joiepan 2018-03-12 16:58 发布在 比特币 0 167

3月10日,一位加密货币交易员兼研究员发表了一份研究报告,报告称他认为来自几个主要的交易所的高达30亿美元的加密货币交易量是捏造出来的。这项研究的作者Sylvain Ribes声称,OKCoin交易所伪造的交易量占交易量的93%。

交易所之间存在巨大差异

Sylvain Ribes的研究报告中,披露了一些有关交易数量的有趣信息。报告称,这些交易来自于OKCoin(Okex)和火币等交易所,这两家交易所可能伪造了交易量。Ribes的数据是他根据所有主要交易所的订单计算出来的。

此外,Ribes还谈到一个名为“滑点”的术语,他把这个术语定义为“观察到的中间差价和客户同意出售资产的最低价格之间的百分比变化。”

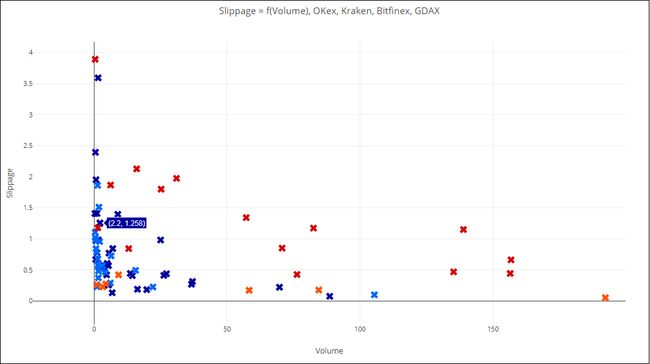

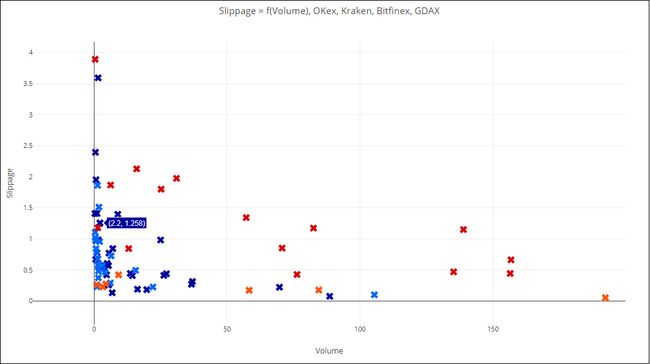

Ribes的研究表明,他通过对来自GDAX,Bitfinex, Kraken和币安等交易所不用种类的加密货币的数量的研究,发现交易所之间存在巨大的差异。

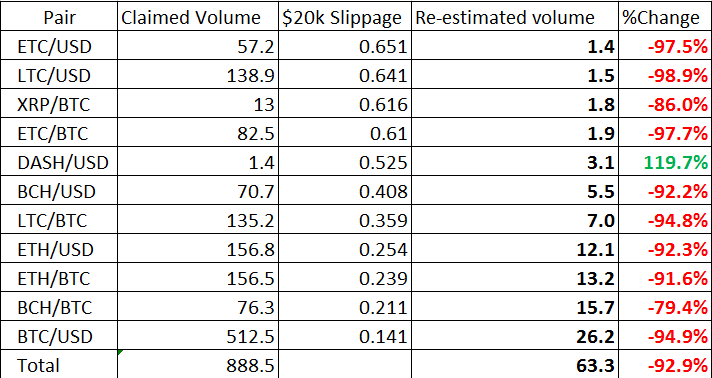

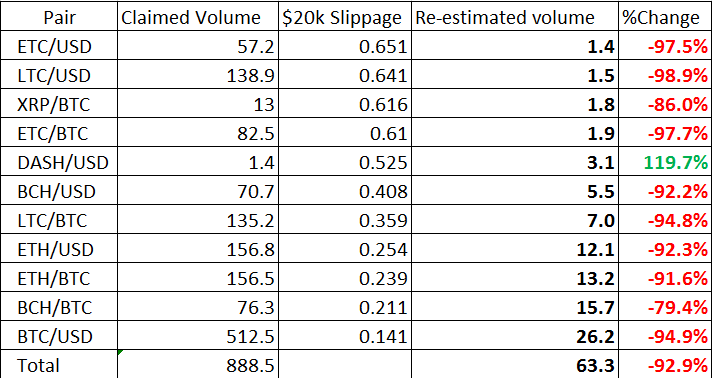

“我发现交易所之间存在巨大差别,也可能是因为他们的用户习惯不同造成的。但是目前只能通过一些数据来解释。仅从这些数据来看,他们夸大的成分高达95%。”

以下是Okex的图表。Okex目前是第一大交易所。数据来源于Coinmarketcap和Livecoinwatch两大网站。

Okex的交易量大部分都存在造假

Okex的成交量引起了Ribes的注意。他表示,由于市场是不受监管的,人工伪造成交量和虚售应该是存在的。Ribes的“滑点和成交量”图表显示,这对数字货币的日成交量为10万美元,涉及四家交易所,时间为24小时。

Ribes说,当交易量达到了500万美金,需要花费超过10%的滑点,因此,你想要清算的资产将达近5万美金。但2018年3月6日的那个时刻显示的是:NEO/BTC, IOTA/USD, QTUM/USD ,而这些都是几乎没有流动性的资产。

尽管这些数字本身就向我证明了一个大部分Okex的交易量是假的,但我并没有亲眼看到他们是如何实现的–于是我登录了这些交易所,并查看了一些数字货币交易历史。然后我发现,事实上,他们以一种明显和人为的方式对交易量进行了造假。

