Backtrader 文档学习- Sizers

Backtrader 文档学习- Sizers

1.概述

- 智能仓位

Strategy提供了交易方法,即:buy,sell和close。看一下buy的定义:

def buy(self, data=None,

size=None, price=None, plimit=None,

exectype=None, valid=None, tradeid=0, **kwargs):

注意,如果调用者未指定,则size的默认值为None。Sizers发挥重要作用的地方:

- size=None 请求Strategy向其Sizers请求实际股份

意味着Strategies有一个Sizer:后台机制会向Strategy添加默认的Sizer,如果用户没有添加,则会添加默认的Sizer。strategy的默认Sizer是SizerFix。定义的初始化:

class SizerFix(SizerBase):

params = (('stake', 1),)

默认的Sizer只是使用1单位的stake(无论是股票、合约等)买入/卖出。

2.使用Sizers

(1)From Cerebro

可以通过2种不同的方法向Cerebro添加Sizers:

- addsizer(sizercls, *args, **kwargs)

添加一个Sizer,该Sizer将应用于添加到cerebro的任何策略。这是默认的Sizer。例如:

cerebro = bt.Cerebro()

cerebro.addsizer(bt.sizers.SizerFix, stake=20) # default sizer for strategies

- addsizer_byidx(idx, sizercls, *args, **kwargs)

Sizer仅将添加到引用idx的Strategy中

可以从addstrategy中获取此idx。如:

cerebro = bt.Cerebro()

cerebro.addsizer(bt.sizers.SizerFix, stake=20) # default sizer for strategies

idx = cerebro.addstrategy(MyStrategy, myparam=myvalue)

cerebro.addsizer_byidx(idx, bt.sizers.SizerFix, stake=5)

cerebro.addstrategy(MyOtherStrategy)

在这个例子中:

-

系统中添加了一个默认的Sizer,适用于所有没有指定具体Sizer的策略

-

对于MyStrategy,在得到增加策略的idx后,可以添加一个特定的sizer(更改stake参数)

第二个策略MyOtherStrategy被添加到系统中。没有为它指定特定的Sizer 。

说明:- MyStrategy将最终使用一个内部特定的Sizer

- MyOtherStrategy策略将使用默认Sizer

注意:

default并不意味着策略共享单个Sizer实例。每个strategy都会收到不同的default sizer实例

要共享单个实例,应该共享的sizer应该是单例类。如何定义一个超出了backtrader的范围 。

(2)From Strategy

Strategy类提供了API:setsizer和getsizer(以及sizer属性)来管理Sizer。定义:

- def setsizer(self, sizer):需要一个已经实例化的Sizer

- def getsizer(self):返回当前的Sizer实例

- sizer : 是可以直接get/set的属性

在这种情况下,Sizer可以是: - 作为参数传递给策略

- 在__init__期间使用属性sizer或setsizer设置,如:

class MyStrategy(bt.Strategy):

params = (('sizer', None),)

def __init__(self):

if self.p.sizer is not None:

self.sizer = self.p.sizer

例如,允许在Cerebro调用发生时创建同级别的Sizer,并将其作为参数传递给系统中的所有策略,有效地允许共享Sizer。

3.Sizer Development

Subclass from backtrader.Sizer

This gives you access to self.strategy and self.broker although it shouldn’t be needed in most cases. Things that can be accessed with the broker

data’s position with self.strategy.getposition(data)

complete portfolio value through self.broker.getvalue()

Notice this could of course also be done with self.strategy.broker.getvalue()

Some of the other things are already below as arguments

1.从backtrader.Sizer子类中继承

可以访问self.strategy和self.broker,尽管在大多数情况下不需要。可以使用broker访问

- 使用self.strategy.getposition(data)获取数据仓位

- 通过self.broker.getvalue()获取完整的组合价值

注意,也可以使用self.strategy.broker.getvalue()完成

This method returns the desired size for the buy/sell operation

The returned sign is not relevant, ie: if the operation is a sell operation (isbuy will be False) the method may return 5 or -5. Only the absolute value will be used by the sell operation.

