均值回归_Mean Reverting Strategy

0. 引库

%matplotlib inline

import matplotlib.pyplot as plt

import seaborn

plt.style.use('seaborn')

import matplotlib as mpl

mpl.rcParams['font.family'] = 'serif'

import warnings; warnings.simplefilter('ignore')

import numpy as np

import pandas as pd

import tushare as ts

1. 数据准备 & 回测准备

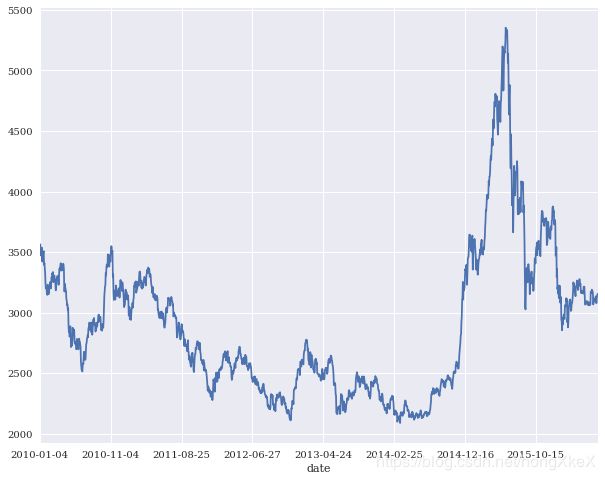

data = ts.get_k_data('hs300', start = '2010-01-01', end='2016-06-30')[['date','close']]

data.rename(columns={'close': 'price'}, inplace=True)

data.set_index('date', inplace = True)

data['price'].plot(figsize = (10,8));

data.head()

|

price |

| date |

|

| 2010-01-04 |

3535.229 |

| 2010-01-05 |

3564.038 |

| 2010-01-06 |

3541.727 |

| 2010-01-07 |

3471.456 |

| 2010-01-08 |

3480.130 |

2. 策略开发思路

data['returns'] = np.log(data['price'] / data['price'].shift(1))

SMA = 50

data['SMA'] = data['price'].rolling(SMA).mean()

data.tail()

|

price |

returns |

SMA |

| date |

|

|

|

| 2016-06-24 |

3077.16 |

-0.012967 |

3135.5614 |

| 2016-06-27 |

3120.54 |

0.013999 |

3132.7446 |

| 2016-06-28 |

3136.40 |

0.005070 |

3129.9560 |

| 2016-06-29 |

3151.39 |

0.004768 |

3127.5396 |

| 2016-06-30 |

3153.92 |

0.000802 |

3126.0490 |

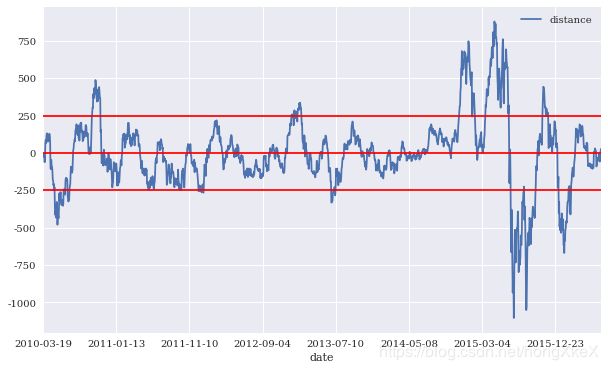

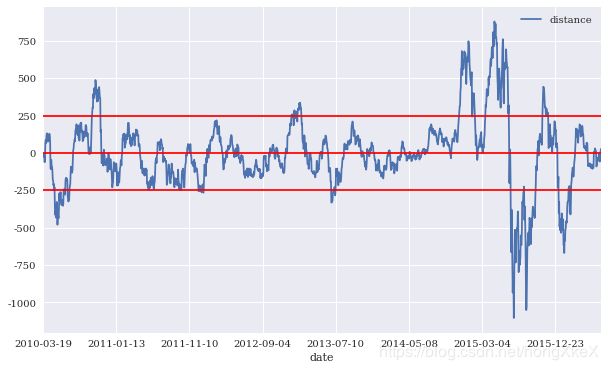

threshold = 250

data['distance'] = data['price'] - data['SMA']

data['distance'].dropna().plot(figsize=(10, 6), legend=True);

plt.axhline(threshold, color='r');

plt.axhline(-threshold, color='r');

plt.axhline(0, color='r');

