数据科学 案例5 Logistic回归之构建初始信用评级和分类模型检验(代码)

- 8 逻辑回归

- 1、导入数据和数据清洗

- 2、衍生变量:

- 3、分类变量的相关关系

- 4、线性回归

- 4.1 数据预处理(字符型转化为数值型,查看变量间的关系)

- 4.2 随机抽样,建立训练集与测试集

- 4.3 线性回归

- 4.4 预测

- 4.5 模型评估

- 1、设定阈值

- 2、混淆矩阵

- 3、计算准确率

- 4、绘制ROC曲线

- 5、逻辑回归

- 5.1 包含分类预测变量的逻辑回归

- 5.2 多元逻辑回归

- 6、其他变量处理

8 逻辑回归

信用风险建模案例

数据说明:本数据是一份汽车贷款违约数据

#名称—中文含义

#application_id—申请者ID

#account_number—帐户号

#bad_ind—是否违约

#vehicle_year—汽车购买时间

#vehicle_make—汽车制造商

#bankruptcy_ind—曾经破产标识

#tot_derog—五年内信用不良事件数量(比如手机欠费消号)

#tot_tr—全部帐户数量

#age_oldest_tr—最久账号存续时间(月)

#tot_open_tr—在使用帐户数量

#tot_rev_tr—在使用可循环贷款帐户数量(比如信用卡)

#tot_rev_debt—在使用可循环贷款帐户余额(比如信用卡欠款)

#tot_rev_line—可循环贷款帐户限额(信用卡授权额度)

#rev_util—可循环贷款帐户使用比例(余额/限额)

#fico_score—FICO打分

#purch_price—汽车购买金额(元)

#msrp—建议售价

#down_pyt—分期付款的首次交款

#loan_term—贷款期限(月)

#loan_amt—贷款金额

#ltv—贷款金额/建议售价*100

#tot_income—月均收入(元)

#veh_mileage—行使历程(Mile)

#used_ind—是否二手车

#weight—样本权重

import os

import numpy as np

from scipy import stats

import pandas as pd

import statsmodels.api as sm

import statsmodels.formula.api as smf

import matplotlib.pyplot as plt

?pd.read_csv

1、导入数据和数据清洗

表格中有两行列标签(需注意)

accepts = pd.read_csv(r'.\data\accepts.csv',header =1,encoding='gbk')

accepts2 = accepts.drop([5845,5846,11692]).dropna()

accepts2.head()

|

application_id |

account_number |

bad_ind |

vehicle_year |

vehicle_make |

bankruptcy_ind |

tot_derog |

tot_tr |

age_oldest_tr |

tot_open_tr |

... |

purch_price |

msrp |

down_pyt |

loan_term |

loan_amt |

ltv |

tot_income |

veh_mileage |

used_ind |

weight |

| 0 |

2314049 |

11613 |

1 |

1998 |

FORD |

N |

7 |

9 |

64 |

2 |

... |

17200 |

17350 |

0 |

36 |

17200 |

99 |

6550 |

24000 |

1 |

1 |

| 1 |

63539 |

13449 |

0 |

2000 |

DAEWOO |

N |

0 |

21 |

240 |

11 |

... |

19588.54 |

19788 |

683.54 |

60 |

19588.54 |

99 |

4666.67 |

22 |

0 |

4.75 |

| 3 |

8725187 |

15359 |

1 |

1997 |

FORD |

N |

3 |

10 |

35 |

5 |

... |

12999 |

12100 |

3099 |

60 |

10800 |

118 |

1500 |

10000 |

1 |

1 |

| 4 |

4275127 |

15812 |

0 |

2000 |

TOYOTA |

N |

0 |

10 |

104 |

2 |

... |

26328.04 |

22024 |

0 |

60 |

26328.04 |

122 |

4144 |

14 |

0 |

4.75 |

| 5 |

8712513 |

16979 |

0 |

2000 |

DODGE |

Y |

2 |

15 |

136 |

4 |

... |

26272.72 |

26375 |

0 |

36 |

26272.72 |

100 |

5400 |

1 |

0 |

4.75 |

5 rows × 25 columns

accepts2['tot_rev_line'] = accepts2['tot_rev_line'].astype(float)

accepts2['tot_income'] = accepts2['tot_income'].astype(float)

accepts2['loan_amt'] = accepts2['loan_amt'].astype(float)

accepts2['tot_income'] = accepts2['tot_income'].astype(float)

accepts2['down_pyt'] = accepts2['down_pyt'].astype(float)

accepts2['loan_amt'] = accepts2['loan_amt'].astype(float)

accepts2['tot_rev_debt'] = accepts2['tot_rev_debt'].astype(float)

