一直想写一些对别人有帮助的文章,可不知道从何处着手。刚在坐享的时候,突然想到(又分神了),我是不是可以试着翻译一些英文文章呢?说干就干,先从最近看到的一篇Ray Dalio(Bridgewater基金管理公司主席)2017年8月10日在Linkedin上发布的文章开始。因为我的会计和金融知识是在加拿大学的英文版,有时候翻译成中文没那么准确,有什么不恰当的地方,请大家指正。

Risks Are Rising While Low Risks Are Discounted

当低风险还被低估时,真正的风险正在上升

There are returns, and there are risks. We think of them individually, and then we combine them into a portfolio. We think of returns and opportunities as coming from those things we’d bet on, and we think of risks as the adverse market consequences of us being wrong due to our being out of balance. We start with our balanced beta portfolio—i.e., that portfolio that would most certainly fund our intended uses of the money. Everyone should have their own based on their own projected uses of money, though more generally, it’s our All Weather portfolio. We then create a balanced portfolio of opportunity/alpha bets based on what we think is likely to happen. We then combine them.

世界上有回报,也有风险。我们单独考虑它们,再合并入一个投资组合中。我们认为投资给我们带来回报和机遇,而风险是由于我们投资组合失衡而导致的错误且有害的市场后果(注:这句话很难翻译,谁有好的建议,请赐教)。我们先来创建一个系统风险平衡型的投资组合(注:Beta是一种评估系统风险的标准),比如,把钱用到打算要用的地方。尽管这看起来更像是一种适合于所有人的投资组合,每个人还是应该根据自己的预期来创建一个属于自己的投资组合。接着,基于可能发生事情的判断,我们再创建一个把机遇和回报有效结合的投资组合(注:Alpha是衡量相对于指数的投资回报)。最后我们把两种投资组合合并起来(注:一种考虑风险,另一种考虑回报)。

We bet on the events/outcomes that we think we have an edge in understanding. For events/outcomes where we don’t think we have a particular edge—e.g., political events—we aim to construct our portfolio to be relatively neutral or balanced to those risks.

我们对于我们理解的事情和结果下注。而对于我们不熟悉的事情和结果,比如政治事件,我们力求创建一个中性或者能平衡风险的投资组合。

Risk and Volatility 风险和波动

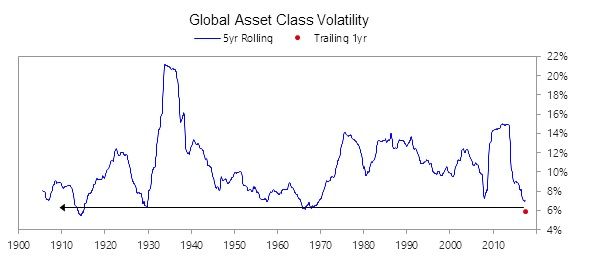

As a rule, periods of lower risk/volatility tend to lead to periods of greater risk/volatility. That is reflected in our aggregate market volatility gauge (see below), and markets are pricing in volatility to remain low next year too.

一般来说,越低的风险和低波期容易引发越大的风险和波动期。这可以从在下面的市场总波动图中反映出来,市场的波动率明年还会保持低位。

As a related rule, people adapt to the circumstances they have experienced and are then surprised when the future is different than the past. In other words, most people are inclined to assume that the circumstances they have recently encountered will persist, which leads them to change what they are doing to be consistent with that recently experienced environment. For example, low-volatility periods in which credit is readily available tend to lead people to assume that it’s safe to borrow more, which leads them to lever up their positions, which contributes to greater volatility and hurts them when things change.

作为一个相关准则,人们容易适应经历过的情况,而当未来和过往不同时,总是大吃一惊。换而言之,大多数人倾向于假设他们最近遇到的情况会一直保持下去,这会导致他们改变正在做的事情,为了和他们经历过的情况保持一致。比如,低波动时期,信用比较宽松,这使人们认为借更多的钱是很安全的,所以他们就借钱投资,最后导致更大的波动而伤害到他们。

That appears to be the case now—i.e., prospective risks are now rising and do not appear appropriately priced in because of a) a backward looking at risk and b) corporate leveraging up has been high because interest rates are low relative to many companies’ projected ROEs and because past risks have been low. The emerging risks appear more political than economic, which makes them especially challenging to price in. Most immediately, during the calm of the August vacation season, we are seeing 1) two confrontational, nationalistic, and militaristic leaders playing chicken with each other, while the world is watching to see which one will be caught bluffing, or if there will be a hellacious war, and 2) the odds of Congress failing to raise the debt ceiling (leading to a technical default, a temporary government shutdown, and increased loss of faith in the effectiveness of our political system) rising. It’s hard to bet on such things, one way or another, so the best that one can do is be neutral to such possibilities.

目前的情况就是这样,比如,可预见的风险正在上升,但貌似没人正确的考虑它们,原因是,一,根据以前的风险来判断现在的风险,二,因为利率相对于企业预期的资产回报率更低和过往的风险已经很低,企业借了很多的钱。正在出现的风险更多的是政治风险,而不是经济风险,这就使得要把风险考虑进来的难度就比较大。就在最近,在安静的8月休假季(注:在北美,很多人会在夏天休带薪假),我们看到,一,两个挑衅的、民族主义的,好斗的领导人(注:美国和朝鲜)互相试胆,而全世界就看着谁只是吓吓对方,或者是否真能引起一场大战;二,国会无法提高债务上限的可能性正在上升(如果真这样,会导致债务违约,政府部门暂时关门,和进一步丧失对我们政治系统有效性的信心)。对于这种事情,我们很难判断,所以最好的方法就是,对于各种可能性保持中立。

When it comes to assessing political matters (especially global geopolitics like the North Korea matter), we are very humble. We know that we don’t have a unique insight that we’d choose to bet on. Most importantly, we aim to stay liquid, stay diversified, and not be overly exposed to any particular economic outcomes. We like to hedge our bets, though we are never completely hedged. We can also say that if the above things go badly, it would seem that gold (more than other safe haven assets like the dollar, yen, and treasuries) would benefit, so if you don’t have 5-10% of your assets in gold as a hedge, we’d suggest that you relook at this. Don’t let traditional biases, rather than an excellent analysis, stand in the way of you doing this (and if you do have an excellent analysis of why you shouldn’t have such an allocation to gold, we’d appreciate you sharing it with us).

当评估政治事件时(特别是类似于朝鲜事件的全球地缘政治),我们非常谦虚。我们知道自己没有独特的洞察力让我们可以选择下注。更重要的是,我们还要保持资产的可变现能力,资产的多样化,和不要让任何特殊的经济结果影响资产。尽管不能完全规避风险,但我们还是喜欢这么做。所以我们说,如果上面提到的事情真的往不好的方向发展,投资黄金(作为一种比美金,日元和国债更安全的资产)可能收益更高。如果你的资产里面还没有5-10%的、作为避险工具的黄金,我们建议你需要重新考虑了。除非你有很好的分析,那就不要让传统的偏见妨碍你这么做(如果你有关于不买黄金很好的分析,请与我们分享)。

结语:翻译完,才发现之前读过一遍的理解是不准确的,虽然继续读,可能会有更多的理解。逐字逐句翻译倒逼我把文章的每一个细节都要准确理解,还要结合上下文,把意思很好的表达出来。以后我会经常翻译一些投资理财类的文章,帮助自己学习的同时,希望对其他人也有帮助。