沪深300配对交易

目录

- 获取数据

- 相关系数三级目录

- 协整检验

- 聚类算法进一步筛选

- 回测

获取数据

通过pandas_datareader来获取沪深300的股票数据,为此,先从网上爬虫得到沪深300的股票名单

import os

import pandas as pd

import pandas_datareader as web

import pickle

import requests

import bs4 as bs

import matplotlib.pyplot as plt

import numpy as np

# import tushare

def save_hs300_tickers():

# resp = requests.get('https://en.wikipedia.org/wiki/List_of_S%26P_500_companies')

resp = requests.get(

'https://zh.wikipedia.org/wiki/%E6%B2%AA%E6%B7%B1300#%E6%88%90%E4%BB%BD%E8%82%A1%E5%88%97%E8%A1%A8')

soup =bs.BeautifulSoup(resp.text, "lxml")

table = soup.find('table', {'class':"wikitable collapsible sortable"})

tickers = []

for row in table.find_all('tr')[1:]:

ticker = row.find('td').text

if ticker[0] == "6" :

ticker = ticker + ".SS"

else :

ticker = ticker + ".SZ"

tickers.append(ticker)

with open("hs300tickers.pickle","wb") as f:

pickle.dump(tickers,f)

print(tickers)

return tickers之后下载数据

def get_data_from_yahoo(reload_hs300=False):

if reload_hs300:

tickers = save_hs300_tickers()

else:

with open("hs300tickers.pickle", "rb") as f:

tickers = pickle.load(f)

if not os.path.exists('stock_dfs'):

os.makedirs('stock_dfs')

start_date = dt.datetime(2010, 1, 1)

end_date = dt.datetime(2020, 6, 1)

for ticker in tickers[:]:

print(ticker)

if not os.path.exists('stock_dfs/{}.csv'.format(ticker)):

df = web.DataReader(ticker,'yahoo',start_date, end_date )

df.to_csv('stock_dfs/{}.csv'.format(ticker))

else:

print('Already have {}'.format(ticker))这些步骤也可以用tushare完成,现在电脑里已经有了300个CSV文件,为了之后读取文件更方便,先写一个整合数据的程序

def compile_data():

with open("hs300tickers.pickle", "rb") as f:

tickers = pickle.load(f)

main_df = pd.DataFrame()

for count,ticker in enumerate(tickers):

df = pd.read_csv('stock_dfs/{}.csv'.format(ticker))

df.set_index('Date',inplace=True)

df.rename(columns={'Adj Close': ticker}, inplace=True)

df.drop(['Open', 'High', 'Low', 'Close', 'Volume'], 1, inplace=True)

df.fillna(method = 'ffill')

if main_df.empty:

main_df = df

else:

main_df = main_df.join(df,how='outer')

if count % 10 ==0:

print(count)

print(main_df.head())

main_df.to_csv('hs300_closes.csv')

把300只股票的收盘价统一放进hs300_closes.csv中

相关系数三级目录

计算相关系数非常简单

df = pd.read_csv('hs300_closes.csv')

df = df[-700:-400]

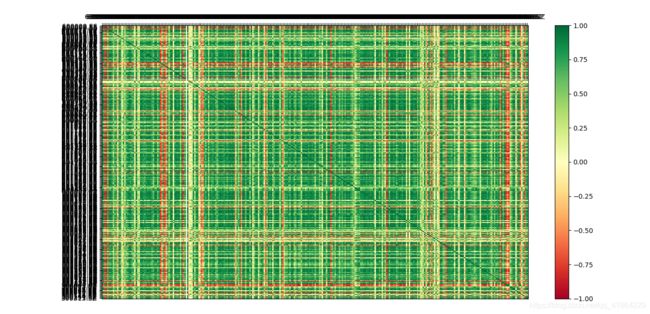

df_corr = df.corr()df_corr就是相关系数矩阵,可以通过下面的程序画出相关系数热力图

data = df_corr.values

fig = plt.figure()

ax = fig.add_subplot(1,1,1)

heatmap = ax.pcolor(data,cmap=plt.cm.RdYlGn)

fig.colorbar(heatmap)

ax.set_xticks(np.arange(data.shape[0])+0.5, minor=False)

ax.set_yticks(np.arange(data.shape[1])+0.5, minor=False)

ax.invert_yaxis()

ax.xaxis.tick_top()

column_labels = df_corr.columns

row_labels = df_corr.index

ax.set_xticklabels(column_labels)

ax.set_yticklabels(row_labels)

heatmap.set_clim(-1,1)

plt.tight_layout()

plt.show()