2.重写方法_getsizing(self, comminfo, cash, data, isbuy)

- comminfo:包含有关数据的佣金信息的CommissionInfo实例,允许计算持仓价值、操作成本、操作的佣金

- cash:broker中当前可用的现金

- data:操作的目标

- isbuy:buy操作将为True,sell操作将为False

此方法返回buy/sell操作的所需size

返回的操作信号不相关,比如:如果操作是卖出操作(isbuy将为False),则该方法可以返回5或-5。只有卖出使用绝对值。

Sizer已经传给broker并请求给定数据的佣金信息、实际的现金水平,并提供对数据的直接引用,操作的目的。

FixedSizesizer的定义:

import backtrader as bt

class FixedSize(bt.Sizer):

params = (('stake', 1),)

def _getsizing(self, comminfo, cash, data, isbuy):

return self.params.stake

- 非常简单,因为Sizer不进行任何计算,参数就在那里

- 但该机制应允许构建复杂的Size(又名持仓控制)系统,用于在进入/退出市场时管理仓位。

另外一个例子:仓位反转

class FixedRerverser(bt.FixedSize):

def _getsizing(self, comminfo, cash, data, isbuy):

position = self.broker.getposition(data)

size = self.p.stake * (1 + (position.size != 0))

return size

size = self.p.stake * (1 + (position.size != 0))

- position.size != 0 成立返回True ,1+True = 2

- position.size != 0 不成立返回False ,1+False = 1

基于现有的FixedSize来继承params并覆盖_getsizing:

- 通过属性broker获取数据的position

- 使用position.size来决定是否要加倍stake

- 返回计算出的值

将减轻策略的负担,即决定是否必须撤销或开立头寸,Sizer处于控制之中,并且可以在不影响逻辑的情况下随时更换。

4.Practical Sizer Applicability

Wihtout considering complex sizing algorithms, two different sizers can be used to turn a strategy from Long-Only to Long-Short. Simply by changing the Sizer in the cerebro execution, the strategy will change behavior. A very simple close crosses SMA algorithm:

不考虑复杂的sizer算法,两种不同的sizer可用于将策略从仅做多转变为做多-做空。只需改变cerebro执行中的Sizer,策略就会改变行为。

下面是非常简单的收盘价交叉SMA算法:

class CloseSMA(bt.Strategy):

params = (('period', 15),)

def __init__(self):

sma = bt.indicators.SMA(self.data, period=self.p.period)

self.crossover = bt.indicators.CrossOver(self.data, sma)

def next(self):

if self.crossover > 0:

self.buy()

elif self.crossover < 0:

self.sell()

Notice how the strategy doesn’t consider the current position (by looking at self.position) to decide whether a buy or sell has to actually be done. Only the signal from the CrossOver is considered. The Sizers will be in charge of everything.

注意,策略不考虑当前仓位(通过self.position查看)来决定是否实际买入或卖出。只有考虑来自交叉的信号。sizer将负责一切。

如果仓位已开,此sizer将只负责在卖出时返回非零sizer .

class LongOnly(bt.Sizer):

params = (('stake', 1),)

def _getsizing(self, comminfo, cash, data, isbuy):

if isbuy:

return self.p.stake

# Sell situation

position = self.broker.getposition(data)

if not position.size:

return 0 # do not sell if nothing is open

return self.p.stake

将所有合并(并假设backtrader已经导入并且数据已加载到系统中):

...

cerebro.addstrategy(CloseSMA)

cerebro.addsizer(LongOnly)

...

cerebro.run()

...

