【tushare使用经验分享】等权重模型、均值方差模型、风险平价模型的投资组合配置比较

id:472745

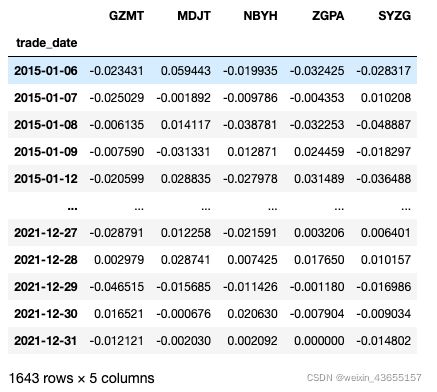

获取2015.1.1至2021.12.31期间 贵州茅台、美的集团、宁波银行、中国平安、三一重工 五只股票的日度收益数据。 利用2015.1.1—2019.12.31间的数据作为训练样本,并分别利用以下三种模型构造投资组合:(1)等权重;(2)哈利马科维兹(M-V)模型;(3)风险平价模型。 试比较以上三种投资组合在 2020.1.1—2021.12.31之间的表现。

##模块导入 import datetime import time from datetime import timedelta from dateutil.relativedelta import * import statsmodels.api as sm import pandas as pd import numpy as np import matplotlib.pyplot as plt from pandas import DataFrame, Series import math import tushare as ts token='xxx' ts.set_token(token) pro=ts.pro_api() import ffn %matplotlib inline一、提取五只股票日度收益率数据

#提取各只股票的日度收益率数据(前复权) df_gzmt=ts.pro_bar(ts_code='600519.SH', adj='qfq',start_date='20150101',end_date='20211231').set_index(['trade_date']).sort_index() df_mdjt=ts.pro_bar(ts_code='000333.SZ', adj='qfq',start_date='20150101',end_date='20211231').set_index(['trade_date']).sort_index() df_nbyh=ts.pro_bar(ts_code='002142.SZ', adj='qfq',start_date='20150101',end_date='20211231').set_index(['trade_date']).sort_index() df_zgpa=ts.pro_bar(ts_code='601318.SH', adj='qfq',start_date='20150101',end_date='20211231').set_index(['trade_date']).sort_index() df_syzg=ts.pro_bar(ts_code='600031.SH', adj='qfq',start_date='20150101',end_date='20211231').set_index(['trade_date']).sort_index() #将数据存入dataframe中 data=pd.DataFrame({'GZMT':ffn.to_log_returns(df_gzmt['close']), 'MDJT':ffn.to_log_returns(df_mdjt['close']), 'NBYH':ffn.to_log_returns(df_nbyh['close']), 'ZGPA':ffn.to_log_returns(df_zgpa['close']), 'SYZG':ffn.to_log_returns(df_syzg['close'])}) data=data.dropna() data.index=pd.to_datetime(data.index) data.describe() data#绘制收益率折线图 data.plot(figsize=(12,6),grid=True) #绘制累积收益率折线图 cumreturn=(1+data).cumprod() cumreturn.plot(figsize=(12,6),grid=True)data.corr()#各只股票的相关系数相关系数 #划分训练集与测试集 train_set=data.loc['2015':'2019'] test_set=data.loc['2020':'2021']二、构建模型

1、均值方差模型

#构建均值方差模型 def M_V(R, rf, Sigma, output_type = 'Dict', print_out = False): ''' :param R: list格式,输入各收益序列 :param rf: num格式或list格式,输入无风险利率 :param Sigma: two-d list格式,输入各收益序列协方差矩阵 :param output_type: Bool类型,True为打印结果,Flase为不打印结果 :param : num格式或list格式 :return: dataframe ''' # Step 1: 初始化收入变量格式 N = len(R) # 获取资产类别数 R = np.array(R).reshape(N) # 格式化收益率序列 rf = np.array(rf) # 格式化无风险利率 Sigma = np.array(Sigma).reshape(N, N) # 格式化协方差矩阵 # Step 2: 利用minimize函数进行模型求解: eps = 1e-10 # 找到一个非常接近0的值作为误差限 w0 = np.ones(N) / (N) # 各类别资产权重参数初始化 fun = lambda w: - np.dot(w, R - rf) / np.dot(np.dot(w, Sigma), np.transpose(w))**0.5 # 约束函数:最大化对数sharpe-ratio cons = ({'type': 'eq', 'fun': lambda w: np.sum(w) - 1}, # 限制条件一:全部投资 {'type': 'ineq', 'fun': lambda w: w - eps}, # 限制条件二:不可做空 ) res = minimize(fun, w0, method='SLSQP', constraints=cons) # Step 4: 计算各指标 w_op = res.x # 获取权重数据 r_op = np.dot(res.x, R) # 计算收益率 sigma_op = np.dot(np.dot(w_op, Sigma), np.transpose(w_op)) # 计算组合波动率 SR = (r_op - rf) / sigma_op # 计算夏普比率 # Step 5: 是否打印测试 if print_out: print(''' 最优权重配比:{0:} 最优收益率:{1:.2f} 最优风险:{2:.2f} 最优夏普比率:{3:.2f} '''.format(w_op, r_op, sigma_op, SR)) # Step 6: 打印模块 if str(output_type).upper() == 'DATAFRAME': return pd.DataFrame({'Weights':[w_op], 'Return':r_op, 'Sigma':sigma_op, 'SR':SR}) elif str(output_type).upper() == 'DICT': return {'Weights':w_op, 'Return':r_op, 'Sigma':sigma_op, 'SR':SR} elif str(output_type).upper() == 'LIST': return [w_op, r_op, sigma_op, SR] else: return {'Weights':w_op, 'Return':r_op, 'Sigma':sigma_op, 'SR':SR} def weights_calculate_MV(returns): weights_strategy_MV = [] R = [] for i in range(5): R.append(np.mean(returns[tickers[i]])) rf = np.mean(rff['rff']) Sigma = np.cov(returns[tickers[0:5]], rowvar=False) outcome = M_V(R=R, rf=rf, Sigma=Sigma) weights_strategy_MV.append(outcome['Weights']) return weights_strategy_MV2、风险平价模型

