摘要

本文是利用Python语言对Kaggle上Give Me Some Credit网贷数据集进行申请评分卡(a卡)的数据清洗,建模,熟悉评分卡构建流程。结合信贷评分卡原理,从数据预处理、建模分析、创建信用评分卡到建立自动评分机制,创立了一个简单的信用准入评分系统。并对建立基于AI 的机器学习评分卡系统的路径进行思考和总结。

工作原理

信用评分卡是一种成熟的预测方法,在信用风险评估以及金融风险控制领域更是得到了比较广泛的使用,其原理是将模型变量利用WOE-IV编码离散化之后运用logistic回归模型进行的一种二分类广义线性模型。

评分卡由一系列特征组成,每个特征对应申请表上的一个数据(年龄、银行流水、收入等)。并且一个特征项都会存在一串属性(对于年龄这个问题,答案可能就有30岁以下、30到40岁等)。开发评分卡模型的过程中,必须先确定属性与申请人未来信用表现之间的相关关系,分配适当的权重分值。分值越大,说明该属性蕴含的信用表现越佳。而申请得分就是其分值的简单求和。一旦评分大于等于金融放款机构所设定的阈值,表示该申请人的风险水平是可接受的范围,可以被批准。

数据处理

载入库

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

plt.style.use("bmh")

plt.rc('font', family='SimHei', size=13)

%matplotlib inline

import os

导入数据

data_train = pd.read_csv('cs-training.csv')

data_test = pd.read_csv('cs-test.csv')

探索性数据分析

特征解释:

data_train.info()

有缺失值的特征:MonthlyIncome,NumberOfDependents。

修改列名:

columns = ({'SeriousDlqin2yrs':'Label',

'RevolvingUtilizationOfUnsecuredLines':'Revol',

'NumberOfOpenCreditLinesAndLoans':'NumOpen',

'NumberOfTimes90DaysLate':'Num90late',

'NumberRealEstateLoansOrLines':'NumEstate',

'NumberOfTime60-89DaysPastDueNotWorse':'Num60-89late',

'NumberOfDependents':'NumDependents',

'NumberOfTime30-59DaysPastDueNotWorse':'Num30-59late'}

)

data_train.rename(columns=columns,inplace = True)

data_test.rename(columns=columns,inplace = True)

badrate

bad = data_train.loc[data_train['Label']==1].shape[0]

good = data_train.loc[data_train['Label']==0].shape[0]

print('badrate为:{:.2f}%'.format(round(bad*100/(good+bad),2)))

坏客户只占用户6.68%。

异常值探索

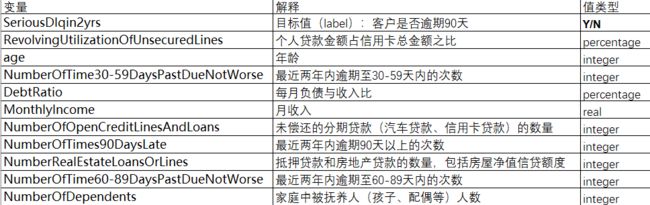

特征 年龄

年龄分布

f,[ax1,ax2]=plt.subplots(1,2,figsize=(20,6))

sns.distplot(data_train['age'],ax=ax1)

sns.boxplot(y='age',data=data_train,ax=ax2)

plt.show()

从图可以发现,年龄基本呈正态分布。

异常值处理:

处理数据异常值一般有:3倍标准差区分异常值、分箱四分位距区分异常值或者直接去除首尾各1%的数据这三种方法。

数据现在是处于正态分布,故采用3倍标准差去除异常。

data_train = data_train[data_train['age']!=0]

age_Mean = np.mean(data_train['age'])

age_Std = np.std(data_train['age'])

UpLimit = round((age_Mean + 3*age_Std),2)

DownLimit = round((age_Mean - 3*age_Std),2)

data_train = data_train[(data_train['age']>=DownLimit)&(data_train['age']<=UpLimit)]

