本期原文选自The Economist 2016-9-24的Leaders板块The low-rate world,释义来自牛津高阶七版、搜狗百科等资源。如果您也在学习The Economist,欢迎订阅我的文集The Economist,一起学习交流。英文修习者可以通过学习文中词汇,然后将商论的官方译文回译成英文,再对照英文原文进行比较,找出差距,以此提高自己的英文水平。

The low-rate world

They do not naturally crave the limelight【1】. But for the past decade the attention on central bankers has been unblinking【2】—and increasingly hostile. During the financial crisis the Federal Reserve and other central banks were hailed for their actions: by slashing rates and printing money to buy bonds, they stopped a shock from becoming a depression. Now their signature policy, of keeping interest rates low or even negative, is at the centre of the biggest macroeconomic debate in a generation.

【1】limelight 公众注意的中心,本意是石灰光(灯)

【2】unblinking 目不转睛地;blink 眨眼,闪烁

The central bankers say that ultra-loose monetary policy【3】 remains essential to prop up still-weak economies and hit their inflation targets. The Bank of Japan (BoJ) this week promised to keep ten-year government bond【4】 yields around zero. On September 21st the Federal Reserve put off a rate rise yet again. In the wake of【5】 the Brexit vote, the Bank of England has cut its main policy rate【6】 to 0.25%, the lowest in its 300-year history.

【3】ultra-loose monetary policy 超宽松货币政策

【4】government bond 政府债券,政府公债

【5】in the wake of 在……之后

【6】policy rate 政策利率

Come Yellen and high water

But a growing chorus of critics frets about【7】 the effects of the low-rate world—a topsy-turvy【8】 place where savers are charged a fee, where the yields on a large fraction of rich-world government debt come with a minus sign, and where central banks matter more than markets in deciding how capital is allocated. Politicians have waded in【9】. Donald Trump, the Republican presidential nominee, has accused Janet Yellen, the Fed’s chairman, of keeping rates low for political reasons. Wolfgang Schäuble, Germany’s finance minister, blames the European Central Bank for the rise of Alternative for Germany, a right-wing party.

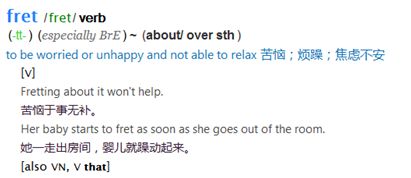

【7】fret about 担忧,焦虑

【8】topsy-turvy 颠倒混乱

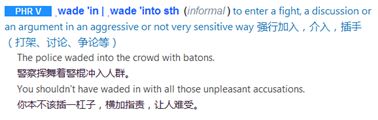

【9】wade in/wade in sth 强行介入;wade涉水

This is a debate on which both sides get a lot wrong. It is too simple to say that central bankers are causing the low-rate world; they are also reacting to it. Real long-term interest rates have been declining for decades, driven by fundamental factors such as ageing populations and the integration of savings-rich China into the world economy (see article). Nor have they been reckless【10】. In most of the rich world inflation is below the official target. Indeed, in some ways central banks have not been bold enough. Only now, for example, has the BoJ explicitly pledged to overshoot【11】 its 2% inflation target. The Fed still seems anxious to push up rates as soon as it can.

【10】reckless 鲁莽的,无所顾忌的

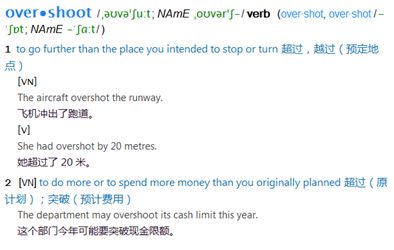

【11】overshoot 超过,突破

Yet the evidence is mounting that the distortions caused by the low-rate world are growing even as the gains are diminishing. The pension-plan deficits of companies and local governments have ballooned【12】 because it costs more to honour【13】 future pension promises when interest rates fall (see article). Banks, which normally make money from the difference between short-term and long-term rates, struggle when rates are flat or negative. That impairs their ability to make loans even to the creditworthy. Unendingly low rates have skewed financial markets, ensuring a big sell-off【14】 if rates were suddenly to rise. The longer this goes on, the greater the perils that accumulate.

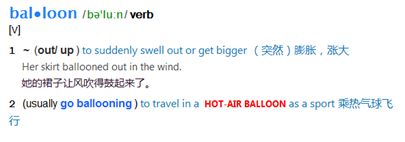

【12】balloon 激增,膨胀;名词本意是气球

【13】honour 信守(承诺)

【14】sell-off 抛售

To live safely in a low-rate world, it is time to move beyond a reliance on central banks. Structural reforms to increase underlying growth rates have a vital role. But their effects materialise only slowly and economies need succour now. The most urgent priority is to enlist【15】 fiscal policy. The main tool for fighting recessions has to shift from central banks to governments.

【15】enlist sth (in sth) 谋取(帮助)

To anyone who remembers the 1960s and 1970s, that idea will seem both familiar and worrying. Back then governments took it for granted that it was their responsibility to pep up【16】 demand. The problem was that politicians were good at cutting taxes and increasing spending to boost the economy, but hopeless at reversing course when such a boost was no longer needed. Fiscal stimulus became synonymous with an ever-bigger state. The task today is to find a form of fiscal policy that can revive the economy in the bad times without entrenching government in the good.

