Investment decision rules

NPV and stand-alone projects

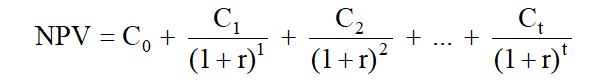

NPV investment rule: when making an investment decision, take the alternative with the highest NPV, Choosing this alternative is equivalent to receiving its NPV in cash today.

NPV profile: a graph of the project's NPV over a range of discount rates.

the difference between the cost of capital and the IRR is the maximum estimation error in the cost of capital that can exist without altering the original decision.

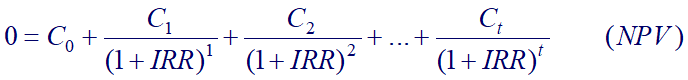

the IRR investment rule

the IRR investment rule: take any investment opportunity where the IRR exceeds the opportunity cost of capital; turn down any opportunity where IRR is less than the opportunity cost of capital.

only guaranteed to work for a stand-alone project if all of the project's negative cash flows precede its positive cash flows.

Pitfall #1: Delayed investments

Pitfall #2: multiple IRRs

Pitfall #3: nonexistent IRR

IRR and Mutually Exclusive Projects

Mutually exclusive projects: If choose one, can’t choose the other

the IRR rule can go wrong because a higher IRR does not necessarily mean a better project (or higher NPV).

Incremental IRR: IRR of the incremental cash flows that would result from replacing one project with another

The Incremental IRR Rule: If the IRR from the incremental cash flows resulting from project A - project B is great than the cost of capital, then replacing B with A is profitable

shortcomings: incremental IRR may not exist; IRR exceeds the cost of capital for both projects does not imply that either project has a positive NPV

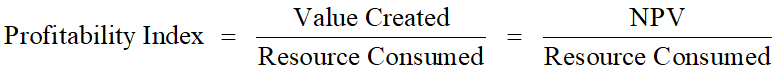

Profitability index and Resource constraints

profitability index (PI):The ratio of the project’s NPV to its initial investment

PI measures the benefit per unit cost, based on the time value of money. For example, a profitability index of 0.1 implies that for every $1 of investment, we create an additional $0.10 in value

Accept the project if PI > 0

Resource constraints: Every firm has a limit set on various resources for investment. For example, the funds available for investments are limited.

a firm can only take up a limited number of projects. With limited resource, a firm should pick up projects with the highest profitability index

shortcomings: With multiple resource constraints, the profitability index can break down completely; as IRR, profitability index may lead to incorrect decisions in comparisons of mutually exclusive investments

The Payback Rule

payback investment rule: only accept a project if its cash flows pay back its initial investment within a pre-specified period.

payback period: the amount of time it takes to pay back the initial investment.

Pitfall #1: ignore the project's cost of capital and the time value of money.

Pitfall #2: ignore cash flows after the payback period.

Pitfall #3: relies on a ad hoc decision criterion (what is the right number of years to require for the payback period?).

Discounted Payback Period: Compute the present value of each cash flow and then determine how long it takes to pay back on a discounted basis

Advantages: Easy to understand; Includes time value of money; Biased towards liquidity

Disadvantages: Requires an arbitrary cutoff point; May reject positive NPV investments; Ignores cash flows beyond the cutoff point; Biased against long-term projects, such as R&D and new products

Fundamentals of capital budgeting

Forecast earnings

concepts

capital budget: A list of the investments that a company plans to undertake

1. Investment in a new –product line that requires investment in plant, equipment, and inventories.

2. Investment in an automated equipment that will allows the firm to reduce its cost.

3. Replacement of an existing plant in order to expand capacity or lower operating costs

Capital Budgeting: Process used to analyze alternative investments and decide which ones to accept

1.Coming up with proposals for investment projects

2.Evaluating them

3.Deciding which ones to accept and which to reject

Incremental Earnings/Cash flow: The amount by which the firm’s earnings/cash flow are expected to change as a result of the investment decision

Indirect Effects on Incremental Earnings

Opportunity cost: The value a resource could have provided in its best alternative use

should be included when calculating the incremental earnings of a project

Project Externalities: Indirect effects of the project that may affect the profits of other business activities of the firm

should be included when calculating the incremental earnings of a project

e.g. Cannibalization: the situation when sales of a new product displaces sales of an existing product

