配对交易策略 Pair Trading

0. 引库

import pandas as pd

import numpy as np

import tushare as ts

import seaborn

from matplotlib import pyplot as plt

plt.style.use('seaborn')

%matplotlib inline

data = pd.read_csv('pair-trade-data.csv')

data.set_index('date',inplace = True)

data.head()

|

000568 |

000858 |

| date |

|

|

| 2010/1/4 |

27.488118 |

26.117536 |

| 2010/1/5 |

27.335123 |

26.391583 |

| 2010/1/6 |

26.941707 |

25.694008 |

| 2010/1/7 |

26.388011 |

24.913389 |

| 2010/1/8 |

26.825140 |

24.863562 |

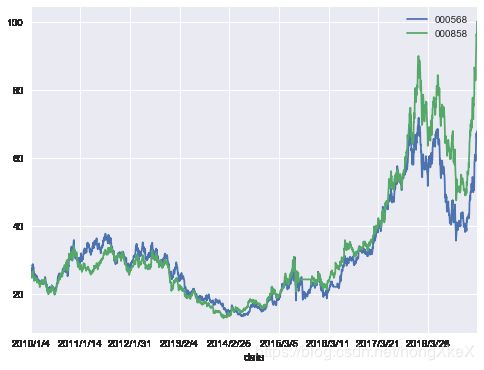

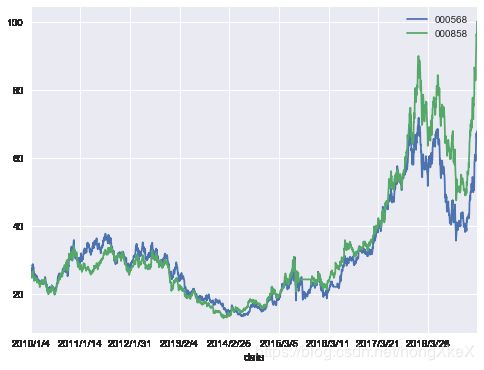

data.plot(figsize=(8, 6));

2. 策略开发思路

data['priceDelta'] = data['000568'] - data['000858']

data.head()

|

000568 |

000858 |

priceDelta |

| date |

|

|

|

| 2010/1/4 |

27.488118 |

26.117536 |

1.370582 |

| 2010/1/5 |

27.335123 |

26.391583 |

0.943540 |

| 2010/1/6 |

26.941707 |

25.694008 |

1.247699 |

| 2010/1/7 |

26.388011 |

24.913389 |

1.474622 |

| 2010/1/8 |

26.825140 |

24.863562 |

1.961578 |

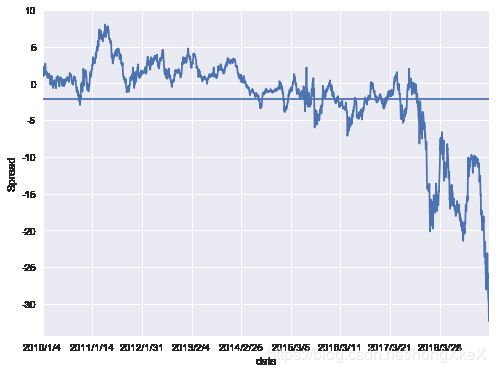

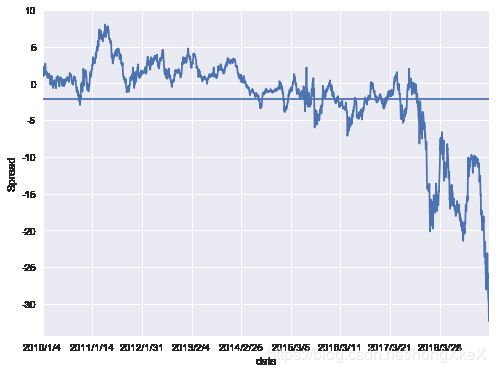

data['priceDelta'].plot(figsize=(8, 6));

plt.ylabel('Spread')

plt.axhline(data['priceDelta'].mean());

data['zscore'] = (data['priceDelta'] - np.mean(data['priceDelta']))/np.std(data['priceDelta'])

data.head()

|

000568 |

000858 |

priceDelta |

zscore |

| date |

|

|

|

|

| 2010/1/4 |

27.488118 |

26.117536 |

1.370582 |

0.569895 |

| 2010/1/5 |

27.335123 |

26.391583 |

0.943540 |

0.500520 |

| 2010/1/6 |

26.941707 |

25.694008 |

1.247699 |

0.549932 |

| 2010/1/7 |

26.388011 |

24.913389 |

1.474622 |

0.586796 |

| 2010/1/8 |

26.825140 |

24.863562 |

1.961578 |

0.665903 |

len(data[data['zscore'] > 1.5])