观察年龄大小对label值的影响

##

#先做一个等距粗分箱

data_train['ageCat'] = np.nan

data_train.loc[(data_train['age']>18)&(data_train['age']<40),'ageCat'] = 1

data_train.loc[(data_train['age']>=40)&(data_train['age']<60),'ageCat'] = 2

data_train.loc[(data_train['age']>=60)&(data_train['age']<80),'ageCat'] = 3

data_train.loc[(data_train['age']>=80),'ageCat'] = 4

BadrateList = {}

for m in data_train['ageCat'].value_counts().index:

data = data_train.loc[data_train['ageCat']==m]

Badrate = data.loc[data['Label']==0].shape[0]/data.loc[data['Label']==1].shape[0]

BadrateList[m] = Badrate

BadrateList=dict(sorted(BadrateList.items(),key=lambda x:x[0]))

f,ax = plt.subplots(figsize=(8,5))

sns.countplot('ageCat', hue='Label', data=data_train, ax=ax)

ax2 = ax.twinx()

ax2.plot([x-1 for x in BadrateList.keys()], [round(x,2) for x in BadrateList.values()],'ro--',linewidth=2)

可以看到年龄越大,badrate越大,呈现单调性。为后面的等频分箱求WOE提供参考。

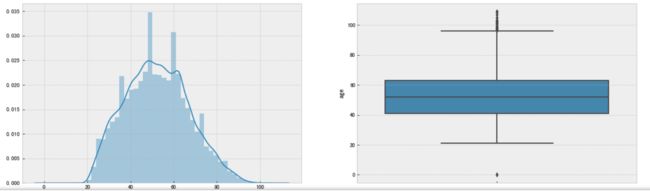

特征 Revol

该特征的意义是:除了房贷车贷之外的信用卡金额(即贷款金额额度)/信用卡总额度。即通常是小于等于1的,一般大于1是属于透支。

print(data_train['Revol'][data_train['Revol']>1].count())

print(data_train['Revol'].max())

print(data_train['Revol'].min())

3321

50708.0

0.0

特征值超过几万显然不太正常,估计很有可能是没有除以分母信用卡总额度,而是分子的纯信用卡账面贷款金额。

现在尝试确定属于透支的最大数字和异常值的范围:

#四分位距法

Percentile = np.percentile(data_train['Revol'],[0,25,50,75,100])

IQR = Percentile[3] - Percentile[1]

UpLimit = Percentile[3]+IQR*1.5

DownLimit = Percentile[1]-IQR*1.5

print('上限为:{0}, 下限为:{1}'.format(UpLimit,DownLimit))

print('上界异常值占比:{0}%'.format(round(data_train[data_train['Revol']>UpLimit].shape[0]*100/data_train.shape[0],2)))

上限为:1.3529709321249999, 下限为:-0.763938468875

上界异常值占比:0.51%

#分段观察Revol分布

f,[[ax1,ax2],[ax3,ax4]]=plt.subplots(2,2,figsize=(20,10))

sns.distplot(data_train['Revol'][data_train['Revol']<1],bins=10,ax=ax1)

sns.distplot(data_train['Revol'][(data_train['Revol']>=1)&(data_train['Revol']<100)],bins=10,ax=ax2)

sns.distplot(data_train['Revol'][(data_train['Revol']>=100)&(data_train['Revol']<10000)],bins=10,ax=ax3)

sns.distplot(data_train['Revol'][(data_train['Revol']>=10000)&(data_train['Revol']<51000)],bins=10,ax=ax4)

ax1.set_title('0==1].shape[0]))

print('大于等于1的数量为:{0}'.format(data_train.loc[data_train['Revol']>=1].shape[0]))

- Revol小于1的分布中,大部分数据都处于(0,0.1)区间,而随着Revol特征值变大,数量递减;

- 在Revol大于1的数值分布中,都明显的呈现了递减趋势,主要集中在100以内的范围内;