2、衍生变量:

def divMy(x,y):

import numpy as np

if x==np.nan or y==np.nan:

return np.nan

elif y==0:

return -1

else:

return x/y

divMy(1,2)

0.5

accepts2["dti_hist"]=accepts2[["tot_rev_line","tot_income"]].apply(lambda x:divMy(x[0],x[1]),axis = 1)

accepts2["dti_mew"]=accepts2[["loan_amt","tot_income"]].apply(lambda x:divMy(x[0],x[1]),axis = 1)

accepts2["fta"]=accepts2[["down_pyt","loan_amt"]].apply(lambda x:divMy(x[0],x[1]),axis = 1)

accepts2["nth"]=accepts2[["loan_amt","tot_rev_debt"]].apply(lambda x:divMy(x[0],x[1]),axis = 1)

accepts2["nta"]=accepts2[["loan_amt","tot_rev_line"]].apply(lambda x:divMy(x[0],x[1]),axis = 1)

accepts2.head()

|

application_id |

account_number |

bad_ind |

vehicle_year |

vehicle_make |

bankruptcy_ind |

tot_derog |

tot_tr |

age_oldest_tr |

tot_open_tr |

... |

ltv |

tot_income |

veh_mileage |

used_ind |

weight |

dti_hist |

dti_mew |

fta |

nth |

nta |

| 0 |

2314049 |

11613 |

1 |

1998 |

FORD |

N |

7 |

9 |

64 |

2 |

... |

99 |

6550.00 |

24000 |

1 |

1 |

0.076336 |

2.625954 |

0.000000 |

33.992095 |

34.400000 |

| 1 |

63539 |

13449 |

0 |

2000 |

DAEWOO |

N |

0 |

21 |

240 |

11 |

... |

99 |

4666.67 |

22 |

0 |

4.75 |

12.265920 |

4.197541 |

0.034895 |

0.566061 |

0.342212 |

| 3 |

8725187 |

15359 |

1 |

1997 |

FORD |

N |

3 |

10 |

35 |

5 |

... |

118 |

1500.00 |

10000 |

1 |

1 |

3.964000 |

7.200000 |

0.286944 |

2.687236 |

1.816347 |

| 4 |

4275127 |

15812 |

0 |

2000 |

TOYOTA |

N |

0 |

10 |

104 |

2 |

... |

122 |

4144.00 |

14 |

0 |

4.75 |

0.434363 |

6.353292 |

0.000000 |

-1.000000 |

14.626689 |

| 5 |

8712513 |

16979 |

0 |

2000 |

DODGE |

Y |

2 |

15 |

136 |

4 |

... |

100 |

5400.00 |

1 |

0 |

4.75 |

1.064259 |

4.865319 |

0.000000 |

7.196034 |

4.571554 |

5 rows × 30 columns

3、分类变量的相关关系

3.1 交叉表

cross_table = pd.crosstab(accepts2.used_ind,accepts2.bad_ind, margins=True)

cross_table

| bad_ind |

0 |

1 |

All |

| used_ind |

|

|

|

| 0 |

2914 |

612 |

3526 |

| 1 |

3724 |

960 |

4684 |

| All |

6638 |

1572 |

8210 |

3.2 列联表

def percConvert(ser):

return ser/float(ser[-1])

cross_table = pd.crosstab(accepts2.used_ind,accepts2.bad_ind, margins=True)

cross_table.apply(percConvert, axis=1)

| bad_ind |

0 |

1 |

All |

| used_ind |

|

|

|

| 0 |

0.826432 |

0.173568 |

1.0 |

| 1 |

0.795047 |

0.204953 |

1.0 |

| All |

0.808526 |

0.191474 |

1.0 |

print('''chisq = %6.4f

p-value = %6.4f

dof = %i

expected_freq = %s''' %stats.chi2_contingency(cross_table.iloc[:2, :2]))

chisq = 12.5979

p-value = 0.0004

dof = 1

expected_freq = [[2850.86333739 675.13666261]