#构建风险平价模型 def R_P(R, rf, Sigma, output_type = 'Dict', print_out = False): ''' :param R: list格式,输入各收益序列 :param rf: num格式或list格式,输入无风险利率 :param Sigma: two-d list格式,输入各收益序列协方差矩阵 :param output_type: Bool类型,True为打印结果,Flase为不打印结果 :param : num格式或list格式 :return: dataframe ''' # Step 1: 初始化收入变量格式 N = len(R) # 获取资产类别数 R = np.array(R).reshape(N) # 格式化收益率序列 rf = np.array(rf) # 格式化无风险利率 Sigma = np.array(Sigma).reshape(N, N) # 格式化协方差矩阵 # Step 2: 利用minimize函数进行模型求解: eps = 1e-10 # 找到一个非常接近0的值作为误差限 w0 = np.ones(N) / N # 各类别资产权重参数初始化 fun = lambda w: np.dot(w - np.dot(np.dot(w, Sigma), np.transpose(w))/N / np.dot(w, Sigma), np.transpose(w - np.dot(np.dot(w, Sigma), np.transpose(w))/N / np.dot(w, Sigma) )) cons = ({'type': 'eq', 'fun': lambda w: np.sum(w) - 1}, # 限制条件一:全部投资 {'type': 'ineq', 'fun': lambda w: w - eps}, # 限制条件二:不可做空 ) res = minimize(fun, w0, method='SLSQP', constraints=cons) # Step 4: 计算各指标 w_op = res.x # 获取权重数据 r_op = np.dot(res.x, R) # 计算收益率 sigma_op = np.dot(np.dot(w_op, Sigma), np.transpose(w_op)) # 计算组合波动率 SR = (r_op - rf) / sigma_op # 计算夏普比率 # Step 5: 是否打印测试 if print_out: print(''' 最优权重配比:{0:} 最优收益率:{1:.2f} 最优风险:{2:.2f} 最优夏普比率:{3:.2f} '''.format(w_op, r_op, sigma_op, SR)) # Step 6: 打印模块 if str(output_type).upper() == 'DATAFRAME': return pd.DataFrame({'Weights':[w_op], 'Return':r_op, 'Sigma':sigma_op, 'SR':SR}) elif str(output_type).upper() == 'DICT': return {'Weights':w_op, 'Return':r_op, 'Sigma':sigma_op, 'SR':SR} elif str(output_type).upper() == 'LIST': return [w_op, r_op, sigma_op, SR] else: return {'Weights':w_op, 'Return':r_op, 'Sigma':sigma_op, 'SR':SR} def weights_calculate_RP(returns): weights_strategy_RP = [] R = [] for i in range(5): R.append(np.mean(returns[tickers[i]])) rf = np.mean(rff['rff']) Sigma = np.cov(returns[tickers[0:5]], rowvar=False) outcome = R_P(R=R, rf=rf, Sigma=Sigma) weights_strategy_RP.append(outcome['Weights']) return weights_strategy_RP3、均值模型

def weights_calculate_EW(returns): weights_strategy_EW = np.ones(5)/returns.shape[1] return weights_strategy_EW三、计算组合权重

