均值-方差模型实现及应用_python_数据分析_9

用的是米筐的研究模块,从结果来看,均值方差模型对参数的敏感性很高,很多参数都不如随机权重,很难应用到实战。

import pandas as pd

import numpy as np

from scipy import linalg

import matplotlib.pyplot as plt

stockslist = ['000001.XSHE','000002.XSHE','600004.XSHG','600033.XSHG','000651.XSHE']

data = get_price_change_rate(stockslist,start_date = '20100101',end_date = '20200420')

data.to_csv('MeanVar.csv')

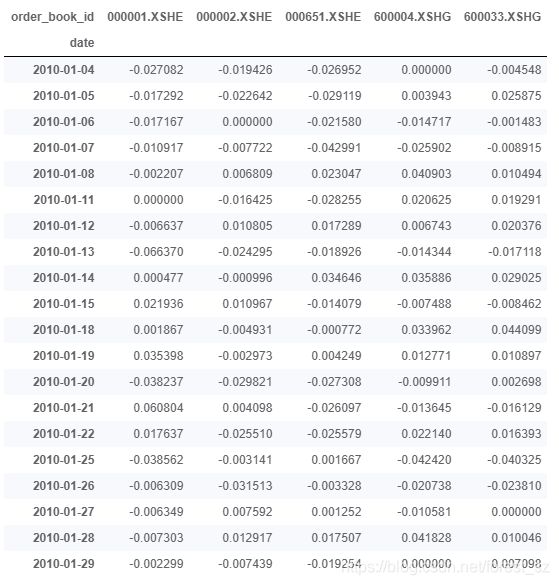

print(data.head(20))

train_set = data[data.index<'20171231']

#print(train_set.tail(20))

test_set = data[data.index>'20180101']

#print(test_set.head(20))

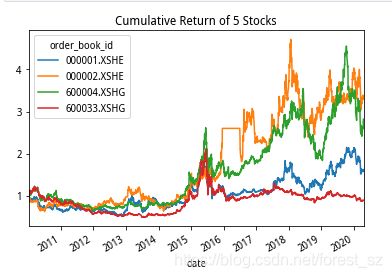

#看一下5个股票的历史表现

cumreturn = (1 + data).cumprod()

cumreturn.plot()

plt.title('Cumulative Return of Stocks')

plt.show()

#相关性分析

data.corr()

#核心模块,实现均值方差模型的计算

class MeanVariance:

#传入收益率数据

def __init__(self,returns):

self.returns = returns

#定义最小化方差函数,即求解二次规划

def minVar(self,goalRet):

covs = np.array(self.returns.cov())

means = np.array(self.returns.mean())

L1 = np.append(np.append(covs.swapaxes(0,1),[means],0),

[np.ones(len(means))],0).swapaxes(0,1)

L2 = list(np.ones(len(means)))

L2.extend([0,0])

L3 = list(means)

L3.extend([0,0])

L4 = np.array([L2,L3])

L = np.append(L1,L4,0)

results = linalg.solve(L,np.append(np.zeros(len(means)),[1,goalRet],0))

return np.array([list(self.returns.columns),results[:-2]])

#定义绘制最小方差前缘曲线函数

def frontierCurve(self):

goals = [x/500000 for x in range(-100,4000)]

variances = list(map(lambda x: self.calVar(self.minVar(x)[1,:].astype(np.float)),goals))

plt.plot(variances,goals)

#定义各资产比例,计算收益率均值

def meanRet(self,fracs):

meanRisky = ffn.to_returns(self.returns).mean()

#assert (len(meanRisky == len(fracs),'Length of fractions must be equal to number of assets')

return np.sum(np.multiply(meanRisky,np.array(fracs)))

#定义各资产比例,计算收益率方差

def calVar(self,fracs):

return np.dot(np.dot(fracs,self.returns.cov()),fracs)

#计算有效前缘

minVar = MeanVariance(data)

minVar.frontierCurve()

#计算训练集权重

varMinimizer = MeanVariance(train_set)

goal_return = 0.003

portfolio_weight = varMinimizer.minVar(goal_return)

portfolio_weight

#计算测试集收益率

test_return = np.dot(test_set,np.array([portfolio_weight[1,:].astype(np.float)]).swapaxes(0,1))

test_return = pd.DataFrame(test_return,index = test_set.index)

test_cum_return = (1+test_return).cumprod()

#计算随机权重组合

sim_weight = np.random.uniform(0,1,(100,len(stockslist)))

sim_weight = np.apply_along_axis(lambda x: x/sum(x),1,sim_weight)

sim_return = np.dot(test_set,sim_weight.swapaxes(0,1))

sim_return = pd.DataFrame(sim_return,index = test_cum_return.index)

sim_cum_return = (1+sim_return).cumprod()

plt.plot(sim_cum_return.index,sim_cum_return,color = 'green')

plt.plot(test_cum_return.index,test_cum_return,label = 'MeanVar')

plt.legend()

plt.title('MeanVar & Random')