Tushare Day6—— 第18章 资产收益计算(嘻嘻嘻)

资产收益计算

- 1 通过接口导入茅台股2019至今的数据

- 2 获取收盘价列并错位合并求单期收益率

- 2.1 获取收盘价列

- 2.2 索引设置为时间列

- 2.3 下移得到延迟一期收盘价

- 2.4 将收盘价与延迟一期收盘价合并为表格

- 2.5 计算延迟一期收益率

- 3 计算多期收益

- 3.1 将收盘价、延迟一期收盘价及收益率合并为一个表格

- 3.2 下移两期得到延迟二期收盘价并合并到表格中

- 3.3 查看第六行、十一行信息

- 3.4 单独查看第十一行延迟一期、延迟二期收益率

- 4 用ffn包内函数计算简单单期收益率

- 5 计算年化收益率

- 5.1 计算年化收益率(单期为日)

- 5.2 构造函数计算年化收益率(单期分别为日月季年)

- 6 计算单期连续复利收益率

- 6.1 用公式计算单期连续复利收益率

- 6.2 调用ffn中的to_log_returns函数计算单期连续复利收益率

- 7 用公式计算多期连续复利收益率

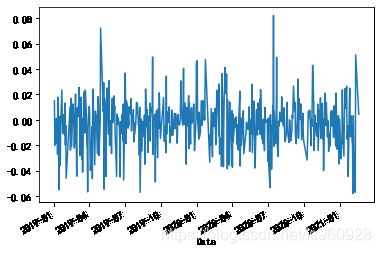

- 7.1 绘制延迟一期、二期的连续复利收益率图像

- 8 连续复利收益率的优良性质:单期加总即得多期

- 9 绘制收益图

- 9.1 简单收益率曲线图

- 9.2 累积收益率曲线图(连乘)

- 10 资产风险的测度

- 10.1 方差风险度量方法

- 10.2 下行偏差风险度量方法(MARR取收益率的均值)

- 10.3 风险价值度量法(vaR)

- 10.3.1 历史模拟法

- 10.3.2 协方差矩阵法

- 10.4 期望亏空度量方法

- 10.5 最大回撤风险度量

- 10.5.1 收益

- 10.5.2 公式计算回撤值、回撤率及其最大值

- 10.5.3 计算航天和大橡塑股票的最大回撤率

import numpy as np

import pandas as pd

import matplotlib

matplotlib.use('TkAgg')

import matplotlib.pyplot as plt

%matplotlib inline

from scipy import stats

import matplotlib

import tushare as ts

#指定默认字体

matplotlib.rcParams['font.sans-serif'] = ['SimHei']

matplotlib.rcParams['font.family']='sans-serif'

#解决负号'-'显示为方块的问题

matplotlib.rcParams['axes.unicode_minus'] = False

通过接口导入茅台股2019至今的数据

pro = ts.pro_api('my_token')

df = pro.daily(ts_code='600519.SH', start_date='20190101', end_date='20210220')

stock = df.set_index(["trade_date"])

stock.head(10)

| ts_code | open | high | low | close | pre_close | change | pct_chg | vol | amount | |

|---|---|---|---|---|---|---|---|---|---|---|

| trade_date | ||||||||||

| 20210219 | 600519.SH | 2451.16 | 2496.66 | 2381.6 | 2460.00 | 2471.00 | -11.00 | -0.4452 | 59385.46 | 1.452516e+07 |

| 20210218 | 600519.SH | 2587.98 | 2627.88 | 2465.0 | 2471.00 | 2601.00 | -130.00 | -4.9981 | 65912.32 | 1.670414e+07 |

| 20210210 | 600519.SH | 2485.00 | 2601.20 | 2485.0 | 2601.00 | 2456.43 | 144.57 | 5.8854 | 61370.57 | 1.567593e+07 |

| 20210209 | 600519.SH | 2368.80 | 2456.43 | 2350.0 | 2456.43 | 2368.80 | 87.63 | 3.6993 | 33296.55 | 7.972930e+06 |

| 20210208 | 600519.SH | 2337.00 | 2378.88 | 2313.0 | 2368.80 | 2313.00 | 55.80 | 2.4125 | 35785.73 | 8.420759e+06 |

| 20210205 | 600519.SH | 2325.00 | 2364.60 | 2291.0 | 2313.00 | 2320.85 | -7.85 | -0.3382 | 39729.06 | 9.253566e+06 |

