【金融】【python】三因子(three factor)简单模型实证

三因子 three factor 简单模型实证

- 三因子模型实证

本文章原用于financial asset pricing课程,代码部分参考http://www.rhd361.com/special/news?id=3557bb1468c34b48b174f617c5415df0

三因子模型实证

# XXX: 发现参考的源代码有很大的问题,他用%m-%Y来索引排序明显不对啊

# 使用总市值加权计算

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

%config InlineBackend.figure_format = 'svg'

path = "./thrFactorData/STK_MKT_ThrfacDay.xlsx";

data_sample = pd.read_excel(path, skiprows=[1,2]);

data_sample.head()

def handleMonthR(local, Sname):

path = "./"+local+".xlsx";

data_temp = pd.read_excel(path, skiprows=[0,1,2,3], usecols=[0,1,2,3,4,5],

names=['date','t1','t2','t3','t4','r'],skipfooter=1);

# data_temp = data_temp.replace('/','-');

data_temp['datetime'] = pd.to_datetime(data_temp['date']);

data_temp['date_index'] = data_temp['datetime'].apply(lambda x : x.strftime('%Y-%m'));

data_temp.set_index('date_index',inplace=True)

data_temp.sort_index(inplace=True)

data_sep = data_temp.loc[:,['r']]

data_sep.rename(columns={'r': Sname}, inplace=True)

return data_sep

# 准备股票数据:

share_code = ["000002","000725","002024","600276","600848"];

share_name = ["wanke","JDFang","suning","hengrui","SHLinGang"];

data_sep = handleMonthR(share_code[0], share_name[0]);

data_sep = pd.merge(handleMonthR(share_code[1], share_name[1]), data_sep, right_index=True, left_index=True, sort=True, how='inner');

data_sep = pd.merge(handleMonthR(share_code[2], share_name[2]), data_sep, right_index=True, left_index=True, sort=True, how='inner');

data_sep = pd.merge(handleMonthR(share_code[3], share_name[3]), data_sep, right_index=True, left_index=True, sort=True, how='inner');

data_sep = pd.merge(handleMonthR(share_code[4], share_name[4]), data_sep, right_index=True, left_index=True, sort=True, how='inner');

data_sep.head()

data_sample.dropna(how="any", inplace=True);

data_sample.info()

data_sample['date'] = pd.to_datetime(data_sample['TradingDate']);

data_sample['date_index'] = data_sample['date'].apply(lambda x : x.strftime('%Y-%m'))

data_sample.set_index('date_index',inplace=True)

data_sample.sort_index(inplace=True)

# data_sample.drop(["TradingDate"],axis=1,inplace=True)

data_sample.head()

# P9705: 创业板;P9706: 综合A股市场;P9707: 综合B股市场;P9709: 综合A股和创业板; P9710: 综合AB股和创

p9706 = data_sample.loc[data_sample["MarkettypeID"].isin(["P9706"]),["RiskPremium2","SMB2","HML2","date"]]

p9706.info()

p9706['year'] = p9706['date'].apply(lambda x: x.year)

p9706['month'] = p9706['date'].apply(lambda x: x.month)

p9706['day'] = p9706['date'].apply(lambda x: x.day)

p9706 = p9706.groupby(['year', 'month']).apply(lambda t: t[t.day == t.day.max()]).reset_index(drop = True)

p9706['date_index'] = p9706['date'].apply(lambda x : x.strftime('%Y-%m'))

p9706.set_index('date_index',inplace=True)

p9706.sort_index(inplace=True)

# TODO: 不知道为什么drop year 和 month、day会删没了

# p9706 = p9706.drop(['year','month'], axis=1, inplace=True)

plt.title('Three Factor - Total market capitalization weightin')

plt.plot(p9706.values[:,3],p9706.values[:,0])

plt.plot(p9706.values[:,3],p9706.values[:,1])

plt.plot(p9706.values[:,3],p9706.values[:,2])

plt.legend(['Rp','SMB','HML'])

plt.show()

p9706 = p9706.loc[:,['RiskPremium2','SMB2','HML2']]

p9706.head()

import matplotlib.pyplot as plt

%matplotlib inline

%config InlineBackend.figure_format = 'svg'

