pandas_样本(资产)组合产品的绩效评价

目录

1. 产品描述并生成产品

2. 计算产品的年化收益率、年化波动率

3. 计算产品的历史日收益率

4. 计算产品的日VaR

5. 计算产品的最大回撤

6. 计算产品的夏普比率

7. 计算产品的Beta值(β)和Jensen's Alpha(α)

8. 计算产品的特雷诺比率

9. 绘制产品净值曲线

数据:

1. 产品描述并生成产品

1.1 产品需求:某个客户需要9%的收益率,对该客户进行组合优化配置,设计适合该客户的金融产品雏形

1.2 设计符合要求的产品

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

df_004 = pd.read_csv('600004.csv',encoding='utf-8')

df_015 = pd.read_csv('600015.csv',encoding='utf-8')

df_023 = pd.read_csv('600023.csv',encoding='utf-8')

df_033 = pd.read_csv('600033.csv',encoding='utf-8')

df_343 = pd.read_csv('600343.csv',encoding='utf-8')

df_346 = pd.read_csv('600346.csv',encoding='utf-8')

df_183 = pd.read_csv('600183.csv',encoding='utf-8')

df_1398 = pd.read_csv('601398.csv',encoding='utf-8')

df_050 = pd.read_csv('600050.csv',encoding='utf-8')

df_000 = pd.read_csv('600000.csv',encoding='utf-8')

df_004['ret_004'] = df_004['closePrice'].pct_change()

df_004 = df_004.loc[:,['tradeDate','ret_004']]

df_015['ret_015'] = df_015['closePrice'].pct_change()

df_015 = df_015.loc[:,['tradeDate','ret_015']]

df_023['ret_023'] = df_023['closePrice'].pct_change()

df_023 = df_023.loc[:,['tradeDate','ret_023']]

df_033['ret_033'] = df_033['closePrice'].pct_change()

df_033 = df_033.loc[:,['tradeDate','ret_033']]

df_343['ret_343'] = df_343['closePrice'].pct_change()

df_343 = df_343.loc[:,['tradeDate','ret_343']]

df_346['ret_346'] = df_346['closePrice'].pct_change()

df_346 = df_346.loc[:,['tradeDate','ret_346']]

df_183['ret_183'] = df_183['closePrice'].pct_change()

df_183 = df_183.loc[:,['tradeDate','ret_183']]

df_1398['ret_1398'] = df_1398['closePrice'].pct_change()

df_1398 = df_1398.loc[:,['tradeDate','ret_1398']]

df_050['ret_050'] = df_050['closePrice'].pct_change()

df_050 = df_050.loc[:,['tradeDate','ret_050']]

df_000['ret_000'] = df_000['closePrice'].pct_change()

df_000 = df_000.loc[:,['tradeDate','ret_000']]

ten_df = pd.merge(df_004,df_015,on='tradeDate')

ten_df = pd.merge(ten_df,df_023,on='tradeDate')

ten_df = pd.merge(ten_df,df_033,on='tradeDate')

ten_df = pd.merge(ten_df,df_343,on='tradeDate')

ten_df = pd.merge(ten_df,df_346,on='tradeDate')

ten_df = pd.merge(ten_df,df_183,on='tradeDate')

ten_df = pd.merge(ten_df,df_1398,on='tradeDate')

ten_df = pd.merge(ten_df,df_050,on='tradeDate')

ten_df = pd.merge(ten_df,df_000,on='tradeDate')

ten_df.dropna(inplace=True)

ten_df['tradeDate'] = pd.to_datetime(ten_df['tradeDate'])

ten_df.set_index('tradeDate',inplace=True)

def annualize_rets(returns,n_periods):

'''

给定一系列的收益率和期数,算出年化收益率

'''

# 每一期的平均收益

r_periodic_mean = ((1+returns).prod())**(1/returns.shape[0])-1

return (1+r_periodic_mean)**n_periods-1

def annualize_std(returns,n_periods):

'''

给定一系列的收益率,算出年化的标准差

'''

return returns.std()*np.sqrt(n_periods)

def portfolio_return(weights,returns):

'''

计算投资组合收益率,weights和returns需要矩阵形式

weights是组合资产的权重

returns是组合中的资产年化收益率

'''

return weights.T @ returns

def portfolio_vol(weights,covmat):