17

data['position_1'] = np.where(data['zscore'] > 1.5, -1, np.nan)

data['position_1'] = np.where(data['zscore'] < -1.5, 1, data['position_1'])

data['position_1'] = np.where(abs(data['zscore']) < 0.5, 0, data['position_1'])

data.head()

|

000568 |

000858 |

priceDelta |

zscore |

position_1 |

| date |

|

|

|

|

|

| 2010/1/4 |

27.488118 |

26.117536 |

1.370582 |

0.569895 |

NaN |

| 2010/1/5 |

27.335123 |

26.391583 |

0.943540 |

0.500520 |

NaN |

| 2010/1/6 |

26.941707 |

25.694008 |

1.247699 |

0.549932 |

NaN |

| 2010/1/7 |

26.388011 |

24.913389 |

1.474622 |

0.586796 |

NaN |

| 2010/1/8 |

26.825140 |

24.863562 |

1.961578 |

0.665903 |

NaN |

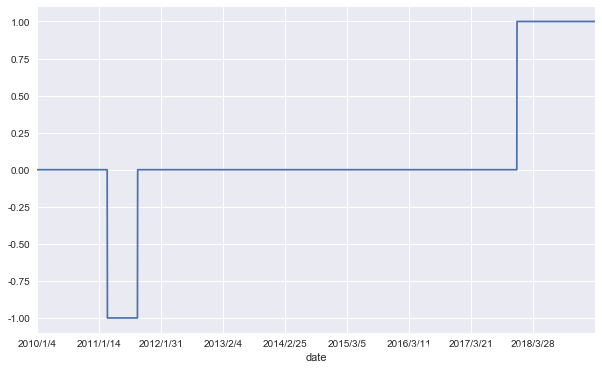

产生交易信号

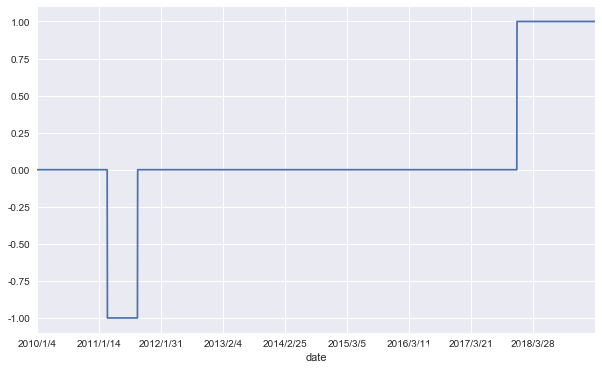

data['position_1'] = data['position_1'].ffill().fillna(0)

data['position_1'].plot(ylim=[-1.1, 1.1], figsize=(10, 6));

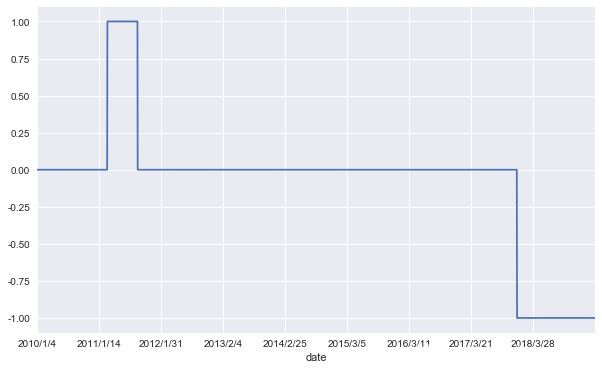

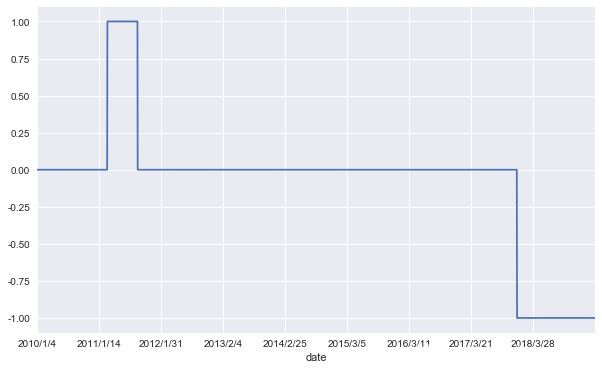

data['position_2'] = -np.sign(data['position_1'])

data['position_2'].plot(ylim=[-1.1, 1.1], figsize=(10, 6));

