申请者评分模型(A卡)开发(基于逻辑回归)

申请者评分模型(A卡)开发(基于逻辑回归)

1项目背景

申请者评分模型应用在信贷场景中的贷款申请环节,主要是以申请者的历史信息为基础,预测未来放款后逾期或者违约的概率,为银行客户关系管理提供数据依据,从而有效的控制违约风险。

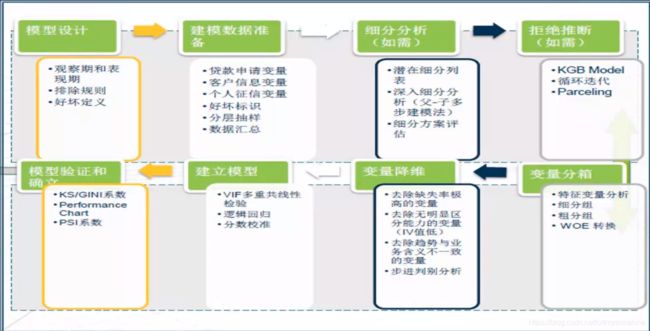

2开发流程

本次建模基本流程:

1.数据准备:收集并整合在库客户的数据,定义目标变量,排除特定样本。

2.探索性数据分析:评估每个变量的值分布情况,处理异常值和缺失值。

3.数据预处理:变量筛选,变量分箱,WOE转换、分割训练集测试集。

4.模型开发:逻辑回归拟合模型。

5.模型评估:常见几种评估方法,ROC、KS等。

6.生成评分卡

3数据准备

3.1样本选取

首先根据准入规则(如年龄、在网时长等)、行内黑名单过滤客户,再通过反欺诈模型过滤客户,得到用于建立信用评分卡的样本。

3.2数据说明

本次建模数据一共用到三个表:

“CreditFirstUse”:客户首次使用信用卡时间信息表

“CreditSampleWindow”:客户历史违约信息表(基于客户编号)

“Data_Whole”:客户基本信息表

3.3定义目标变量

申请者评分模型需要解决的问题是未来一段时间(如12个月)客户出现违约(如至少一次90天或90天以上逾期)的概率。在这里“12个月”为“观察时间窗口”,“至少一次90天或90天以上逾期”为表现时间窗口即违约日期时长,那么我们如何确定观察时间窗口和违约日期时长(如M2算违约,还是M3算违约)呢?

3.3.1定义违约日期时长(表现时间窗口)

sample_window=pd.read_csv("CreditSampleWindow.csv")

sample_window.head()

sample_window.shape

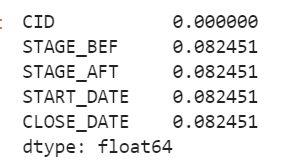

#查看缺失值所占比例

sample_window.isnull().sum()/sample_window.shape[0]

# 选取某一个ID查看数据结构

sample_record = sample_window[sample_window.CID == sample_window.iat[4,0]]

sample_record.sort_values('START_DATE')

#去掉重复值

sample_window.drop_duplicates(inplace=True)

#去掉没有逾期阶段记录的信息

sample_window.dropna(subset=['STAGE_BEF','STAGE_AFT'],inplace=True)

sample_window.shape

#取每个 ID 每个月份的最高逾期记录也就是STAGE_AFT作为该月份的逾期指标

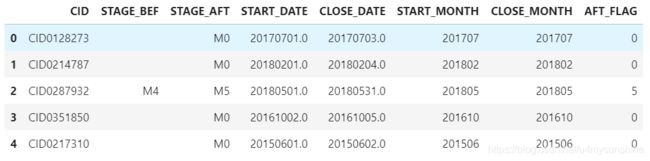

sample_window['START_MONTH']=sample_window.START_DATE.apply(lambda x: int(x//100)) #取年月

sample_window['CLOSE_MONTH']=sample_window.CLOSE_DATE.apply(lambda x: int(x//100))

sample_window['AFT_FLAG']=sample_window.STAGE_AFT.apply(lambda x:int(x[-1])) #取数字

sample_window.head()

#因为选取数据的时间是有一个节点的,由于系统原因,截至时间节点为0了

#所以将 CLOSE_DATE 为0的数据填补为 201806(根据缺失的业务背景确定)

sample_window.loc[sample_window.CLOSE_MONTH==0,'CLOSE_MONTH']=201806

# 提取 ID、月份、月份对应状态作为新的数据

overdue = sample_window.loc[:,["CID","START_MONTH","AFT_FLAG"]]\

.rename(columns={"START_MONTH":"CLOSE_MONTH"})\

.append(sample_window.loc[:,["CID","CLOSE_MONTH","AFT_FLAG"]],ignore_index=True)

# 生成每个订单的逾期信息,以表格形式。提取当月最差的状态

overdue = overdue.sort_values(by=["CID","CLOSE_MONTH","AFT_FLAG"])\

.drop_duplicates(subset=["CID","CLOSE_MONTH"],keep="last")\

.set_index(["CID","CLOSE_MONTH"]).unstack(1) #unstack索引的级别,level=1

overdue.columns = overdue.columns.droplevel() #删除列索引上的levels

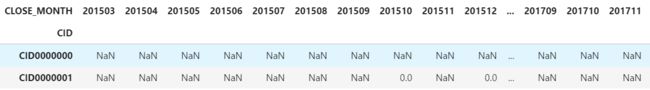

overdue.head(2)

