AI训练营金融风控—02EDA探索性数据分析打卡

本学习笔记为阿里金融风控训练营的学习内容,学习链接为:AI训练营金融风控-阿里云天池

我的完整笔记为:AI训练营金融风控 — 02 EDA探索性数据分析打卡_天池notebook-阿里云天池

回顾:

AI训练营金融风控—01赛题理解打卡_宇宙高能量者的博客-CSDN博客

一、学习知识点概要

比赛地址:零基础入门金融风控-贷款违约预测_学习赛_天池大赛-阿里云天池

- 学习如何对数据集整体概况进行分析,包括数据集的基本情况(缺失值,异常值)

- 学习了解变量间的相互关系、变量与预测值之间的存在关系

二、学习内容

- 数据总体了解:

- 读取数据集并了解数据集大小,原始特征维度;

- 通过info熟悉数据类型;

- 粗略查看数据集中各特征基本统计量;

- 缺失值和唯一值:

- 查看数据缺失值情况

- 查看唯一值特征情况

- 深入数据-查看数据类型

- 类别型数据

- 数值型数据

- 离散数值型数据

- 连续数值型数据

- 数据间相关关系

- 特征和特征之间关系

- 特征和目标变量之间关系

- 用pandas_profiling生成数据报告

三、学习问题与解答

1. 读取文件的拓展知识:

- pandas读取数据时相对路径载入报错时,尝试使用os.getcwd()查看当前工作目录。

- TSV与CSV的区别:

- 从名称上即可知道,TSV是用制表符(Tab,'\t')作为字段值的分隔符;CSV是用半角逗号(',')作为字段值的分隔符;

- Python对TSV文件的支持: Python的csv模块准确的讲应该叫做dsv模块,因为它实际上是支持范式的分隔符分隔值文件(DSV,delimiter-separated values)的。 delimiter参数值默认为半角逗号,即默认将被处理文件视为CSV。当delimiter='\t'时,被处理文件就是TSV。

- 读取文件的部分(适用于文件特别大的场景)

- 通过nrows参数,来设置读取文件的前多少行,nrows是一个大于等于0的整数。

- 分块读取

data_train_sample = pd.read_csv("train.csv",nrows=5)#设置chunksize参数,来控制每次迭代数据的大小

i = 0 # 控制输出

chunker = pd.read_csv("train.csv",chunksize=5)

for item in chunker:

print(type(item))

#

print(len(item))

i+=1

if i >= 4: # 由于数据量过大,限制输出4条就跳出循环

break

#5 2. 具体的查看缺失特征及缺失率

# nan可视化

missing = data_train.isnull().sum()/len(data_train)

missing = missing[missing > 0]

missing.sort_values(inplace=True)

missing.plot.bar()3. 查看训练集测试集中特征属性只有一值的特征

one_value_fea = [col for col in data_train.columns if data_train[col].nunique() <= 1]4. 过滤数值型类别特征

#过滤数值型类别特征

def get_numerical_serial_fea(data,feas):

numerical_serial_fea = []

numerical_noserial_fea = []

for fea in feas:

temp = data[fea].nunique()

if temp <= 10:

numerical_noserial_fea.append(fea)

continue

numerical_serial_fea.append(fea)

return numerical_serial_fea, numerical_noserial_fea

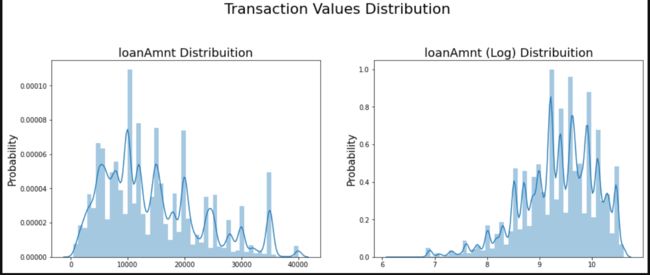

numerical_serial_fea, numerical_noserial_fea = get_numerical_serial_fea(data_train,numerical_fea)5. 数值连续型变量分析