3. 计算策略年化收益并可视化

data['returns_1'] = (np.log(data['000568'] / data['000568'].shift(1))).fillna(0)

data['returns_2'] = (np.log(data['000858'] / data['000858'].shift(1))).fillna(0)

data.head(10)

|

000568 |

000858 |

priceDelta |

zscore |

position_1 |

position_2 |

returns_1 |

returns_2 |

| date |

|

|

|

|

|

|

|

|

| 2010/1/4 |

27.488118 |

26.117536 |

1.370582 |

0.569895 |

0.0 |

-0.0 |

0.000000 |

0.000000 |

| 2010/1/5 |

27.335123 |

26.391583 |

0.943540 |

0.500520 |

0.0 |

-0.0 |

-0.005581 |

0.010438 |

| 2010/1/6 |

26.941707 |

25.694008 |

1.247699 |

0.549932 |

0.0 |

-0.0 |

-0.014497 |

-0.026787 |

| 2010/1/7 |

26.388011 |

24.913389 |

1.474622 |

0.586796 |

0.0 |

-0.0 |

-0.020766 |

-0.030852 |

| 2010/1/8 |

26.825140 |

24.863562 |

1.961578 |

0.665903 |

0.0 |

-0.0 |

0.016430 |

-0.002002 |

| 2010/1/11 |

25.936311 |

24.631037 |

1.305274 |

0.559285 |

0.0 |

-0.0 |

-0.033696 |

-0.009396 |

| 2010/1/12 |

26.409867 |

25.336916 |

1.072951 |

0.521543 |

0.0 |

-0.0 |

0.018094 |

0.028255 |

| 2010/1/13 |

26.577433 |

25.137609 |

1.439824 |

0.581143 |

0.0 |

-0.0 |

0.006325 |

-0.007897 |

| 2010/1/14 |

28.420660 |

26.109231 |

2.311428 |

0.722738 |

0.0 |

-0.0 |

0.067054 |

0.037924 |

| 2010/1/15 |

28.253094 |

26.208885 |

2.044209 |

0.679327 |

0.0 |

-0.0 |

-0.005913 |

0.003810 |

data['strategy'] = 0.5*(data['position_1'].shift(1) * data['returns_1']) + 0.5*(data['position_2'].shift(1) * data['returns_2'])

data[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).tail(1)

|

returns_1 |

returns_2 |

strategy |

| date |

|

|

|

| 2019/4/8 |

2.470158 |

3.837651 |

0.986754 |

data[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).plot(figsize=(10, 6));

Pair trading 策略 - 小范围时间(2013.6-2014.12)

data2 = pd.read_csv('pair-trade-data2.csv')

data2.set_index('date',inplace = True)

data2.head()

|

000568 |

000858 |

| date |

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

| 2013/6/4 |

20.357220 |

20.060867 |

| 2013/6/5 |

20.514540 |

20.274644 |

| 2013/6/6 |

20.113374 |

20.172031 |

| 2013/6/7 |

19.704342 |

19.667508 |

data2.plot(figsize=(8, 6));

data2['priceDelta'] = data['000568'] - data['000858']

data2.head()

|

000568 |

000858 |

priceDelta |

| date |

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

0.376004 |

| 2013/6/4 |

20.357220 |

20.060867 |

0.296353 |

| 2013/6/5 |

20.514540 |

20.274644 |

0.239896 |

| 2013/6/6 |

20.113374 |

20.172031 |

-0.058657 |

| 2013/6/7 |

19.704342 |

19.667508 |

0.036833 |

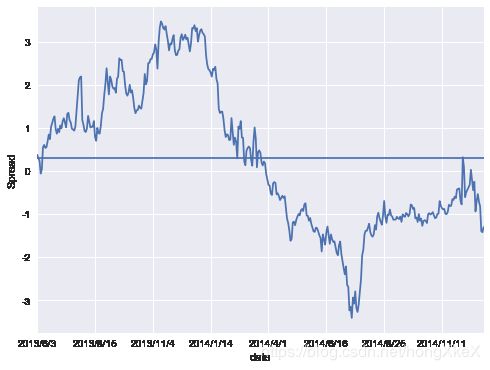

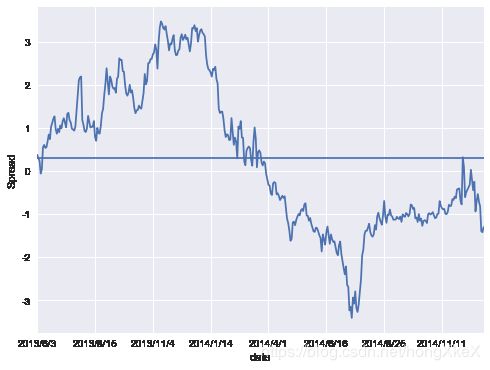

data2['priceDelta'].plot(figsize=(8, 6));