构建转移矩阵,横坐标(行)表示转移前状态,纵坐标(列)表示下一个月状态(转移后) , 选取连续两个月的有记录的,记录逾期阶段迁移,计算 count 录入转移矩阵。

import collections

def get_mat(df):

trans_mat=pd.DataFrame(data=0,columns=range(10),index=range(10))

counter=collections.Counter()

for i,j in zip(df.columns,df.columns[1:]):

select = (df[i].notnull()) & (df[j].notnull()) #选取连续两个月有记录的

counter += collections.Counter(tuple(x) for x in df.loc[select, [i,j]].values) #连续两个月的预期阶段转移

for key in counter.keys():

trans_mat.loc[key[0],key[1]]=counter[key] #将对应的值放进转移矩阵

trans_mat['all_count']=trans_mat.apply(sum,axis=1) #对行进行汇总

bad_count = []

for j in range(10):

bad_count.append(trans_mat.iloc[j,j+1:10].sum()) #计算转坏的数量,行表示上个月,列表示这个月

trans_mat['bad_count']=bad_count

trans_mat['to_bad']=trans_mat.bad_count/trans_mat.all_count #计算转坏的比例

return trans_mat

get_mat(overdue)

仅仅从转移矩阵来看,在逾期阶段到了 M2 时, 下一阶段继续转坏的概率达到了 67%,逾期阶段到达 M3 阶段时,下一阶段继续转坏的概率为 86%,可根据业务需要(营销、风险等等)来考虑定义进入 M2 或M3 阶段的用户为坏客户。这里由于数据的原因我们暂定为 M4。

3.3.2定义观察时间窗口

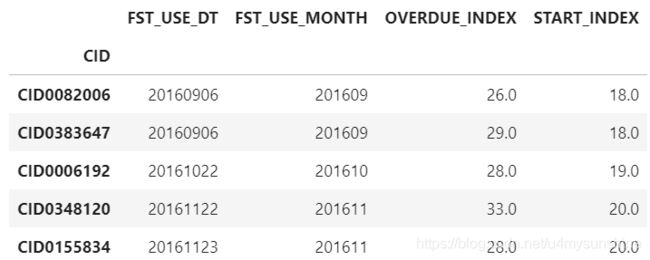

first_use=pd.read_csv("CreditFirstUse.csv",encoding="utf-8")

first_use.set_index("CID",inplace=True)

first_use["FST_USE_MONTH"]=first_use.FST_USE_DT.map(lambda x:x//100)

#计算每一笔订单第一次出现逾期 M2的月份的索引的位置

def get_first_overdue(ser):

array=np.where(ser>=2)[0]

if array.size>0:

return array[0]

else:

return np.nan

OVER_DUE_INDEX=overdue.apply(get_first_overdue,axis=1)

first_use['OVERDUE_INDEX']=OVER_DUE_INDEX

# FST_USE_MONTH在over_due的列索引中的index

first_use["START_INDEX"] =first_use.FST_USE_MONTH.map({k:v for v,k in enumerate(overdue.columns)})

first_use.loc[first_use.OVERDUE_INDEX.notnull()].head()

#查看异常数据

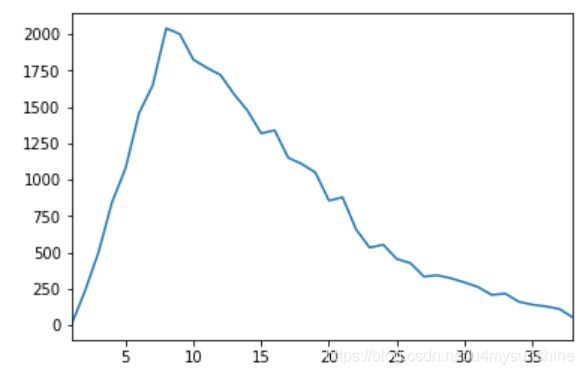

first_use.loc[first_use.OVERDUE_INDEX#逾期月份累计分布

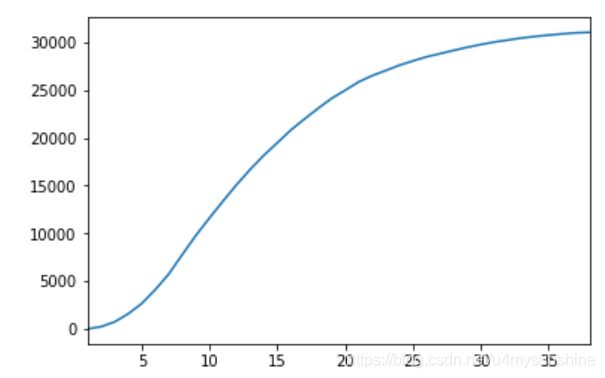

month_count.cumsum().plot()

理想情况下,累计分布曲线会在某个月开始收敛。

在这里不收敛,根据业务通常定义24个月。

3.3.4好坏客户标签(y)的定义

我们定义在24个月逾期90天的客户为坏客户。

4探索性数据分析

4.1异常值

通过表查看异常值

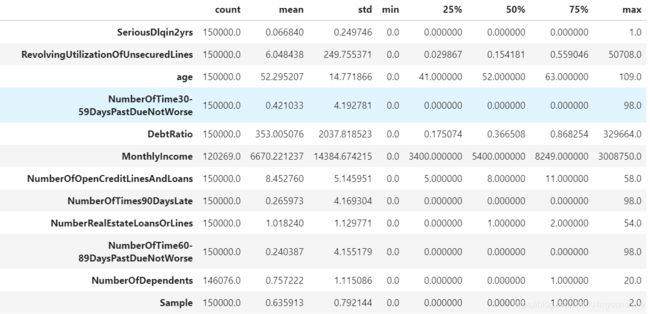

train_data=pd.read_csv("Data_Whole.csv",index_col=0)

train_data.describe().T

(1)分析RevolvingUtilizationOfUnsecuredLines

一般情况下为0-1.有大于1的情况:

1.主动申请提额后额度回调,一般不会大于2

2.高风险欠款后贷款额度被调的很低时,这个比例会变大

(2)分析age

age最小值为0,去看age=0的有多少

(train_data.age==0).sum()

train_data=train_data[train_data.age>0] #只有一条数据,删除

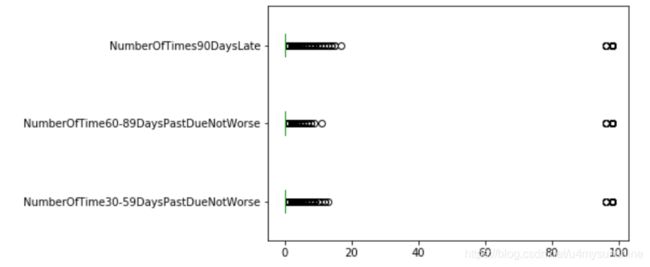

通过箱线图查看异常值

columns = ["NumberOfTime30-59DaysPastDueNotWorse",

"NumberOfTime60-89DaysPastDueNotWorse",

"NumberOfTimes90DaysLate"]

train_data[columns].plot.box(vert=False)

for col in columns:

train_data = train_data[train_data[col]<90]

4.2缺失值

缺失值大于50%或者70%的变量,不考虑这个变量。

缺失值特别小,0.1%,删除缺失值。

缺失值补全的方法:

1.单一值补全

数值型变量:样本均值或中位数

分类型变量:新增一个类别

2.分组补全(利用与其相关性较强的变量)

数值型变量:各分组均值或各分组中位数

3.模型预测

各种变量:利用多变量组合模型预测缺失值

4.WOE补全

各种变量:直接计算WOE(仅限于LR模型)

train_data.notnull().sum()/train_data.shape[0]

#查看皮尔逊相关系数

train_data.corr()

4.2.1单一值补全

def single_value_imp(df, var, fill):

# df: 输入数据名

# var: 需要补全的变量名

# fill: 填充种类 (1. mean; 2. median)

out = df.copy()

cnt = len(var)

for i in range(cnt):

x = var[i]

if fill[i] == 1:

out[x].loc[out[x].isnull()] = out[x].describe()[1]

if fill[i] == 2:

out[x].loc[out[x].isnull()] = out[x].describe()[5]

return out

temp_1 = single_value_imp(train_data, ['NumberOfDependents' , 'MonthlyIncome'], [2, 2])

temp_1.isnull().sum()

4.2.2分组补全

def grp_value_imp(df, var, col, bins, fill):

# df: 输入数据名

# var: 需要补全的变量名

# col: 分组的变量

# bins:变量分组cutoff

# fill: 填充种类 (1. mean; 2. median)

temp = df.copy()

#分箱

temp[col + '_grp'] = pd.cut(temp[col], bins)

#组内统计

if fill == 1:

grp_stat = pd.DataFrame(temp.groupby(col + '_grp')[var].mean()).rename(columns = {var: var + '_fill'})

if fill == 2:

grp_stat = pd.DataFrame(temp.groupby(col + '_grp')[var].median()).rename(columns = {var: var + '_fill'})

#分组补全

temp = pd.merge(temp, grp_stat, how = 'left', left_on = col + '_grp', right_index = True)

temp[var] = temp[var].fillna(temp[var + '_fill'])

result = temp.drop([col + '_grp', var + '_fill'], axis = 1)

return result

train_data['age'].describe().T

sub_1 = grp_value_imp(df = train_data, var = 'NumberOfDependents', col = 'age', bins = [-np.inf, 30, 40, 50, 60, 70, np.inf], fill = 2)

train_data['NumberRealEstateLoansOrLines'].describe([.90, .95, .99]).T

temp_2 = grp_value_imp(df = sub_1, var = 'MonthlyIncome', col = 'NumberRealEstateLoansOrLines', bins = [-np.inf, 0, 1, 2, 3, np.inf], fill = 2)

temp_2.isnull().sum()

4.2.3模型预测补全

import lightgbm as lgb

def fill_missing(data, to_fill, fill_type):

# data: 输入数据名

# to_fill: 需要补全的变量名

# fill_type: 填充种类 (1. 分类; 2. 回归)

df = data.copy()

columns = data.columns.values.tolist()

columns.remove(to_fill)

X = df.loc[:,columns]

y = df.loc[:,to_fill]

X_train = X.loc[df[to_fill].notnull()]