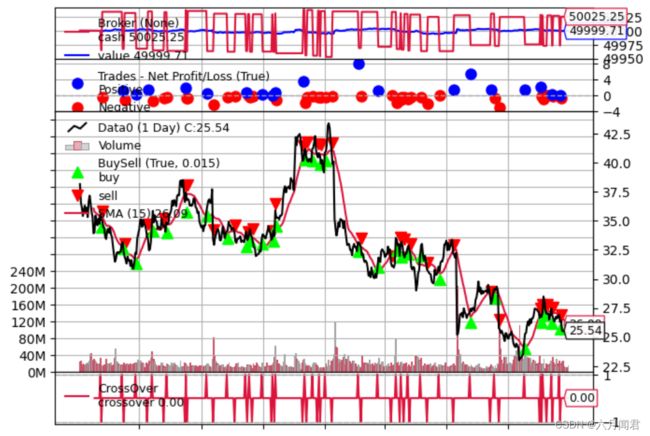

python ./sizertest.py --plot --longonly

图示:

...

cerebro.addstrategy(CloseSMA)

cerebro.addsizer(FixedReverser)

...

cerebro.run()

...

执行

python ./sizertest.py --plot

不同之处:

- 交易数量已经翻倍

- 现金数永远不会回到价值数,因为战略总是在市场中运行

无论如何两种方法都是负面的,不成功的,只是一个例子而已。

5.代码

#!/usr/bin/env python

# -*- coding: utf-8; py-indent-offset:4 -*-

###############################################################################

#

# Copyright (C) 2015-2023 Daniel Rodriguez

#

# This program is free software: you can redistribute it and/or modify

# it under the terms of the GNU General Public License as published by

# the Free Software Foundation, either version 3 of the License, or

# (at your option) any later version.

#

# This program is distributed in the hope that it will be useful,

# but WITHOUT ANY WARRANTY; without even the implied warranty of

# MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

# GNU General Public License for more details.

#

# You should have received a copy of the GNU General Public License

# along with this program. If not, see 6.bt.Sizer Reference

(1)Sizer

class backtrader.Sizer()

Sizers的基类。任何sizer都应该对此子类化并覆盖_getsizing方法

成员属性:

- 策略:将决定Sizer工作

允许访问策略的整个api,例如在_getsizing中需要实际数据仓位时:

position = self.strategy.getposition(data)

- broker:将由Sizer的工作策略决定

提供一些复杂Sizer可能需要的信息,如投资组合价值

(2)getsizing

_getsizing(comminfo, cash, data, isbuy)

方法必须由Sizer的子类覆盖以提供调整功能

参数:

-

comminfo: CommissionInfo 实例包含有关数据佣金的信息,并允许计算头寸价值、运营成本和运营佣金

-

cash: broker中当前可用现金

-

data: 数据源对象

-

isbuy: True 是 buy, False 是 sell

方法必须返回要执行的实际sizer(int)。如果返回0,将不执行任何操作。

将使用返回值的绝对值 。

(3)FixedSize

class backtrader.sizers.FixedSize()

sizer只是为任何操作返回一个固定的sizer。通过指定份额参数,根据系统希望用于交易的份额数量来控制size。

参数:

-

stake(default:1) -

tranches(default:1)

(4)FixedReverser

class backtrader.sizers.FixedReverser()

sizer返回需要的固定sizer 来反转开仓位置,或开仓的固定大小

- 开仓位置参数 stake

- 反转开仓位置: 2 * stake

参数:

stake(default:1)

(5)PercentSizer

class backtrader.sizers.PercentSizer()

sizer返回可用现金的百分比

参数:

percents(default:20)

(6)AllInSizer

class backtrader.sizers.AllInSizer()

sizer返回经纪人的所有可用现金

参数:

percents(default:100)

(7)PercentSizerInt

class backtrader.sizers.PercentSizerInt()

This sizer return percents of available cash in form of size truncated to an int

sizer取整数的int,返回可用现金的百分比 。

参数:

percents(default:20)

(8)AllInSizerInt

class backtrader.sizers.AllInSizerInt()

This sizer return all available cash of broker with the size truncated to an int

sizer返回取整数broker的所有可用现金 。

参数:

percents(default:100)