plt.ylabel('Spread')

plt.axhline(data2['priceDelta'].mean());

data2['zscore'] = (data2['priceDelta'] - np.mean(data2['priceDelta']))/np.std(data2['priceDelta'])

data2.head()

|

000568 |

000858 |

priceDelta |

zscore |

| date |

|

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

0.376004 |

0.048513 |

| 2013/6/4 |

20.357220 |

20.060867 |

0.296353 |

0.000596 |

| 2013/6/5 |

20.514540 |

20.274644 |

0.239896 |

-0.033369 |

| 2013/6/6 |

20.113374 |

20.172031 |

-0.058657 |

-0.212979 |

| 2013/6/7 |

19.704342 |

19.667508 |

0.036833 |

-0.155532 |

len(data2[data2['zscore'] > 1.5])

40

len(data2[data2['zscore'] < -1.5])

16

data2['position_1'] = np.where(data2['zscore'] > 1.5, -1, np.nan)

data2['position_1'] = np.where(data2['zscore'] < -1.5, 1, data2['position_1'])

data2['position_1'] = np.where(abs(data2['zscore']) < 0.5, 0, data2['position_1'])

data2.head()

|

000568 |

000858 |

priceDelta |

zscore |

position_1 |

| date |

|

|

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

0.376004 |

0.048513 |

0.0 |

| 2013/6/4 |

20.357220 |

20.060867 |

0.296353 |

0.000596 |

0.0 |

| 2013/6/5 |

20.514540 |

20.274644 |

0.239896 |

-0.033369 |

0.0 |

| 2013/6/6 |

20.113374 |

20.172031 |

-0.058657 |

-0.212979 |

0.0 |

| 2013/6/7 |

19.704342 |

19.667508 |

0.036833 |

-0.155532 |

0.0 |

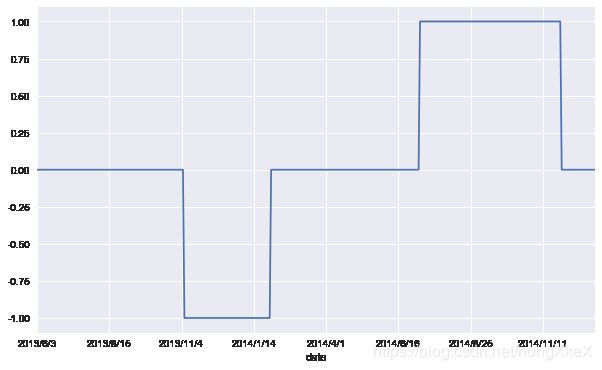

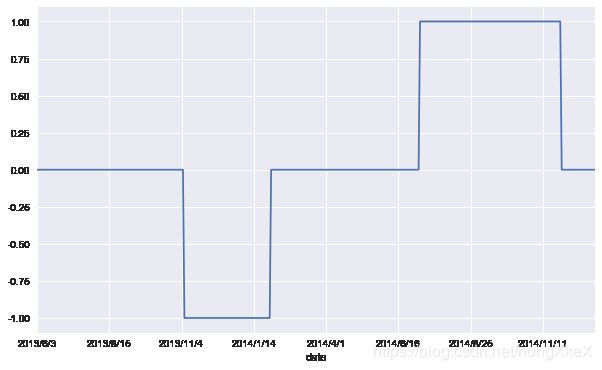

data2['position_1'] = data2['position_1'].ffill().fillna(0)

data2['position_1'].plot(ylim=[-1.1, 1.1], figsize=(10, 6));