| 20210204 | 600519.SH | 2191.00 | 2330.00 | 2191.0 | 2320.85 | 2189.91 | 130.94 | 5.9792 | 63851.01 | 1.459693e+07 |

| 20210203 | 600519.SH | 2150.00 | 2198.27 | 2140.0 | 2189.91 | 2145.00 | 44.91 | 2.0937 | 38714.15 | 8.384049e+06 |

| 20210202 | 600519.SH | 2112.22 | 2149.99 | 2102.1 | 2145.00 | 2109.32 | 35.68 | 1.6915 | 34582.25 | 7.372234e+06 |

| 20210201 | 600519.SH | 2130.00 | 2160.00 | 2095.0 | 2109.32 | 2116.18 | -6.86 | -0.3242 | 29340.59 | 6.219639e+06 |

获取收盘价列并错位合并求单期收益率

获取收盘价列

close=stock.close

close.head(10)

trade_date

20210219 2460.00

20210218 2471.00

20210210 2601.00

20210209 2456.43

20210208 2368.80

20210205 2313.00

20210204 2320.85

20210203 2189.91

20210202 2145.00

20210201 2109.32

Name: close, dtype: float64

索引设置为时间列

close.index=pd.to_datetime(close.index) #转换为时间索引

close.index.name="Date" #日期

close.head(10)

Date

2021-02-19 2460.00

2021-02-18 2471.00

2021-02-10 2601.00

2021-02-09 2456.43

2021-02-08 2368.80

2021-02-05 2313.00

2021-02-04 2320.85

2021-02-03 2189.91

2021-02-02 2145.00

2021-02-01 2109.32

Name: close, dtype: float64

下移得到延迟一期收盘价

lagclose=close.shift(1) #设置第一行为nan.,数据往下移动

lagclose.head(10)

Date

2021-02-19 NaN

2021-02-18 2460.00

2021-02-10 2471.00

2021-02-09 2601.00

2021-02-08 2456.43

2021-02-05 2368.80

2021-02-04 2313.00

2021-02-03 2320.85

2021-02-02 2189.91

2021-02-01 2145.00

Name: close, dtype: float64

close.head(10)

Date

2021-02-19 2460.00

2021-02-18 2471.00

2021-02-10 2601.00

2021-02-09 2456.43

2021-02-08 2368.80

2021-02-05 2313.00

2021-02-04 2320.85

2021-02-03 2189.91

2021-02-02 2145.00

2021-02-01 2109.32

Name: close, dtype: float64

lagclose.head(10)

Date

2021-02-19 NaN

2021-02-18 2460.00

2021-02-10 2471.00

2021-02-09 2601.00

2021-02-08 2456.43

2021-02-05 2368.80

2021-02-04 2313.00

2021-02-03 2320.85

2021-02-02 2189.91

2021-02-01 2145.00

Name: close, dtype: float64

将收盘价与延迟一期收盘价合并为表格

CalcClose=pd.DataFrame({

"close":close,"lagclose":lagclose})

CalcClose.head(10)

| close | lagclose | |

|---|---|---|

| Date | ||

| 2021-02-19 | 2460.00 | NaN |

| 2021-02-18 | 2471.00 | 2460.00 |

| 2021-02-10 | 2601.00 | 2471.00 |

| 2021-02-09 | 2456.43 | 2601.00 |

| 2021-02-08 | 2368.80 | 2456.43 |

| 2021-02-05 | 2313.00 | 2368.80 |

| 2021-02-04 | 2320.85 | 2313.00 |

| 2021-02-03 | 2189.91 | 2320.85 |

| 2021-02-02 | 2145.00 | 2189.91 |

| 2021-02-01 | 2109.32 | 2145.00 |

计算延迟一期收益率

dayret1=(close-lagclose)/lagclose

dayret1.name="dayret1"

dayret1.head(10)