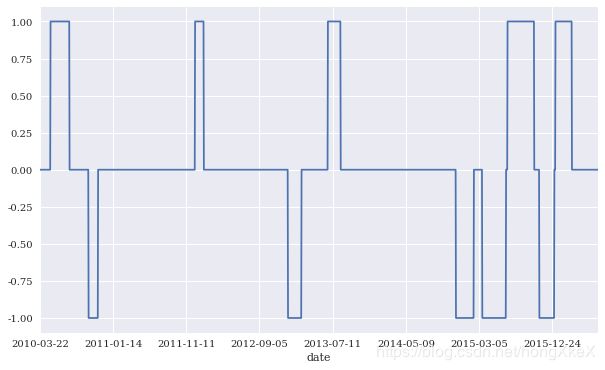

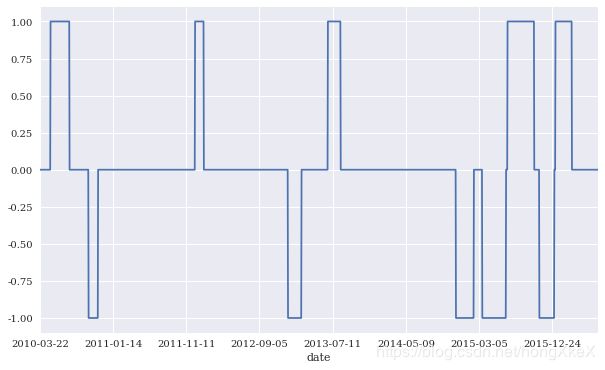

data['position'] = np.where(data['distance'] > threshold, -1, np.nan)

data['position'] = np.where(data['distance'] < -threshold, 1, data['position'])

data['position'] = np.where(data['distance'] * data['distance'].shift(1) < 0, 0, data['position'])

data['position'] = data['position'].ffill().fillna(0)

data['position'].ix[SMA:].plot(ylim=[-1.1, 1.1], figsize=(10, 6));

3. 计算策略年化收益并可视化

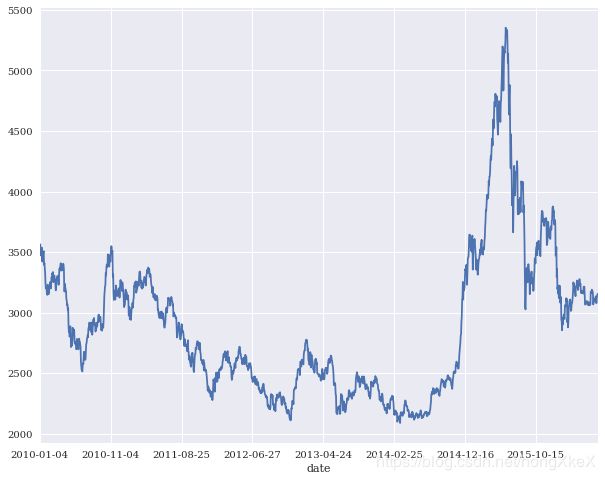

data['strategy'] = data['position'].shift(1) * data['returns']

data[['returns', 'strategy']].dropna().cumsum().apply(np.exp).plot(figsize=(10, 6));

data[['returns', 'strategy']].mean() * 252

returns -0.018261

strategy -0.080739

dtype: float64

策略思想总结

均值回归策略应用了股市投资中经典的高抛低吸思想,该类策略一般在震荡市中表现优异;但在单边趋势行情中一般表现糟糕,往往会大幅跑输市场