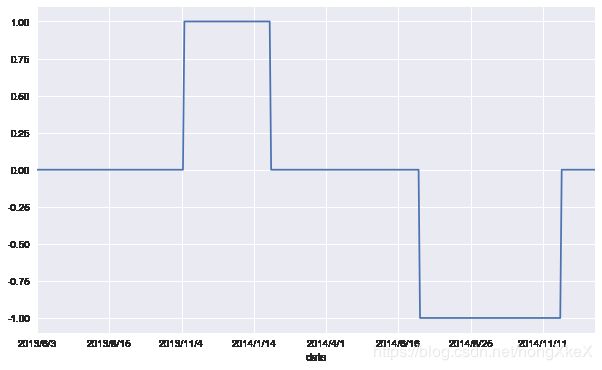

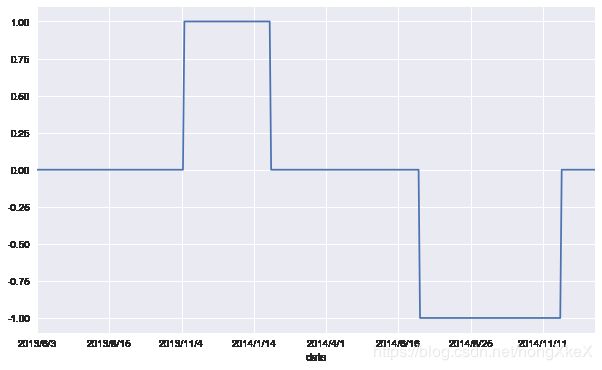

data2['position_2'] = -np.sign(data2['position_1'])

data2['position_2'].plot(ylim=[-1.1, 1.1], figsize=(10, 6));

data2['returns_1'] = (np.log(data2['000568'] / data2['000568'].shift(1))).fillna(0)

data2['returns_2'] = (np.log(data2['000858'] / data2['000858'].shift(1))).fillna(0)

data2.head(10)

|

000568 |

000858 |

priceDelta |

zscore |

position_1 |

position_2 |

returns_1 |

returns_2 |

| date |

|

|

|

|

|

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

0.376004 |

0.048513 |

0.0 |

-0.0 |

0.000000 |

0.000000 |

| 2013/6/4 |

20.357220 |

20.060867 |

0.296353 |

0.000596 |

0.0 |

-0.0 |

-0.017618 |

-0.013968 |

| 2013/6/5 |

20.514540 |

20.274644 |

0.239896 |

-0.033369 |

0.0 |

-0.0 |

0.007698 |

0.010600 |

| 2013/6/6 |

20.113374 |

20.172031 |

-0.058657 |

-0.212979 |

0.0 |

-0.0 |

-0.019749 |

-0.005074 |

| 2013/6/7 |

19.704342 |

19.667508 |

0.036833 |

-0.155532 |

0.0 |

-0.0 |

-0.020546 |

-0.025329 |

| 2013/6/13 |

19.562754 |

19.012515 |

0.550239 |

0.153334 |

0.0 |

-0.0 |

-0.007212 |

-0.033871 |

| 2013/6/14 |

19.617816 |

19.012515 |

0.605301 |

0.186459 |

0.0 |

-0.0 |

0.002811 |

0.000000 |

| 2013/6/17 |

19.255979 |

18.720423 |

0.535556 |

0.144501 |

0.0 |

-0.0 |

-0.018616 |

-0.015482 |

| 2013/6/18 |

19.405434 |

18.853192 |

0.552241 |

0.154539 |

0.0 |

-0.0 |

0.007731 |

0.007067 |

| 2013/6/19 |

19.956054 |

19.269202 |

0.686852 |

0.235521 |

0.0 |

-0.0 |

0.027979 |

0.021826 |

data2['strategy'] = 0.5*(data2['position_1'].shift(1) * data2['returns_1']) + 0.5*(data2['position_2'].shift(1) * data2['returns_2'])

data2[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).tail(1)

|

returns_1 |

returns_2 |

strategy |

| date |

|

|

|

| 2014/12/31 |

0.892955 |

0.97347 |

1.12623 |

data2[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).plot(figsize=(10, 6));

data2[['returns_1','returns_2','strategy']].dropna().mean() * 252

returns_1 -0.073915

returns_2 -0.017554

strategy 0.077608

dtype: float64

data2[['returns_1','returns_2','strategy']].dropna().std() * 252 ** 0.5

returns_1 0.300306

returns_2 0.280425

strategy 0.057016

dtype: float64

data2['cumret'] = data2['strategy'].dropna().cumsum().apply(np.exp)

data2['cummax'] = data2['cumret'].cummax()

drawdown = (data2['cummax'] - data2['cumret'])

drawdown.max()

0.03645280148896235

Pair trading 策略 - 考虑时间序列平稳性

import pandas as pd

import numpy as np

import tushare as ts

import seaborn

from matplotlib import pyplot as plt

plt.style.use('seaborn')

%matplotlib inline

1. 数据准备

data3 = pd.read_csv('pair-trade-data2.csv')

data3.set_index('date',inplace = True)

data3.head()

|

000568 |

000858 |

| date |

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

| 2013/6/4 |

20.357220 |

20.060867 |

| 2013/6/5 |

20.514540 |

20.274644 |

| 2013/6/6 |

20.113374 |

20.172031 |

| 2013/6/7 |

19.704342 |

19.667508 |

data3.plot(figsize=(8,6));

