6. Retail Credit Risk and Credit Score Model

6. Retail Credit Risk and Credit Score Model

1. Retail Credit Risk

1.1 Definition

The retail banking industry revolves around receiving deposits from and lending money to consumers and small businesses. Loans can take the form of

- home mortgages

- home equity lines of credit (HELOCs),

- installment loans (revolving loans covering automobiles, credit cards, etc.),

- small business loans (SBLs).

From the perspective of the lending institution, these individual loans constitute small pieces of large portfolios designed to reduce the incremental risk to any one exposure.

1.2 Retail Credit Risk vs. Corporate Credit Risk

Retail Credit Risk

Retail credit exposures are relatively small as components of larger portfolios such that a default by any one customer will not present a serious threat to a lending institution.

Due to the inherent diversification of a retail credit portfolio and its behavior in normal markets, estimating the default percentage allows a bank to effectively treat this loss as a cost of “doing business” and to factor it into the prices it charges its customers.

Banks will often have time to take preemptive actions to reduce retail credit risk as a result of changes in customer behavior signaling a potential rise in defaults. These preemptive actions may include marketing to lower risk customers and increasing interest rates for higher risk customers.

Corporate Credit Risk

A commercial credit portfolio often consists of large exposures to corporations that can have a significant impact on their industry and the economy overall.

A commercial credit portfolio is subjected to the risk that its losses may exceed the expected threshold, which could have a crippling effect on the bank.

Commercial credit portfolios typically don’t offer these signals like retail credit portfolio, as problems might not become known until it is too late to correct them.

1.3 The Dark Side of Retail Credit Risk

An unexpected, systematic risk factor may cause losses to rise beyond an estimated threshold, damaging a bank’s retail portfolio through declines in asset and collateral values and increases in the default rate. This represents the “dark side” of retail credit risk. Primary causes include:

- The lack of historical loss data due to the relative newness of specific products.

- An across the board increase in risk factors impacting the economy overall that causes retail credit products to behave unexpectedly.

- An evolving social and legal system which may inadvertently “encourage” defaults.

- An operational flaw in the credit process due to its semi-automated structure that results in credit granted to higher risk individuals.

2. Credit Score Model

2.1 Definition

A credit risk scoring model takes information about an applicant and converts it into a number for the purpose of assessing risk; the higher the number, the higher the probability of repayment by the borrower and the lower the overall risk.

Credit scoring models facilitate the gathering of an enormous amount of information into a single automated process.

Credit scoring models will determine positive and negative values and weight each attribute according to past history and the associated probability of repayment.

2.2 Types of Credit Score Model

Credit bureau scores

This refers to an applicant’s FICO score, and is very fast, easy, and cost effective to implement and evaluate.

Scores will typically range from a low of 300 to a high of 850, with higher scores associated with lower risk to the lender and lower interest rates for the borrower.

Pooled model

This model, built by outside parties, is more costly than implementing a credit bureau score model.

It offers the advantage of flexibility to tailor it to a specific industry.

Custom model

It is created by the lender itself using data specifically pulled from the lender’s own credit application pool.

This model type allows a lender to evaluate applicants for their own specific products.

A strong competitive edge in selecting the best customers and offering the best risk-adjusted pricing.

Cost: Credit bureau scores < Pooled mode < Custom model

2.3 Mortgage Credit Assessment

In assessing an application for mortgage credit, the key variables include:

FICO score: a numerical score serving as a measure of default risk tied to the borrower’s credit history.

Loan-to-value (LTV) ratio: the amount of the mortgage divided by the associated property’s total appraised value.

Debt-to-income (DTI) ratio: the ratio of monthly debt payments (mortgage, auto, etc.) to the monthly gross income of the borrower.

Payment (pmt) type: dictates the type of mortgage (adjustable rate, fixed, etc.)

Documentation (doc) types, which include:

- Full doc: a loan which requires evidence of assets and income.

- Stated income: employment is verified but borrower income is not.

- No ratio: similar to stated income, employment is documented but income is not. The debt-to-income ratio is not calculated.

- No income/no asset: Income and assets are provided on the loan application but are not lender verified (other than the source of income).

- No doc: no documentation of income or assets is provided.