Sunk costs: costs that have been or will be paid regardless of the decision whether or not the investment is undertaken

should NOT be included in the incremental earnings analysis

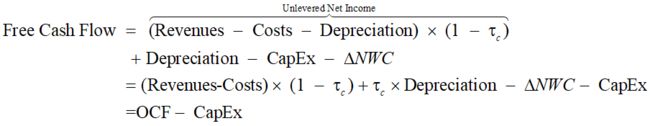

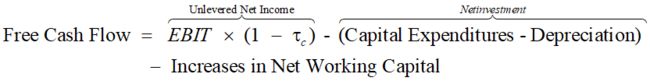

Determining Free Cash Flow and NPV

Subtract capital expenditures & Add back depreciation& Subtract increase in Net Working Capital (NWC)

Further Adjustments to Free Cash Flow

Other Non-cash Items

E.g. Amortization

Timing of Cash Flows

Alternative Methods of Depreciation

Straight-line depreciation

Modified Accelerated Cost Recovery System (MACRS) depreciation

•The most accelerated depreciation allowed

•Need to know which asset class is appropriate for tax purposes

•Multiply MACRS percentage given in table by the initial cost

•Depreciated to zero

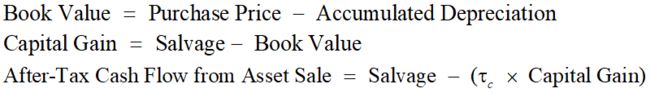

Liquidation or Salvage Value

Liquidation value of assets that are no longer needed and may be disposed of

If the market salvage value is different from the book value, then there is a tax

effect: You have to pay taxes at the ordinary income tax rate on the difference

Terminal or Continuation Value

An additional, one-time cash flow at the end of the forecast horizon.

The market value of the free cash flow from the project at all future dates.

Tax Carryforwards

Tax loss carryforwards and carrybacks: allow corporations to take losses during its current year and offset them against gains in nearby years

Choosing Among Alternatives

When comparing alternatives, we only need to compare those cash flows that differ between them

Analyzing the Project

Break-Even Analysis

The break-even level of an input: the level that causes the NPV of the investment to equal zero

Sensitivity Analysis

Sensitivity Analysis: how the NPV varies with avchange in one of the assumptions, holding the other assumptions constant

Scenario Analysis

Scenario Analysis: the effect on the NPV of simultaneously changing

multiple assumptions

Valuing Stocks

The Dividend-Discount Model

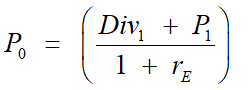

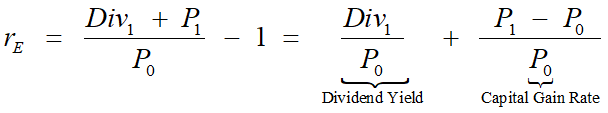

a one year investor

equity cost of capital: expected return of other investments available in the market with equivalent risk to the firm's shares.

dividend yield: expected annual dividend of the stock divided by its current price.

capital gain: the difference between the expected sale price and purchase price for the stock.

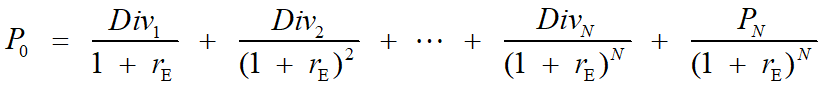

a multiyear investor

general dividend-discount model: the price of stock is equal to the present value of the expected future dividends it will pay.

applying the dividend-discount model

constant dividend growth

dividends versus investment and growth

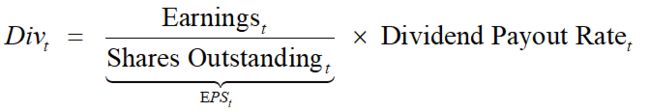

dividend payout rate: the fraction of its earnings that the firm pays as dividends each year.

a firm can increase its dividend in these ways:

1. increase its earnings (net income)

2. increase its dividend payout rate

retention rate: the fraction of current earnings that the firm retains

Profitable Growth: the balance between dividend and investment when it want to increase its share price.

Changing Growth Rates

dividend growth rate is not necessarily constant

Limitations of the dividend-discount model:

There is a tremendous amount of uncertainty associated with forecasting a firm’s dividend growth rate and future dividends

Small changes in the assumed dividend growth rate can lead to large changes in the estimated stock price

Can not accurately estimate the stock price if the firm also do shares repurchase

total payout and free cash flow valuation models

share repurchases and the total payout model

share repurchase: firm uses excess cash to buy back its own stock.