X_pred = X.loc[df[to_fill].isnull()]

y_train = y.loc[df[to_fill].notnull()]

if fill_type == 1:

model = lgb.LGBMClassifier()

else:

model = lgb.LGBMRegressor()

model.fit(X_train,y_train)

pred = model.predict(X_pred).round()

df.loc[df[to_fill].isnull(), to_fill] = pred

return df

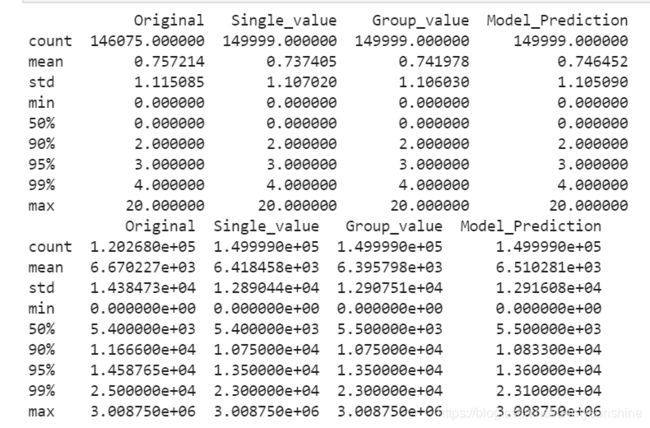

4.2.4三种补全方法的比较

print(pd.DataFrame({'Original': train_data['NumberOfDependents'].describe([.9, .95, .99]),

'Single_value': temp_1['NumberOfDependents'].describe([.9, .95, .99]),

'Group_value': temp_2['NumberOfDependents'].describe([.9, .95, .99]),

'Model_Prediction': temp_3['NumberOfDependents'].describe([.9, .95, .99])}))

print(pd.DataFrame({'Original': train_data['MonthlyIncome'].describe([.9, .95, .99]),

'Single_value': temp_1['MonthlyIncome'].describe([.9, .95, .99]),

'Group_value': temp_2['MonthlyIncome'].describe([.9, .95, .99]),

'Model_Prediction': temp_3['MonthlyIncome'].describe([.9, .95, .99])}))

5数据预处理

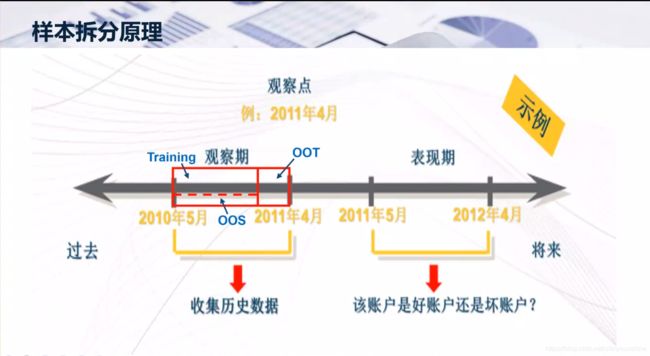

5.1数据集划分

OOT = temp_3[temp_3.Sample == 2].drop(['Sample'], axis = 1)

DEV = temp_3[temp_3.Sample == 0].drop(['Sample'], axis = 1)

OOS = temp_3[temp_3.Sample == 1].drop(['Sample'], axis = 1)

#导出

DEV.to_csv("C:\Work Station\CDA\Spyder\Data\dev.csv")

OOS.to_csv("C:\Work Station\CDA\Spyder\Data\oos.csv")

OOT.to_csv("C:\Work Station\CDA\Spyder\Data\oot.csv")

5.2变量筛选

5.2.1IV值筛选

dev = pd.read_csv("dev.csv", index_col = 0, engine = "python")

from auto_bin import auto_bin

## 对每一个变量进行分析,选择合适的分箱个数

model_data.columns

# 自动分箱的添加

auto_col_bins = {"RevolvingUtilizationOfUnsecuredLines": 10,

"age": 7,

"DebtRatio": 10,

"MonthlyIncome": 9}

# 用来保存每个分组的分箱数据

bins_of_col = {}

# 生成自动分箱的分箱区间和分箱后的 IV 值

for col in auto_col_bins:

# print(col)

bins_df = auto_bin(dev, col, "SeriousDlqin2yrs",

n = auto_col_bins[col],

iv=False,detail=False,q=20)

bins_list = list(sorted(set(bins_df["min"])\

.union(bins_df["max"])))

# 保证区间覆盖使用 np.inf 替换最大值 -np.inf 替换最小值

bins_list[0],bins_list[-1] = -np.inf,np.inf

bins_of_col[col] = bins_list

# 手动分箱的添加

# 不能使用自动分箱的变量

hand_bins = {

"NumberOfTime30-59DaysPastDueNotWorse": [0, 1, 2, 3],

"NumberOfOpenCreditLinesAndLoans": [0, 1, 3],

"NumberOfTimes90DaysLate": [0, 1],

"NumberRealEstateLoansOrLines": [0],

"NumberOfTime60-89DaysPastDueNotWorse": [0, 1],

"NumberOfDependents":[0, 1, 2, 3]}

# 保证区间覆盖使用 np.inf 替换最大值 以及 -np.inf

hand_bins = {k:[-np.inf,*v, np.inf] for k,v in hand_bins.items()}

# 合并手动分箱数据

bins_of_col.update(hand_bins)