tickers = ["GZMT","MDJT","NBYH","ZGPA","SYZG"] td_dates = train_set.index #记录交易日信息,方便以后进行查找 ts_dates = test_set.index n = len(td_dates) rff= pd.DataFrame(np.ones((n,1))*0.003, index = td_dates, columns =['rff']) nv_strategy_EW= [] nv_strategy_MV= [] nv_strategy_RP= [] nv_strategy_EW = [1] r_strategy_EW = [] nv_strategy_MV = [1] r_strategy_MV = [] nv_strategy_RP = [1] r_strategy_RP = [] returns=train_set # 设置训练日期 returns_test=test_set #设置测试日期 weights_strategy_EW = weights_calculate_EW(returns) # 计算等权重策略权重序列 weights_strategy_MV = weights_calculate_MV(returns) # 计算马科维茨模型策略权重序列 weights_strategy_RP = weights_calculate_RP(returns) # 计算风险平价策略权重序列 data_weight={"weights_strategy_EW":weights_strategy_EW, "weights_strategy_MV":weights_strategy_MV[0], "weights_strategy_RP":weights_strategy_RP[0]} df_weight=pd.DataFrame(data_weight,index=['GZMT','MDJT','NBYH','ZGPA','SYZG']) df_weightfor i in range(len(ts_dates)): r_strategy_EW.append(weights_strategy_EW[0] * returns_test[tickers[0]][ts_dates[i]] + weights_strategy_EW[1] * returns_test[tickers[1]][ts_dates[i]] + weights_strategy_EW[2] * returns_test[tickers[2]][ts_dates[i]] + weights_strategy_EW[3] * returns_test[tickers[3]][ts_dates[i]] + weights_strategy_EW[4] * returns_test[tickers[4]][ts_dates[i]]) r_strategy_MV.append(weights_strategy_MV[0][0] * returns_test[tickers[0]][ts_dates[i]] + weights_strategy_MV[0][1] * returns_test[tickers[1]][ts_dates[i]] + weights_strategy_MV[0][2] * returns_test[tickers[2]][ts_dates[i]] + weights_strategy_MV[0][3] * returns_test[tickers[3]][ts_dates[i]] + weights_strategy_MV[0][4] * returns_test[tickers[4]][ts_dates[i]]) r_strategy_RP.append(weights_strategy_RP[0][0] * returns_test[tickers[0]][ts_dates[i]] + weights_strategy_RP[0][1] * returns_test[tickers[1]][ts_dates[i]] + weights_strategy_RP[0][2] * returns_test[tickers[2]][ts_dates[i]] + weights_strategy_RP[0][3] * returns_test[tickers[3]][ts_dates[i]] + weights_strategy_RP[0][4] * returns_test[tickers[4]][ts_dates[i]]) nv_strategy_EW.append(nv_strategy_EW[i] * (1 + r_strategy_EW[i])) nv_strategy_MV.append(nv_strategy_MV[i]* (1 + r_strategy_MV[i])) nv_strategy_RP.append(nv_strategy_RP[i] * (1 + r_strategy_RP[i]))四、进行模型回测

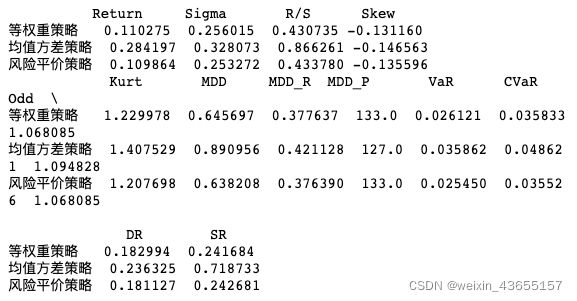

#Risk_Factor为导入文件 import Risk_Factor as RF r_series = [r_strategy_EW ,r_strategy_MV , r_strategy_RP] nv_series = [nv_strategy_EW ,nv_strategy_MV ,nv_strategy_RP] Period = 'D' Indicators = 'ALL' alpha = 0.05 output_type = 'pd.DataFrame' strategy_names = ['等权重策略', '均值方差策略', '风险平价策略'] rf=0.0002 # 进入风险值计算回测系统框架(该框架为自主创建,需要读取该文件) Risks = RF.Risk_Indicators(r_series, nv_series,rf_series = rf, Period = Period, Indicators= Indicators, alpha=alpha, output_type=output_type) Risks = pd.DataFrame(Risks.values.tolist(), index = strategy_names, columns = Risks.columns) #打印风险值情况 print(Risks[Risks.columns[:4]]) print(Risks[Risks.columns[4:]]) nv_set=data.loc['2019-12-31':'2021']#横坐标提取 nv_index=nv_set.index result_nv={"nv_strategy_EW":nv_strategy_EW,"nv_strategy_MV":nv_strategy_MV,"nv_strategy_RP":nv_strategy_RP} result_nv_strategy=pd.DataFrame(result_nv, index= nv_index) plt.figure(figsize=(12,6)) plt.grid() plt.plot(result_nv_strategy['nv_strategy_EW'], label='nv_strategy_EW', color="red") plt.plot(result_nv_strategy['nv_strategy_MV'], label='nv_strategy_MV', color="green") plt.plot(result_nv_strategy['nv_strategy_RP'], label='nv_strategy_RP', color="yellow") plt.legend(loc='best')