python3线性回归

目录

导包

获得数据

数据清洗

第二种导入方法

清除inf和nan

训练线性回归方程

总体相关参数

交叉检验

不同时期相关性

导包

import pandas as pd

import numpy as np

from urllib.request import urlretrieve获得数据

>>> vs_url = 'http://WWW.stoxx.com/download/historical_values/h_vstoxx.txt'

>>> es_url = 'http://WWW.stoxx.com/download/historical_values/hbrbcpe.txt'

urlretrieve(es_url , './data/es.txt')

('./data/es.txt', )

urlretrieve(vs_url , './data/vs.txt')

('./data/vs.txt', )

>>> lines = open('./data/es.txt', 'r').readlines()

>>> lines = [line.replace( ' ',"")for line in lines]

>>> lines[:6]

['PriceIndices-EUROCurrency\n', 'Date;Blue-Chip;Blue-Chip;Broad;Broad;ExUK;ExEuroZone;Blue-Chip;Broad\n', ';Europe;Euro-Zone;Europe;Euro-Zone;;;Nordic;Nordic\n', ';SX5P;SX5E;SXXP;SXXE;SXXF;SXXA;DK5F;DKXF\n', '31.12.1986;775.00;900.82;82.76;98.58;98.06;69.06;645.26;65.56\n', '01.01.1987;775.00;900.82;82.76;98.58;98.06;69.06;645.26;65.56\n']

数据清洗

>>> new_file = open('./data/es50.txt', 'w')

>>> new_file.writelines('date' + lines[3][:-1]+ ';DEL' + lines[3][-1]) #列数据+:DEL+'\n'

>>> new_file.writelines(line[4:])

>>> new_file.close()

>>> es = pd.read_csv ( './data/es50.txt' , index_col=0 ,parse_dates=True , sep=';' , dayfirst=True)

>>> np.round(es.tail())

SX5P SX5E SXXP SXXE SXXF SXXA DK5F DKXF DEL

date

2016-09-28 2847.0 2991.0 343.0 324.0 408.0 350.0 9072.0 581.0 NaN

2016-09-29 2849.0 2992.0 343.0 324.0 408.0 351.0 9112.0 583.0 NaN

2016-09-30 2843.0 3002.0 343.0 325.0 408.0 350.0 9116.0 583.0 NaN

2016-10-03 2845.0 2998.0 343.0 325.0 408.0 351.0 9131.0 584.0 NaN

2016-10-04 2871.0 3030.0 346.0 328.0 411.0 354.0 9212.0 589.0 NaN

>>> del es['DEL']第二种导入方法

es2 = pd.read_csv(es_url, index_col=0 , parse_dates=True ,sep=';', dayfirst=True , header=None,skiprows=4 , names=cols)

es2.tail()

SX5P SX5E SXXP SXXE SXXF SXXA DK5F DKXF

2016-09-28 2846.55 2991.11 342.57 324.24 407.97 350.45 9072.09 581.27

2016-09-29 2848.93 2991.58 342.72 324.08 407.65 350.90 9112.09 582.60

2016-09-30 2843.17 3002.24 342.92 325.31 408.27 350.09 9115.81 583.26

2016-10-03 2845.43 2998.50 343.23 325.08 408.44 350.92 9131.24 584.32

2016-10-04 2871.06 3029.50 346.10 327.73 411.41 353.92 9212.05 588.71

vs = pd.read_csv ( './data/vs.txt' , index_col=0 ,parse_dates=True , sep=',' , header=2,dayfirst=True)

import datetime as dt

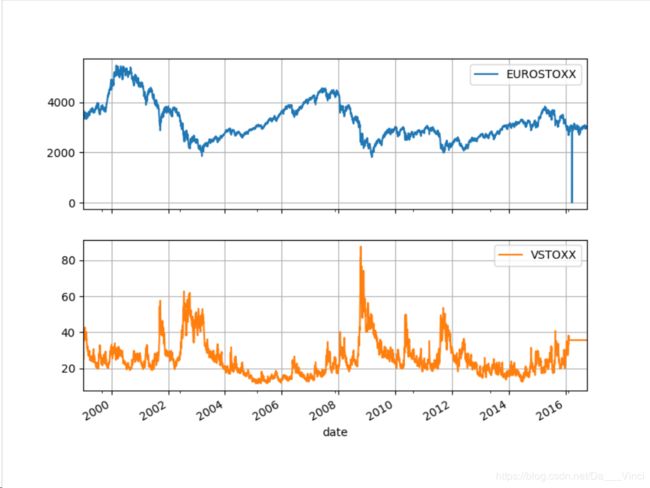

data = pd.DataFrame({'EUROSTOXX':es['SX5E'][es.index > dt.datetime(1999 ,1 ,1)]})

data = data.join(pd.DataFrame({'VSTOXX':vs['V2TX'][vs.index > dt.datetime(1999 ,1 ,1)]}))

>>> data = data.fillna(method='ffill')data.plot(subplots=True,grid=True,figsize=(8,6))

array([,

],

dtype=object)

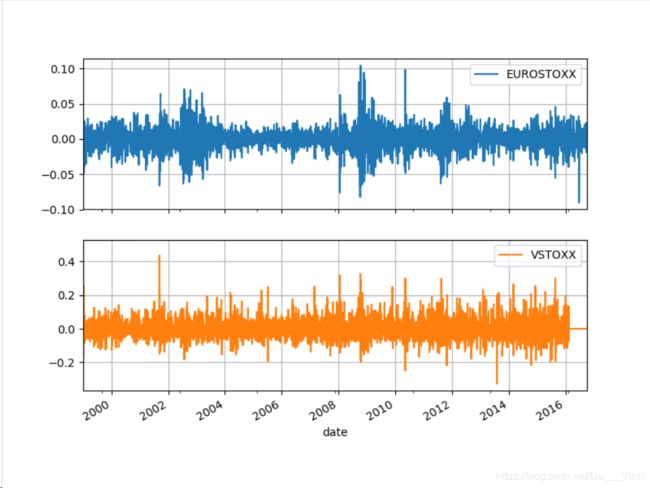

rets = np.log(data/data.shift(1))rets.head()