2. 策略开发思路

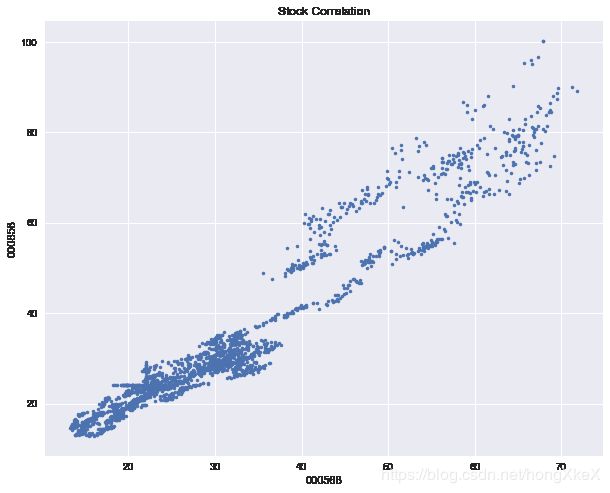

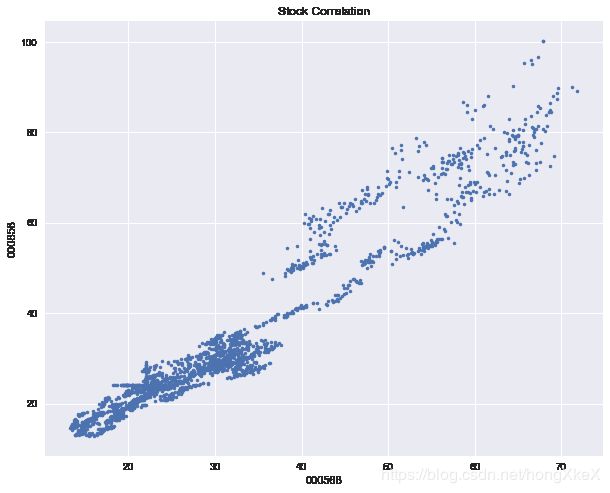

data3.corr()

|

000568 |

000858 |

| 000568 |

1.000000 |

0.552409 |

| 000858 |

0.552409 |

1.000000 |

plt.figure(figsize =(10,8))

plt.title('Stock Correlation')

plt.plot(data['000568'], data['000858'], '.');

plt.xlabel('000568')

plt.ylabel('000858')

data.dropna(inplace = True)

[slope, intercept] = np.polyfit(data3.iloc[:,0], data3.iloc[:,1], 1).round(2)

slope,intercept

(0.51, 7.82)

data3['spread'] = data3.iloc[:,1] - (data3.iloc[:,0]*slope + intercept)

data3.head()

