Backtrader 文档学习-Order StopTrail(Limit)

Backtrader 文档学习-Order StopTrail(Limit)

1.概述

版本1.9.36.116之后支持[StopTrail, StopTrailLimit and OCO]的订单类型,并支持broker的实时交互 。

StopTrail订单,它是一种追踪止损订单。当市场价格朝定义的交易方向移动时,StopTrail订单会自动调整止损价,以便保护您的利润。当市场价格达到您的止损价格时,订单将被触发并执行。类似于追踪止盈的概念。

- OCO:始终将第一笔order作为oco的参数。

- StopTrailLimit:broker模拟和IB broker具有相同的行为。指定:价格作为初始停止触发价格(还要指定trailamount),然后plimit作为初始限价。两者之间的差异将确定limitoffset(限价与停止触发价格保持的距离)。

使用模式完全集成到策略实例的标准buy、sell和close市场操作方法中。注意:

- 指标希望的执行类型,如exectype=bt.Order.StopTrail

- 跟踪价格必须使用固定距离,或使用基于百分比的距离计算

- 固定距离:trailamount=10

- 基于距离的百分比:trailpercent=0.02(即:2%)

如果通过发出买单进入多头市场,则使用StopTrail和trailamount的卖单如下所示:

- 如果未指定price,则使用最新的收盘价

- trailamount从price中减去以找到stop价格(或触发价格) stop = price - trailamount

- next 的迭代中,broker检查触发价格是否已达到

- 如果是:订单将使用Market执行类型方法执行

- 如果不是,则通过使用最新的close并减去trailamount距离来重新计算停止价格

- 如果新价格上涨,则更新

- 如果新价格会下降(或根本不会改变),则会被丢弃

就是说:通过buy进入市场,跟踪止损价格向上跟随价格,但如果价格开始下跌,则保持不变,以潜在地确保利润。

如果通过sell进入市场,发出带有StopTrail的买单只是做相反的事情,即:价格向下跟随。

- 通过buy进入市场,跟踪止损价格向上跟随价格

- 通过sell进入市场,跟踪止损价格向下跟随价格

2.使用模式

# For a StopTrail going downwards

# last price will be used as reference

self.buy(size=1, exectype=bt.Order.StopTrail, trailamount=0.25)

# or

self.buy(size=1, exectype=bt.Order.StopTrail, price=10.50, trailamount=0.25)

# For a StopTrail going upwards

# last price will be used as reference

self.sell(size=1, exectype=bt.Order.StopTrail, trailamount=0.25)

# or

self.sell(size=1, exectype=bt.Order.StopTrail, price=10.50, trailamount=0.25)

可以指定trailpercent而不是trailamount,距离价格的距离将被计算为价格的百分比

# For a StopTrail going downwards with 2% distance

# last price will be used as reference

self.buy(size=1, exectype=bt.Order.StopTrail, trailpercent=0.02)

# or

self.buy(size=1, exectype=bt.Order.StopTrail, price=10.50, trailpercent=0.02)

# For a StopTrail going upwards with 2% difference

# last price will be used as reference

self.sell(size=1, exectype=bt.Order.StopTrail, trailpercent=0.02)

# or

self.sell(size=1, exectype=bt.Order.StopTrail, price=10.50, trailpercent=0.02)

3.示例

使用StopTrailLimit:

- 唯一区别在于当触发跟踪止损价格时会发生什么。

In this case the order is executed as a Limit order (the same behavior a StopLimit order has, but in this case with a dynamic triggering price)

在这个例子中,order将作为Limit 订单执行(与StopLimit订单具有相同的行为,但在此情况下是动态的触发价格)。

注意:必须指定plimit=x.x来买或卖,这将是限价

注意:限价不像stop/trigger价格那样动态改变

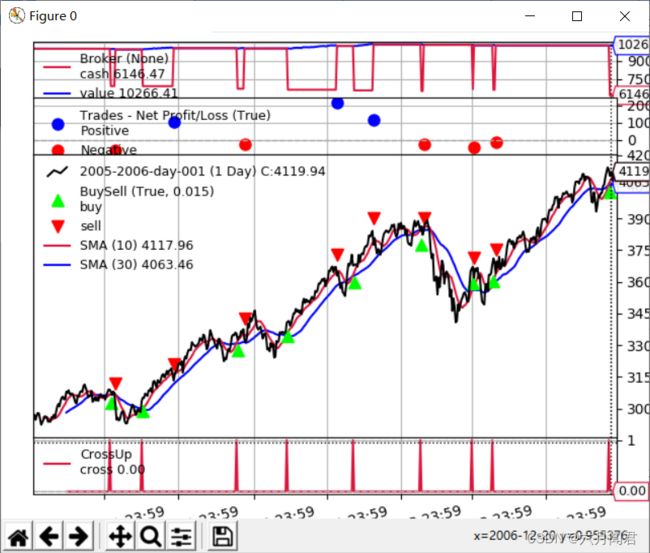

(1)trailamount=50.0

An example is always worth a thousand words and hence the usual backtrader sample, which

好例子胜过千言万语,举例说明,它是一个标准的backtrader示例:

- 使用移动均线交叉来进入市场

- 使用跟踪止损来退出市场。

执行50点的固定价格距离 :

核心代码:

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

print('-' * 10)

else:

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

执行:

python ./trail.py --plot --strat trailamount=50.0

**************************************************

2005-02-14,3075.76,3025.76,3025.76

----------

2005-02-15,3086.95,3036.95,3036.95

2005-02-16,3068.55,3036.95,3018.55

2005-02-17,3067.34,3036.95,3017.34

2005-02-18,3072.04,3036.95,3022.04

2005-02-21,3063.64,3036.95,3013.64

...