# 准备无风险利率df

path = "./RESSET债券--月无风险收益率.xlsx";

data_rft = pd.read_excel(path, skiprows=[],names=['date','yy','mm','rft']);

data_rft['date_index'] = data_rft['date'].apply(lambda x : x.strftime('%Y-%m'));

data_rft.set_index('date_index',inplace=True)

data_rft.sort_index(inplace=True)

plt.title('Rft')

plt.plot(data_rft.values[:,0],data_rft.values[:,3])

plt.show()

data_rft = data_rft.loc[:,['date','rft']]

data_rft.head()

finalData = pd.merge(p9706, data_sep, right_index=True, left_index=True, sort=True, how='inner');

finalData = pd.merge(finalData, data_rft, right_index=True, left_index=True, sort=True, how='inner');

# finalData['wanke'] = finalData['r'] - finalData['rft'];

share_name = ["wanke","JDFang","suning","hengrui","SHLinGang"];

for i in share_name:

finalData[i] = finalData[i] - finalData['rft'];

print(finalData.head())

plt.title('Shares')

plt.plot(finalData.values[:,8],finalData.values[:,3])

plt.plot(finalData.values[:,8],finalData.values[:,4])

plt.plot(finalData.values[:,8],finalData.values[:,5])

plt.plot(finalData.values[:,8],finalData.values[:,6])

plt.plot(finalData.values[:,8],finalData.values[:,7])

plt.legend(share_name)

plt.show()

finalData.corr()

import statsmodels.api as sm

x = finalData[["RiskPremium2","SMB2","HML2"]].values;

X = sm.add_constant(x);

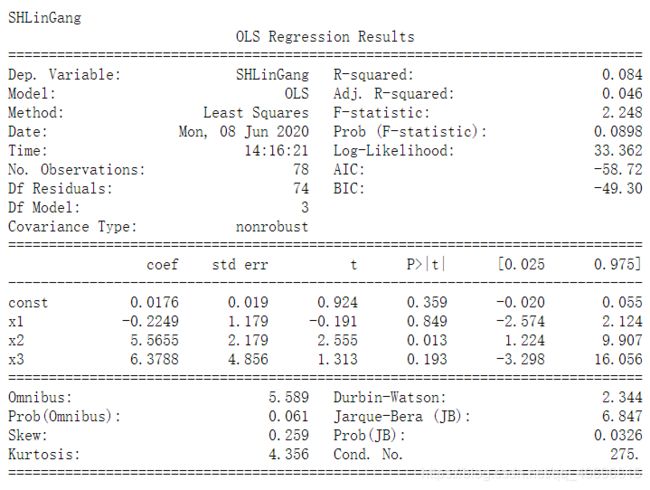

share_name = ["wanke","JDFang","suning","hengrui","SHLinGang"];

for i in share_name:

y = finalData[i];

model = sm.OLS(y, X)

results = model.fit()

print(i)

print(results.summary())

print()

plt.title('share')

plt.plot(finalData.values[:,8],finalData.values[:,3])

plt.plot(finalData.values[:,8],finalData.values[:,4])

plt.plot(finalData.values[:,8],finalData.values[:,5])

plt.plot(finalData.values[:,8],finalData.values[:,6])

plt.plot(finalData.values[:,8],finalData.values[:,7])

plt.plot(finalData.values[:,8], finalData.values[:,1])

plt.plot(finalData.values[:,8], finalData.values[:,2])

plt.legend(["wanke","JDFang","suning","hengrui","SHLinGang",'Rp','SML'])

plt.show()

import statsmodels.api as sm

x = finalData[["RiskPremium1","SMB1"]].values;

X = sm.add_constant(x);

y = finalData['wanke'];

model = sm.OLS(y, X)

results = model.fit()

print(results.summary())