# 计算分箱数据的 IV 值

def get_iv(df,col,y,bins):

df = df[[col,y]].copy()

df["cut"] = pd.cut(df[col],bins)

bins_df = df.groupby("cut")[y].value_counts().unstack()

bins_df["br"] = bins_df[1] / (bins_df[0] + bins_df[1])

bins_df["woe"] = np.log((bins_df[0] / bins_df[0].sum()) /

(bins_df[1] / bins_df[1].sum()))

iv = np.sum((bins_df[0] / bins_df[0].sum() -

bins_df[1] / bins_df[1].sum())*bins_df.woe)

return iv ,bins_df

# 保存 IV 值信息

info_values = {}

# 保存 woe 信息

woe_values = {}

for col in bins_of_col:

iv_woe = get_iv(dev,col,

"SeriousDlqin2yrs",

bins_of_col[col])

info_values[col], woe_values[col] = iv_woe

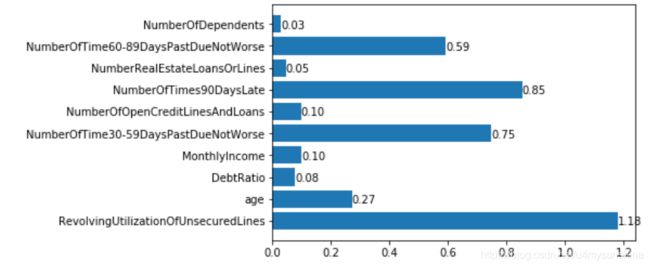

#画IV值直方图

def plt_iv(info_values):

keys,values = zip(*info_values.items())

nums = range(len(keys))

plt.barh(nums,values)

plt.yticks(nums,keys)

for i, v in enumerate(values):

plt.text(v, i-.2, f"{v:.3f}")

plt_iv(info_values)

删除iv值小于0.03的变量,这里不需要删除。

# DebtRatio为U型

#分析DebtRatio分布

sc.Eq_Bin_Plot(train_data = dev, test_data = dev, col = "DebtRatio", target = 'SeriousDlqin2yrs' , k = 10, special = 9999)

# For DebtRatio <= 1

sc.Eq_Bin_Plot(train_data = dev[dev.DebtRatio <= 1], test_data = dev[dev.DebtRatio <= 1], col = "DebtRatio", target = 'SeriousDlqin2yrs' , k = 5, special = 9999) #单调上升

# For DebtRatio > 1

sc.Eq_Bin_Plot(train_data = dev[dev.DebtRatio > 1], test_data = dev[dev.DebtRatio > 1], col = "DebtRatio", target = 'SeriousDlqin2yrs' , k = 5, special = 9999) #单调下降

# Sample Bias caused problem - DebtRatio资产负债越大风险越小?

# 资产负债高的已经在前面拒绝掉了,只能剔除此变量

#分箱并WOE赋值

dev_woe = dev.copy()

for col in bins_of_col:

dev_woe[col + '_woe'] = pd.cut(dev[col], bins_of_col[col])\

.map(woe_values[col]["woe"])

oos = pd.read_csv('oos.csv', encoding="utf8", index_col = 0, engine = "python")

oos_woe = oos.copy()

for col in bins_of_col:

oos_woe[col + '_woe'] = pd.cut(oos[col], bins_of_col[col])\

.map(woe_values[col]["woe"])

oot = pd.read_csv('oot.csv', encoding="utf8", index_col = 0, engine = "python")

oot_woe = oot.copy()

for col in bins_of_col:

oot_woe[col + '_woe'] = pd.cut(oot[col], bins_of_col[col])\

.map(woe_values[col]["woe"])

dev_woe.to_csv("dev_woe.csv")

oos_woe.to_csv("oos_woe.csv")

oot_woe.to_csv("oot_woe.csv")

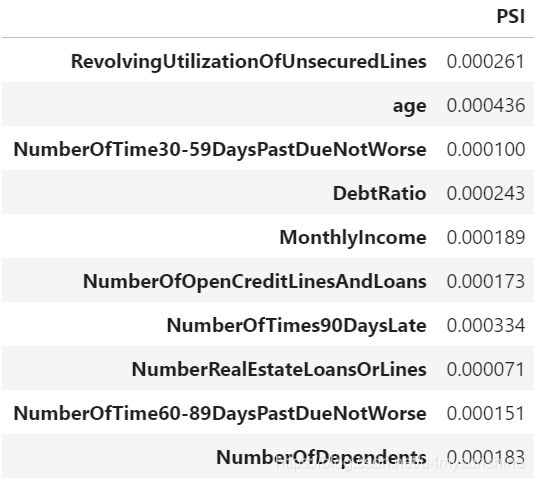

5.2.2PSI筛选

dev_woe = pd.read_csv("dev_woe.csv", index_col = 0)

oos_woe = pd.read_csv("oos_woe.csv", index_col = 0)

oot_woe = pd.read_csv("oot_woe.csv", index_col = 0)

def PSI_Cal(df1,df2,var,grp):

A=pd.DataFrame(df1.groupby(by=grp)[var].count()).rename(columns={var:var+'_1'})

B=pd.DataFrame(df2.groupby(by=grp)[var].count()).rename(columns={var:var+'_2'})

C=pd.merge(A,B,how='left',left_index=True,right_index=True)

PSI_df=C/C.sum()

PSI_df['log']=np.log(PSI_df[var+'_1'])/PSI_df[var+'_2']

PSI_df['PSI']=(PSI_df[var+'_1']-PSI_df[var+'_2'])*PSI_df['log']

return PSI_df['PSI'].sum()