...

**************************************************

2005-05-19,3051.79,3001.79,3001.79

----------

2005-05-20,3050.45,3001.79,3000.45

2005-05-23,3070.98,3020.98,3020.98

2005-05-24,3066.55,3020.98,3016.55

2005-05-25,3059.84,3020.98,3009.84

2005-05-26,3086.08,3036.08,3036.08

2005-05-27,3084.0,3036.08,3034.0

2005-05-30,3096.54,3046.54,3046.54

2005-05-31,3076.75,3046.54,3026.75

2005-06-01,3125.88,3075.88,3075.88

2005-06-02,3131.03,3081.03,3081.03

2005-06-03,3114.27,3081.03,3064.27

2005-06-06,3099.2,3081.03,3049.2

2005-06-07,3134.82,3084.82,3084.82

2005-06-08,3125.59,3084.82,3075.59

2005-06-09,3122.93,3084.82,3072.93

2005-06-10,3143.85,3093.85,3093.85

2005-06-13,3159.83,3109.83,3109.83

2005-06-14,3162.86,3112.86,3112.86

2005-06-15,3147.55,3112.86,3097.55

2005-06-16,3160.09,3112.86,3110.09

2005-06-17,3178.48,3128.48,3128.48

2005-06-20,3162.14,3128.48,3112.14

2005-06-21,3179.62,3129.62,3129.62

2005-06-22,3182.08,3132.08,3132.08

2005-06-23,3190.8,3140.8,3140.8

2005-06-24,3161.0,3140.8,3111.0

...

...

...

**************************************************

2006-12-19,4100.48,4050.48,4050.48

----------

2006-12-20,4118.54,4068.54,4068.54

2006-12-21,4112.1,4068.54,4062.1

2006-12-22,4073.5,4068.54,4023.5

2006-12-27,4134.86,4084.86,4084.86

2006-12-28,4130.66,4084.86,4080.66

2006-12-29,4119.94,4084.86,4069.94

输出说明:

3075.76 +0.5 =3076.26

打印输入格式: 日期, 收盘价 ,price限价 ,stoplimit价格=self.data.close - self.p.trailamount

而不是等待通常的交叉向下模式,系统使用跟踪止损退出市场。看第一个操作的例子:

- 收盘价格进入多头:3075.76

- 系统计算的跟踪止损价格:3025.76(距离50个单位)

- 示例计算的跟踪止损价格:3025.76(每行显示的最后价格)

这之后第一次计算:

- 收盘价上涨到3086.95,止损价格调整为3036.95

- 接下来的收盘价没有超过3086.95,触发价格没有改变

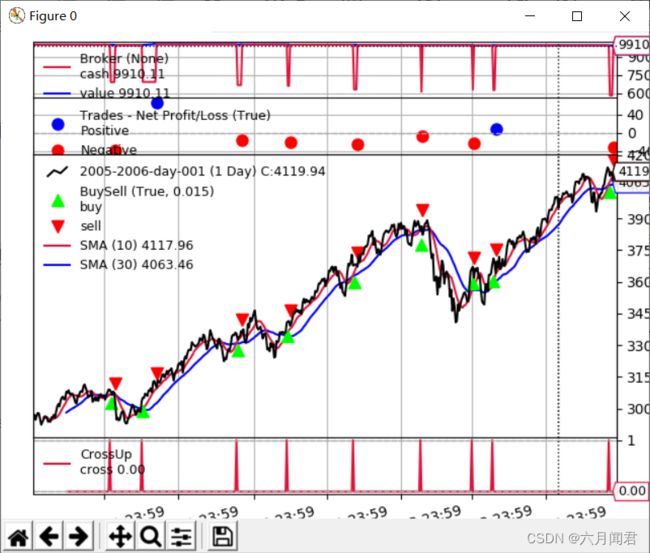

(2)trailamount=30.0

同样的模式可以在另外两个操作中看到。

为了便于比较,只有30点固定距离的执行(只有图表)