'''

计算投资组合风险(波动率),weights和covmat需要矩阵形式

covmat代表的是协方差矩阵

'''

return np.sqrt(weights.T @ covmat @ weights)

def get_gmvp(covmat):

'''

寻找全局最小方差点

covmat 代表资产之间的协方差矩阵

'''

from scipy.optimize import minimize

n = covmat.shape[0]

init_guess = np.repeat(1/n,n)

bounds = ((0.0,1.0),)*n #每个资产的权重在0~1之间

weights_sum_to_1 = {'type':'eq','fun': lambda weights:np.sum(weights)-1}

weights = minimize(portfolio_vol,init_guess,args=(covmat,),method='SLSQP',bounds=bounds,constraints=(weights_sum_to_1))

return weights.x

def minimize_vol(target_return,annual_rets,covmat):

'''

最小方差边界函数

target_return 为客户所要求的收益率水平

annual_rets 代表组合中的资产的年化收益率

covmat 代表资产之间的协方差矩阵

'''

from scipy.optimize import minimize

n = annual_rets.shape[0]

init_guess = np.repeat(1/n,n)

bounds = ((0.0,1.0),)*n #每个资产的权重在0~1之间

weights_sum_to_1 = {'type':'eq','fun': lambda weights:np.sum(weights)-1}

return_is_target = {'type':'eq','args':(annual_rets,),'fun': lambda weights,annual_rets: portfolio_return(weights,annual_rets)-target_return}

weights = minimize(portfolio_vol,init_guess,args=(covmat,),method='SLSQP',bounds=bounds,constraints=(weights_sum_to_1,return_is_target))

return weights.x

def var_historic(r,level=5):

'''

给定一个DataFrame或者Series,计算VaR

注意:5%的显著性水平要写成5,而不是0.05

'''

if isinstance(r,pd.Series):

return abs(np.percentile(r,level))

elif isinstance(r,pd.DataFrame):

return r.aggregate(var_historic,level=level)

else:

raise TypeError('收益率必须为DataFrame或Series')

def drawdown(return_series:pd.Series):

'''

把一个时间序列做成最大回撤的表格

表格字段为:

财富指数

上一个最大值

回撤率

'''

wealth = 1*(1+return_series).cumprod()

previos_max = wealth.cummax()

drawdowns = (wealth-previos_max)/previos_max

return pd.DataFrame({'wealth':wealth,

'previos_max':previos_max,

'drawdowns':drawdowns})该产品选择了10个标的,计算这10个标的各自的年化收益率和年化协方差

er_009 = annualize_rets(ten_df,252)

cov_009 = np.cov(ten_df,rowvar=False)*252检查该产品的gmvp的收益率是否小于指定的收益率0.09,成立,则该产品有效

gmvp_10samples_weights = get_gmvp(cov_009)

gmvp_10samples_ret = portfolio_return(gmvp_10samples_weights,er_009)

gmvp_10samples_ret

# out: 0.07938558348434649该产品gmvp的收益率为0.07938558348434649,小于0.09,该产品有效

2. 计算产品的年化收益率、年化波动率

计算出该产品最优投资组合对应的权重,计算该权重下的年化收益率和年化波动率

fund_009_weights = minimize_vol(0.09,er_009,cov_009)

fund_009_weightsfund_009_ret = portfolio_return(fund_009_weights,er_009)

fund_009_vol = portfolio_vol(fund_009_weights,cov_009)

fund_009_ret,fund_009_vol![]()

3. 计算产品的历史日收益率

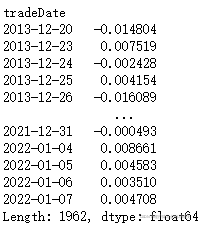

根据各个标的的日收益率历史数据和产品的权重,往回推算出产品的历史日收益率

计算产品的日收益率

daily_ret_fund009 = ten_df@fund_009_weights

daily_ret_fund0094. 计算产品的日VaR

# 历史模拟法计算

VaR_fund009 = var_historic(daily_ret_fund009)

VaR_fund009![]()