绿色代表正相关,红色代表负相关,颜色越深值越大。可以通过图有一个大致上的判断。

协整检验

两只股票价格的相关系数不能直接做为选择股票对的标准,一般要求配对的股票能够通过协整检验。协整检验是为了检验两个或多个非平稳时间序列有无因果关系。协整检验要先检验两只股票的价格时间序列是否同阶单整,本次就简化为先看两只股票的价格的一阶差分是否平稳,都单整后进行协整检验。整检验有两种方法,一种是先做回归,看残差是否平稳,这种方法叫Engel-Granger 两步协整检验法;另一种为Johansen Test 协整检验法。

import statsmodels.api as sm

from statsmodels.tsa.stattools import coint,adfuller

def cointrgration(priceX,priceY):

if priceX is None or priceY is None:

print('数据缺失')

priceX = np.log(priceX)

priceY = np.log(priceY)

ret_x = np.diff(priceX)

ret_y = np.diff(priceY)

ret_x = ret_x[1:]

ret_y = ret_y[1:]

adf_x = adfuller(ret_x)

adf_y = adfuller(ret_y)

results = sm.OLS(priceY,sm.add_constant(priceX)).fit()

spread = results.resid

adfSpread = adfuller(spread)

if adfSpread[0]<adfSpread[4]['1%'] and adf_x[0]<adf_x[4]['1%'] and adf_y[0]<adf_y[4]['1%']:

return True

else:

return False

上面是python实现协整检验的方法,也可以用arch包进行以上操作。

聚类算法进一步筛选

一般同行业内的股票才可以进行配对交易。目前筛选股票的过程中并没有考虑到这一点,因此筛选出来的股票对中,会有一些统计意义上可以配对,但实际没有什么逻辑的股票对。所以用聚类算法对股票进行分类,筛选出适合实际操作的股票对。可以直接用sklearn库进行聚类,本次用的AP算法进行聚类,好处是不用事先给出聚类数目。

from sklearn.cluster import affinity_propagation

from sklearn.covariance import GraphicalLassoCV

def Clusters():

df = pd.read_csv('hs300_diff.csv')

df = df[-700:-400]

df.drop(['Date'],axis=1,inplace=True)

stock_dataset = np.array(df)

stock_dataset = stock_dataset.copy().T

stock_dataset = stock_dataset/np.std(stock_dataset,axis=0)

np.nan_to_num(stock_dataset)

stock_model = GraphicalLassoCV()

stock_model.fit(stock_dataset)

_,labels = affinity_propagation(stock_model.covariance_)

n_labels = max(labels)

print('Stock Clusters: {}'.format(n_labels + 1)) # 10,即得到10个类别

print(len(labels))

return labels完整的筛选股票对程序如下

def filter_data():

df = pd.read_csv('hs300_closes.csv')

df = df[-700:-400]

df_corr = df.corr()

pair_list=[]

pair_SSD=[]

pair_corr=[]

tickers = df_corr.columns

labels = Clusters()

for i in range(0,300):

for j in range(i,300):

corr = df_corr.iloc[i,j]

if corr > 0.95:

if labels[i] ==labels[j]:

priceX = df[str(tickers[i])].values

priceY = df[str(tickers[j])].values

if cointrgration(priceX ,priceY ):

pair_list.append((tickers[i],tickers[j]))

pair_SSD.append(SSD(priceX,priceY))

pair_corr.append(corr)

data = pd.DataFrame([pair_list,pair_corr,pair_SSD],index=['pair','corr','SSd'])

return data回测

对筛选出来的股票,在聚宽进行回测,采用标准的布林带策略,回测结果如下

参考资料

https://blog.csdn.net/FrankieHello/article/details/86770852

https://www.youtube.com/watch?v=eAtcIoVGb-4&list=PLQVvvaa0QuDcR-u9O8LyLR7URiKuW-XZq&index=8