本文主要简单介绍下本人工作经历中关于对冲基金的业务:

Hedge Funds:Use wide range of complex and sophisticated Investment Strategies

- Investment Vehicles

- Big Bets

- Wide range of assets

- Specialise in sophisticated investment techniques

Prime Brokerage是为对冲基金提供各类服务的desk:

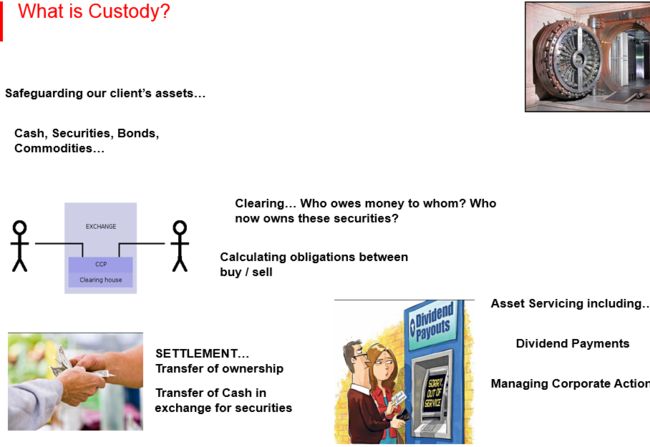

What is Custody(资金托管),主要是保护客户的资产:(cash,securities,bonds,commodities...)

Clearng...who owes money to whom? who now owns theses securities?(谁欠谁钱,谁拥有这些股票等 )

settlement...Transfer of ownership ,transfer of cash ,exchange for securities 所有权的转移

Asset Servcing including... Dividend payments(利率结算)Managing corporate actions.

Trade Execution(交易执行):

PB’s can execute trades on behalf of clients or other brokers, and earn a fee for doing so…

Execution means Broker or dealer who finalises and processes a trade on behalf of a customer by different types of execution – Trading floor, electroninc (market makers), orders being filled.

Order to the floor --NYSE still uses this method today

internalisation--Broker fills order from it's own inventory

Electronic communications network(ECN)-- Automatically Match Buy and Sell orders electronically to fill an order

Order to Market Makers--Used on exchanges such as the NASDAQ

What is Margin?

Margin= Protection from Risk

Risk = Exposure to things which could harm you

Risk Management = Finding and measuring those risks so appropriate action can be taken

Margin = Is a way of identifying and protecting yourself from counterparty and market risk

Cash Management and Financing

Cash management and financing, traditionally performed by the Operations side of a Prime Brokerage.

Hedge Funds have LOTS of Cash,Manage client’s cash and provide them with returns on their cash holdings.

In it’s simplest form, financing is a floating line of credit, usually associated to an underlying benchmark like LIBOR.

Client Reporting

As a Prime Broker, we have an obligation to provide our Hedge Fund clients with daily reporting that is accurate and reflect the latest market data and client positions…