The Scent of Money

语言词汇

One can fall back on barter. But barter is effective only when exchanging a limited range of products. It cannot form the basis for a complex economy.

PHRASAL VERB If you fall back on something, you do it or use it after other things have failed. 转而使用

例:When necessary, instinct is the most reliable resource you can fall back on. 必要时,本能是你可使用的最可靠的资源。

例:Will you to stay the course or fall back on your over-developed need to react?

例:In situations like this the current fad is to fall back on a fail-fast, fail-early culture.

And if 1,000 different commodities are traded, buyers and sellers must juggle 499,500 different exchange rates!5How do you figure it out?

V-T If you juggle lots of different things, such as your work and your family, you try to give enough time or attention to all of them. 尽量兼顾

例:The management team meets several times a week to juggle budgets and resources. 管理团队一周开几次会,力图兼顾预算和资源。

For thousands of years, philosophers, thinkers and prophets have besmirched money and called it the root of all evil.

V-T If you besmirch someone or their reputation, you say that they are a bad person or that they have done something wrong, usually when this is not true. 诽谤; 玷污[文学性]

例:He has accused local people of trying to besmirch his reputation. 他指责当地人企图败坏他的名誉。

例:Mr Poots said a minority should not besmirch the good work of the majority.

例:The Free Syrian Army, a group of rebel fighters, said that government forces, hoping to besmirch the opposition, were responsible.

例:To say such ties have turned this supposed market watchdog into a lapdog is to besmirch the safeguards that lapdogs afford everywhere.

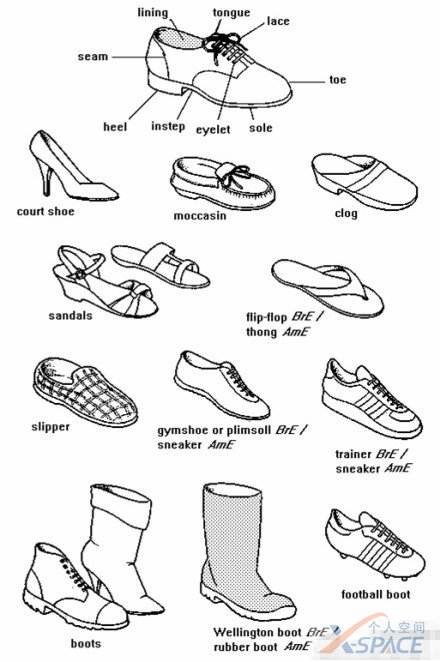

各种鞋

汉英积累

报恩 reciprocate the favor

结实的鞋子 a sturdy pair of boots

达成三方交易 set up a three-way deal

金锭银锭 silver and gold ingots

内容

人人都爱金钱,那么金钱是怎样产生的?这要从早期物物交换的交易方式说起。

一开始,人类社群规模较小,物物交换完全可以满足人们的需求。但是随着人类社群的不断扩大,物物交换变得极其低效——那么多人,那么多种产品,那么多的不确定因素影响着商品的产出,人们要议出合理又满意的“价格”十分艰难;同时,寻找换购对象也十分困难:果农A有清脆香甜的苹果,想向鞋匠B换购鞋子,可是B不需要苹果,B想离婚,而且B请的离婚律师也未必需要苹果。为了解决这些问题,金钱应运而生。

金钱有什么优点呢?首先,金钱使得我们能用所有物换取任何我们想要却还没有的物品。其次,因为不像食物那样容易变质,也不像木材谷物那样占地方、需要投入精力去维护,易于存储的金钱可帮助我们轻松积累财富。最后,金钱易于携带,当交易地点很远时,货币使得一切变得简单起来。

金钱的这些特性使得更加复杂的商业网络和活跃的商业市场得以出现。那么金钱是如何做到这一点的?

