt.subplots(4,2,figsize=(8,7),dpi=256)

for i,col in enumerate(data.columns):

n=int(str('42')+str(i+1))

plt.subplot(n)

df_col=data[col]

plt.plot(df_col,label=col,color=colors[i])

plt.xticks(rotation=20)

plt.title(f'{col}的价格走势')

plt.tight_layout()

plt.show() 计算他们的日度收益率:

data1=pd.DataFrame(columns=data.columns)

for col in data.columns:

data1[col]=data[col].pct_change()

data1=data1.dropna()

data1.head()同样画出他们的图:

fig, ax = plt.subplots(4,2,figsize=(8,7),dpi=256)

for i,col in enumerate(data1.columns):

n=int(str('42')+str(i+1))

plt.subplot(n)

df_col=data1[col]

plt.plot(df_col,label=col,color=colors[i])

plt.xticks(rotation=20)

plt.title(f'{col}的日度收益率')

plt.tight_layout()

plt.show()

投资组合

我们都知道特征组合就是一样资产买一点....所以核心是 每种资产都买多少?这个比例是关键。

我们先随机给一个权重比例看看:

weights = np.random.random(len(stocks_lst)-1)

weights /= np.sum(weights)

weights计算投资组合的价格和收益率:

data['portfolio']=(data.iloc[:,:-1]*weights).sum(axis=1)

data1['portfolio']=data['portfolio'].pct_change().dropna()计算他们所有资产这两年的收益率:

#这两年的收益率

(data.iloc[-1,:]-data.iloc[0,:])/data.iloc[0,:]当然也可以这样算,但是我感觉这样直接相加不准:

data1.sum() #这样不准计算他们的波动性:

#这两年的波动性

data1.std()

优化投资组合比例

我们要选择一个最优的投资组合,无非是最大的收益率,或者最小的波动率。

有一个指标可以结合他们,叫夏普比率,表示每承担一单位风险所获得的回报。

# optimal portfolio sharpe ratio

noa=len(stocks_lst)-1

rf = 0.04

def statistics(weights,risk_free=0.04):

data['portfolio']=(data.iloc[:,:noa]*weights).sum(axis=1)

data1['portfolio']=data['portfolio'].pct_change().dropna()

port_returns = (data['portfolio'][-1]-data['portfolio'][0])/data['portfolio'][0]

port_variance = data1['portfolio'].std()

return np.array([port_returns, port_variance, (port_returns-risk_free*2)/port_variance])

#最小化夏普指数的负值

#Minimize the negative value of the Sharpe Index

def min_sharpe(weights):

return -statistics(weights)[2]比如我等权给一个比例,然后计算上面的指标:

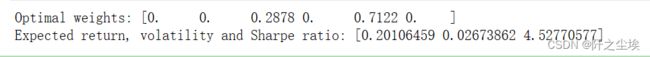

statistics(weights=[1/6]*6,risk_free=0.04)选择开始优化,最大化夏普比率,也就是最小化夏普比率负数:

# constraints an bounds

cons = ({'type':'eq', 'fun':lambda x: np.sum(x)-1})

bnds = tuple((0,1) for x in range(noa))

opts = optimization.minimize(min_sharpe, noa*[1./noa,],method = 'SLSQP',bounds = bnds, constraints = cons,options={'maxiter': 100000})

print("Optimal weights:", opts['x'].round(4))

print("Expected return, volatility and Sharpe ratio:", statistics(opts['x']))好家伙,直接给我扔掉了4个公司......只有两个公司被选入了。

如果最小化方差会是一个怎么样的组合呢:

# Minimal variance

np.set_printoptions(suppress=True)

def min_variance(weights):

return statistics(weights)[1]

optv = optimization.minimize(min_variance,noa*[1./noa],method = 'SLSQP',

bounds = bnds, constraints = cons,options={'maxiter': 100000})

print("Optimal weights:", optv['x'].round(4))

print("Expected return, volatility and Sharpe ratio:", statistics(optv['x']))emmm,收益率太低。我们还是选第一个组合吧。

