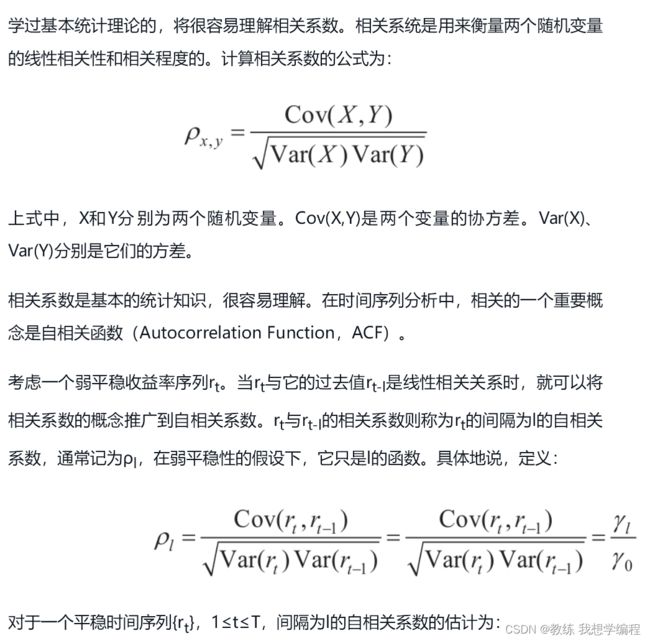

原理

import tushare as ts

ts.set_token('你的token')

df=ts.get_k_data('399300', index=True,start='2016-01-01', end='2016-12-31')

df.head()

本接口即将停止更新,请尽快使用Pro版接口:https://tushare.pro/document/2

|

date |

open |

close |

high |

low |

volume |

code |

| 0 |

2016-01-04 |

3725.86 |

3470.41 |

3726.25 |

3469.01 |

115370674.0 |

sz399300 |

| 1 |

2016-01-05 |

3382.18 |

3478.78 |

3518.22 |

3377.28 |

162116984.0 |

sz399300 |

| 2 |

2016-01-06 |

3482.41 |

3539.81 |

3543.74 |

3468.47 |

145966144.0 |

sz399300 |

| 3 |

2016-01-07 |

3481.15 |

3294.38 |

3481.15 |

3284.74 |

44102641.0 |

sz399300 |

| 4 |

2016-01-08 |

3371.87 |

3361.56 |

3418.85 |

3237.93 |

185959451.0 |

sz399300 |

import numpy as np

df['r']=(df['close'] - df['close'].shift(1)) / df['close'].shift(1)

df['rtn']=np.log(df['close'] / df['close'].shift(1))

df=df.dropna()

df.head()

|

date |

open |

close |

high |

low |

volume |

code |

r |

rtn |

| 1 |

2016-01-05 |

3382.18 |

3478.78 |

3518.22 |

3377.28 |

162116984.0 |

sz399300 |

0.002412 |

0.002409 |

| 2 |

2016-01-06 |

3482.41 |

3539.81 |

3543.74 |

3468.47 |

145966144.0 |

sz399300 |

0.017544 |

0.017391 |

| 3 |

2016-01-07 |

3481.15 |

3294.38 |

3481.15 |

3284.74 |

44102641.0 |

sz399300 |

-0.069334 |

-0.071855 |

| 4 |

2016-01-08 |

3371.87 |

3361.56 |

3418.85 |

3237.93 |

185959451.0 |

sz399300 |

0.020392 |

0.020187 |

| 5 |

2016-01-11 |

3303.12 |

3192.45 |

3342.48 |

3192.45 |

174638387.0 |

sz399300 |

-0.050307 |

-0.051617 |

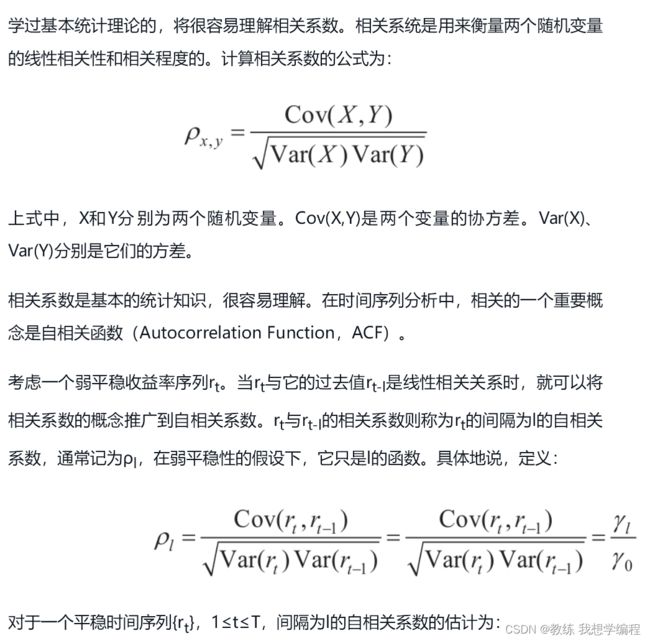

import matplotlib.pyplot as plt

from statsmodels.graphics.tsaplots import plot_acf

%matplotlib inline

fig = plt.figure(figsize=(10,5))

ax1=fig.add_subplot(111)

fig = plot_acf(df['rtn'],ax=ax1,lags=50)

plt.show()

1阶的自相关系数为负值,2阶自相关系数为正值,如果从股票现象来分析的话,今天股票和昨天股票的涨跌和昨天股票涨跌成负相关,今天和前天成正相关,理论上来说是比较何理的,比如昨天涨了,但是今天动力不足,或者利好出货,很有可能下跌,然后明天再次卷土重来,当然要得出这个结论还需要进行很多验证才行,但是感觉上来说,是成立的。