Date

2021-02-19 NaN

2021-02-18 0.004472

2021-02-10 0.052610

2021-02-09 -0.055582

2021-02-08 -0.035674

2021-02-05 -0.023556

2021-02-04 0.003394

2021-02-03 -0.056419

2021-02-02 -0.020508

2021-02-01 -0.016634

Name: dayret1, dtype: float64

计算多期收益

将收盘价、延迟一期收盘价及收益率合并为一个表格

calcret=pd.merge(CalcClose,pd.DataFrame(dayret1),left_index=True,right_index=True)#数据归并了

calcret.head(10)

| close | lagclose | dayret1 | |

|---|---|---|---|

| Date | |||

| 2021-02-19 | 2460.00 | NaN | NaN |

| 2021-02-18 | 2471.00 | 2460.00 | 0.004472 |

| 2021-02-10 | 2601.00 | 2471.00 | 0.052610 |

| 2021-02-09 | 2456.43 | 2601.00 | -0.055582 |

| 2021-02-08 | 2368.80 | 2456.43 | -0.035674 |

| 2021-02-05 | 2313.00 | 2368.80 | -0.023556 |

| 2021-02-04 | 2320.85 | 2313.00 | 0.003394 |

| 2021-02-03 | 2189.91 | 2320.85 | -0.056419 |

| 2021-02-02 | 2145.00 | 2189.91 | -0.020508 |

| 2021-02-01 | 2109.32 | 2145.00 | -0.016634 |

下移两期得到延迟二期收盘价并合并到表格中

dayret2=(close - close.shift(2))/close.shift(2)

dayret2.name="dayret2"

calcret["dayret2"]=dayret2

calcret.head(10)

| close | lagclose | dayret1 | dayret2 | |

|---|---|---|---|---|

| Date | ||||

| 2021-02-19 | 2460.00 | NaN | NaN | NaN |

| 2021-02-18 | 2471.00 | 2460.00 | 0.004472 | NaN |

| 2021-02-10 | 2601.00 | 2471.00 | 0.052610 | 0.057317 |

| 2021-02-09 | 2456.43 | 2601.00 | -0.055582 | -0.005896 |

| 2021-02-08 | 2368.80 | 2456.43 | -0.035674 | -0.089273 |

| 2021-02-05 | 2313.00 | 2368.80 | -0.023556 | -0.058390 |

| 2021-02-04 | 2320.85 | 2313.00 | 0.003394 | -0.020242 |

| 2021-02-03 | 2189.91 | 2320.85 | -0.056419 | -0.053217 |

| 2021-02-02 | 2145.00 | 2189.91 | -0.020508 | -0.075770 |

| 2021-02-01 | 2109.32 | 2145.00 | -0.016634 | -0.036801 |

查看第六行、十一行信息

calcret.iloc[5,:]

close 2313.000000

lagclose 2368.800000

dayret1 -0.023556

dayret2 -0.058390

Name: 2021-02-05 00:00:00, dtype: float64

calcret.iloc[10,:]

close 2116.180000

lagclose 2109.320000

dayret1 0.003252

dayret2 -0.013436

Name: 2021-01-29 00:00:00, dtype: float64

单独查看第十一行延迟一期、延迟二期收益率

calcret.iloc[10,-2:] #查看收益

dayret1 0.003252

dayret2 -0.013436

Name: 2021-01-29 00:00:00, dtype: float64

用ffn包内函数计算简单单期收益率

import ffn

ffnSimpleret=ffn.to_returns(close) #计算简单收益

ffnSimpleret.name="ffnSimpleret"

ffnSimpleret

Date

2021-02-19 NaN

2021-02-18 0.004472

2021-02-10 0.052610

2021-02-09 -0.055582

2021-02-08 -0.035674

...

2019-01-08 -0.018389

2019-01-07 0.001157

2019-01-04 -0.005764

2019-01-03 -0.019934

2019-01-02 0.015220

Name: ffnSimpleret, Length: 517, dtype: float64

计算年化收益率

计算年化收益率(单期为日)

- comprod()函数用于连乘,下框中用于(1+收益率的连乘)

- 此处运用了第三种年化收益率的计算方式

#假定每年有245个交易日

annualize=(1+dayret1).cumprod()[-1]**(245/517)-1

annualize #通过某一天的收益,计算年化

-0.48801288886576977

构造函数计算年化收益率(单期分别为日月季年)

def annualizecom(returns ,period): #根据年月日季度计算收益

if period=="day":

annualize=(1+returns).cumprod()[-1]**(245/len(returns))-1

return annualize

elif period=="month":

annualize=(1+returns).cumprod()[-1]**(12/len(returns))-1

return annualize

pass

elif period=="quarter":

annualize=(1+returns).cumprod()[-1]**(4/len(returns))-1

return annualize

elif period=="year":

annualize=(1+returns).cumprod()[-1]**(1/len(returns))-1

return annualize

else:

raise Excetion("error ")

用构造的函数分别计算几种收益率:

annualizecom(dayret1 ,"year")

