三重预测指数炒股

预测指数,预测板块,预测个股,进行股票交易。

导包:

#importing required libraries 导入必要的库函数

from sklearn.preprocessing import MinMaxScaler

from keras.models import Sequential

from keras.layers import Dense, Dropout, LSTM

import akshare as ak

import numpy as np

import pandas as pd

import datetime

import matplotlib.pyplot as plt

import mplfinance as mpf

from pylab import mpl

mpl.rcParams['font.sans-serif'] = ['SimHei'] # 设置中文字体为微软雅

plt.rcParams['font.sans-serif'] = ['SimHei'] # 字体设置

import matplotlib

matplotlib.rcParams['axes.unicode_minus']=False # 负号显示问题获取指数:

end =datetime.datetime.now().strftime('%Y%m%d')

#code= str(stock_pool['代码'].values[i])

code = "sh000001"

df = ak.stock_zh_index_daily(symbol="sh000001")

df.rename(columns= {'date':'Date'},inplace=True)

df['code'] = code

data = df

#creating dataframe 建立新的数据集框架,以长度为索引,取date和close这两列

new_data = data[['Date','close']]

#对于数据内容表现形式的转换,这里是转化为年-月-日的格式,同时建立以这个时间的索引

#new_data['Date'] = pd.to_datetime(new_data.Date,format='%Y-%m-%d')

new_data.index = new_data['Date']

new_data.drop('Date', axis=1, inplace=True)预测函数:

def predict(df):

#creating train and test sets 划分训练集测试集

new_data = df

num = len(new_data)

dataset = new_data.values

print(dataset)

train = dataset[0:int(num*0.4),:]

valid = dataset[int(num*0.4):,:]

#converting dataset into x_train and y_train 将两个数据集归一化处理

scaler = MinMaxScaler(feature_range=(0, 1))

#总数据集归一化

scaled_data = scaler.fit_transform(dataset)

#确定正式训练集测试集,大小是在刚刚划分的数据集合中,按60:1的比例划分,这里的划分不能算是k折交叉验证,知道的朋友麻烦留言解答一下,感谢

x_train, y_train = [], []

for i in range(60,len(train)):

x_train.append(scaled_data[i-60:i,0])

y_train.append(scaled_data[i,0])

#转为numpy格式

x_train, y_train = np.array(x_train), np.array(y_train)

#重新改变矩阵的大小,这里如果不理解可以参考我的传送门

x_train = np.reshape(x_train, (x_train.shape[0],x_train.shape[1],1))

# create and fit the LSTM network 建立模型

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(x_train.shape[1],1)))

model.add(LSTM(units=50))

model.add(Dense(1))

#编译模型,并给模型喂数据

model.compile(loss='mean_squared_error', optimizer='adam')

model.fit(x_train, y_train, epochs=1, batch_size=1, verbose=2)

#predicting 246 values, using past 60 from the train data 用测试集最后的60个数据

inputs = new_data[len(new_data) - len(valid) - 60:].values

inputs = inputs.reshape(-1,1)

inputs = scaler.transform(inputs)

#取最终的测试集

X_test = []

for i in range(60,inputs.shape[0]):

X_test.append(inputs[i-60:i,0])

X_test = np.array(X_test)

#调整矩阵的规模

X_test = np.reshape(X_test, (X_test.shape[0],X_test.shape[1],1))

#模型预测

closing_price = model.predict(X_test)

closing_price = scaler.inverse_transform(closing_price)

#计算rms

rms=np.sqrt(np.mean(np.power((valid-closing_price),2)))

#for plotting 绘画结果

train = new_data[:int(num*0.4)]

valid = new_data[int(num*0.4):]