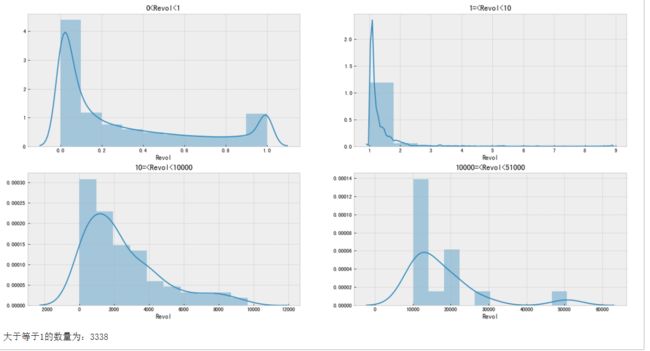

将1~50000等频分箱,计算相应的badrate进行观察

#qcut等频分箱

data2 = data_train[(data_train['Revol']>1)&(data_train['Revol']<51000)]

data2['Revol_100'] = pd.qcut(data2['Revol'],10)

badrate ={}

revol_100_list = list(set(data2['Revol_100']))

for x in revol_100_list:

a = data2[data2['Revol_100'] == x]

bad = a['Label'][a['Label']==1].count()

good = a['Label'][a['Label']==0].count()

badrate[x]=bad/(good+bad)

f = zip(badrate.keys(),badrate.values())

badrate = pd.DataFrame(f)

badrate.columns = ['cut','badrate']

badrate = badrate.sort_values('cut')

print(badrate)

badrate.plot('cut','badrate')

cut badrate

7 (0.999, 1.007] 0.282282

3 (1.007, 1.014] 0.313253

6 (1.014, 1.026] 0.340361

5 (1.026, 1.045] 0.406627

0 (1.045, 1.075] 0.409639

1 (1.075, 1.118] 0.439759

4 (1.118, 1.215] 0.493976

2 (1.215, 1.442] 0.481928

8 (1.442, 2.198] 0.427711

9 (2.198, 50708.0] 0.129518

data_train['Revol'].loc[data_train['Revol']>=2].count()

371

从业务角度出发,随着信用卡贷款比例增高,客户风险越高,badrate就会越大。Revol大于1,客户就已经处于“透支”状态,但是"透支"比例总是有上限的。当Revol大于2时,badrate显著下降至12.95%,接近总体badrate的6.68%,那么可以将Revol大于2的371个客户的Revol值看作属于0~1之间。

特征 DebtRatio

该特征情况经过探索,情况和Revol类似:也是疑似存在比率分母缺失。那么用相似的方法处理。

print(data_train['DebtRatio'][data_train['DebtRatio']>1].count())

print(data_train['DebtRatio'].max())

print(data_train['DebtRatio'].min())

35122

329664.0

0.0

data3['D_100'] = pd.qcut(data3['DebtRatio'],10)

badrate ={}

D100_list = list(set(data3['D_100']))

for x in D100_list:

a = data3[data3['D_100'] == x]

bad = a['Label'][a['Label']==1].count()

good = a['Label'][a['Label']==0].count()

badrate[x]=bad/(good+bad)

f = zip(badrate.keys(),badrate.values())

badrate = pd.DataFrame(f)

badrate.columns = ['cut','badrate']

badrate = badrate.sort_values('cut')

print(badrate)

badrate.plot('cut','badrate',figsize=(20,8))

data_train['DebtRatio'].loc[data_train['DebtRatio']>=2].count()

31200

经过比对,当DebtRatio>2时,badrate就下降至与总体一致,故后面将DebtRatio>2与DebtRatio<1分成一箱。

缺失值探索

特征 NumDependents

NumDependents中缺失值占比

print(data_train[data_train['NumDependents'].isnull()].shape[0])

print(round(data_train[data_train['NumDependents'].isnull()].shape[0]/data_train.shape[0],4))

3911

0.0261

计算缺失值和未缺失值的badrate

d_Null = data_train.loc[data_train['NumDependents'].isnull()]

d_notNull = data_train.loc[data_train['NumDependents'].notnull()]

print('缺失值为{0}%'.format(round(d_Null[d_Null['Label']==1].shape[0]*100/d_Null.shape[0],2)))

print('未缺失值为{0}%'.format(round(d_notNull[d_notNull['Label']==1].shape[0]*100/d_notNull.shape[0],2)))

缺失值为4.55%

未缺失值为6.74%

说明badrate在NumDependents的缺失值下并没有区别,不能将缺失值看作一种特殊的状态对待,那么可以填充缺失值

print(data_train.loc[data_train['MonthlyIncome'].isnull()].shape[0])

print(data_train.loc[(data_train['NumDependents'].isnull())&(data_train['MonthlyIncome'].isnull())].shape[0])