-0.002728742960895203

annualizecom(dayret1 ,"month")

-0.032257919719301587

annualizecom(dayret1 ,"quarter")

-0.010870376832554318

annualizecom(dayret1 ,"day")

-0.48801288886576977

计算单期连续复利收益率

用公式计算单期连续复利收益率

comporet=np.log(close/lagclose)#计算指数收益

comporet.name="comporet" #连续收益计算

comporet.head(10)

Date

2021-02-19 NaN

2021-02-18 0.004462

2021-02-10 0.051273

2021-02-09 -0.057187

2021-02-08 -0.036326

2021-02-05 -0.023838

2021-02-04 0.003388

2021-02-03 -0.058073

2021-02-02 -0.020721

2021-02-01 -0.016774

Name: comporet, dtype: float64

查看第六项收益率:

comporet[5]

-0.023838114555942435

调用ffn中的to_log_returns函数计算单期连续复利收益率

ffnComporet=ffn.to_log_returns(close) #计算出指数收益率

ffnComporet.head(10)

Date

2021-02-19 NaN

2021-02-18 0.004462

2021-02-10 0.051273

2021-02-09 -0.057187

2021-02-08 -0.036326

2021-02-05 -0.023838

2021-02-04 0.003388

2021-02-03 -0.058073

2021-02-02 -0.020721

2021-02-01 -0.016774

Name: close, dtype: float64

用公式计算多期连续复利收益率

comporet2=np.log(close/close.shift(2))#计算指数收益

comporet2.name="comporet" #连续收益计算

comporet2 .head(10)

Date

2021-02-19 NaN

2021-02-18 NaN

2021-02-10 0.055735

2021-02-09 -0.005914

2021-02-08 -0.093512

2021-02-05 -0.060164

2021-02-04 -0.020450

2021-02-03 -0.054685

2021-02-02 -0.078794

2021-02-01 -0.037495

Name: comporet, dtype: float64

绘制延迟一期、二期的连续复利收益率图像

comporet.plot()

comporet2=comporet.dropna()#删除无效数据

comporet2.plot()

连续复利收益率的优良性质:单期加总即得多期

sumcomporet=comporet+comporet.shift(1)

sumcomporet.plot()

绘制收益图

简单收益率曲线图

comporet.plot()

累积收益率曲线图(连乘)

(dayret2+1).cumprod()

Date

2021-02-19 NaN

2021-02-18 NaN

2021-02-10 1.057317

2021-02-09 1.051083

2021-02-08 0.957249

...

2019-01-08 0.061300

2019-01-07 0.060243

2019-01-04 0.059965

2019-01-03 0.058431

2019-01-02 0.058138

Name: dayret2, Length: 517, dtype: float64

((dayret2+1).cumprod()-1).plot()#累积收益

资产风险的测度

SAPower代表“航天动力”股票,DalianRP代表“大橡塑”股票,下面比较两只股票风险的的大小

方差风险度量方法

pro = ts.pro_api('4c1fa508ab60e554d221c55a47dfa557a6c7bfd0c239b45657c2262d')

df = pro.daily(ts_code='600343.SH', start_date='20200101', end_date='20201231')

df

| ts_code | trade_date | open | high | low | close | pre_close | change | pct_chg | vol | amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 600343.SH | 20201231 | 9.39 | 9.76 | 9.36 | 9.76 | 9.42 | 0.34 | 3.6093 | 198064.73 | 190630.321 |

| 1 | 600343.SH | 20201230 | 9.29 | 9.46 | 9.02 | 9.42 | 9.31 | 0.11 | 1.1815 | 104800.25 | 97214.206 |

| 2 | 600343.SH | 20201229 | 9.40 | 9.59 | 9.29 | 9.31 | 9.46 | -0.15 | -1.5856 | 80965.77 | 76417.065 |

| 3 | 600343.SH | 20201228 | 9.55 | 9.71 | 9.34 | 9.46 | 9.55 | -0.09 | -0.9424 | 92974.76 | 88318.154 |

| 4 | 600343.SH | 20201225 | 9.33 | 9.59 | 9.21 | 9.55 | 9.40 | 0.15 | 1.5957 | 103874.88 | 97898.896 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 238 | 600343.SH | 20200108 | 9.52 | 9.83 | 9.47 | 9.74 | 9.49 | 0.25 | 2.6344 | 160906.15 | 155266.627 |