[3787.13666261 896.86333739]]

cross_table = pd.crosstab(accepts2.used_ind,accepts2.bad_ind, margins=False)

cross_table = cross_table.div(cross_table.sum(1),axis = 0)

cross_table

print('''chisq = %6.4f

p-value = %6.4f

dof = %i

expected_freq = %s''' %stats.chi2_contingency(cross_table.iloc[:2, :2]))

4、线性回归

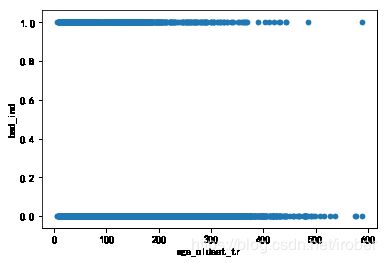

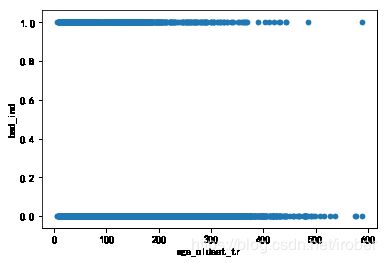

4.1 数据预处理(字符型转化为数值型,查看变量间的关系)

plt.rcParams['font.sans-serif'] = [u'SimHei']

plt.rcParams['axes.unicode_minus'] = False

accepts2['age_oldest_tr'] = accepts2['age_oldest_tr'].astype(int)

accepts2['bad_ind'] = accepts2['bad_ind'].astype(int)

accepts2.plot(x = 'age_oldest_tr',y = 'bad_ind', kind = 'scatter')

4.2 随机抽样,建立训练集与测试集

candidates = ['bad_ind','tot_derog','age_oldest_tr','tot_open_tr','rev_util','fico_score','loan_term','ltv',

'veh_mileage','dti_hist','dti_mew','fta','nth','nta']

accepts2[candidates] = accepts2[candidates].astype(float)

train = accepts2.sample(frac=0.7, random_state=1234).copy()

test = accepts2[~ accepts2.index.isin(train.index)].copy()

print(' 训练集样本量: %i \n 测试集样本量: %i' %(len(train), len(test)))

训练集样本量: 5747

测试集样本量: 2463

4.3 线性回归

lg = smf.glm('bad_ind ~ age_oldest_tr', data=train,

family=sm.families.Binomial(sm.families.links.logit)).fit()

lg.summary()

Generalized Linear Model Regression Results

| Dep. Variable: |

bad_ind |

No. Observations: |

5747 |

| Model: |

GLM |

Df Residuals: |

5745 |

| Model Family: |

Binomial |

Df Model: |

1 |

| Link Function: |

logit |

Scale: |

1.0000 |

| Method: |

IRLS |

Log-Likelihood: |

-2730.8 |

| Date: |

Sat, 15 Feb 2020 |

Deviance: |

5461.6 |

| Time: |

11:24:04 |

Pearson chi2: |

5.89e+03 |

| No. Iterations: |

5 |

Covariance Type: |

nonrobust |

|

coef |

std err |

z |

P>|z| |

[0.025 |

0.975] |

| Intercept |

-0.5769 |

0.065 |

-8.897 |

0.000 |

-0.704 |

-0.450 |

| age_oldest_tr |

-0.0057 |

0.000 |

-13.682 |

0.000 |

-0.006 |

-0.005 |

4.4 预测

train['proba'] = lg.predict(train)

test['proba'] = lg.predict(test)

test['proba'].head(10)

4 0.237216

10 0.155657

13 0.277338

20 0.060517

22 0.235165

25 0.098014

27 0.050966

32 0.193184

51 0.254062

52 0.318912

Name: proba, dtype: float64

4.5 模型评估

1、设定阈值

test['prediction'] = (test['proba'] > 0.3).astype('int')

2、混淆矩阵

pd.crosstab(test.bad_ind, test.prediction, margins=True)

| prediction |

0 |

1 |

All |

| bad_ind |

|

|

|

| 0.0 |

1877 |

138 |

2015 |

| 1.0 |

366 |

82 |

448 |

| All |

2243 |

220 |

2463 |

3、计算准确率

acc = sum(test['prediction'] == test['bad_ind']) /np.float(len(test))

print('The accurancy is %.2f' %acc)