#每个数字特征得分布可视化

# 这里画图估计需要10-15分钟

f = pd.melt(data_train, value_vars=numerical_serial_fea)

g = sns.FacetGrid(f, col="variable", col_wrap=2, sharex=False, sharey=False)

g = g.map(sns.distplot, "value")- 查看某一个数值型变量的分布,查看变量是否符合正态分布,如果不符合正太分布的变量可以log化后再观察下是否符合正态分布。

- 如果想统一处理一批数据变标准化 必须把这些之前已经正态化的数据剔除

- 正态化的原因:一些情况下正态非正态可以让模型更快的收敛,一些模型要求数据正态(eg. GMM、KNN),保证数据不要过偏态即可,过于偏态可能会影响模型预测结果。

6. 单一变量分布可视化

plt.figure(figsize=(8, 8))

sns.barplot(data_train["employmentLength"].value_counts(dropna=False)[:20],

data_train["employmentLength"].value_counts(dropna=False).keys()[:20])

plt.show()7. 根绝y值不同可视化x某个特征的分布

- 首先查看类别型变量在不同y值上的分布

train_loan_fr = data_train.loc[data_train['isDefault'] == 1]

train_loan_nofr = data_train.loc[data_train['isDefault'] == 0]fig, ((ax1, ax2), (ax3, ax4)) = plt.subplots(2, 2, figsize=(15, 8))

train_loan_fr.groupby('grade')['grade'].count().plot(kind='barh', ax=ax1, title='Count of grade fraud')

train_loan_nofr.groupby('grade')['grade'].count().plot(kind='barh', ax=ax2, title='Count of grade non-fraud')

train_loan_fr.groupby('employmentLength')['employmentLength'].count().plot(kind='barh', ax=ax3, title='Count of employmentLength fraud')

train_loan_nofr.groupby('employmentLength')['employmentLength'].count().plot(kind='barh', ax=ax4, title='Count of employmentLength non-fraud')

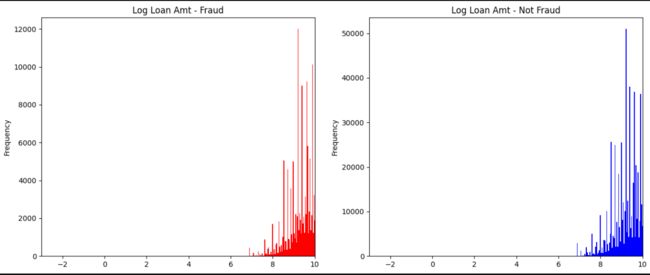

plt.show()- 其次查看连续型变量在不同y值上的分布

fig, ((ax1, ax2)) = plt.subplots(1, 2, figsize=(15, 6))

data_train.loc[data_train['isDefault'] == 1] \

['loanAmnt'].apply(np.log) \

.plot(kind='hist',

bins=100,

title='Log Loan Amt - Fraud',

color='r',

xlim=(-3, 10),

ax= ax1)

data_train.loc[data_train['isDefault'] == 0] \

['loanAmnt'].apply(np.log) \

.plot(kind='hist',

bins=100,

title='Log Loan Amt - Not Fraud',

color='b',

xlim=(-3, 10),

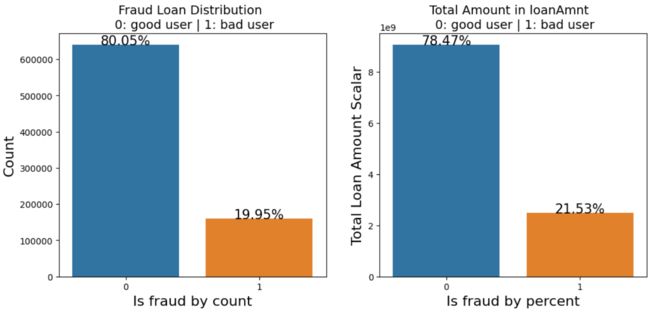

ax=ax2)total = len(data_train)

total_amt = data_train.groupby(['isDefault'])['loanAmnt'].sum().sum()

plt.figure(figsize=(12,5))

plt.subplot(121)##1代表行,2代表列,所以一共有2个图,1代表此时绘制第一个图。

plot_tr = sns.countplot(x='isDefault',data=data_train)#data_train‘isDefault’这个特征每种类别的数量**