| 239 | 600343.SH | 20200107 | 9.55 | 9.56 | 9.40 | 9.49 | 9.58 | -0.09 | -0.9395 | 97338.88 | 92170.541 |

| 240 | 600343.SH | 20200106 | 9.50 | 9.68 | 9.43 | 9.58 | 9.44 | 0.14 | 1.4831 | 144709.76 | 138248.280 |

| 241 | 600343.SH | 20200103 | 9.25 | 9.55 | 9.24 | 9.44 | 9.24 | 0.20 | 2.1645 | 130065.35 | 122290.734 |

| 242 | 600343.SH | 20200102 | 9.20 | 9.30 | 9.16 | 9.24 | 9.15 | 0.09 | 0.9836 | 73605.63 | 68052.974 |

243 rows × 11 columns

SAPower = df.set_index(["trade_date"])

SAPower.index = pd.to_datetime(SAPower.index)

SAPower.head(10)

| ts_code | open | high | low | close | pre_close | change | pct_chg | vol | amount | |

|---|---|---|---|---|---|---|---|---|---|---|

| trade_date | ||||||||||

| 2019-12-31 | 600343.SH | 9.17 | 9.21 | 9.07 | 9.15 | 9.21 | -0.06 | -0.6515 | 39672.46 | 36228.607 |

| 2019-12-30 | 600343.SH | 9.19 | 9.22 | 9.00 | 9.21 | 9.19 | 0.02 | 0.2176 | 49130.47 | 44842.067 |

| 2019-12-27 | 600343.SH | 9.10 | 9.28 | 9.08 | 9.19 | 9.10 | 0.09 | 0.9890 | 80067.92 | 73673.092 |

| 2019-12-26 | 600343.SH | 9.01 | 9.10 | 8.99 | 9.10 | 9.05 | 0.05 | 0.5525 | 41205.66 | 37261.199 |

| 2019-12-25 | 600343.SH | 9.06 | 9.07 | 9.00 | 9.05 | 9.07 | -0.02 | -0.2205 | 30857.58 | 27893.791 |

| 2019-12-24 | 600343.SH | 8.99 | 9.09 | 8.97 | 9.07 | 9.00 | 0.07 | 0.7778 | 35425.88 | 31933.627 |

| 2019-12-23 | 600343.SH | 9.07 | 9.24 | 8.99 | 9.00 | 9.05 | -0.05 | -0.5525 | 58083.95 | 52851.891 |

| 2019-12-20 | 600343.SH | 9.26 | 9.28 | 9.05 | 9.05 | 9.25 | -0.20 | -2.1622 | 50570.17 | 46290.687 |

| 2019-12-19 | 600343.SH | 9.24 | 9.29 | 9.16 | 9.25 | 9.21 | 0.04 | 0.4343 | 53179.06 | 49060.929 |

| 2019-12-18 | 600343.SH | 9.34 | 9.35 | 9.21 | 9.21 | 9.27 | -0.06 | -0.6472 | 81377.10 | 75335.475 |

data = pro.daily(ts_code='600346.SH', start_date='20200101', end_date='20201231')

DalianPR = data.set_index(["trade_date"])

DalianPR.index=pd.to_datetime(DalianPR.index) #时间类型

DalianPR.head(10)

| ts_code | open | high | low | close | pre_close | change | pct_chg | vol | amount | |