【16】pep up demand 提振需求

That means going beyond the standard response to calls for more public spending: namely, infrastructure investment. To be clear, spending on productive infrastructure is a good thing. Much of the rich world could do with new toll roads, railways and airports, and it will never be cheaper to build them. To manage the risk of white-elephant【17】 projects, private-sector partners should be involved from the start. Pension and insurance funds are desperate for long-lasting assets that will generate the steady income they have promised to retirees. Specialist pension funds can advise on a project’s merits, with one eye on【18】 eventually buying the assets in question.

【17】white-elephant 昂贵而无用之物;白象方便面当时开拓国外市场的时候,就把它的品牌翻译成了white elephant,结果可想而知

【18】with one eye on sth;have one eye/half eye on sth 做一件事时悄悄注意另一件事

But infrastructure spending is not the best way to prop up weak demand. Ambitious capital projects cannot be turned on and off to fine-tune the economy. They are a nightmare to plan, take ages to deliver and risk becoming bogged down【19】 in politics. To be effective as a countercyclical tool, fiscal policy must mimic the best features of modern-day monetary policy, whereby independent central banks can act immediately to loosen or tighten as circumstances require.

【19】bog sth/sb down (in sth) 使陷入烂泥,阻碍

Small-government Keynesianism【20】

Politicians will not—and should not—hand over big budget decisions to technocrats. Yet there are ways to make fiscal policy less politicised and more responsive. Independent fiscal councils, like Britain’s Office for Budget Responsibility, can help depoliticise public-spending decisions, but they do nothing to speed up fiscal action. For that, more automaticity is needed, binding some spending to changes in the economic cycle. The duration and generosity of unemployment benefits could be linked to the overall joblessness rate in the economy, for example. Sales taxes, income-tax deductions or tax-free allowances on saving could similarly vary in line with the state of the economy, using the unemployment rate as the lodestar【21】.

【20】Keynesianism凯恩斯主义(Keynesian),或称凯恩斯主义经济学(Keynesian economics),是根据凯恩斯的著作《就业、利息和货币通论》(1936年)的思想基础上的经济理论,主张国家采用扩张性的经济政策,通过增加需求促进经济增长。(以上释义来自搜狗百科)

【21】lodestar 北极星,指导原则

All this may seem unlikely to happen. Central banks have had to take on so much responsibility since the financial crisis because politicians have so far failed to shoulder theirs. But each new twist on ultra-loose monetary policy has less power and more drawbacks. When the next downturn【22】 comes, this kind of fiscal ammunition will be desperately needed. Only a small share of public spending needs to be affected for fiscal policy to be an effective recession-fighting weapon. Rather than blaming central bankers for the low-rate world, it is time for governments to help them.

【22】downturn 衰退

【小结】

各国央行并没有特别渴望受到关注(limelight),但在过去的十年间,人们对央行官员们持续关注(the attention on central bankers has been unblinking),而且越来越怀有敌意。金融危机期间,美联储和其他央行曾削减利率(slashing rates)、印钱购买债券,从而阻止了经济萧条(recession)。但如今,保持低利率甚至负利率的政策却饱受争议。中央官员认为,要想提振仍旧疲软的经济状况(prop up still-weak economies),仍需采用超宽松货币政策(ultra-loose monetary policy)。日本银行本周承诺将十年期政府公债收益率(government bond yields)保持在零左右。英国脱欧公投之后(in the wake of),英国央行将其主要政策利率(policy rate)降至0.25%,这是300年来的历史最低点。但越来越多的批评之声(chorus of critics)担心(fret about)低利率环境会导致一个颠倒混乱的(topsy-turvy)世界。政治家们已经强行介入(wade in)。央行官员的应对方式并非鲁莽(reckless)之举。央行在某些方面甚至不够大胆(bold enough)。现在日本央行才保证超越(overshoot)2%的通胀目标。低利率环境会造成市场扭曲。当利率降低时,要兑现未来养老金发放的承诺(honour future pension promises)就需要投入更多资金,这造成公司和地方政府的养老金计划赤字激增(balloon)。如果突然加息,必然引发大规模抛售(sell-off)。谋取财政政策的帮助(enlist fiscal policy)才是当务之急。上世纪60年代和70年代,政府认为有责任提振需求(pep up demand)。政治家们擅长通过减税和增加支出的方式提振经济(boost the economy),但不再需要这样的刺激时,指望他们改弦更张则令人失望。投资基础设施(infrastructure)是惯常的应对方式。为了防止产生大而无用(white-elephant)的项目,私营部门一开始就应该参与其中。在针对某个项目的优点提出意见时,专门养老基金也应关注(with one eye on)最终的投资者。基础设施项目需要多年的实施,还可能因政治因素而停滞(bogged down)。可以将失业率作为指导原则(lodestar),依据经济状况来调整营业税(sales taxes)、所得税减免(income-tax deductions)或储蓄免税额(tax-free allowances on saving)。当下一次经济衰退(downturn)来临时,政治家们应肩负责任,使财政政策成为有力的武器。现在,政府不应将低利率世界归咎于央行官员们(blame central bankers for),而应帮助他们。

注:本文仅供学习交流之用,不代表作者观点。