29708

3911

从上面得知MonthlyIncome为空的客户,NumDependents也为空。

下面观察MonthlyIncome为空时,NumDependents不为空的情况。并期望用相似的情况解决NumDependents的空值

D_Null = data_train.loc[(data_train['MonthlyIncome'].isnull())&(data_train['NumDependents'].notnull()),'NumDependents']

D_Null.value_counts().plot(kind='bar', figsize=(10,5))

该情况下,数据绝大部分集中于0处,这也和NumDependents总体分布相似,那么填充为0值。

data_train['NumDependents'] = data_train['NumDependents'].fillna(0)

特征 MonthlyIncome

缺失情况

print(data_train[data_train['MonthlyIncome'].isnull()].shape[0])

print(round(data_train[data_train['MonthlyIncome'].isnull()].shape[0]/data_train.shape[0],4))

29708

0.1981

缺失比例接近20%,考虑使用随机森林算法填充:

data_train.drop(['Unnamed: 0'],axis=1)

from sklearn.ensemble import RandomForestRegressor

process_miss = data_train.iloc[:,[5,0,1,2,3,4,6,7,8,9]]

known = process_miss[process_miss.MonthlyIncome.notnull()].values

unknown = process_miss[process_miss.MonthlyIncome.isnull()].values

x = known[:,1:]

y = known[:,0]

rf = RandomForestRegressor(random_state=0,n_estimators=100,max_depth=3,max_features=3,n_jobs=-1)

rf.fit(x,y)

pre = rf.predict(unknown[:,1:]).round(0)

data_train.loc[data_train['MonthlyIncome'].isnull(),'MonthlyIncome'] = pre

特征 Num30-59、 60-89 、90 late

f,[ax,ax1,ax2]=plt.subplots(1,3,figsize=(20,5))

ax.boxplot(x=data_train['Num30-59late'])

ax1.boxplot(x=data_train['Num60-89late'])

ax2.boxplot(x=data_train['Num90late'])

ax.set_xlabel('Num30-59late')

ax1.set_xlabel('Num60-89late')

ax2.set_xlabel('Num90late')

plt.show()

for i in ['Num30-59late','Num60-89late','Num90late']:

print(data_train[i][data_train[i]>20].count())

269

269

269

从图中看出,三个特征均有大于20的异常值。一般来说逾期不会存在这么多次数,并且异常个数很少,可以考虑删去。

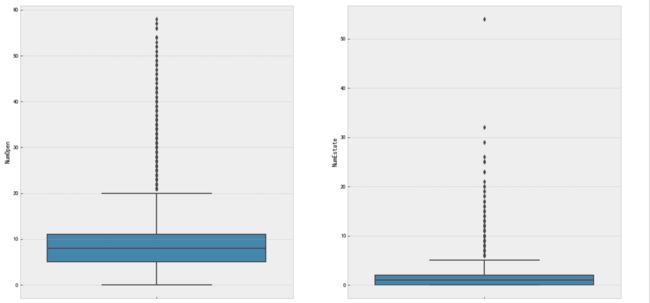

特征 NumOpen和NumEstate

分布和上个特征类似,都是存在少量上界异常值:大于50和大于30

f,[ax1,ax2]=plt.subplots(1,2,figsize=(20,10))

sns.boxplot(y='NumOpen',data=data_train,ax = ax1)

sns.boxplot(y='NumEstate',data=data_train,ax =ax2)

建模部分

导入库及数据

import numpy as np

import pandas as pd

import scipy.stats as stats

import matplotlib.pyplot as plt

import seaborn as sns

plt.style.use("bmh")

plt.rc('font', family='SimHei', size=13)