valid['Predictions'] = closing_price

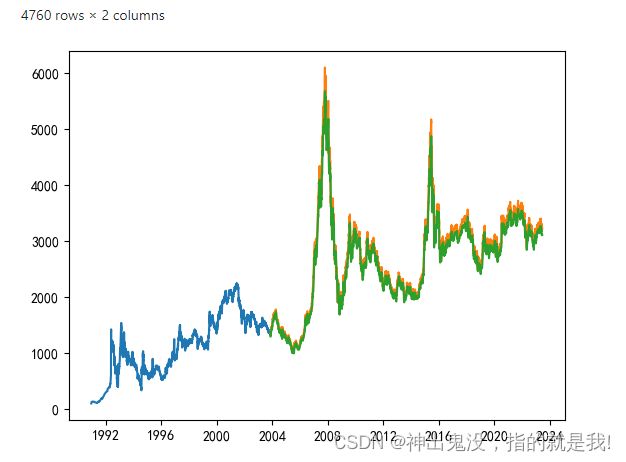

plt.plot(train['close'])

plt.plot(valid[['close','Predictions']])

return valid预测指数:

index1 = predict(new_data)

index1

import akshare as ak

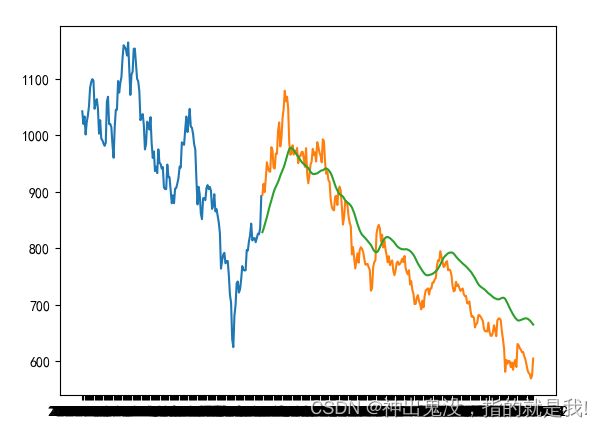

ind ="能源金属"

industry = ak.stock_board_industry_hist_em(symbol=ind, start_date="20001201", end_date=end, period="日k", adjust="")

industry .rename(columns= {'日期':'Date','开盘':'open','最高':'high','最低':'low','收盘':'close','成交量':'volume'},inplace=True)

industry['code'] = ind

industry

new_data2 = industry[['Date','close']]

#对于数据内容表现形式的转换,这里是转化为年-月-日的格式,同时建立以这个时间的索引

#new_data['Date'] = pd.to_datetime(new_data.Date,format='%Y-%m-%d')

new_data2.index = new_data2['Date']

new_data2.drop('Date', axis=1, inplace=True)ind1 = predict(new_data2)

ind1确定股票代码:”

def gp_type_szsh(gp):

if gp.find('60',0,3)==0:

gp_type='sh'+gp

elif gp.find('688',0,4)==0:

gp_type='sh'+gp

elif gp.find('900',0,4)==0:

gp_type='sh'+gp

elif gp.find('00',0,3)==0:

gp_type='sz'+gp

elif gp.find('300',0,4)==0:

gp_type='sz'+gp

elif gp.find('200',0,4)==0:

gp_type='sz'+gp

return gp_type获取股票数据:

import datetime

from_date='1990-01-01'

to_date=datetime.date.today().strftime('%Y%m%d')

codelist = ak.stock_board_industry_cons_em(symbol="能源金属")['代码']

def stock_pre(stock):

code = stock

dd = ak.stock_zh_a_daily(symbol=code ,start_date = from_date,end_date = to_date)

dd.rename(columns= {'date':'Date'},inplace=True)

data = dd

#creating dataframe 建立新的数据集框架,以长度为索引,取date和close这两列

new_data3 = data[['Date','close']]

#对于数据内容表现形式的转换,这里是转化为年-月-日的格式,同时建立以这个时间的索引

new_data3['Date'] = pd.to_datetime(new_data3.Date,format='%Y-%m-%d')

new_data3.index = new_data3['Date']

new_data3.drop('Date', axis=1, inplace=True)

return new_data3

stock_last= pd.DataFrame()

stock_last['Date'] = 0

for i in codelist[:2]:

print(i)

stock = predict(stock_pre(gp_type_szsh(i)))

stock_last = pd.merge(stock,stock_last,on='Date',how='left')

stock_last确定信号:

index1['signal']=0

index1.loc[index1['Predictions'].shift(1)>index1['close'].shift(1),'signal']=1

ind1['signal']=0

ind1.loc[ind1['Predictions'].shift(1)>ind1['close'].shift(1),'signal']=1

stock['signal']=0

stock.loc[stock['Predictions'].shift(1)>stock['close'].shift(1),'signal']=1确定数据:

ind1 = ind1.reset_index()

stock = stock.reset_index()

ind1['Date'] = ind1['Date'].apply(lambda x : datetime.datetime.strptime(str(x),'%Y-%m-%d'))

last = pd.merge(ind1,index1,on='Date')

last = pd.merge(last,stock,on='Date')

last['signal3'] = last['signal_x']+last['signal_y']+last['signal']

last['signal4'] = 0

last.loc[last['signal3']>=2,'signal4']=1

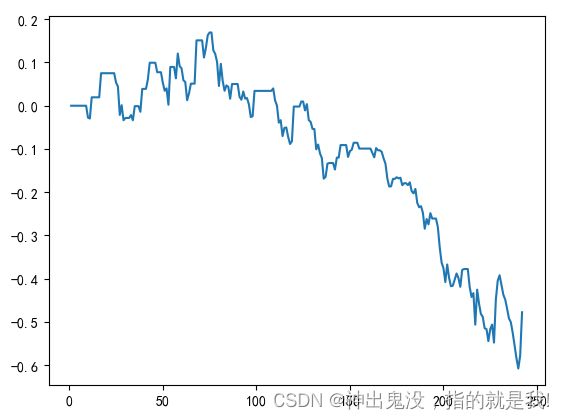

last['pct'] = last['close'].pct_change()*last['signal4']

last['cum'] = last['pct'].cumsum()

last['cum'].plot()

from datetime import datetime,timedelta

df = last

df = df.set_index('Date')

df['当天仓位']=df['signal4'].shift(1)

df['当天仓位'].fillna(method='ffill',inplace=True)

d=df[df['当天仓位']==1].index[0]-timedelta(days=1)

df1=df.loc[d:].copy()

df1['ret'] = df1['close'].pct_change()

df1['ret'][0]=0

df1['当天仓位'][0]=0

#当仓位为1时,买入持仓,当仓位为-1时,空仓,计算资金净值

df1['策略净值']=(df1.ret.values*df1['当天仓位'].values+1.0).cumprod()

df1['指数净值']=(df1.ret.values+1.0).cumprod()

df1['策略收益率']=df1['策略净值']/df1['策略净值'].shift(1)-1

df1['指数收益率']=df1.ret

total_ret=df1[['策略净值','指数净值']].iloc[-1]-1

annual_ret=pow(1+total_ret,250/len(df1))-1

dd=(df1[['策略净值','指数净值']].cummax()-df1[['策略净值','指数净值']])/df1[['策略净值','指数净值']].cummax()

d=dd.max()

beta=df1[['策略收益率','指数收益率']].cov().iat[0,1]/df1['指数收益率'].var()

alpha=(annual_ret['策略净值']-annual_ret['指数净值']*beta)

exReturn=df1['策略收益率']-0.03/250

sharper_atio=np.sqrt(len(exReturn))*exReturn.mean()/exReturn.std()

TA1=round(total_ret['策略净值']*100,2)

TA2=round(total_ret['指数净值']*100,2)

AR1=round(annual_ret['策略净值']*100,2)

AR2=round(annual_ret['指数净值']*100,2)

MD1=round(d['策略净值']*100,2)

MD2=round(d['指数净值']*100,2)

S=round(sharper_atio,2)

df1[['策略净值','指数净值']].plot(figsize=(15,7))

plt.title('三重交易策略简单回测',size=15)

bbox = dict(boxstyle="round", fc="w", ec="0.5", alpha=0.9)

plt.text(df1.index[int(len(df1)/5)], df1['指数净值'].max()/1.5, f'累计收益率:\

策略{TA1}%,指数{TA2}%;\n年化收益率:策略{AR1}%,指数{AR2}%;\n最大回撤: 策略{MD1}%,指数{MD2}%;\n\

策略alpha: {round(alpha,2)},策略beta:{round(beta,2)}; \n夏普比率: {S}',size=13,bbox=bbox)

plt.xlabel('')

ax=plt.gca()

ax.spines['right'].set_color('none')

ax.spines['top'].set_color('none')

plt.show()

#