#变量名单

v_list = dev.drop(['SeriousDlqin2yrs'], axis = 1).columns

#计算PSI

psi_list = []

for col in v_list:

psi = PSI_Cal(dev_woe, oos_woe, col, col + '_woe')

psi_list.append(psi)

psi_df = pd.DataFrame(psi_list).rename(columns = {0: 'PSI'})

psi_df.index = v_list

psi_df

6logistic模型的建立

6.1建立线性回归模型

import statsmodels.api as sm

# 只保留WOE数据

ll = []

for col in dev_woe.columns:

if col.endswith("_woe"):

ll.append(col)

data = dev_woe.loc[:,ll]

data["SeriousDlqin2yrs"] = dev_woe["SeriousDlqin2yrs"]

# Pearson Correlation

x_corr = data.drop('SeriousDlqin2yrs', axis = 1).corr()

import statsmodels.api as sm

Y = data['SeriousDlqin2yrs']

x_exclude = ["SeriousDlqin2yrs"]

x=data.drop(x_exclude,axis=1)

X=sm.add_constant(x) #添加一个截距的列到现存的矩阵

result=sm.Logit(Y,X).fit()

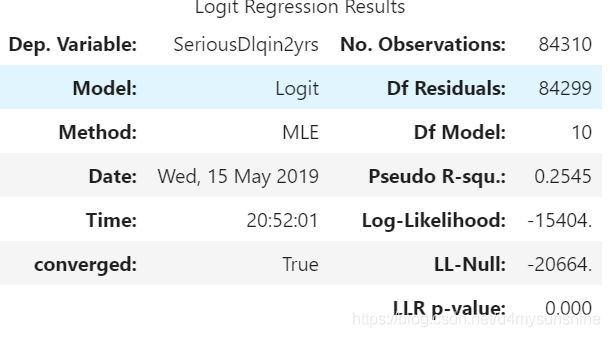

result.summary()

从上表可以看出,NumberOfOpenCreditLinesAndLoans_woe系数是正数,是多重共线性导致的,删除该变量。

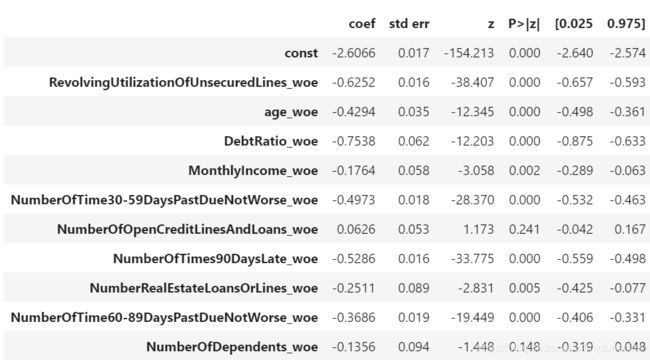

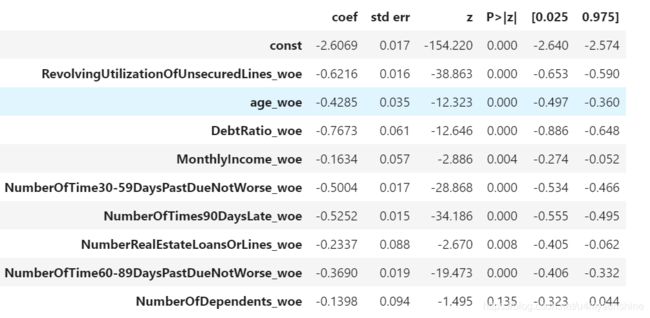

x_exclude = ["SeriousDlqin2yrs","NumberOfOpenCreditLinesAndLoans_woe"]

x=data.drop(x_exclude,axis=1)

X=sm.add_constant(x) #添加一个截距的列到现存的矩阵

result=sm.Logit(Y,X).fit()

result.summary()

NumberOfDependents_woe>0.05,要不要删除呢?

不需要。因为0.05本身只是约定俗成的,不是大于0.05就一定重要,模型重不重要是由人来确定的;对于预测型模型重点关注预测的结果、是否过拟合等问题,对变量本身的重要性不是很关心。

6.2检查多重共线性,VIF

from statsmodels.stats.outliers_influence import variance_inflation_factor

vif = {}

for i in range(x.shape[1]):

vif[x.columns[i]] = variance_inflation_factor(np.array(x), i)

vif

VIF都很小,其实VIF在这里检查不出来多重共线性。很多传统的方法,用到大数据上会失效。

在回归中,为什么不能有多重共线性?

因为在回归中,有个很大的假设,回归中的某个自变量X1系数w1表示挡其他自变量不变时,x1每增加1,因变量增加w1

但是在实际中,多重共线性很普遍

在树的模型中就不用考虑多重共线性

7模型评估

7.1ROC曲线&KS

def app_pred(df, x_list,y_col,result):

'''

:param df: 包含目标变量的数据集,dataframe

:param x_list: 所有自变量的列名

:param y_col: 目标变量,str

:param result:返回包含预测值'prob'的df

:return: KS值

'''

df=df.copy()

ll = []

for col in df.columns:

if col.endswith("_woe"):

ll.append(col)

data = df.loc[:,ll]

data[y_col] = df[y_col]

x=data.drop([y_col],axis=1)

x1=sm.add_constant(x)

result=result.predict(x1)

df['prob']=result

return df

def KS(df, score, target):

'''