%matplotlib inline

import math

import os

from sklearn.ensemble import RandomForestRegressor

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import train_test_split, cross_val_predict

from sklearn.metrics import roc_curve, roc_auc_score

from sklearn.preprocessing import StandardScaler

# 导入数据

data_train = pd.read_csv('cs-training.csv')

data_test = pd.read_csv('cs-test.csv')

columns = ({'SeriousDlqin2yrs':'Label',

'RevolvingUtilizationOfUnsecuredLines':'Revol',

'NumberOfOpenCreditLinesAndLoans':'NumOpen',

'NumberOfTimes90DaysLate':'Num90late',

'NumberRealEstateLoansOrLines':'NumEstate',

'NumberOfTime60-89DaysPastDueNotWorse':'Num60-89late',

'NumberOfDependents':'NumDependents',

'NumberOfTime30-59DaysPastDueNotWorse':'Num30-59late'}

)

data_train.rename(columns=columns,inplace = True)

data_test.rename(columns=columns,inplace = True)

处理测试集异常值

data_train = data_train[data_train['age']!=0]

data_train = data_train[data_train['Num30-59late']<20]

data_train = data_train[data_train['Num60-89late']<20]

data_train = data_train[data_train['Num90late']<20]

data_train= data_train[data_train['NumOpen']<50]

data_train= data_train[data_train['NumEstate']<30]

data_train = data_train.drop(['Unnamed: 0'],axis=1)

data_test = data_test.drop(['Unnamed: 0'],axis=1)

补全测试集和验证集缺失值

#随机森林补全income

def missfill(df):

process_miss = df.iloc[:,[5,1,2,3,4,6,7,8,9]]

known = process_miss[process_miss.MonthlyIncome.notnull()].as_matrix()

unknown = process_miss[process_miss.MonthlyIncome.isnull()].as_matrix()

X = known[:,1:]

y = known[:,0]

rfr = RandomForestRegressor(random_state=0,n_estimators=100,max_depth=3,n_jobs=-1,max_features = 3)

rfr.fit(X,y)

pre= rfr.predict( unknown[:,1:]).round(0)

return pre

# 预处理

def processing(data):

data["NumDependents"] = np.abs(data["NumDependents"])

data["NumDependents"] = data["NumDependents"].fillna(0)

data["NumDependents"] = data["NumDependents"].astype('int64')

data.loc[(data['NumDependents']>=7), 'NumDependents'] = 7

pre = missfill(data)

data.loc[data['MonthlyIncome'].isnull(),'MonthlyIncome'] = pre

#构造新的特征

data["Defaulted"] = data["Num90late"] + data["Num60-89late"] + data["Num30-59late"]

data["Loans"] = data["NumOpen"] + data["NumEstate"]

data["DebtPay"] =np.absolute( data["DebtRatio"] * data["MonthlyIncome"])

data["DebtPay"] = data["DebtPay"].astype('int64')

data["age"] = data["age"].astype('int64')

data["MonthlyIncome"] = data["MonthlyIncome"].astype('int64')

data["age_map"] = data["age"]

data["WithDependents"] = data["NumDependents"]

return data

def hand_bin(data):

# 手动分箱

# Revol特征分箱

data.loc[(data['Revol']>=0)&(data['Revol']<1), 'Revol'] = 0

data.loc[(data['Revol']>1)&(data['Revol']<=30), 'Revol'] = 1

data.loc[(data['Revol']>30), 'Revol'] = 0

# DebtRatio特征分箱

data.loc[(data['DebtRatio']>=0)&(data['DebtRatio']<1), 'DebtRatio'] = 0

data.loc[(data['DebtRatio']>=1)&(data['DebtRatio']<2), 'DebtRatio'] = 1

data.loc[(data['DebtRatio']>=2), 'DebtRatio'] = 0

# Num30-59late, Num60-89late, Num90late,NumOpen

data.loc[(data['Num30-59late']>=8), 'Num30-59late'] = 8

data.loc[(data['Num60-89late']>=7), 'Num60-89late'] = 7

data.loc[(data['Num90late']>=10), 'Num90late'] = 10

data.loc[(data['NumEstate']>=8), 'NumEstate'] = 8

# 衍生变量分箱

data.loc[(data["Defaulted"] >= 1), "Defaulted"] = 1

data.loc[(data["Loans"] <= 5), "Loans"] = 0

data.loc[(data["Loans"] > 5), "Loans"] = 1

data.loc[(data["WithDependents"] >= 1), "WithDependents"] = 1

data.loc[(data["age"] >= 18) & (data["age"] < 60), "age_map"] = 1

data.loc[(data["age"] >= 60), "age_map"] = 0

data["age_map"] = data["age_map"].replace(0, "older")

data["age_map"] = data["age_map"].replace(1, "senior")

data = pd.concat([data, pd.get_dummies(data.age_map,prefix='is')], axis=1)

return data

Ytest = data_test['Label']

