python量化策略——最简单的动量策略,简单趋势追踪策略

趋势性动量策略有效性验证及实现

- 1相关性验证

- 2策略概要

- 3其他回测结果

- 其他量化策略

1相关性验证

- 选取上证指数000001.SH,获取收盘价

- 以50为单位,计算每个55天的收益序列。

- 使用shift(1),获得滞后一个时间段(50天)的时间序列数据。

- 使用df.corr()计算相关性

- 代码如下

运行此代码,需获取token码,这里获取token码

# coding=utf-8

import math

import tushare as ts

import pandas as pd

import matplotlib

import matplotlib.pyplot as plt

import numpy as np

import talib

import pandas as pd

from datetime import datetime, date

matplotlib.rcParams['axes.unicode_minus']=False

plt.rcParams['font.sans-serif']=['SimHei']

ts.set_token('token码')

pro = ts.pro_api()

#读取数据

start_time='20060931'

end_time="20200931"

#dsc1 = pro.index_daily(ts_code='000300.SH', start_date=start_time,end_date=end_time,fields='ts_code,trade_date,close')

#dsp = pro.index_daily(ts_code='NHCI.NH', start_date=start_time, end_date=end_time,fields='ts_code,trade_date,close')

dsb = pro.index_daily(ts_code='000001.SH', start_date=start_time, end_date=end_time)

dsb.open=0

dsb=dsb.sort_index(ascending=False)

dsb.index=pd.to_datetime(dsb.trade_date,format="%Y-%m-%d")

T= 55

for i in range( math.floor(len(dsb)/T)-1):

dsb.open[(i+1)*T]=dsb.close[(i+1)*T]-dsb.close[i*T]

DF=dsb[dsb.open!=0].open

DF=pd.DataFrame(DF)

DF=DF.rename(columns={"open":"close_change"})

DD=DF.shift(1)

DD=pd.DataFrame(DD)

DD=DD.rename( columns={ "close_change":"close_change_shift1" } )

DF1=pd.concat([DF,DD],axis=1) #月度数据

print(DF1.dropna().corr())

输出

close_change close_change_shift1

close_change 1.000000 0.416991

close_change_shift1 0.416991 1.000000

具有正相关性

2策略概要

- 由于滞后一期与本身存在正相关性,因此可以根据上一个时期的股价变动,在接下来的一个时期做出信号判断

- if 上一时期股价变动 Δ t − 1 \Delta_{t-1} Δt−1>0,则买入。。否则买入债券、或融券卖出等操作,这里就用做空吧。毕竟考虑交易费用

- 计算组合收益情况等

# coding=utf-8

import math

import tushare as ts

import pandas as pd

import matplotlib

import matplotlib.pyplot as plt

import numpy as np

import talib

import pandas as pd

from datetime import datetime, date

matplotlib.rcParams['axes.unicode_minus']=False

plt.rcParams['font.sans-serif']=['SimHei']

ts.set_token('输入token码')

pro = ts.pro_api()

start_time='20060204'

end_time="20200428"

dsc1 = pro.index_daily(ts_code='000300.SH', start_date=start_time, end_date=end_time,fields='ts_code,trade_date,close')

dc=dsc1.set_index(dsc1.trade_date).sort_index(ascending=True)

dc.index=pd.to_datetime(dc.index,format="%Y-%m-%d" )

ret=(dc.close-dc.close.shift(1))/dc.close.shift(1)

ret=ret.sort_index(ascending=True)

T=55

###############################信号判断#######################################

sig=pd.Series(0,index=dc.index)

for i in range( math.floor(len(ret)/T)-2):

if dc.close[(1+i)*T]>dc.close[i*T]+50:

for j in range((i+1)*T+1,(i+2)*T+1):

sig[j]=1

sig=sig.tail(len(sig)-T)

RET=ret*sig

cum=np.cumprod(RET+1).dropna()

#############################策略的年化统计######################################

def Tongji(cum):

cum=cum.sort_index()

NH=(cum[-1]-1)*100*252/len(cum.index)

BD=np.std(np.log(cum/cum.shift(-1)))*np.sqrt(252)*100

SR=(NH-4)/BD

return_list=cum

MHC=((np.maximum.accumulate(return_list) - return_list) / np.maximum.accumulate(return_list)).max()*100

print("年化收益率:{:.2f}%:,年化夏普率:{:.2f},波动率为:{:.2f}%,最大回撤:{:.2f}%".format( NH,SR,BD,MHC))

############################################################################

JZ=dc.close.tail(len(cum))/dc.close.tail(len(cum))[0]#上证指数净值

if __name__=="__main__":

print("组合策略:")

Tongji(cum)

print("直接持有:")

Tongji(JZ)

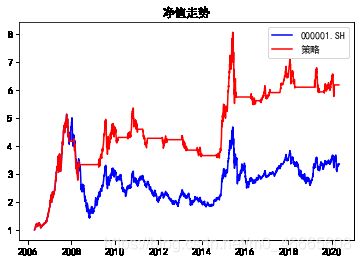

plt.plot(JZ,label="000001.SH",color='b',linestyle='-')

plt.plot(cum,label="策略",color='r',linestyle='-')

plt.title("净值走势")

plt.legend()

结果:

组合策略:

年化收益率:38.38%:,年化夏普率:1.72,波动率为:19.96%,最大回撤:45.97%

直接持有:

年化收益率:17.50%:,年化夏普率:0.48,波动率为:28.01%,最大回撤:72.30%

3其他回测结果

其他量化策略

1.python量化——alpha股票-指数期货对冲策略

2.多因子选股策略

3.海龟交易策略

4.移动平均策略——单/双均线策略

5.改进的美林时钟(介绍)

6.改进的美林时钟策略(一)

7.改进的美林时钟策略(二)

8.改进的美林时钟策略(三)

9.F-F三因子(改进代码+结果)

10.移动波动率策略