:param df: 包含目标变量与预测值的数据集,dataframe

:param score: 得分或者概率,str

:param target: 目标变量,str

:return: KS值

'''

total = df.groupby([score])[target].count()

bad = df.groupby([score])[target].sum()

all = pd.DataFrame({'total':total, 'bad':bad})

all['good'] = all['total'] - all['bad']

all[score] = all.index

all.index = range(len(all))

all = all.sort_values(by=score,ascending=False)

all['badCumRate'] = all['bad'].cumsum() / all['bad'].sum()

all['goodCumRate'] = all['good'].cumsum() / all['good'].sum()

KS = all.apply(lambda x: x.badCumRate - x.goodCumRate, axis=1)

return max(KS)

import scikitplot as skplt

def ROC_plt(df, score, target):

'''

:param df: 包含目标变量与预测值的数据集,dataframe

:param score: 得分或者概率,str

:param target: 目标变量,str

'''

proba_df=pd.DataFrame(df[score])

proba_df.columns=[1]

proba_df.insert(0,0,1-proba_df)

skplt.metrics.plot_roc(df[target], #y真实值

proba_df, #y预测值

plot_micro=False, #绘制微平均ROC曲线

plot_macro=False); ##绘制宏观平均ROC曲线

#训练集预测

dev_woe.drop(["NumberOfOpenCreditLinesAndLoans_woe",'NumberOfOpenCreditLinesAndLoans'],axis=1,inplace=True)

dev_pred = app_pred(dev_woe, x_list,"SeriousDlqin2yrs",result)

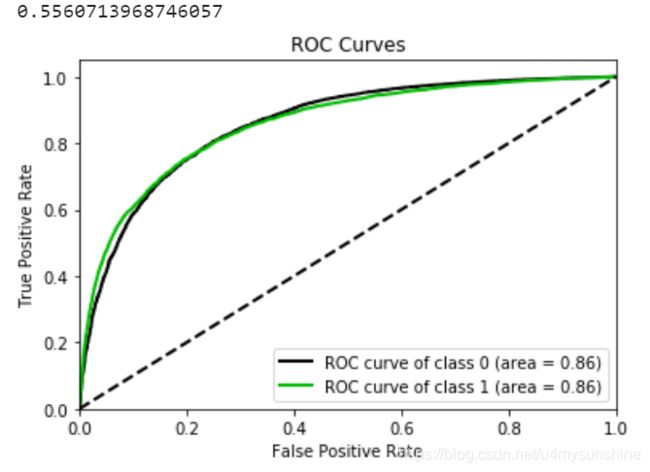

#计算KS(Compare TPR and FPR - 不同阈值下检测出坏样本比例和检测错的好样本比例)

#We'd like TRP to be large and FRP otherwise

print(KS(dev_pred, "prob", "SeriousDlqin2yrs"))

#画ROC图,并计算AUC

ROC_plt(dev_pred, "prob", "SeriousDlqin2yrs")

#测试集预测

oos_woe.drop(["NumberOfOpenCreditLinesAndLoans_woe",'NumberOfOpenCreditLinesAndLoans'],axis=1,inplace=True)

oos_pred = app_pred(oos_woe, x_list, "SeriousDlqin2yrs", result)

# 计算OOS的KS

print(KS(oos_pred, "prob", "SeriousDlqin2yrs"))

# 预测结果为对应 1 的概率,转换为数组用于绘图

ROC_plt(oos_pred, "prob", "SeriousDlqin2yrs")

从同时间的测试集无法看出模型是否过拟合,还要看跨时间的测试集。

#跨时间测试集

oot_woe.drop(["NumberOfOpenCreditLinesAndLoans_woe",'NumberOfOpenCreditLinesAndLoans'],axis=1,inplace=True)

oot_pred = app_pred(oot_woe, x_list, "SeriousDlqin2yrs", result)

# 计算OOT的KS

print(KS(oot_pred, "prob", "SeriousDlqin2yrs"))

# 预测结果为对应 1 的概率,转换为数组用于绘图

ROC_plt(oot_pred, "prob", "SeriousDlqin2yrs")

在现实中,跨时间测试集的Gini系数下降在10%以内,都是正常的。

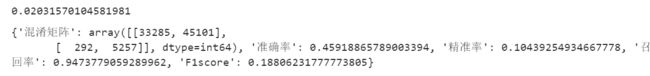

8阈值选择

from sklearn.metrics import confusion_matrix,accuracy_score,precision_score,recall_score,f1_score

#根据通过率选阈值

def ar_select(df,prob,ar):

loc=int(df.shape[0]*ar)

ordered=df.sort_values([prob]).reset_index()

return ordered.loc[loc,prob]

#根据坏账率选阈值

def br_select(df,target,prob,br,ar=0.3,close=0.001):

cutoff_list=sorted(list(set(df[prob])))

ar_cutoff=ar_select(df,prob,ar)

loc=cutoff_list.index(ar_cutoff)

for i in range(loc,len(cutoff_list)):

cutoff=cutoff_list[i]

p=np.where(df[prob]>=cutoff,1,0)

cm=confusion_matrix(df[target],p)

bad_rate=cm[1][0]/(cm[0][0]+cm[1][0])

if abs(bad_rate-br) cut_off1, 1, 0)

cm(dev_pred, "SeriousDlqin2yrs", p_dev)

#根据坏账率选择阈值

cut_off2 = br_select(dev_pred, "SeriousDlqin2yrs", 'prob', br = 0.03, close = 0.005) #0.03的坏账率

cut_off2

p_dev2 = np.where(dev_pred['prob'] > cut_off2, 1, 0)

cm(dev_pred, "SeriousDlqin2yrs", p_dev2)