Xtest = data_test.drop(['Label'], axis=1)

Ytrain = data_train['Label']

Xtrain = data_train.drop(['Label'], axis=1)

data_train = processing(data_train)

data_test = processing(data_test)

data_train = hand_bin(data_train)

data_test = hand_bin(data_test)

data_train.drop('age_map',axis=1,inplace=True)

data_test.drop('age_map',axis=1,inplace=True)

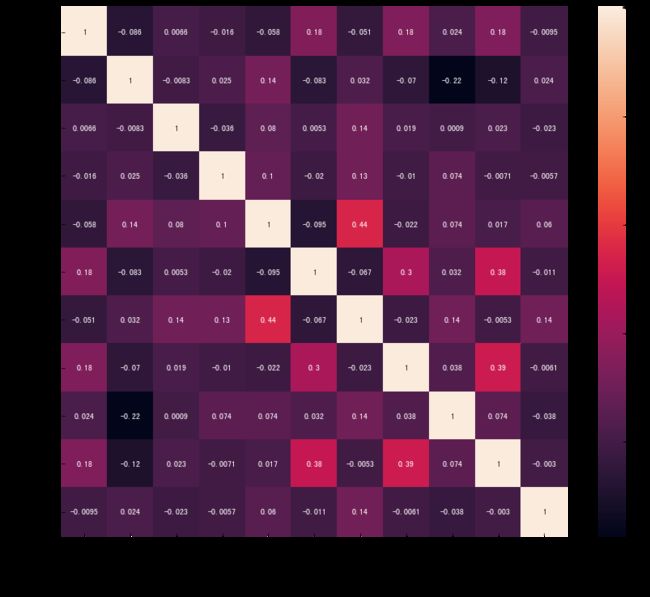

特征相关性热力图

corr = data_train.corr()

plt.figure(figsize=(14,12))

sns.heatmap(corr, annot=True)

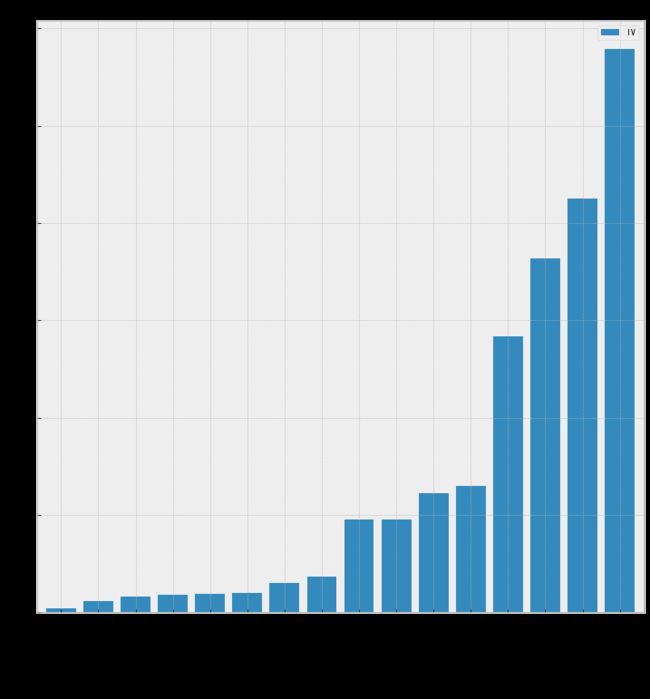

将变量分成离散变量和连续变量分别进行进行woe,iv值计算:

dvar = ['Revol','DebtRatio','Num30-59late', 'Num60-89late','Num90late','Defaulted','WithDependents',