根据1962天的历史日数据得出,在95%置信水平下,每天损失不会操作1.6218%,只有5%的概率,该产品损失会超过1.6218%;也可以说在未来100天内,有5天该产品每天损失会超过1.6218%。

到这一步VaR的结果,看客户是否能接受这样的风险,如果不能接受,重新设计产品

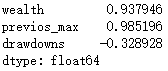

5. 计算产品的最大回撤

res_maxdrawdown = drawdown(daily_ret_fund009)

res_maxdrawdown.min()该产品最大回撤为32.89%,如果客户无法接受,重新设计产品

# 回撤曲线

res_maxdrawdown.plot(y='drawdowns')6. 计算产品的夏普比率

# 夏普比率

rf = 0.0135

sharpe_009 = (fund_009_ret-rf)/fund_009_vol

sharpe_009

# out: 0.40281471239506337. 计算产品的Beta值(β)和Jensen's Alpha(α)

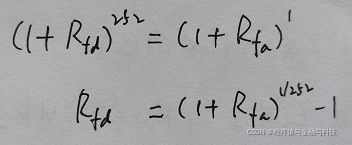

计算无风险资产的日收益率,已知的国债收益率0.0135是年化收益率,要从年化收益率反推出日收益率

# 计算无风险资产的日收益率

rf_daily = (1+rf)**(1/252)-1

rf_daily

# out: 5.321445913253342e-05获取沪深300指数的历史日收益率

hs300_df = pd.read_csv('index_hs300.csv',encoding='utf-8')

hs300_df['ret_hs300'] = hs300_df['closeIndex'].pct_change()

hs300_df['tradeDate'] = pd.to_datetime(hs300_df['tradeDate'])

hs300_df = hs300_df.loc[:,['tradeDate','ret_hs300']]

hs300_df.set_index('tradeDate',inplace=True)

hs300_df.dropna(inplace=True)

ten_hs300_df = pd.merge(ten_df,hs300_df,on='tradeDate')

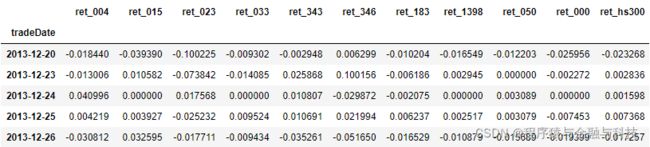

ten_hs300_df.head()market_return_daily = ten_hs300_df['ret_hs300']

# 产品的扣除无风险收益后的收益

excess_ret_fund009 = daily_ret_fund009-rf_daily

# 沪深300扣除无风险收益后的收益

excess_ret_market = market_return_daily-rf_daily

# 给市场组合超额收益加一列1

excess_ret_market = pd.DataFrame(excess_ret_market)

excess_ret_market['Constant'] = 1

# 对市场组合超额收益和产品超额收益做线性回归,寻找alpha和beta

import statsmodels.api as stm

lr = stm.OLS(excess_ret_fund009,excess_ret_market).fit()

lr.summary()取出Beta和Alpha

beta = lr.params[0]

alpha = lr.params[1]

beta,alpha

# out: (0.6575807102116948, 0.00018512144578591218)计算年化Alpha

# 计算年化Alpha

annual_alpha = (1+alpha)**252-1

annual_alpha

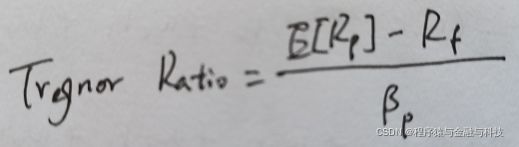

# out: 0.0477513401089308958. 计算产品的特雷诺比率

# 计算特雷诺比率

treynor_009 = (fund_009_ret-rf)/beta

treynor_009

# out: 0.116335529331276869. 绘制产品净值曲线

# 计算009产品的财富指数

fund_009_wealth = 1*(1+daily_ret_fund009).cumprod()

benchmarket_wealth = 1*(1+market_return_daily).cumprod()

df = pd.DataFrame({'fund_009_wealth':fund_009_wealth,'benchmarket_wealth':benchmarket_wealth})

df.plot(figsize=(8,6))数据:

链接:https://pan.baidu.com/s/1Y0aGIbpRdSs2waz_yF008A

提取码:101n