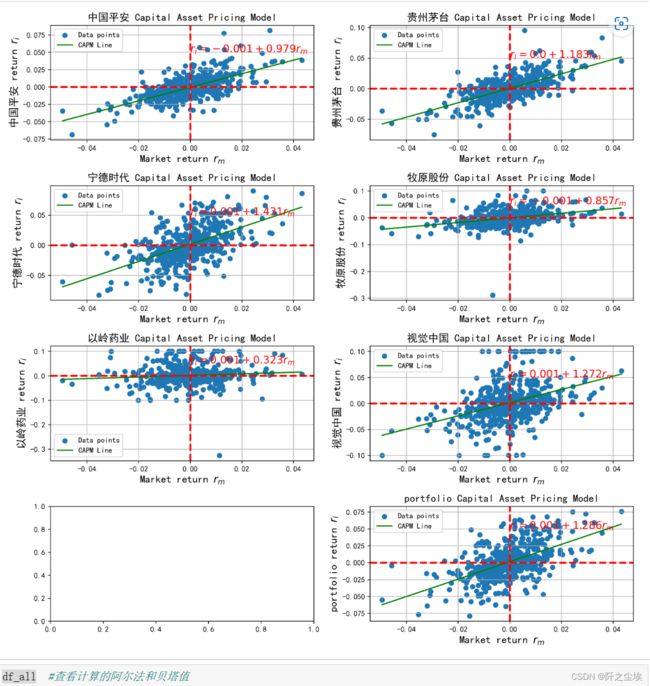

资本资产定价模型CAMP

CAMP模型很简单,公式懒得去word里面写了,我直接用python用图画一个公式:

plt.figure(figsize=(2.7,0.7),dpi=200)

plt.text(0.1, 0.4,fr'$E(R_i)=R_f+\beta_i[E(R_m)-R_f]$')

plt.xticks([]) ;plt.yticks([])

plt.show()所有资产都进行拟合:

df_all=pd.DataFrame(columns=['alpha','beta'])

plt.subplots(4,2,figsize=(12,12),dpi=256)

for i,col in enumerate(data1.columns):

if col!='沪深300':

n=int(str('42')+str(i+1))

plt.subplot(n)

b,a=np.polyfit(data1['沪深300'], data1[col], deg=1)

#plt.figure(figsize=(4,2.5),dpi=128)

plt.scatter(data1['沪深300'], data1[col], label="Data points")

plt.plot(data1['沪深300'], a + b*data1['沪深300'], color='green', label="CAPM Line")

plt.title(f'{col} Capital Asset Pricing Model', fontsize=14)

plt.xlabel('Market return $r_m$', fontsize=14)

plt.ylabel(f'{col} return $r_i$', fontsize=14)

plt.text(0, 0.05, fr'$r_i = {a.round(3)} + {b.round(3)} r_m$', color='red', fontsize=14)

plt.legend()

plt.axvline(color="red",linestyle="dashed",linewidth=2.5)

plt.axhline(color="red",linestyle="dashed",linewidth=2.5)

plt.grid(True, axis='both')

df_all.loc[col,:]=[a,b]

plt.tight_layout()

plt.show()查看计算的阿尔法和贝塔值

df_all #查看计算的阿尔法和贝塔值用公式计算期望收益率

rm = data1['沪深300'].mean() * 252

rf+df_all.loc['中国平安','beta'] * (rm-rf)rf+df_all.loc['贵州茅台','beta'] * (rm-rf)rf+df_all.loc['portfolio','beta'] * (rm-rf)计算VAR和CVAR

定义一个var函数,然后再定义一个一体化函数,var和cvar都算出来,然后画图:

def VaR_r(mu,sigma,q,n):

z=stats.norm.ppf(q)

return (mu*n)+((sigma*np.sqrt(n))*z)def deal_stock(series=data['贵州茅台'],stock_name='贵州茅台'):