The accurancy is 0.80

for i in np.arange(0.02, 0.3, 0.02):

prediction = (test['proba'] > i).astype('int')

confusion_matrix = pd.crosstab(prediction,test.bad_ind,

margins = True)

precision = confusion_matrix.loc[0, 0] /confusion_matrix.loc['All', 0]

recall = confusion_matrix.loc[0, 0] / confusion_matrix.loc[0, 'All']

Specificity = confusion_matrix.loc[1, 1] /confusion_matrix.loc[1,'All']

f1_score = 2 * (precision * recall) / (precision + recall)

print('threshold: %s, precision: %.2f, recall:%.2f ,Specificity:%.2f , f1_score:%.2f'%(i, precision, recall, Specificity,f1_score))

threshold: 0.02, precision: 0.00, recall:0.50 ,Specificity:0.18 , f1_score:0.00

threshold: 0.04, precision: 0.01, recall:0.94 ,Specificity:0.18 , f1_score:0.02

threshold: 0.06, precision: 0.03, recall:0.92 ,Specificity:0.18 , f1_score:0.06

threshold: 0.08, precision: 0.07, recall:0.93 ,Specificity:0.19 , f1_score:0.14

threshold: 0.1, precision: 0.13, recall:0.92 ,Specificity:0.19 , f1_score:0.23

threshold: 0.12000000000000001, precision: 0.21, recall:0.92 ,Specificity:0.21 , f1_score:0.34

threshold: 0.13999999999999999, precision: 0.27, recall:0.92 ,Specificity:0.21 , f1_score:0.42

threshold: 0.16, precision: 0.35, recall:0.90 ,Specificity:0.22 , f1_score:0.51

threshold: 0.18, precision: 0.44, recall:0.89 ,Specificity:0.23 , f1_score:0.59

threshold: 0.19999999999999998, precision: 0.56, recall:0.87 ,Specificity:0.24 , f1_score:0.68

threshold: 0.22, precision: 0.68, recall:0.87 ,Specificity:0.27 , f1_score:0.77

threshold: 0.24, precision: 0.76, recall:0.85 ,Specificity:0.28 , f1_score:0.81

threshold: 0.26, precision: 0.83, recall:0.85 ,Specificity:0.32 , f1_score:0.84

threshold: 0.28, precision: 0.88, recall:0.85 ,Specificity:0.34 , f1_score:0.86

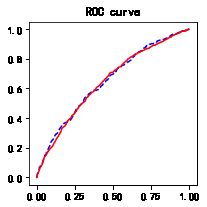

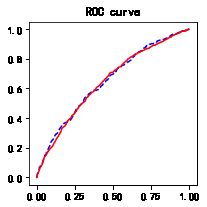

4、绘制ROC曲线

import sklearn.metrics as metrics

fpr_test, tpr_test, th_test = metrics.roc_curve(test.bad_ind, test.proba)

fpr_train, tpr_train, th_train = metrics.roc_curve(train.bad_ind, train.proba)

plt.figure(figsize=[3, 3])

plt.plot(fpr_test, tpr_test, 'b--')

plt.plot(fpr_train, tpr_train, 'r-')

plt.title('ROC curve')

plt.show()

print('AUC = %.4f' %metrics.auc(fpr_test, tpr_test))

AUC = 0.6488

5、逻辑回归

5.1 包含分类预测变量的逻辑回归

formula = '''bad_ind ~ C(used_ind)'''

lg_m = smf.glm(formula=formula, data=train,

family=sm.families.Binomial(sm.families.links.logit)).fit()

lg_m.summary()

