股票因子--IC分析

导入相关的库

import numpy as np

import pandas as pd

import warnings

warnings.filterwarnings("ignore")获取基础数据,使用流通市值因子

factor_name = 'mv' #流通市值

factor = pd.read_csv('mv_zz500.csv', index_col=0)

factor.index = [pd.to_datetime(str(dt)) for dt in factor.index]

if factor_name == 'mv':

factor = np.log(factor.replace(0., np.nan)) #把0替换成NaN,因为0无法取log

stocks = factor.columns.tolist() #获取股票代码列表

factor.head(3)

# 查看是否有缺失值

factor.isna().any().any()

# 获取中信一级行业分类信息

industry_info = pd.read_csv('info_zz500.csv', index_col=0)

industry_info.head(3)进行数据预处理

1)去极值

# 定义函数,for循环也可用pandas的向量化操作

def winsorize(df):

new_data = []

for i in range(len(df)):

df_i = df.iloc[i, :]

df_i_median = df_i.median()

mad = (df_i - df_i_median).abs().median()

max_range = df_i_median + 5 * mad

min_range = df_i_median - 5 * mad

df_i_new = np.clip(df_i, min_range, max_range)

new_data.append(df_i_new)

new_df = pd.concat(new_data, axis=1).T

return new_df

factor1 = winsorize(factor)

factor1.head(3)

factor1.T.describe()2)标准化

# 定义函数。for循环课用pd向量化操作

def standardize(df):

new_data = []

for i in range(len(df)):

df_i = df.iloc[i, :]

mu = df_i.mean()

sigma = df_i.std()

df_i_new = (df_i - mu)/sigma

new_data.append(df_i_new)

new_df = pd.concat(new_data, axis=1).T

return new_df

factor2 = standardize(factor1)

factor2.head(3)

factor2.T.describe().iloc[:,0:5]3)缺失值填充

factor3 = factor2.fillna(0)

factor3.T.describe().iloc[:, 0:5]4)预处理函数封装

def preprocess(df):

return standardize(winsorize(df))

# return standardize(winsorize(df)).fillna(0) #如果涉及填充NaN的话

factor_processed = preprocess(factor)

factor_processed.T.describe().iloc[:,0:5]结果如下

因子IC分析(IC=corr(dt,Rt+1))

1)读取收益率

# 收益率矩阵

ret = pd.read_csv('returns_zz500.csv', index_col=0)

ret.index = [pd.to_datetime(str(dt)) for dt in ret.index]

ret = ret * 0.01

# 下个交易日收益率矩阵

tmr_ret = ret.shift(-1)

print(factor_processed.shape)

print(tmr_ret.shape)2)IC累计计算及可视化

IC_series = factor_processed.corrwith(tmr_ret, axis=1)

IC_series.cumsum().plot()3)Rank IC:对因子值与明天收益率求rank,然后计算相关系数。两个变量求rank后计算的相关系数为Spearman相关系数。累计Rank IC的结果如下。

4)计算IR和胜率

IR: information ratio, IC的均值与标准差的比值,衡量IC的稳定性

胜率: IC大于0的比率,与0.5相差越大越好

IR = IC_series.mean()/IC_series.std()

print('IR is :', IR)

IR = rank_IC_series.mean()/rank_IC_series.std()

print('Rank IR is:', IR)

win_rate = (rank_IC_series > 0).sum()/rank_IC_series.count()

print('win rate is:', win_rate)计算结果为:

IR is : -0.23846143211969653 Rank IR is: -0.1587782467617657 win rate is: 0.4444444444444444

5)考虑行业中性

需要把原始因子对行业哑变量和市值变量一起回归,回归残差作为新的因子

# 将行业信息按照stocks名称重新排列(一个是factor表,一个是industry_info表),stocks里面为从factor表中取出的所有股票的股票代码

industry_info = industry_info.set_index('S_INFO_WINDCODE').reindex(index=stocks)

industry_info.head(5)

# 对每天先按照行业对列分组 -- by=industry_info['INDUSTRIESNAME'], axis=1

# 然后行业内,对每只股票减去行业均值 -- x.sub(x.mean(axis=1), axis=0)

factor_rank_ind = factor_processed.groupby(

by=industry_info['INDUSTRIESNAME'],

axis=1,

group_keys=False,

).apply(lambda x: x.sub(x.mean(axis=1), axis=0))

factor_rank_ind.head(3)

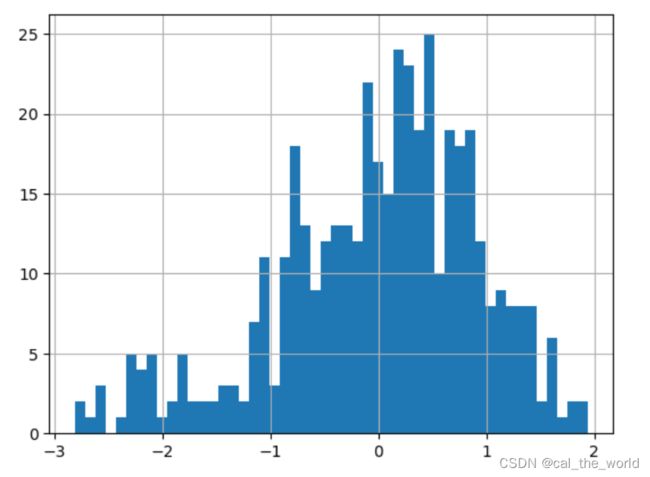

factor_rank_ind.iloc[0].hist(bins=50)取出行业均值的Rank IC满足如下直方分布

计算秩的相关性并可视化行业中性后的累积Rank IC

rank_IC_series1 = factor_rank_ind.corrwith(tmr_ret, axis=1,

method='spearman')

rank_IC_series1.cumsum().plot()最后计算行业中性后的IR

IR = rank_IC_series1.mean()/rank_IC_series1.std()

print('Rank_ind IR is:', IR)结果为:

Rank_ind IR is: -0.15211939082931858