AMZN_returns = np.log(series) - np.log(pd.Series(series).shift(1))

mu = np.mean(AMZN_returns) ; sigma = np.std(AMZN_returns)

#var

AMZN_VaR_1day=VaR_r(mu,sigma,0.01,1) ; AMZN_VaR_60day=VaR_r(mu,sigma,0.01,60)

print(f"{stock_name} 1day var is {AMZN_VaR_1day}, 60days var is {AMZN_VaR_60day}")

#CVaR

AMZN_cvar_1day=AMZN_returns[AMZN_returns <= AMZN_VaR_1day].mean()

AMZN_returns60 = AMZN_returns*60

AMZN_cvar_60day=AMZN_returns60[AMZN_returns60 <= AMZN_VaR_60day].mean()

print(f"{stock_name} 1day cvar is {AMZN_cvar_1day}, 60days cvar is {AMZN_cvar_60day}")

# VaR_1day & cvar 1day

plt.subplots(1,2,figsize=(14,5),dpi=200)

plt.subplot(121)

plt.hist(AMZN_returns[AMZN_returns < AMZN_VaR_1day], bins=20,label='In var')

plt.hist(AMZN_returns[AMZN_returns > AMZN_VaR_1day], bins=20,label='Out var')

plt.axvline(AMZN_VaR_1day, color='blue', linestyle='dashed', linewidth=1,label=f"{stock_name} Var 1day")

plt.axvline(AMZN_cvar_1day, color='k', linestyle='dashed', linewidth=1,label=f"{stock_name} CVaR 1day")

plt.text(AMZN_VaR_1day, 40, f'{stock_name}_VaR_1day={round(AMZN_VaR_1day,3)}', color='black', fontsize=15, horizontalalignment='center', verticalalignment='center')

plt.text(AMZN_cvar_1day, 20, f'{stock_name}_CVaR_1day={round(AMZN_cvar_1day,3)}', color='blue', fontsize=15, horizontalalignment='center', verticalalignment='center')

plt.title(f'1 day VaR & CVaR of {stock_name}(99%)')

plt.legend()

plt.xlabel('return')

plt.ylabel('frequency')

# VaR_60day & CVaR_60day

plt.subplot(122)

plt.hist(AMZN_returns60[AMZN_returns60 < AMZN_VaR_60day], bins=20,label='In var')

plt.hist(AMZN_returns60[AMZN_returns60 > AMZN_VaR_60day], bins=20,label='Out var')

plt.axvline(AMZN_VaR_60day, color='b', linestyle='dashed', linewidth=1,label=f"{stock_name} Var 60day")

plt.axvline(AMZN_cvar_60day, color='k', linestyle='dashed', linewidth=1,label=f"{stock_name} CVar 60day")

plt.text(AMZN_VaR_60day, 30, f'{stock_name}_VaR_60day={round(AMZN_VaR_60day,3)}', color='black', fontsize=15, horizontalalignment='center', verticalalignment='center')

plt.text(AMZN_cvar_60day, 20, f'{stock_name}_CVaR_60day={round(AMZN_cvar_60day,3)}', color='blue', fontsize=15, horizontalalignment='center', verticalalignment='center')

plt.title(f'60 day VaR & CVaR of {stock_name}(99%)')

plt.legend()

plt.xlabel('return')

plt.ylabel('frequency')

plt.tight_layout()

plt.show()

#return AMZN_VaR_1day,AMZN_VaR_60day,AMZN_cvar_1day,AMZN_cvar_60day,AMZN_returnsdeal_stock(series=data['中国平安'],stock_name='中国平安')带进去就行。用起来很方便

deal_stock(series=data['贵州茅台'],stock_name='贵州茅台')其他的不展示了,就展示一下投资组合的吧:

deal_stock(series=data['portfolio'],stock_name='portfolio')