答案是:人们接受了金钱这一集体的假象,建立了基于这一假象的互信系统。每个人都相信自己在A地卖东西获得的货币,到了B地也一定可以换取自己所需的物品。这种信任源自于长久存在的经济政治社会关系网。我们相信货币,因为我们的邻居相信,因为我们的国王相信,因为我们的牧师相信。

金钱制度史:

最早的金钱制度是苏美尔人的“麦元(barley money)”制度,将固定数量的大麦谷粒(最通用的是sila,约为一升)作为通用单位衡量服务和商品的价值。大麦拥有固有价值:它可以食用;但是大麦有其局限性:不便存储运输。金钱制度史上最大的一次突破应该是人类第一次使用不具有固有价值(inherent value)但易于存储运输的货币形式进行交易。

最早的此类货币是美索不达米亚的silver shekel,它并非硬币,而是 8.33 grams of silver。

从固定重量的贵金属货币中,发展出了硬币。最早的硬币产生于公元前640年(by King Alyattes of Lydia, in western Anatolia),这些硬币使用金银等材质,有固定重量和金属配比。硬币表面印有两样信息:一是硬币的价值(含多少贵金属),二是发行者的身份,以确保硬币成分。后世的种种货币都可以说是从Lydia硬币演化而来。

对金银的信任和热爱不是Lydia一个地方的事,事实上,世界各地都出现了类似的金钱系统,有些是自己发明,有些由他国传入。这为全球货币系统的一体化奠定了基础。

金钱制度的发明使得陌生人之间也可以建立信任,相互合作。但是人们相信的并不是彼此,而是金钱本身。因此,金钱很可能反过来破坏传统价值和亲密关系,使人与人之间难以拥有真正意义上的信任。维系家庭和社会的“无价之宝”,如忠诚、道德、荣耀和爱,绝不该轻易被钱收买,金钱却常常沦为小人背叛、欺骗的原动力。有人说,金钱的力量终会获胜,国王、宗教建成的价值大坝终会被金钱冲垮。但万幸的是,总有人类手握超越金钱的“无价之宝”,拯救人类价值于水火之中。让各个分离的人类族群聚成现在的地球村的,不仅仅是金银,也有刀剑的力量。

摘录

Some societies tried to solve the problem by establishing a central barter system that collected products from specialist growers and manufacturers and distributed them to those who needed them. The largest and most famous such experiment was conducted in the Soviet Union, and it failed miserably. ‘Everyone would work according to their abilities, and receive according to their needs’ turned out in practice into ‘everyone would work as little as they can get away with, and receive as much as they could grab’. More moderate and more successful experiments were made on other occasions, for example in the Inca Empire. Yet most societies found a more easy way to connect large numbers of experts – they developed money.

Without this shared belief, global trading networks would have been virtually impossible. The gold and silver that sixteenth-century conquistadors found in America enabled European merchants to buy silk, porcelain and spices in East Asia, thereby moving the wheels of economic growth in both Europe and East Asia. Most of the gold and silver mined in Mexico and the Andes slipped through European fingers to find a welcome home in the purses of Chinese silk and porcelain manufacturers. What would have happened to the global economy if the Chinese hadn’t suffered from the same ‘disease of the heart’ that afflicted Cortés and his companions – and had refused to accept payment in gold and silver?

For thousands of years, philosophers, thinkers and prophets have besmirched money and called it the root of all evil. Be that as it may, money is also the apogee of human tolerance. Money is more open-minded than language, state laws, cultural codes, religious beliefs and social habits. Money is the only trust system created by humans that can bridge almost any cultural gap, and that does not discriminate on the basis of religion, gender, race, age or sexual orientation. Thanks to money, even people who don’t know each other and don’t trust each other can nevertheless cooperate effectively.

Money has always tried to break through these barriers, like water seeping through cracks in a dam. Parents have been reduced to selling some of their children into slavery in order to buy food for the others. Devout Christians have murdered, stolen and cheated – and later used their spoils to buy forgiveness from the church. Ambitious knights auctioned their allegiance to the highest bidder, while securing the loyalty of their own followers by cash payments. Tribal lands were sold to foreigners from the other side of the world in order to purchase an entry ticket into the global economy.

Hence the economic history of humankind is a delicate dance. People rely on money to facilitate cooperation with strangers, but they’re afraid it will corrupt human values and intimate relations. With one hand people willingly destroy the communal dams that held at bay the movement of money and commerce for so long. Yet with the other hand they build new dams to protect society, religion and the environment from enslavement to market forces.