他指出,尽管确实有很多的交易发生,但“仍然存在一个持续的虚售行为”。这项研究还调查了Bittrex,Hitbtc和币安等交易所。

币安CEO称Ribes的研究深入

Ribes说,币安的结果更“有趣”,他指出,该交易所有“当涉及到API交易,它有相当严格的政策“。

Ribes解释说:

“对历史交易记录进行检查之后,没有发现显示任何可疑的交易活动”

报告发表后,币安CEO赵长鹏表示,里贝斯的研究分析很深入。

我们都偏好流动性,但是我们不喜欢一闪而过的流动性。因为许多高频交易都使用这种流动性。币安认为,通过这些限制有助于更多的零售交易员。

此外,Ribes还在Twitter上询问OKCoin和火币是否愿意提供一份关于他最近对虚假交易量的研究的声明。Ribes说:

“我很高兴引用你们的评论,如果你们可疑提供的话。”

这也不是这些交易所第一次被问及交易量造假的事情了。

原文:https://news.bitcoin.com/study-finds-3b-worth-of-faked-cryptocurrency-volumes-and-wash-trades/

作者:Jamie Redman

编译:Joie

稿源(译):巴比特资讯(http://www.8btc.com/study-finds-3b-worth-of-faked-cryptocurrency-volumes-and-wash-trades/

https://news.bitcoin.com/study-finds-3b-worth-of-faked-cryptocurrency-volumes-and-wash-trades/

Study Finds $3B Worth of Faked Cryptocurrency Volumes and Wash Trades

On March 10 a cryptocurrency trader and researcher published a report on how he believes $3 billion worth of cryptocurrency trade volumes, primarily from a couple of exchanges, are concocted. The author of the study, Sylvain Ribes, alleges that the exchange Okcoin has been fabricating up to 93 percent of its trade volumes.

Also read:Thailand Dodges Extreme Cryptocurrency Regulations

Massive Discrepancies Between Exchanges

Sylvain Ribes has published a study that reveals some interesting information about trade volumes stemming from exchanges like Okcoin (Okex) and Huobi, which may be falsifying their trade volumes. Ribes calculated his data from order books across all major exchanges to “measure how badly market selling $50k USD worth of each cryptocurrency would crash the price.”

Further Ribes refers to a term called “slippage,” which he defines as “the percentage change between the observed mid-spread price and the lowest price I had to consent to sell the asset.” Throughout Ribes’ research of various currency volumes coming from exchanges like GDAX, Bitfinex, Kraken, Binance and more he found vast inconsistencies between trading platforms.

“I found ridiculously massive discrepancies between exchanges. Not the kind that can be easily hand-waved away (“oh well, their users must behave differently”), but the kind that can only be explained by some figures being overstated as much as 95%,” explains Ribes’ study.

Leading the pack is Okex, currently ranked #1 exchange by volume with $1.7b total volume on both Coinmarketcap and Livecoinwatch websites.

Orange, dark blue and light blue dots are GDAX, Bitfinex, and Kraken. Red dots are Okex. The exchange “Okex is a ghost town” says Ribes.

‘A Suffocating Majority of Okex Volume Is Fake’

Okex volumes raised a red flag for Ribes who says because the markets are unregulated artificial volumes and wash trading should be expected. Ribes’ slippage and volume chart shows the pairs with a daily volume of $100K across four exchanges over 24 hours.

“Many pairs, albeit boasting up to $5 million volumes, would cost you more than 10% in slippage, should you want to liquidate a mere $50k in assets — Those pairs included, at the time of the data parsing (06/03/18): NEO/BTC, IOTA/USD, QTUM/USD — Hardly illiquid or low-profile assets,” Ribes states.

Although those numbers alone prove to me without the shadow of a doubt that a suffocating majority of Okex volume is fake, I had not witnessed first-hand how they implemented it — I thus logged into their platform and had a look at some pairs trading history. And indeed, they fake their volume in a laughingly obvious and artificial way.

Ribes says that Okex volumes are very different than an exchange like Poloniex that is “generally quite liquid across all pairs.” The trader believes it’s quite “obvious” that Okex volumes are doctored. Further, the paper suggests that the trading platform Huobi Pro has roughly 81.8 percent of “made-up volume.” He details that even though there appears to be more organic volumes taking place “there still exists a strong background of constant low-key wash trading.” The study also looked at exchanges like Bittrex, Hitbtc, and Binance against “respectable” exchanges.

Okex data, and estimated percentage of fake volumes from Ribe’s study.

Binance CEO Calls Ribes Study a “Good In-Depth Analysis”

Hitbtc is a touch less liquid and small differences can be seen for various reasons. Ribes says the results stemming from Binance were more “intriguing,” but notes that the exchange has a “pretty restrictive policy when it comes to API-trading.”

“Inspecting their volume history does not show any obvious suspicious activity,” explains Ribes.

After the report was published, Zhao Changpeng, the CEO of Binance said Ribes study was a “good in-depth analysis.”

We like liquidity, but we don’t like “flash” liquidity, which are used by many HFT “market makers” — Binance believes having these restrictions help the much larger number of retail traders.

Additionally, Ribes has asked Okcoin and Huobi Pro over Twitter if they would like to provide a statement concerning his recent study on phony trade volumes. “I’m happy to quote you on a comment if you’d like to provide one,” the trader states. This is also not the first time these exchanges have been questioned about falsified trade volumes.

What do you think about the study Sylvain Ribes conducted? Do you think his conclusion is correct that some exchanges are faking their volumes? Let us know in the comments below.

Images via Shutterstock, and Sylvain Ribes report.