基于LSTM模型的股票预测(keras实现)

提示:文章写完后,目录可以自动生成,如何生成可参考右边的帮助文档

文章目录

- 前言

- 一、数据获取

- 二、数据预处理

- 三、训练数据和测试数据处理

- 四、LSTM模型建立

- 五、跑模型

- 六、可视化

-

- 结果

- 总结

前言

这大概就是我第一次写博客hhh,大学摆烂好久,一直想开始记录一下自己的学习,只可惜想的这个动作持续了太久

嚣张一点,反正也没人看

一、数据获取

数据获取用的是tushare,不得不说tushare是一个简洁且方便的平台,获得的数据直接就是DataFrame格式,真是非常的耐撕啊。

tushare id:492845

下边贴个栗子:

import tushare as ts

import pandas as pd

ts.set_token('你的token')

# 我获取的是前复权的数据,如果不需要复权可以调用ts.daily()

train_data = ts.pro_bar(ts_code = '600519.SH',adj = 'qfq', start_date = '20000101', end_date = '20211231')

train_data.to_csv('train—_data.csv')

更加详细具体的内容可以看tushare官网,具体接口(公司信息、日线、周线等)和获取方法写的更详细,我就不赘述了。

值得一提的是官网上也有新冠疫情数据的相关接口,也是全免费。

二、数据预处理

这部分还是蛮简单的,主要是因为tushare的股票数据质量很高,没有空缺或者缺失的数据。

rain_data = pd.read_csv("train_data.csv", index_col=['trade_date'] )

test_data = pd.read_csv("test_data.csv", index_col=['trade_date'] )

# 因为tushare获取的日期是从最新开始获取,所以在进行预测前要reverse

train_data, test_data = train_data[::-1], test_data[::-1]

# 原始数据的维度只需要作为输入【开盘价,最高价,最低价,涨跌幅,成交量】

# 因为我只想要得到后一天收盘价的预测结果,所以预测的指导向量是【收盘价】

train_data = train_data[[ 'open', 'high', 'low' , 'pct_chg', 'vol', 'close']]

test_data = test_data[[ 'open', 'high', 'low' , 'pct_chg', 'vol', 'close']]

train_data.index.name = 'date'

test_data.index.name = 'date'

三、训练数据和测试数据处理

这里输入的数据X_train有三个维度【【开盘价,最高价,最低价,涨跌幅,成交量】】,【时序】【步长】

举个栗子可能会说明的比较清楚:

我要用2020-01-01 ~ 2020-02-01的数据作为输入,前10(步长)天预测第11天的收盘价

那么X_train的shape应该就是【5】【10】【股票在1月开盘的天数】

Y_train 的shape是【股票在1月开盘的天数】【1】

关于数据归一化,调用的是sklearn.MinMaxScaler,fit_transform()归一化,inverse_transform()反归一化还原。至于为什么要归一化呢,因为股价、成交量、涨幅比的量纲差距比较大

def train_data(time_step, sx, sy):

train_data = pd.read_csv('trainData.csv')

# 数据归一化

# sc = MinMaxScaler(feature_range=(0,1))

X_train = train_data[['open', 'high', 'low' , 'pct_chg', 'vol']]

Y_train = train_data[['close']]

X_train = sx.fit_transform(X_train)

Y_train = sy.fit_transform(Y_train)

x_train, y_train = [], []

for i in range(time_step, train_data.shape[0]):

x_train.append(X_train[i-time_step:i, :])

y_train.append(Y_train[i])

x_train, y_train = np.array(x_train), np.array(y_train)

x_train = np.reshape(x_train, (x_train.shape[0], x_train.shape[1], 5))

return x_train, y_train, sx, sy

def test_data(time_step, sxx, syy):

train_data = pd.read_csv('trainData.csv')

test_data = pd.read_csv('testData.csv')

all_data = pd.concat((train_data, test_data), axis = 0)