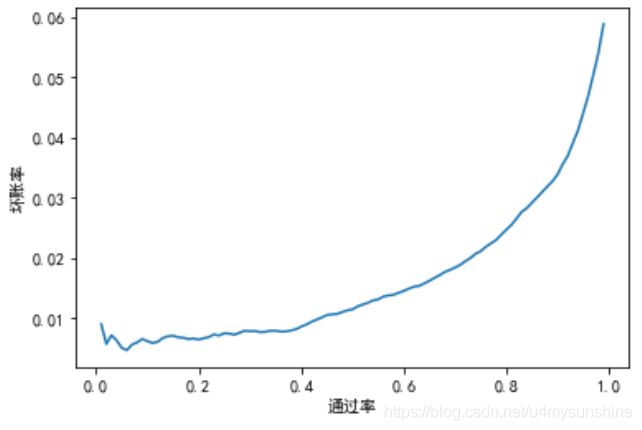

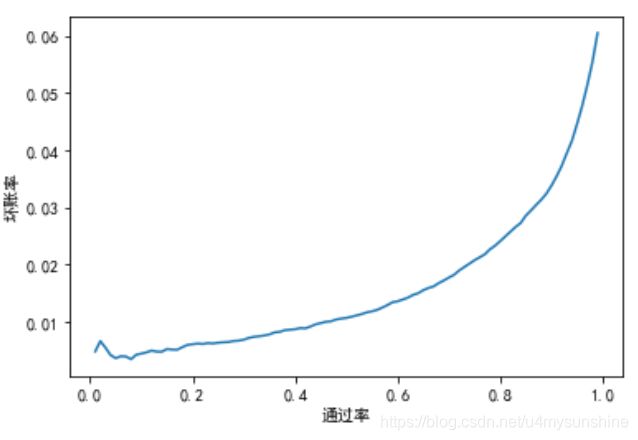

#画通过率和坏账率的图

def plt_a_b(df,target,prob):

app_rate=np.linspace(0,0.99,100)

cut_off_list=[]

bad_rate=[]

for i in range(len(app_rate)):

loc=int(df.shape[0]*app_rate[i])

ordered=df.sort_values([prob]).reset_index()

sub_cut_off=ordered.loc[loc,prob]

cut_off_list.append(sub_cut_off)

pre=np.where(df[prob]>=sub_cut_off,1,0)

cm=confusion_matrix(df[target],pre)

sub_bad_rate=cm[1][0]/(cm[0][0]+cm[1][0])

bad_rate.append(sub_bad_rate)

data={'cut_off':cut_off_list,'app_rate':app_rate,'bad_rate':bad_rate}

ab_table=pd.DataFrame(data)

#设置rc动态参数

plt.rcParams['font.sans-serif']=['Simhei'] #显示中文

plt.rcParams['axes.unicode_minus']=False #显示负号

plt.plot(app_rate,bad_rate)

plt.xlabel("通过率")

plt.ylabel("坏账率")

return ab_table

cut_off_tab = plt_a_b(dev_pred, "SeriousDlqin2yrs", 'prob')

根据业务部门期望的通过率或者是能够忍受的坏账率来选择对应的cut_off

在这里选择通过率为73%,坏账率接近2%的cut_off2 = 0.057394

注意:为了与业务相联系,通常坏账率转换为金额。

#计算测试集

def apply_cutoff(df,target,prob,cut_off):

df=df.copy()

pre=np.where(df[prob]>=cut_off,1,0)

df['pre']=pre

return df

cut_off2 = 0.057394

apply_cutoff(dev_pred, "SeriousDlqin2yrs", 'prob', cut_off2)

apply_cutoff(oos_pred, "SeriousDlqin2yrs", 'prob', cut_off2)

apply_cutoff(oot_pred, "SeriousDlqin2yrs", 'prob', cut_off2)

#测试集画通过率和坏账率的图

LR_ab_tab = plt_a_b(oos_pred, "SeriousDlqin2yrs", 'prob')

LR_ab_tab.to_csv("ab_tab_LR.csv")

9信用评分

- score=A-B*log(odds)

- 求解A,B需要两个假设:

- 1.特定违约概率下的预期分值

- 2.指定违约概率翻倍的分数PDO

base_odds=1/40

base_score=700

PDO=40

B=PDO/np.log(2)

A=base_score+B*np.log(base_odds)

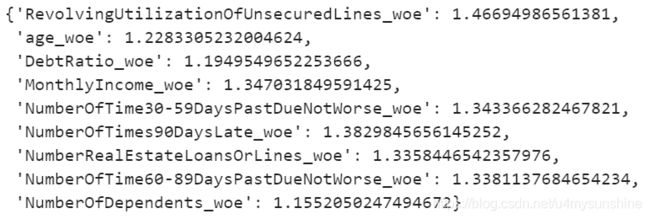

del woe_values['NumberOfOpenCreditLinesAndLoans']

b_score = A - B*result.params["const"]

para=result.params[1:]

para.index=para.index.map(lambda x:x[:-4])

file = "ScoreData1.csv"

with open(file,"w") as fdata:

fdata.write(f"base_score,{base_score}\n")

for col in para.index:

score = woe_values[col]["woe"] * (-B*para[col])

score.name = "Score"

score.index.name = col

score.to_csv(file,header=True,mode="a")