python金融大数据分析笔记----第六章2(处理金融数据及其可视化)

import datetime

import pandas_datareader.data as web

import numpy as np

import pandas as pd

start = datetime.datetime(2016, 1, 1) # or start = '1/1/2016' or '2016-1-1'

end = datetime.date.today()

# 从雅虎财经拉取的苹果股价

DAX = web.DataReader('^GDAXI', 'yahoo', start, end)

DAX.info()

DatetimeIndex: 963 entries, 2016-01-04 to 2019-10-22

Data columns (total 6 columns):

High 963 non-null float64

Low 963 non-null float64

Open 963 non-null float64

Close 963 non-null float64

Volume 963 non-null float64

Adj Close 963 non-null float64

dtypes: float64(6)

memory usage: 52.7 KB

DAX.tail()

Out[5]:

High Low ... Volume Adj Close

Date ...

2019-10-16 12698.370117 12603.830078 ... 99475900.0 12670.110352

2019-10-17 12814.490234 12647.860352 ... 99302200.0 12654.950195

2019-10-18 12700.379883 12603.169922 ... 88676100.0 12633.599609

2019-10-21 12787.349609 12646.280273 ... 80978200.0 12747.959961

2019-10-22 12791.309570 12730.700195 ... 79430700.0 12754.690430

[5 rows x 6 columns]

| 参数 | 格式 | 描述 |

|---|---|---|

| name | 字符串 | 数据集名称——通常是股票代码 |

| data_source | 如“yahoo” | “yahoo”:Yahoo! Finance, ”google”:Google Finance, ”fred”:St. Louis FED (FRED), ”famafrench”:Kenneth French’s data library, ”edgar-index”:the SEC’s EDGAR Index |

| start | 字符串/日期时间/None | 范围左界(默认”2010/1/1”) |

| end | 字符串/日期时间/None | 范围右界(默认当天) |

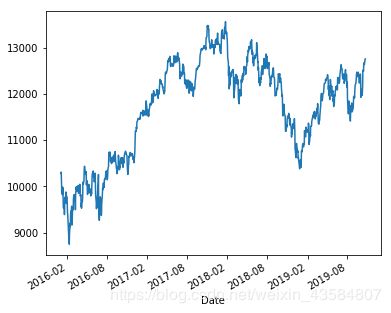

为了更好地概览指数的历史,使用plot方法生成图表

DAX['Close'].plot(figsize=(6,5))

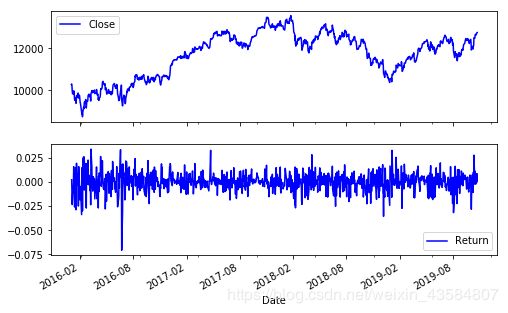

DAX['Return'] = np.log(DAX['Close'] / DAX['Close'].shift(1))

DAX.tail()

Out[15]:

High Low ... Adj Close Return

Date ...

2019-10-16 12698.370117 12603.830078 ... 12670.110352 0.003187

2019-10-17 12814.490234 12647.860352 ... 12654.950195 -0.001197

2019-10-18 12700.379883 12603.169922 ... 12633.599609 -0.001689

2019-10-21 12787.349609 12646.280273 ... 12747.959961 0.009011

2019-10-22 12791.309570 12730.700195 ... 12754.690430 0.000528

[5 rows x 7 columns]

补充:

- shift方法,它相对于索引向前或者向后移动Series或者DataFrame对象

- %time DAX[‘Return’] = np.log(DAX[‘Close’] / DAX[‘Close’].shift(1)) 可用于计算运行该行代码花费的时间

DAX[['Close', 'Return']].plot(subplots=True, style='b', figsize=(8, 5))

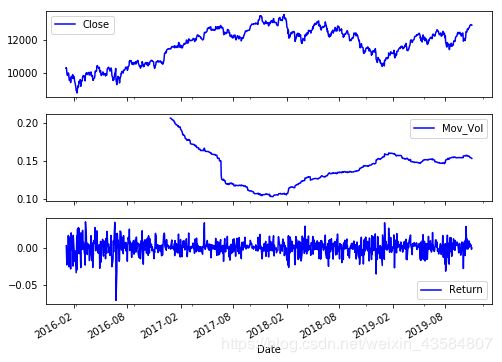

理论知识:

波动率聚集:

波动率不是长,期恒定的,既有高波动率时期(正收益率和负收益率都很高),也有低波动率时期

杠杆效应:

一般来说,波动性和股票市场收益是负相关的,当市场下跌时,波动性升高

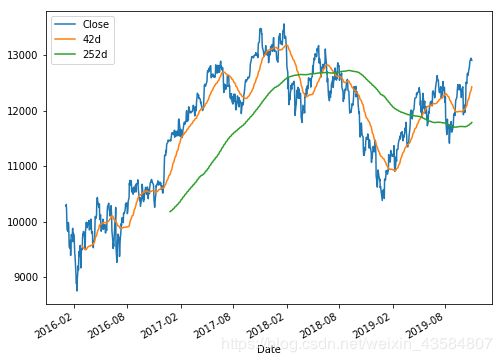

- 波动率对期权交易着特别重要,而技术型股票交易者可能对移动平均值(所谓趋势)更感兴趣;

- 移动平均值,就是指定时间段,对时间序列数据进行移动计算平均值。移动平均值常常用在计算股票的移动平均线、存货成本等方面

- 移动平均值可用DataFrame/Series.rolling(window).mean()计算,相应的还有一些其他滚动函数,eg:DataFrame/Series.rolling(window).max()、DataFrame/Series.rolling(window).min()和DataFrame/Series.rolling(window).corr()

-

#DataFrame/Series.rolling(window, min_periods=None, freq=None, center=False, win_type=None, axis=0)

#window:移动窗口的大小

DAX['42d'] = DAX['Close'].rolling(window=42).mean()

DAX['252d'] = DAX['Close'].rolling(window=252).mean()

DAX[['Close','42d','252d']].tail()

Out[16]:

Close 42d 252d

Date

2019-10-25 12894.509766 12325.037900 11760.310896

2019-10-28 12941.709961 12354.578148 11766.797363

2019-10-29 12939.620117 12380.786249 11773.698157

2019-10-30 12910.230469 12403.904111 11779.947165

2019-10-31 12905.269531 12426.558617 11786.367323

包含两种典型股价图表:

DAX[['Close','42d','252d']].plot(figsize=(8,6))

在期权交易者严重,对数收益率的移动历史标准差——移动历史波动率更重要

import math

DAX['Mov_Vol'] = DAX['Return'].rolling(252).std() * math.sqrt(252)

DAX[['Close','Mov_Vol','Return']].plot(subplots=1, style='b', figsize=(8,6))