|

000568 |

000858 |

spread |

| date |

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

1.956334 |

| 2013/6/4 |

20.357220 |

20.060867 |

1.858684 |

| 2013/6/5 |

20.514540 |

20.274644 |

1.992228 |

| 2013/6/6 |

20.113374 |

20.172031 |

2.094210 |

| 2013/6/7 |

19.704342 |

19.667508 |

1.798294 |

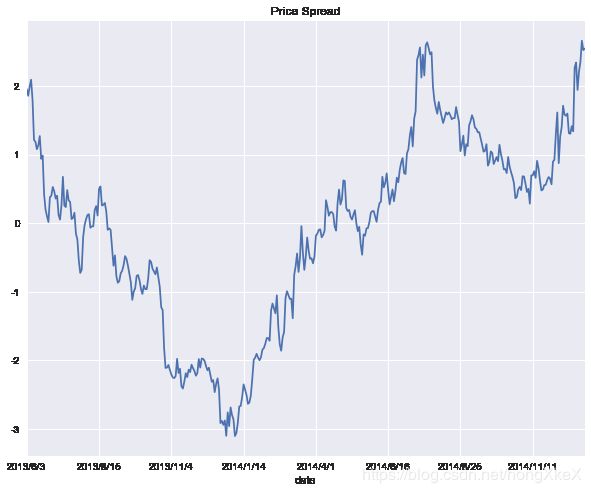

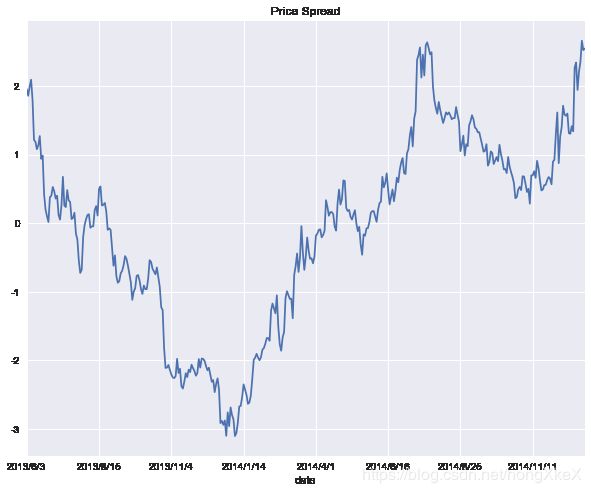

data3['spread'].plot(figsize = (10,8),title = 'Price Spread');

data3['zscore'] = (data3['spread'] - data3['spread'].mean())/data3['spread'].std()

data3.head()

|

000568 |

000858 |

spread |

zscore |

| date |

|

|

|

|

| 2013/6/3 |

20.719056 |

20.343053 |

1.956334 |

1.452385 |

| 2013/6/4 |

20.357220 |

20.060867 |

1.858684 |

1.382488 |

| 2013/6/5 |

20.514540 |

20.274644 |

1.992228 |

1.478078 |

| 2013/6/6 |

20.113374 |

20.172031 |

2.094210 |

1.551075 |

| 2013/6/7 |

19.704342 |

19.667508 |

1.798294 |

1.339261 |

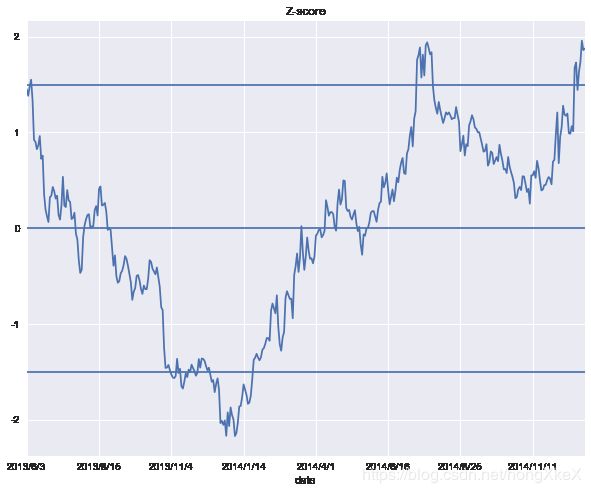

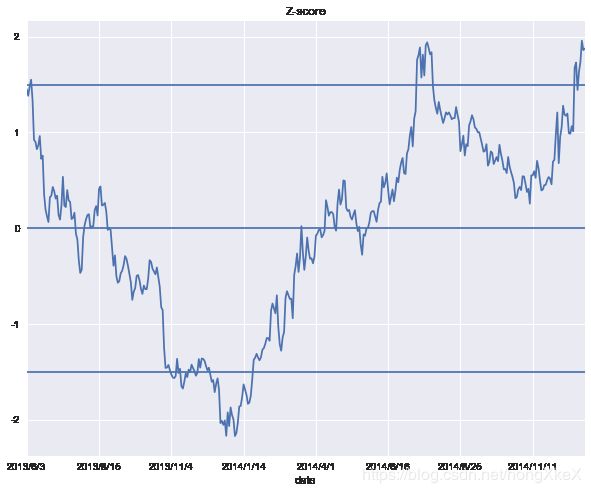

data3['zscore'].plot(figsize = (10,8),title = 'Z-score')

plt.axhline(1.5)

plt.axhline(0)

plt.axhline(-1.5)

产生交易信号

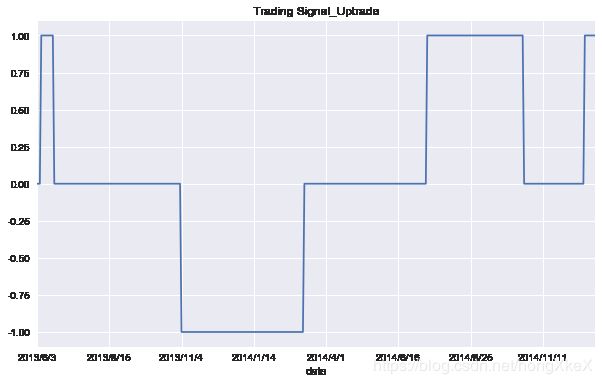

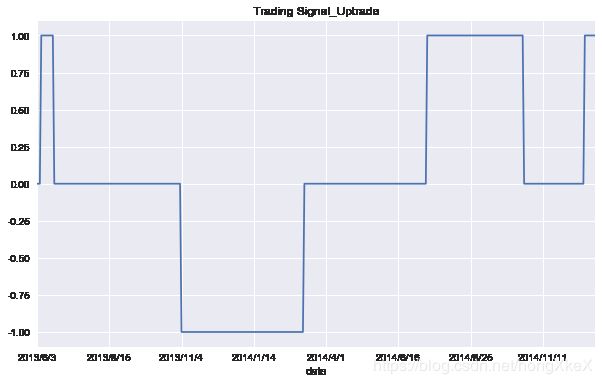

data3['position_1'] = np.where(data3['zscore'] > 1.5, 1, np.nan)