EUROSTOXX VSTOXX

date

1999-01-04 NaN NaN

1999-01-05 0.017228 0.489248

1999-01-06 0.022138 -0.165317

1999-01-07 -0.015723 0.256337

1999-01-08 -0.003120 0.021570>>> rets.plot(subplots=True,grid=True,figsize=(8,6))

array([,

],

dtype=object) 清除inf和nan

import statsmodels.api as sm

rets[np.isnan(rets)] = 0

rets[np.isinf(rets)] = 0

训练线性回归方程

X = sm.add_constant(rets['EUROSTOXX'])

y = rets['VSTOXX']

result = sm.OLS(y,X).fit()result.summary()

"""

OLS Regression Results

==============================================================================

Dep. Variable: VSTOXX R-squared: 0.526

Model: OLS Adj. R-squared: 0.525

Method: Least Squares F-statistic: 5042.

Date: Thu, 14 Mar 2019 Prob (F-statistic): 0.00

Time: 16:11:28 Log-Likelihood: 8271.0

No. Observations: 4554 AIC: -1.654e+04

Df Residuals: 4552 BIC: -1.653e+04

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 4.945e-05 0.001 0.085 0.932 -0.001 0.001

EUROSTOXX -2.7539 0.039 -71.008 0.000 -2.830 -2.678

==============================================================================

Omnibus: 1298.505 Durbin-Watson: 2.084

Prob(Omnibus): 0.000 Jarque-Bera (JB): 24719.917

Skew: 0.875 Prob(JB): 0.00

Kurtosis: 14.279 Cond. No. 66.5

==============================================================================

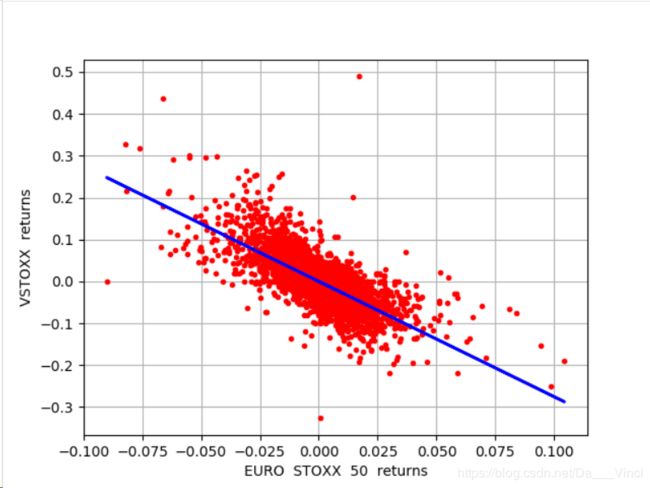

总体相关参数

result.params

const 0.000049

EUROSTOXX -2.753853

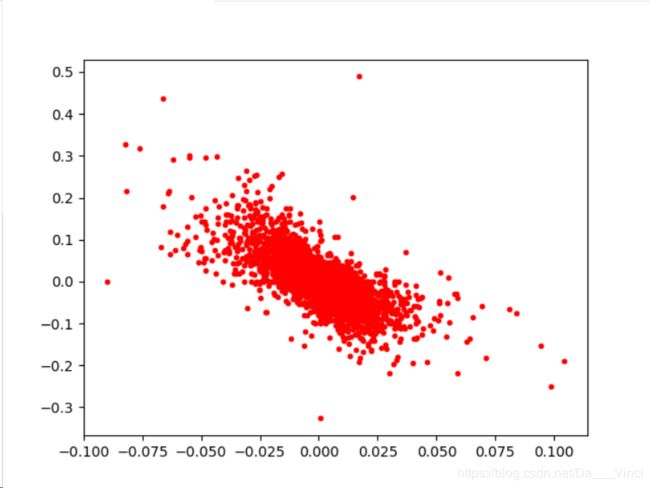

dtype: float64import matplotlib.pyplot as plt

plt.plot(rets['EUROSTOXX'],rets['VSTOXX'],'r.')

[] ax = plt.axis()

x = np.linspace(ax[0] ,ax[1] + 0.01)

plt.plot(rets['EUROSTOXX'],result.params.const+ result.params.EUROSTOXX*rets['EUROSTOXX'],'b',lw=2)

[]

plt.grid(True)

plt.axis('tight')

plt.xlabel('EURO STOXX 50 returns')

plt.ylabel('VSTOXX returns') 交叉检验

rets.corr()

EUROSTOXX VSTOXX

EUROSTOXX 1.000000 -0.724945

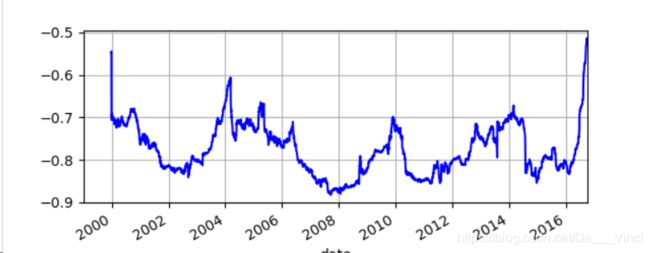

VSTOXX -0.724945 1.000000不同时期相关性

>>> rets['EUROSTOXX'].rolling(window= 252).corr(rets['VSTOXX']).plot(grid=True , style='b')