|---|---|---|---|---|---|---|---|---|---|---|

| trade_date | ||||||||||

| 2020-12-31 | 600346.SH | 28.27 | 28.47 | 27.37 | 27.97 | 28.27 | -0.30 | -1.0612 | 271347.44 | 754838.563 |

| 2020-12-30 | 600346.SH | 28.50 | 28.70 | 27.70 | 28.27 | 28.27 | 0.00 | 0.0000 | 253733.66 | 712823.643 |

| 2020-12-29 | 600346.SH | 28.05 | 28.50 | 27.91 | 28.27 | 28.52 | -0.25 | -0.8766 | 249460.56 | 702195.348 |

| 2020-12-28 | 600346.SH | 28.14 | 28.98 | 27.89 | 28.52 | 28.20 | 0.32 | 1.1348 | 389506.55 | 1105593.177 |

| 2020-12-25 | 600346.SH | 27.85 | 28.40 | 26.90 | 28.20 | 27.84 | 0.36 | 1.2931 | 320665.63 | 888150.676 |

| 2020-12-24 | 600346.SH | 25.83 | 27.88 | 25.66 | 27.84 | 25.83 | 2.01 | 7.7816 | 422756.21 | 1145436.858 |

| 2020-12-23 | 600346.SH | 24.89 | 25.88 | 24.40 | 25.83 | 24.91 | 0.92 | 3.6933 | 440258.29 | 1110170.102 |

| 2020-12-22 | 600346.SH | 24.99 | 25.98 | 24.90 | 24.91 | 25.27 | -0.36 | -1.4246 | 384294.95 | 975570.605 |

| 2020-12-21 | 600346.SH | 25.60 | 25.61 | 24.83 | 25.27 | 25.60 | -0.33 | -1.2891 | 383929.24 | 968798.982 |

| 2020-12-18 | 600346.SH | 25.13 | 25.90 | 25.05 | 25.60 | 25.10 | 0.50 | 1.9920 | 341813.44 | 871416.769 |

import ffn

returnS=ffn.to_returns(SAPower.close).dropna() #航天收盘列

returnD=ffn.to_returns(DalianPR.close).dropna() #d大橡塑收盘列

returnS.std()

0.021819530993107

returnD.std()

0.025298264541065586

经比较发现,大橡塑股票风险更大

下行偏差风险度量方法(MARR取收益率的均值)

def cal_half_dev(returns):

mu=returns.mean() #平均值

temp=returns[returns <mu] #小于平均值的数据

half_deviation=(sum((mu-temp)**2)/len(returns))**0.5

return half_deviation

cal_half_dev(returnS)

0.0157115665441478

cal_half_dev(returnD) #下行风险

0.018292505958246514

比较发现,大橡塑股票的风险更大

风险价值度量法(vaR)

风险价值度量法分为历史模拟法、协方差矩阵法和蒙特卡罗方法

历史模拟法

returnS.quantile(0.05) #历史模拟

-0.03534861369190922

returnD.quantile(0.05)

-0.04523544479325154

可见大橡塑股票的最大可能损失更大

协方差矩阵法

#协方差

from scipy.stats import norm

norm.ppf(0.05,returnS.mean(),returnS.std())

-0.03639441747346504

norm.ppf(0.05,returnD.mean(),returnD.std())

-0.043578796055109476

可见大橡塑股票的最大可能损失更大.此结果与课本不同,是因为选取的时间段不同。

期望亏空度量方法

returnS[returnS<=returnS.quantile(0.05)].mean()

-0.052289418772132064

returnD[returnD<=returnD.quantile(0.05)].mean()

-0.060541230656241445

因为是vaR的变形。,所以比较时与之前结论一致。

最大回撤风险度量

假设某资产(初始值为1元)从第一期到第六期的收益率分别为0,0.10,-0.10,-0.01,0.01,0.02,要计算各期的回撤及第六期的最大回撤

输入收益率并假设时间

import datetime

r=pd.Series([0,0.1,-0.1,-0.01,0.01,0.02],index=[datetime.date(2017,12,x) for x in range(3,9)])

r

2017-12-03 0.00

2017-12-04 0.10

2017-12-05 -0.10

2017-12-06 -0.01

2017-12-07 0.01

2017-12-08 0.02

dtype: float64

收益

value=(1+r).cumprod() #收益

value

2017-12-03 1.000000

2017-12-04 1.100000

2017-12-05 0.990000

2017-12-06 0.980100

2017-12-07 0.989901

2017-12-08 1.009699

dtype: float64

公式计算回撤值、回撤率及其最大值

D=value.cummax()-value # 差异

D

2017-12-03 0.000000

2017-12-04 0.000000

2017-12-05 0.110000

2017-12-06 0.119900

2017-12-07 0.110099

2017-12-08 0.090301

dtype: float64

d=D/(D+value)

d

2017-12-03 0.000000

2017-12-04 0.000000

2017-12-05 0.100000

2017-12-06 0.109000

2017-12-07 0.100090

2017-12-08 0.082092

dtype: float64

MDD=D.max()

MDD

0.1199

mdd=d.max()

mdd

0.109

### ffn包calc_max_drawdown函数计算回撤值、回撤率及其最大值

ffn.calc_max_drawdown(value)

-0.10899999999999999

计算航天和大橡塑股票的最大回撤率

ffn.calc_max_drawdown((1+returnS).cumprod()) #最高峰的值与当下数据的对比,差距越大,风险越高

-0.3877388535031847

ffn.calc_max_drawdown((1+returnD).cumprod())

-0.5753856942496501