'NumEstate','NumDependents','Loans','is_senior','is_older']

svar = ['MonthlyIncome','age','NumOpen','DebtPay']

def bin_woe(tar, var, n=None, cat=None):

total_bad = tar.sum()

total_good =tar.count()-total_bad

totalRate = total_good/total_bad

if cat == 's':

msheet = pd.DataFrame({tar.name:tar,var.name:var,'bins':pd.qcut(var, n, duplicates='drop')})

grouped = msheet.groupby(['bins'])

elif (cat == 'd') and (n is None):

msheet = pd.DataFrame({tar.name:tar,var.name:var})

grouped = msheet.groupby([var.name])

groupBad = grouped.sum()[tar.name]

groupTotal = grouped.count()[tar.name]

groupGood = groupTotal - groupBad

groupRate = groupGood/groupBad

groupBadRate = groupBad/groupTotal

groupGoodRate = groupGood/groupTotal

woe = np.log(groupRate/totalRate)

iv = np.sum((groupGood/total_good-groupBad/total_bad)*woe)

if cat == 's':

new_var, cut = pd.qcut(var, n, duplicates='drop',retbins=True, labels=woe.tolist())

elif cat == 'd':

dictmap = {}

for x in woe.index:

dictmap[x] = woe[x]

new_var, cut = var.map(dictmap), woe.index

return woe.tolist(), iv, cut, new_var

def woe_vs(data):

cutdict = {}

ivdict = {}

woe_dict = {}

woe_var = pd.DataFrame()

for var in data.columns:

if var in dvar:

woe, iv, cut, new = bin_woe(data['Label'], data[var], cat='d')

woe_dict[var] = woe

woe_var[var] = new

ivdict[var] = iv

cutdict[var] = cut

elif var in svar:

woe, iv, cut, new = bin_woe(data['Label'], data[var], n=5, cat='s')

woe_dict[var] = woe

woe_var[var] = new

ivdict[var] = iv

cutdict[var] = cut

ivdict = sorted(ivdict.items(), key=lambda x:x[1], reverse=False)

iv_vs = pd.DataFrame([x[1] for x in ivdict],index=[x[0] for x in ivdict],columns=['IV'])

ax = iv_vs.plot(kind='bar',

figsize=(12,12),

title='Feature Importance',

fontsize=10,

width=0.8)

ax.set_ylabel('Features')

ax.set_xlabel('IV of Features')

return ivdict, woe_var, woe_dict, cutdict

iv_info, woe_data, woe_dict, cut_dict = woe_vs(data_train)

由此可以开始选择选择变量

选择变量

选择变量的基本规则是根据热力图和上面的IV图和在特征相关性高的变量中,选择IV值高的规则,可以选择如下变量:

is_senior | is_older | age:选age

WithDependents | NumDependents:选NumDependents

Defaulted | Num30-59late:选Defaulted

NumOpen |Loans:选NumOpen

最后保留的变量

ivinfo_keep = ['Revol', 'age', 'DebtRatio', 'MonthlyIncome',

'NumOpen', 'Num90late', 'NumEstate', 'Num60-89late',

'NumDependents','Defaulted','DebtPay']

再次计算相关系数:

可以判断各变量之间不存在明显的相关性

逻辑回归建模

X = woe_data[ivinfo_keep]

y = Ytrain

X_train, X_val, y_train, y_val = train_test_split(X,y,random_state=42)

logit = LogisticRegression(random_state=0,

solver="sag",

penalty="l2",

class_weight="balanced",

C=1.0,

max_iter=500)

logit.fit(X_train, y_train)

logit_scores_proba = logit.predict_proba(X_train)

logit_scores = logit_scores_proba[:,1]

利用ROC曲线判断效果:

def plot_roc_curve(fpr, tpr, auc_score, label=None):

plt.figure(figsize=(10,8))

plt.plot(fpr, tpr, linewidth=2, label='AUC = %0.2f'%auc_score)

plt.plot([0,1],[0,1], "k--")

plt.axis([0,1,0,1])

plt.xlabel("False Positive Rate")

plt.ylabel("True Positive rate")

plt.legend()

fpr_logit, tpr_logit, thresh_logit = roc_curve(y_train, logit_scores)

auc_score = roc_auc_score(y_train, logit_scores)

print("AUC: {}".format(auc_score))

plot_roc_curve(fpr_logit,tpr_logit, auc_score)

