Backtrader 文档学习-Indicators- TA-Lib

Backtrader 文档学习-Indicators- TA-Lib

1.概述

即使BT提供的内置指标数量已经很多,开发指标主要是定义输入、输出并以自然方式编写公式,还是希望使用TA-LIB。原因:

- 指标X在指标库中,而不在BT中

- TA-LIB众所周知的,人们信任口碑好

应大家需要,BT提供了TA-LIB集成

安装前提:

- 用于TA-Lib的Python包装器

- TA-LIB所需的任何依赖项(例如numpy), 安装细节在GitHub中

2.使用ta-lib

使用BT中已内置的任何指标一样简单。简单移动平均线的示例:

import backtrader as bt

class MyStrategy(bt.Strategy):

params = (('period', 20),)

def __init__(self):

self.sma = bt.indicators.SMA(self.data, period=self.p.period)

...

...

ta-lib示例:

import backtrader as bt

class MyStrategy(bt.Strategy):

params = (('period', 20),)

def __init__(self):

self.sma = bt.talib.SMA(self.data, timeperiod=self.p.period)

...

...

ta-lib指标的参数是由库本身定义的,而不是由bt定义的。在这种情况下,ta-lib中的SMA采用一个名为timeperiod的参数来定义操作window的大小。

对于需要多个输入参数的指标,例如随机指标:

import backtrader as bt

class MyStrategy(bt.Strategy):

params = (('period', 20),)

def __init__(self):

self.stoc = bt.talib.STOCH(self.data.high, self.data.low, self.data.close,

fastk_period=14, slowk_period=3, slowd_period=3)

...

...

Notice how high, low and close have been individually passed. One could always pass open instead of low (or any other data series) and experiment.

The ta-lib indicator documentation is automatically parsed and added to the backtrader docs. You may also check the ta-lib source code/docs. Or adittionally do:

注意最高价、最低价和收盘价是作为参数分别传递的。总是传递开盘价,而不是最低价(或任何其他数据系列)。

ta-lib指标文档被自动解析并添加到bt文档中。可以查看ta-lib源代码/文档:

print(bt.talib.SMA.doc)

输出:

SMA([input_arrays], [timeperiod=30])

Simple Moving Average (Overlap Studies)

Inputs:

price: (any ndarray)

Parameters:

timeperiod: 30

Outputs:

real

文档说明信息:

- 输入参数定义,(忽略“ndarray”注释,因为bt在后台管理转换)

- 有哪些参数,对应默认值

- 指标函数实际提供了哪些输出值

要为bt.talib.STOCH指标选择特定的移动平均线,可通过backtrader.talib.MA_Type访问标准ta-lib MA_Type :

import backtrader as bt

print('SMA:', bt.talib.MA_Type.SMA)

print('T3:', bt.talib.MA_Type.T3)

结果:

SMA: 0

T3: 8

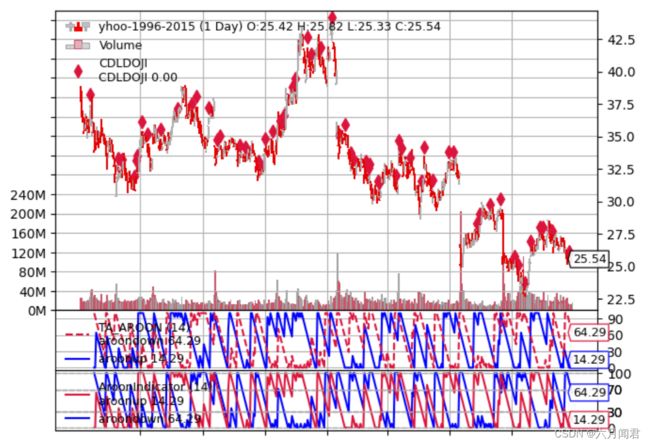

3.用ta-lib绘图

正如常规用法一样,绘制ta-lib指标并没有特别的操作。

注意:

输出蜡烛的指标(所有寻找烛台模式的指标)提供二进制输出:0或100。为了避免在图表中添加子图,有一个自动绘图转换功能,可以在模式被识别的时间点的数据上绘制子图。

(0)在jupyter中实现命令行代码功能

bt给出的示例都是在命令行的方式,通过命令行不同的参数,实现不同功能。找到一个不用修改代码,直接在jupyter中运行的方法:

代码:

#!/usr/bin/env python

# -*- coding: utf-8; py-indent-offset:4 -*-

###############################################################################

#

# Copyright (C) 2015-2023 Daniel Rodriguez

#

# This program is free software: you can redistribute it and/or modify

# it under the terms of the GNU General Public License as published by

# the Free Software Foundation, either version 3 of the License, or

# (at your option) any later version.

#

# This program is distributed in the hope that it will be useful,

# but WITHOUT ANY WARRANTY; without even the implied warranty of

# MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

# GNU General Public License for more details.

#

# You should have received a copy of the GNU General Public License

# along with this program. If not, see 修改部分:

- 绘图代码

cerebro.plot(iplot=False,**pkwargs)

- 不用main调用

用’–help’.split() ,传递不同的参数。

%matplotlib inline

runstrat('--help'.split())

执行结果:

usage: ipykernel_launcher.py [-h] [--data0 DATA0] [--fromdate FROMDATE]

[--todate TODATE]

[--ind {sma,ema,stoc,rsi,macd,bollinger,aroon,ultimate,trix,kama,adxr,dema,ppo,tema,roc,williamsr}]

[--no-doji] [--use-next] [--plot [kwargs]]

Sample for sizer

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to be read in (default:

./datas/yhoo-1996-2015.txt)

--fromdate FROMDATE Starting date in YYYY-MM-DD format (default:

2005-01-01)

--todate TODATE Ending date in YYYY-MM-DD format (default: 2006-12-31)

--ind {sma,ema,stoc,rsi,macd,bollinger,aroon,ultimate,trix,kama,adxr,dema,ppo,tema,roc,williamsr}

Which indicator pair to show together (default: sma)

--no-doji Remove Doji CandleStick pattern checker (default:

False)

--use-next Use next (step by step) instead of once (batch)

(default: False)

--plot [kwargs], -p [kwargs]

Plot the read data applying any kwargs passed For

example (escape the quotes if needed): --plot

style="candle" (to plot candles) (default: None)

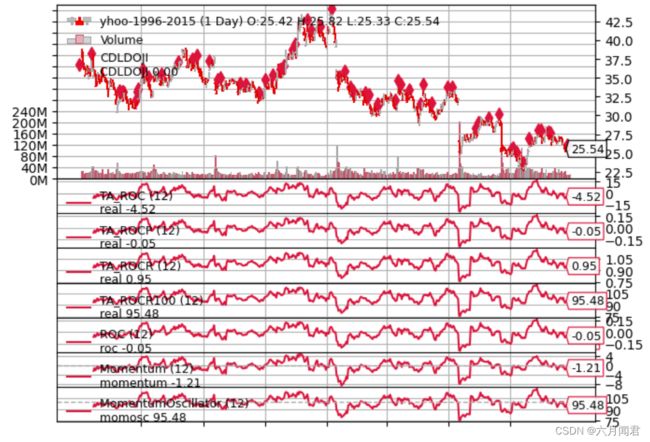

(1)示例和对比

The following are plots comparing the outputs of some ta-lib indicators against the equivalent built-in indicators in backtrader. To consider:

ta-lib指标与bt中相应内置指标绘图对比,考虑:

- ta-lib指示器在图上获得一个TA_前缀,示例专门完成的,以帮助用户识别是哪个指标来源,ta还是bt的。

- 移动平均线(如果两者的结果相同)将绘制在另一条现有移动平均线之上。如果这两个指标不能分开,测试通过 。

- 所有示例都包括一个CDLDOJI指示器作为参考

(2)KAMA (Kaufman Moving Average

第一个示例,因为它是唯一有差异的(在bt和ta所有样本的直接比较中):

- 样本的初始值不相同

- 某个时间点,值聚合在一起,两个KAMA实现具有相同的行为。

分析了ta-lib源代码之后: - ta-lib中的实现为KAMA的第一个值做出了非行业标准的选择。

这个不同的选择可以在ta源代码中找到(引用自源代码),使用昨天的价格作为前期的KAMA。

bt做的选择例如从股票软件图表中选择一样

-

股票软件图表中的KAMA

需要一个初始值来开始计算,所以第一个KAMA只是一个简单的移动平均值 -

因此两者有所不同。此外:

ta-lib KAMA实现不允许为Kaufman定义的可伸缩常数的调整指定快速和慢速周期。

测试:

%matplotlib inline

runstrat('--plot --ind kama'.split())

(4)SMA

测试:

%matplotlib inline

runstrat('--plot --ind sma'.split())

(5)EMA

测试:

runstrat(‘–plot --ind ema’.split())

(6)Stochastic

测试:

runstrat(‘–plot --ind stoc’.split())

(7)RSI

测试:

runstrat(‘–plot --ind rsi’.split())

(8)MACD

测试:

runstrat(‘–plot --ind macd’.split())

(9)Bollinger Bands

测试:

runstrat(‘–plot --ind bollinger’.split())

报错,花了一些时间找问题。

TypeError: Invalid parameter value for nbdevup (expected float, got int)

源代码:

bt.talib.BBANDS(self.data, timeperiod=25,

plotname='TA_BBANDS')

bt.indicators.BollingerBands(self.data, period=25)

修改为:

elif self.p.ind == 'bollinger':

tbl.BBANDS(self.data, timeperiod=25, nbdevup=2.0,nbdevdn=2.0, matype=0,plotname='TA_BBANDS')

bt.indicators.BBands(self.data, period=25) #nbdevup=2,nbdevdn=2, matype=0

源代码两处问题:

- 参数应该是float ,调整接口默认是int,所以报错。直接指定浮点数:nbdevup=2.0,nbdevdn=2.0 。

- bt.indicators.BBands 不是bt.indicators.BBANDS ,bt和ta两个的名字大小写不一样 。

(10)AROON

注意:

ta-lib选择将下行线放在第一位,与backtrader内置指标相比,颜色是相反的。

测试:

runstrat(‘–plot --ind aroon’.split())

(11)Ultimate Oscillator

测试:

runstrat(‘–plot --ind ultimate’.split())

(12)Trix

测试:

runstrat(‘–plot --ind trix’.split())

(13)ADXR

测试:

runstrat(‘–plot --ind adxr’.split())

(14)DEMA

测试:

runstrat(‘–plot --ind dema’.split())

(15)TEMA

测试:

runstrat(‘–plot --ind tema’.split())

(16)PPO

backtrader不仅提供了ppo线,还提供传统的macd方法。

测试:

runstrat(‘–plot --ind ppo’.split())

(17)WilliamsR

测试:

runstrat(‘–plot --ind williamsr’.split())

(18)ROC

所有指标显示具有完全相同的形状,但跟踪动量或变化率有几种定义

测试:

runstrat(‘–plot --ind roc’.split())

(20)对比talib和bt.indicator

ind = []

tal = []

for i in dir(bt.indicators):

if i[:1] != '_' :

ind.append (i)

for i in dir(bt.talib) :

if i[:1] != '_' :

tal.append (i)

print(len(ind)) # 410

print(len(tal)) # 181

tal_notin_ind = []

tal_in_ind = []

for i in tal :

if i in ind :

#index = ind.index(i)

tal_in_ind.append(i)

else :

#print(i,' not in ind.')

tal_notin_ind.append(i)

print('talib in bt indicator:')

print(tal_in_ind)

print('talib not in bt indicator:')

print(tal_notin_ind)

输出结果:

bt indicator 有410属性方法

talib 只有181个属性方法

410

181

talib in bt indicator:

['ADX', 'ADXR', 'APO', 'ATR', 'CCI', 'DEMA', 'EMA', 'KAMA', 'MACD', 'PPO', 'ROC', 'RSI', 'SMA', 'TEMA', 'TRIX', 'WMA', 'absolute_import', 'bt', 'division', 'print_function', 'sys', 'unicode_literals', 'with_metaclass']

talib not in bt indicator:

['ACOS', 'AD', 'ADD', 'ADOSC', 'AROON', 'AROONOSC', 'ASIN', 'ATAN', 'AVGPRICE', 'BBANDS', 'BETA', 'BOP', 'CDL2CROWS', 'CDL3BLACKCROWS', 'CDL3INSIDE', 'CDL3LINESTRIKE', 'CDL3OUTSIDE', 'CDL3STARSINSOUTH', 'CDL3WHITESOLDIERS', 'CDLABANDONEDBABY', 'CDLADVANCEBLOCK', 'CDLBELTHOLD', 'CDLBREAKAWAY', 'CDLCLOSINGMARUBOZU', 'CDLCONCEALBABYSWALL', 'CDLCOUNTERATTACK', 'CDLDARKCLOUDCOVER', 'CDLDOJI', 'CDLDOJISTAR', 'CDLDRAGONFLYDOJI', 'CDLENGULFING', 'CDLEVENINGDOJISTAR', 'CDLEVENINGSTAR', 'CDLGAPSIDESIDEWHITE', 'CDLGRAVESTONEDOJI', 'CDLHAMMER', 'CDLHANGINGMAN', 'CDLHARAMI', 'CDLHARAMICROSS', 'CDLHIGHWAVE', 'CDLHIKKAKE', 'CDLHIKKAKEMOD', 'CDLHOMINGPIGEON', 'CDLIDENTICAL3CROWS', 'CDLINNECK', 'CDLINVERTEDHAMMER', 'CDLKICKING', 'CDLKICKINGBYLENGTH', 'CDLLADDERBOTTOM', 'CDLLONGLEGGEDDOJI', 'CDLLONGLINE', 'CDLMARUBOZU', 'CDLMATCHINGLOW', 'CDLMATHOLD', 'CDLMORNINGDOJISTAR', 'CDLMORNINGSTAR', 'CDLONNECK', 'CDLPIERCING', 'CDLRICKSHAWMAN', 'CDLRISEFALL3METHODS', 'CDLSEPARATINGLINES', 'CDLSHOOTINGSTAR', 'CDLSHORTLINE', 'CDLSPINNINGTOP', 'CDLSTALLEDPATTERN', 'CDLSTICKSANDWICH', 'CDLTAKURI', 'CDLTASUKIGAP', 'CDLTHRUSTING', 'CDLTRISTAR', 'CDLUNIQUE3RIVER', 'CDLUPSIDEGAP2CROWS', 'CDLXSIDEGAP3METHODS', 'CEIL', 'CMO', 'CORREL', 'COS', 'COSH', 'DIV', 'DX', 'EXP', 'FLOOR', 'FUNC_FLAGS_CANDLESTICK', 'FUNC_FLAGS_SAMESCALE', 'FUNC_FLAGS_UNSTABLE', 'HT_DCPERIOD', 'HT_DCPHASE', 'HT_PHASOR', 'HT_SINE', 'HT_TRENDLINE', 'HT_TRENDMODE', 'LINEARREG', 'LINEARREG_ANGLE', 'LINEARREG_INTERCEPT', 'LINEARREG_SLOPE', 'LN', 'LOG10', 'MA', 'MACDEXT', 'MACDFIX', 'MAMA', 'MAVP', 'MAX', 'MAXINDEX', 'MA_Type', 'MEDPRICE', 'MFI', 'MIDPOINT', 'MIDPRICE', 'MIN', 'MININDEX', 'MINMAX', 'MINMAXINDEX', 'MINUS_DI', 'MINUS_DM', 'MOM', 'MULT', 'NATR', 'OBV', 'OUT_FLAGS_DASH', 'OUT_FLAGS_DOTTED', 'OUT_FLAGS_HISTO', 'OUT_FLAGS_LINE', 'OUT_FLAGS_LOWER', 'OUT_FLAGS_UPPER', 'PLUS_DI', 'PLUS_DM', 'ROCP', 'ROCR', 'ROCR100', 'R_TA_FUNC_FLAGS', 'R_TA_OUTPUT_FLAGS', 'SAR', 'SAREXT', 'SIN', 'SINH', 'SQRT', 'STDDEV', 'STOCH', 'STOCHF', 'STOCHRSI', 'SUB', 'SUM', 'T3', 'TAN', 'TANH', 'TRANGE', 'TRIMA', 'TSF', 'TYPPRICE', 'ULTOSC', 'VAR', 'WCLPRICE', 'WILLR', 'np', 'tafunc', 'tafunctions', 'talib']

两者名称完全相同的属性方法:

['ADX', 'ADXR', 'APO', 'ATR', 'CCI', 'DEMA', 'EMA', 'KAMA', 'MACD', 'PPO', 'ROC', 'RSI', 'SMA', 'TEMA', 'TRIX', 'WMA', 'absolute_import', 'bt', 'division', 'print_function', 'sys', 'unicode_literals', 'with_metaclass']