python ./trail.py --plot --strat trailamount=30.0

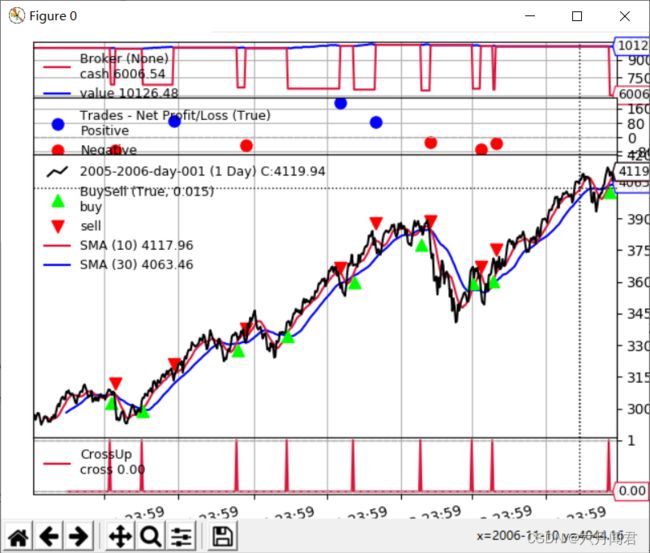

(3)trailpercent=0.02

按百分比2%

$ ./trail.py --plot --strat trailpercent=0.02

4.代码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import backtrader as bt

class St(bt.Strategy):

params = dict(

ma=bt.ind.SMA,

p1=10,

p2=30,

stoptype=bt.Order.StopTrail,

trailamount=0.0,

trailpercent=0.0,

)

def __init__(self):

ma1, ma2 = self.p.ma(period=self.p.p1), self.p.ma(period=self.p.p2)

self.crup = bt.ind.CrossUp(ma1, ma2)

self.order = None

def next(self):

if not self.position:

if self.crup:

o = self.buy()

self.order = None

print('*' * 50)

elif self.order is None:

self.order = self.sell(exectype=self.p.stoptype,

trailamount=self.p.trailamount,

trailpercent=self.p.trailpercent)

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

print('-' * 10)

else:

if self.p.trailamount:

tcheck = self.data.close - self.p.trailamount

else:

tcheck = self.data.close * (1.0 - self.p.trailpercent)

print(','.join(

map(str, [self.datetime.date(), self.data.close[0],

self.order.created.price, tcheck])

)

)

def runstrat(args=None):

args = parse_args(args)

cerebro = bt.Cerebro()

# Data feed kwargs

kwargs = dict()

# Parse from/to-date

dtfmt, tmfmt = '%Y-%m-%d', 'T%H:%M:%S'

for a, d in ((getattr(args, x), x) for x in ['fromdate', 'todate']):

if a:

strpfmt = dtfmt + tmfmt * ('T' in a)

kwargs[d] = datetime.datetime.strptime(a, strpfmt)

# Data feed

data0 = bt.feeds.BacktraderCSVData(dataname=args.data0, **kwargs)

cerebro.adddata(data0)

# Broker

cerebro.broker = bt.brokers.BackBroker(**eval('dict(' + args.broker + ')'))

# Sizer

cerebro.addsizer(bt.sizers.FixedSize, **eval('dict(' + args.sizer + ')'))

# Strategy

cerebro.addstrategy(St, **eval('dict(' + args.strat + ')'))

# Execute

cerebro.run(**eval('dict(' + args.cerebro + ')'))

if args.plot: # Plot if requested to

cerebro.plot(**eval('dict(' + args.plot + ')'))

def parse_args(pargs=None):

parser = argparse.ArgumentParser(

formatter_class=argparse.ArgumentDefaultsHelpFormatter,

description=(

'StopTrail Sample'

)

)

parser.add_argument('--data0', default='../../datas/2005-2006-day-001.txt',

required=False, help='Data to read in')

# Defaults for dates

parser.add_argument('--fromdate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--todate', required=False, default='',

help='Date[time] in YYYY-MM-DD[THH:MM:SS] format')

parser.add_argument('--cerebro', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--broker', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--sizer', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--strat', required=False, default='',

metavar='kwargs', help='kwargs in key=value format')

parser.add_argument('--plot', required=False, default='',

nargs='?', const='{}',

metavar='kwargs', help='kwargs in key=value format')

return parser.parse_args(pargs)

if __name__ == '__main__':

runstrat()

5.Help

python ./trail.py --help

usage: trail.py [-h] [--data0 DATA0] [--fromdate FROMDATE] [--todate TODATE]

[--cerebro kwargs] [--broker kwargs] [--sizer kwargs]

[--strat kwargs] [--plot [kwargs]]

StopTrail Sample

optional arguments:

-h, --help show this help message and exit

--data0 DATA0 Data to read in (default:

./datas/2005-2006-day-001.txt)

--fromdate FROMDATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--todate TODATE Date[time] in YYYY-MM-DD[THH:MM:SS] format (default: )

--cerebro kwargs kwargs in key=value format (default: )

--broker kwargs kwargs in key=value format (default: )

--sizer kwargs kwargs in key=value format (default: )

--strat kwargs kwargs in key=value format (default: )

--plot [kwargs] kwargs in key=value format (default: )

6. Futures and Spot Compensation

期货和现货补偿 ,不了解期货业务,暂时不学习。