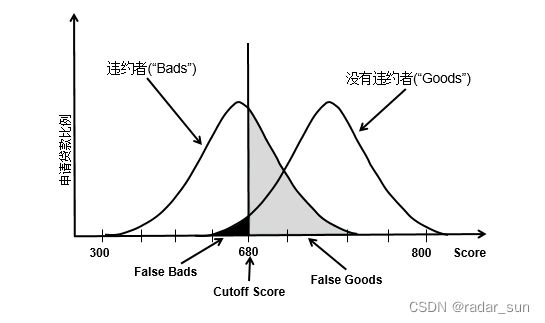

2.4 Cutoff Scores

Cutoff scores represent thresholds where lenders determine whether they will or will not lend money (and the terms of the loan) to a particular borrower. As noted earlier, the higher the score, the lower the risk to the lending institution.

Setting the cutoff score too low presents a higher risk of default to the lender. Setting the cutoff score too high may limit potential profitable opportunities by unintentionally eliminating low risk borrowers.

Once the cutoff score is established, historical experience can be used to establish the estimated profitability for a specific product line and the associated loss rate. As estimates are made from longer time horizons (which hopefully capture a full economic cycle), a bank may adjust its cutoff score to maximize the appropriate

balance between risk and profitability.

Banks are required by the Basel Accord to group their portfolios into subgroups that share similar loss attributes, with score bands used to differentiate the groups by risk levels. For each of these subgroups, banks are required to estimate the PD \text{PD} PD and the LGD \text{LGD} LGD. The implied PD \text{PD} PD is a by-product of the historical loss rate and the LGD \text{LGD} LGD such that if a portfolio has a loss rate of 3 % 3\% 3% with a 75 % 75\% 75% LGD \text{LGD} LGD, then the PD \text{PD} PD is 4% (i.e., 3 % / 75 % = 4 % 3\% / 75\% = 4\% 3%/75%=4%).

2.5 Scorecard Performance

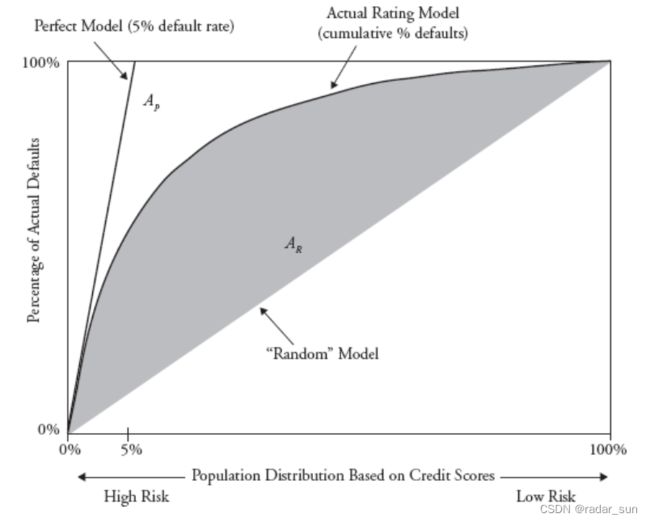

Credit scoring is used as a means of predicting default risk, such that high/low scores on the scorecard are assigned to strong/weak credits. In assessing the performance of the scorecard, a cumulative accuracy profile (CAP) and the accuracy ratio (AR) are often used. The CAP shows the population distribution based on credit scores (and therefore risk) versus the percentage of actual defaults.

Lines plotted on the graph include the perfect model line, random model line, and observed cumulative default percentage line defined as follows:

- In a perfect model, if the bank predicts, for example, 5 % 5\% 5% of its accounts will default over a specific period, 100 % 100\% 100% of those defaults will come from the riskiest 5 % 5\% 5% of the population.

- A random model will assume 5 % 5\% 5% of the defaults will come from the riskiest 5 % 5\% 5%. 20 % 20\% 20% will come from the riskiest 20 % 20\% 20%, etc.

- The observed cumulative default line represents the actual defaults observed by

the bank.

The area between the perfect model and the random model is represented by A p A_p Ap, while the area between the observed cumulative default percentage line and the random line is represented by A R A_R AR. The accuracy ratio ( AR \text{AR} AR) is defined as A R / A P A_R/A_P AR/AP, with a ratio close te 1 1 1 implying a more accurate model.

A scoring model must be monitored on a regular basis due to underlying changes in the population as well as potential product changes.