X_all = all_data[['open', 'high', 'low' , 'pct_chg', 'vol']]

Y_all = all_data[['close']]

x_test, y_test = [], []

# print(len(all_data), len(test_data), time_step)

X_all = X_all[len(all_data) - len(test_data) - time_step:]

Y_all = Y_all[len(all_data) - len(test_data) - time_step:]

X_all = sxx.fit_transform(X_all)

Y_all = syy.fit_transform(Y_all)

for i in range(time_step, test_data.shape[0]):

x_test.append(X_all[i-time_step:i, :])

y_test.append(Y_all[i])

x_test, y_test = np.array(x_test), np.array(y_test)

x_test = np.reshape(x_test, (x_test.shape[0], x_test.shape[1], 5))

return x_test, y_test, sxx, syy

四、LSTM模型建立

def stock_predict(x_train, y_train, _epochs, _steps_per_epoch):

x_train = tf.convert_to_tensor(x_train)

y_train = tf.convert_to_tensor(y_train)

print(x_train.shape)

regressor = Sequential()

regressor.add(LSTM(units = 50, return_sequences = False, input_shape = (x_train.shape[1], x_train.shape[2])))

regressor.add(Dropout(0.2))

regressor.add(Dense(units = 1))

regressor.compile(optimizer = 'adam', loss = 'mae')

regressor.fit(x_train, y_train, epochs = _epochs, steps_per_epoch = _steps_per_epoch)

return regressor

五、跑模型

sx = MinMaxScaler(feature_range=(0,1))

sy = MinMaxScaler(feature_range=(0,1))

sxx = MinMaxScaler(feature_range=(0,1))

syy = MinMaxScaler(feature_range=(0,1))

x_train, y_train, sx, sy = train_data(60, sx, sy)

x_test, y_test, sxx, syy = test_data(60, sx, sy)

regressor = stock_predict(x_train, y_train, _epochs=64, _steps_per_epoch=100)

actual_stock_price = y_test

predicted_stock_price = regressor.predict(x_test)

actual_stock_price = syy.inverse_transform(actual_stock_price)

predicted_stock_price = syy.inverse_transform(predicted_stock_price)```

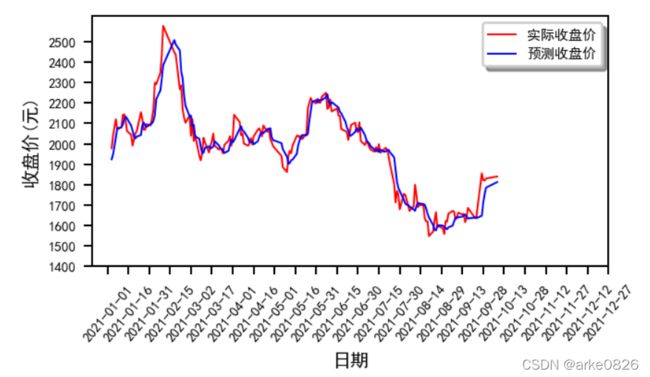

六、可视化

plt.figure(dpi = 180, figsize = (4,2))

plt.plot(actual_stock_price, color = 'r', label = '实际收盘价', linewidth=0.8)

plt.plot(predicted_stock_price, color = 'b', label = '预测收盘价', linewidth=0.8)

ax = plt.gca()

ax.xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m-%d'))

plt.rcParams['font.sans-serif']=['SimHei']

plt.rcParams['axes.unicode_minus']=False

plt.xticks(pd.date_range('2021-1-1','2022-1-1',freq='15d'), rotation = 50, fontsize = 6)

plt.yticks(range(1400, 2600, 100), fontsize = 6)

plt.xlabel('日期', fontsize = 8)

plt.ylabel('收盘价(元)', fontsize = 8)

plt.legend(shadow = True, fontsize = 6)

plt.show()

结果

总结

第一次做博客还是很菜的,本人也只是初学深度学习的小菜鸡一枚,还请各位大佬指正