AUC: 0.8290290455012129

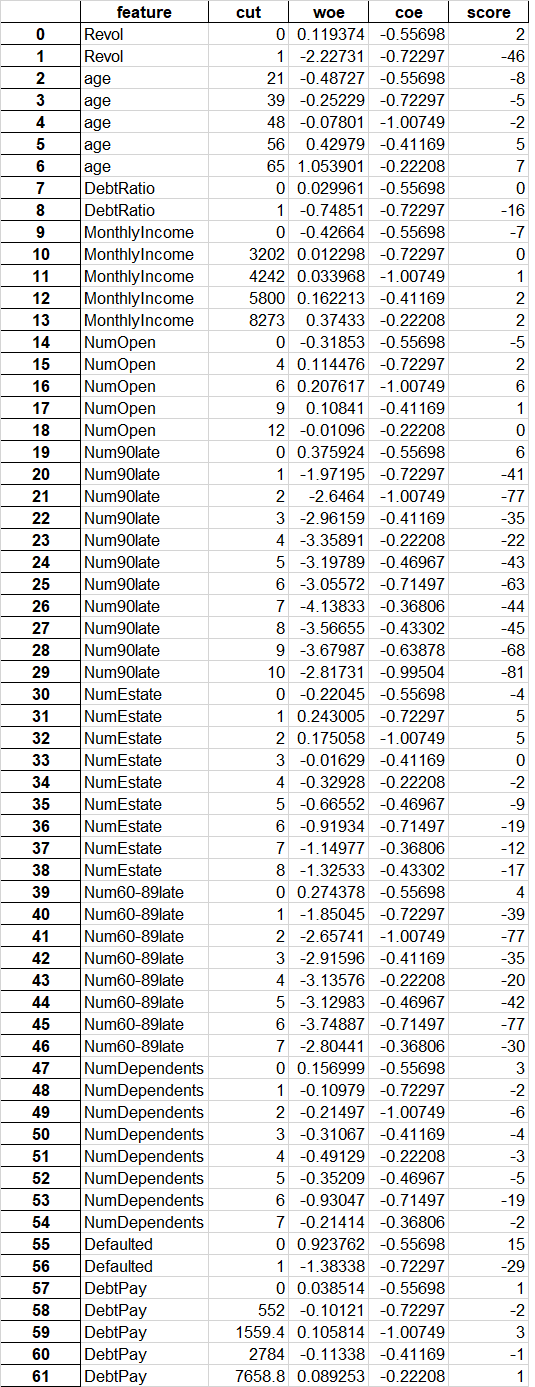

从上面图形和auc值可以看出拟合效果较好,接下来开始计算评分卡:

coe = logit.coef_

intercept = logit.intercept_

B = 20 / math.log(2)

A = 600 + B / math.log(20)

# 基础分

base = round(A-B * intercept[0], 0)

featurelist = []

woelist = []

coelist = []

cutlist = []

for k,v in woe_dict.items():

if k in ivinfo_keep:

for n in range(0,len(v)):

featurelist.append(k)

woelist.append(v[n])

coelist.append(coe[0][n])

cutlist.append(cut_dict[k][n])

scoreboard = pd.DataFrame({'feature':featurelist, 'woe':woelist, 'coe':coelist, 'cut':cutlist},

columns=['feature','cut','woe','coe'])

scoreboard['score'] = round(-scoreboard['woe']*scoreboard['coe']*B,0).astype('int64')

scoreboard

结果如下:

总结:

1.用户的属性有千千万万个维度,而评分卡模型所选用的特征很有限,这时候就需要一定的原则对变量筛选:预测能力、变量相关性等。

- 评分卡模型采用的是对每个字段的分段进行评分,对于特征的分段处理就是采用变量分箱。

- 对字段的每个分段进行评分的方式是采用WOE-IV编码,将预测概率值转化为评分,利用变量相关性分析确保其合理性。

4.本质上是采用逻辑回归进行二分类,但重点在于特征筛选和处理方面。