Generalized Linear Model Regression Results

| Dep. Variable: |

bad_ind |

No. Observations: |

5747 |

| Model: |

GLM |

Df Residuals: |

5745 |

| Model Family: |

Binomial |

Df Model: |

1 |

| Link Function: |

logit |

Scale: |

1.0000 |

| Method: |

IRLS |

Log-Likelihood: |

-2836.2 |

| Date: |

Sat, 15 Feb 2020 |

Deviance: |

5672.4 |

| Time: |

11:24:31 |

Pearson chi2: |

5.75e+03 |

| No. Iterations: |

4 |

Covariance Type: |

nonrobust |

|

coef |

std err |

z |

P>|z| |

[0.025 |

0.975] |

| Intercept |

-1.5267 |

0.053 |

-29.060 |

0.000 |

-1.630 |

-1.424 |

| C(used_ind)[T.1] |

0.1927 |

0.068 |

2.838 |

0.005 |

0.060 |

0.326 |

5.2 多元逻辑回归

1、向前法

def forward_select(data, response):

remaining = set(data.columns)

remaining.remove(response)

selected = []

current_score, best_new_score = float('inf'), float('inf')

while remaining:

aic_with_candidates=[]

for candidate in remaining:

formula = "{} ~ {}".format(

response,' + '.join(selected + [candidate]))

aic = smf.glm(

formula=formula, data=data,

family=sm.families.Binomial(sm.families.links.logit)

).fit().aic

aic_with_candidates.append((aic, candidate))

aic_with_candidates.sort(reverse=True)

best_new_score, best_candidate=aic_with_candidates.pop()

if current_score > best_new_score:

remaining.remove(best_candidate)

selected.append(best_candidate)

current_score = best_new_score

print ('aic is {},continuing!'.format(current_score))

else:

print ('forward selection over!')

break

formula = "{} ~ {} ".format(response,' + '.join(selected))

print('final formula is {}'.format(formula))

model = smf.glm(

formula=formula, data=data,

family=sm.families.Binomial(sm.families.links.logit)

).fit()

return(model)

candidates = ['bad_ind','tot_derog','age_oldest_tr','tot_open_tr','rev_util','fico_score','loan_term','ltv',

'veh_mileage','dti_hist','dti_mew','fta','nth','nta']

data_for_select = train[candidates]

lg_m1 = forward_select(data=data_for_select, response='bad_ind')

lg_m1.summary()

aic is 5112.102444955438,continuing!

aic is 4930.620746960663,continuing!

aic is 4867.936361578135,continuing!

aic is 4862.177989178937,continuing!

aic is 4856.0240437714365,continuing!

aic is 4853.140577715231,continuing!

aic is 4851.285414957676,continuing!

forward selection over!

final formula is bad_ind ~ fico_score + ltv + age_oldest_tr + rev_util + nth + tot_derog + fta

Generalized Linear Model Regression Results

| Dep. Variable: |

bad_ind |

No. Observations: |

5747 |

| Model: |

GLM |

Df Residuals: |

5739 |

| Model Family: |

Binomial |

Df Model: |

7 |

| Link Function: |

logit |

Scale: |

1.0000 |

| Method: |

IRLS |

Log-Likelihood: |

-2417.6 |

| Date: |

Sat, 15 Feb 2020 |

Deviance: |

4835.3 |

| Time: |

11:24:47 |

Pearson chi2: |

5.60e+03 |

| No. Iterations: |

6 |

Covariance Type: |

nonrobust |

|

coef |

std err |

z |

P>|z| |

[0.025 |

0.975] |

| Intercept |

5.6094 |

0.591 |

9.491 |

0.000 |

4.451 |

6.768 |

| fico_score |

-0.0139 |

0.001 |

-16.606 |

0.000 |

-0.015 |

-0.012 |

| ltv |

0.0278 |

0.002 |

11.201 |

0.000 |

0.023 |

0.033 |

| age_oldest_tr |

-0.0035 |

0.000 |

-7.929 |

0.000 |

-0.004 |

-0.003 |

| rev_util |

0.0010 |

0.000 |

2.564 |

0.010 |

0.000 |

0.002 |

| nth |

0.0004 |

0.000 |

2.529 |

0.011 |

8.63e-05 |

0.001 |

| tot_derog |

0.0253 |

0.011 |

2.271 |

0.023 |

0.003 |

0.047 |

| fta |

-0.6570 |

0.349 |

-1.880 |

0.060 |

-1.342 |

0.028 |

2、计算方差膨胀因子

def vif(df, col_i):

from statsmodels.formula.api import ols

cols = list(df.columns)

cols.remove(col_i)

cols_noti = cols

formula = col_i + '~' + '+'.join(cols_noti)

r2 = ols(formula, df).fit().rsquared

return 1. / (1. - r2)