Implications for the Dividend-Discount Model

1. The more cash the firm uses to repurchase shares, the less it has available to pay dividends.

2. By repurchasing, the firm decreases the number of shares outstanding, which increases its earnings per and dividends per share

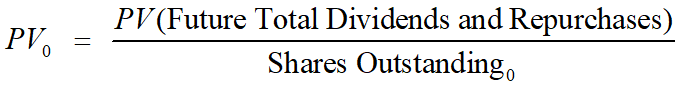

total payout model: values all of the firms's equity, rather than a single share.

Future total payouts are discounted using equity cost of capital.

This model values all of the firm’s equity, rather than a single share. It is more reliable and easier to apply when the firm uses share repurchases

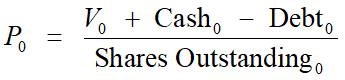

the discounted free cash flow model

Determines the value of the firm to all investors, including both equity and debt holders

enterprise value: the net cost of acquiring the firm’s equity, taking its cash, paying off all debt, and owning the unlevered business

Enterprise value = market value of equity + debt - cash

Valuing the Enterprise: Discount the free cash flow to all investors using the weighted average cost of capital

Discount rate: firm's weighted average cost of capital

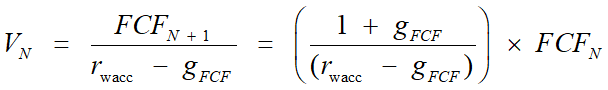

Often, the terminal value is estimated by assuming a constant long-run growth rate gFCF for free cash flows beyond year N, so that

Valuation Based on Comparable Firms

Valuation Multiples

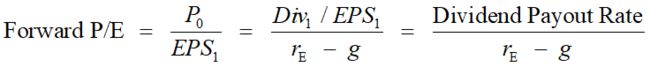

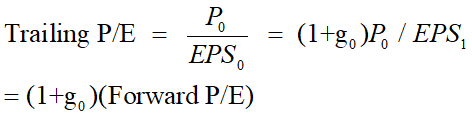

P/E Ratio: Share price divided by earnings per share

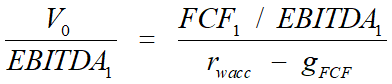

Enterprise Value Multiples

This valuation multiple is higher for firms with high growth rates and low capital requirements(so that free cash flow is high in proportion to EBITDA).

One advantage of this multiple over P/E ratio is that it can be better used to compare firms with different amount of leverage.

Limitations of Multiples

The potential large difference between the firm and the comparing counterparts may lead to very imprecise estimate of value

Comparables only provide information regarding the value of a firm relative to other firms in the comparison set. Therefore, using multiples will not help us determine if an entire industry is incorrectly valued

Comparison with Discounted Cash Flow Methods

The multiples approach: easy to implement and is based on real values instead of unrealistic forecasts of future cash flows.

Discounted cash flows methods: can incorporate specific information about the firm’s cost of capital or future growth and have the potential to be more accurate and insightful.

No single technique provides a final answer regarding a stock’s true value. Most real-world practitioners use a combination of these approaches and gain confidence if the results are consistent across a variety of methods.

Information, Competition, and Stock Prices

For a publicly traded firm, its current stock price should already provide very accurate information, aggregated from a multitude of investors, regarding the true value of its shares

Based on its current stock price, a valuation model will tell us something about the firm’s future cash flows or cost of capital

Competition and Efficient Markets

Efficient Markets Hypothesis: Implies that securities will be fairly priced, based on their future cash flows, given all information that is available to investors

Public, Easily Interpretable Information

1. the impact of information that is available to all investors on the firm’s future cash flows can be readily ascertained, then all investors can determine the effect of this information on the firm’s value.

2. In this situation, we expect the stock price to react nearly instantaneously to such news

Private or Difficult-to-Interpret Information

1. Private information will be held by a relatively small number of investors. These investors may be able to profit by trading on their information.

2. In this case,the efficient markets hypothesis will not hold in the strict sense. However, as these informed traders begin to trade, they will tend to move prices, so over time prices will begin to reflect their information as well

整理不易,各位考试加油啦~~~~