plot_tr.set_title("Fraud Loan Distribution \n 0: good user | 1: bad user", fontsize=14)

plot_tr.set_xlabel("Is fraud by count", fontsize=16)

plot_tr.set_ylabel('Count', fontsize=16)

for p in plot_tr.patches:

height = p.get_height()

plot_tr.text(p.get_x()+p.get_width()/2.,

height + 3,

'{:1.2f}%'.format(height/total*100),

ha="center", fontsize=15)

percent_amt = (data_train.groupby(['isDefault'])['loanAmnt'].sum())

percent_amt = percent_amt.reset_index()

plt.subplot(122)

plot_tr_2 = sns.barplot(x='isDefault', y='loanAmnt', dodge=True, data=percent_amt)

plot_tr_2.set_title("Total Amount in loanAmnt \n 0: good user | 1: bad user", fontsize=14)

plot_tr_2.set_xlabel("Is fraud by percent", fontsize=16)

plot_tr_2.set_ylabel('Total Loan Amount Scalar', fontsize=16)

for p in plot_tr_2.patches:

height = p.get_height()

plot_tr_2.text(p.get_x()+p.get_width()/2.,

height + 3,

'{:1.2f}%'.format(height/total_amt * 100),

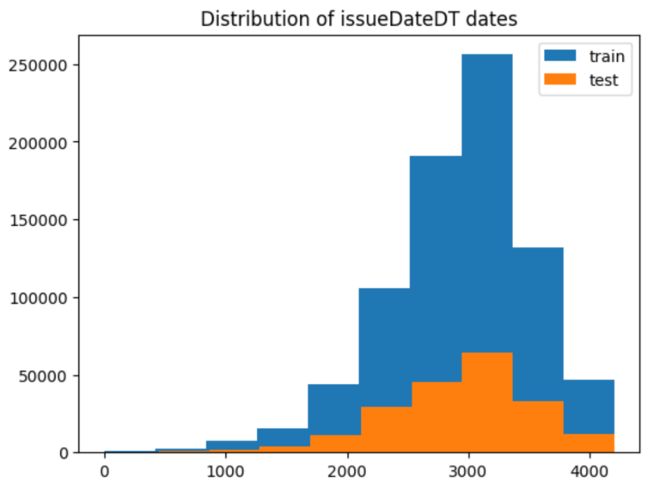

ha="center", fontsize=15) 8. 时间格式数据处理及查看

#转化成时间格式 issueDateDT特征表示数据日期离数据集中日期最早的日期(2007-06-01)的天数

data_train['issueDate'] = pd.to_datetime(data_train['issueDate'],format='%Y-%m-%d')

startdate = datetime.datetime.strptime('2007-06-01', '%Y-%m-%d')

data_train['issueDateDT'] = data_train['issueDate'].apply(lambda x: x-startdate).dt.daysplt.hist(data_train['issueDateDT'], label='train');

plt.hist(data_test_a['issueDateDT'], label='test');

plt.legend();

plt.title('Distribution of issueDateDT dates');

#train 和 test issueDateDT 日期有重叠 所以使用基于时间的分割进行验证是不明智的9. 掌握透视图可以让我们更好的了解数据

#透视图 索引可以有多个,“columns(列)”是可选的,聚合函数aggfunc最后是被应用到了变量“values”中你所列举的项目上。

pivot = pd.pivot_table(data_train, index=['grade'], columns=['issueDateDT'], values=['loanAmnt'], aggfunc=np.sum)10. 用pandas_profiling生成数据报告

import pandas_profiling

pfr = pandas_profiling.ProfileReport(data_train)

pfr.to_file("./example.html")四、学习思考与总结

数据探索性分析是我们初步了解数据,熟悉数据为特征工程做准备的阶段,甚至很多时候EDA阶段提取出来的特征可以直接当作规则来用。可见EDA的重要性,这个阶段的主要工作还是借助于各个简单的统计量来对数据整体的了解,分析各个类型变量相互之间的关系,以及用合适的图形可视化出来直观观察。