candidates = ['bad_ind','fico_score','ltv','age_oldest_tr','tot_derog','nth','tot_open_tr','veh_mileage','rev_util']

exog = train[candidates].drop(['bad_ind'], axis=1)

for i in exog.columns:

print(i, '\t', vif(df=exog, col_i=i))

fico_score 1.6474312909303999

ltv 1.0312076990808654

age_oldest_tr 1.2398180183116478

tot_derog 1.387916859405689

nth 1.019005900596472

tot_open_tr 1.130385791173031

veh_mileage 1.0249442971334133

rev_util 1.0857772491871416

train['proba'] = lg_m1.predict(train)

test['proba'] = lg_m1.predict(test)

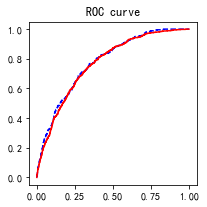

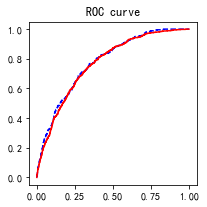

import sklearn.metrics as metrics

fpr_test, tpr_test, th_test = metrics.roc_curve(test.bad_ind, test.proba)

fpr_train, tpr_train, th_train = metrics.roc_curve(train.bad_ind, train.proba)

plt.figure(figsize=[3, 3])

plt.plot(fpr_test, tpr_test, 'b--')

plt.plot(fpr_train, tpr_train, 'r-')

plt.title('ROC curve')

plt.show()

print('AUC = %.4f' %metrics.auc(fpr_test, tpr_test))

AUC = 0.7756

6、其他变量处理

目前vehicle_year、vehicle_make、bankruptcy_ind、used_ind这些分类变量无法通过逐步变量筛选法

解决方案:

- 1、逐一根据显著性测试

- 2、使用决策树等方法筛选变量,但是多分类变量需要事先进行变量概化

- 3、使用WOE转换,多分类变量也需要事先进行概化,使用scorecardpy包中的woe算法可以自动进行概化

使用第一种方法

formula = '''bad_ind ~ fico_score+ltv+age_oldest_tr+tot_derog+nth+tot_open_tr+veh_mileage+rev_util+C(bankruptcy_ind)'''

lg_m = smf.glm(formula=formula, data=train,

family=sm.families.Binomial(sm.families.links.logit)).fit()

lg_m.summary()

Generalized Linear Model Regression Results

| Dep. Variable: |

bad_ind |

No. Observations: |

5747 |

| Model: |

GLM |

Df Residuals: |

5737 |

| Model Family: |

Binomial |

Df Model: |

9 |

| Link Function: |

logit |

Scale: |

1.0000 |

| Method: |

IRLS |

Log-Likelihood: |

-2416.0 |

| Date: |

Sat, 15 Feb 2020 |

Deviance: |

4832.0 |

| Time: |

11:44:38 |

Pearson chi2: |

5.54e+03 |

| No. Iterations: |

6 |

Covariance Type: |

nonrobust |

|

coef |

std err |

z |

P>|z| |

[0.025 |

0.975] |

| Intercept |

5.4394 |

0.596 |

9.122 |

0.000 |

4.271 |

6.608 |

| C(bankruptcy_ind)[T.Y] |

-0.3261 |

0.136 |

-2.397 |

0.017 |

-0.593 |

-0.059 |

| fico_score |

-0.0138 |

0.001 |

-16.393 |

0.000 |

-0.015 |

-0.012 |

| ltv |

0.0290 |

0.002 |

12.024 |

0.000 |

0.024 |

0.034 |

| age_oldest_tr |

-0.0034 |

0.000 |

-7.282 |

0.000 |

-0.004 |

-0.002 |

| tot_derog |

0.0330 |

0.012 |

2.788 |

0.005 |

0.010 |

0.056 |

| nth |

0.0004 |

0.000 |

2.617 |

0.009 |

9.82e-05 |

0.001 |

| tot_open_tr |

-0.0103 |

0.012 |

-0.866 |

0.387 |

-0.034 |

0.013 |

| veh_mileage |

8.365e-07 |

1.17e-06 |

0.713 |

0.476 |

-1.46e-06 |

3.14e-06 |

| rev_util |

0.0011 |

0.000 |

2.610 |

0.009 |

0.000 |

0.002 |