data3['position_1'] = np.where(data3['zscore'] < -1.5, -1, data3['position_1'])

data3['position_1'] = np.where(abs(data3['zscore']) < 0.5, 0, data3['position_1'])

data3['position_1'] = data3['position_1'].ffill().fillna(0)

data3['position_1'].plot(ylim=[-1.1, 1.1], figsize=(10, 6),title = 'Trading Signal_Uptrade');

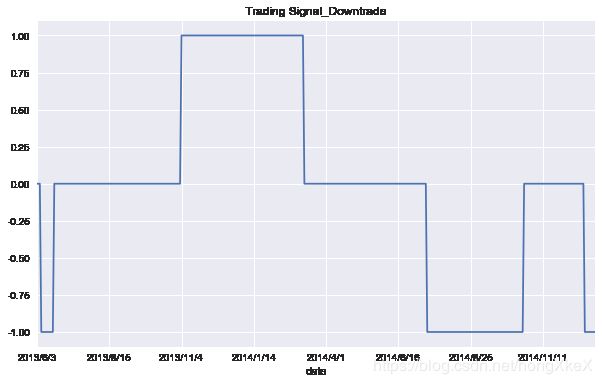

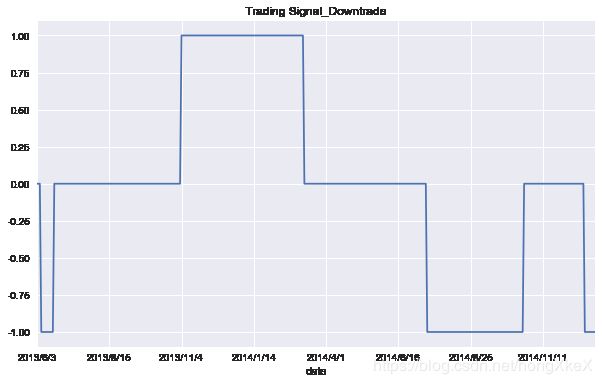

data3['position_2'] = -np.sign(data3['position_1'])

data3['position_2'].plot(ylim=[-1.1, 1.1], figsize=(10, 6),title = 'Trading Signal_Downtrade');

3. 计算策略年化收益并可视化

data3['returns_1'] = np.log(data3['000568'] / data3['000568'].shift(1))

data3['returns_2'] = np.log(data3['000858'] / data3['000858'].shift(1))

data3['strategy'] = 0.5*(data3['position_1'].shift(1) * data3['returns_1']) + 0.5*(data3['position_2'].shift(1) * data3['returns_2'])

data3[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).tail(1)

|

returns_1 |

returns_2 |

strategy |

| date |

|

|

|

| 2014/12/31 |

0.892955 |

0.97347 |

1.174494 |

data3[['returns_1','returns_2','strategy']].dropna().cumsum().apply(np.exp).plot(figsize=(10, 8),title = 'Strategy_Backtesting');

data3[['returns_1','returns_2','strategy']].dropna().mean() * 252

returns_1 -0.073915

returns_2 -0.017554

strategy 0.105002

dtype: float64

data3[['returns_1','returns_2','strategy']].dropna().std() * 252 ** 0.5

returns_1 0.300306

returns_2 0.280425

strategy 0.068639

dtype: float64

data3['cumret'] = data3['strategy'].dropna().cumsum().apply(np.exp)

data3['cummax'] = data3['cumret'].cummax()

drawdown = (data3['cummax'] - data3['cumret'])

drawdown.max()

0.038159777097367176

策略的思考

- 对多只ETF进行配对交易,是很多实盘量化基金的交易策略;

策略的风险和问题:

-

Spread不回归的风险,当市场结构发生重大改变时,用过去历史回归出来的Spread会发生不回归的重大风险;

-

中国市场做空受到限制,策略中有部分做空的收益是无法获得的;

-

回归系数需要Rebalancing;

-

策略没有考虑交易成本和其他成本;