向量自回归与结构向量误差修正模型

(一)R语言vars包来进行VAR、SVAR和SVECM的建模

VAR模型

VAR(y, p=1, type=c("const","trend", "both", "none"), season=NULL, exogen=NULL, lag.max=NULL,ic=c("AIC", "HQ", "SC", "FPE"))

y是一个数据矩阵;p为滞后阶数;type为回归的类型;season为季节数据频数的设置(如果是季节数据,则season=4);exogen为外生变量矩阵;lag.max为最大滞后阶数;ic为信息准则。

SVAR模型

SVAR(x,estmethod=c("scoring", "direct"), Amat=NULL, Bmat=NULL, start=NULL,max.iter=100, conv.crit=1e-07, maxls=1, lrtest=TRUE,...)

x为数据矩阵;estmethod为由得分算法(默认)或负对数似然函数直接最小化估计;Amat和Bmat为A和B的结构系数矩阵;start为未知系数的初始值;conv.crit为收敛值;maxls为最大步长;lrtest为逻辑值,用来确定计算过度识别系统的似然比率。

SVEC模型

SVEC(x, LR=NULL, SR=NULL,r=1, start=NULL, max.iter=100, conv.crit=1e-07, maxls=1,lrtest=TRUE, boot=FALSE, runs=100)

x必须为ca.jo类型格式的,也就是说必须由设定协整方程后再构建SVEC;LR和SR分别为设定长期和短期的结构系数矩阵;r为协整方程个数。

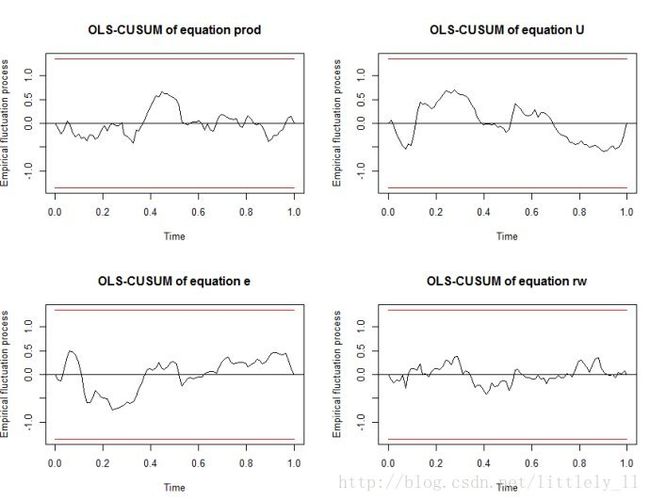

诊断检验

vars包中进行诊断检验的函数为arch.test(), normality.test(),serial.test()和stability()

脉冲响应和预测方差误差分解

脉冲响应函数

irf(x, impulse=NULL,response=NULL, n.ahead=10, ortho=TRUE, cumulative=FALSE, boot=TRUE,ci=0.95, runs=100,seed=NULL, ...)

方差分解

fevd(x,n.ahead=10,...)

(二)案例分析

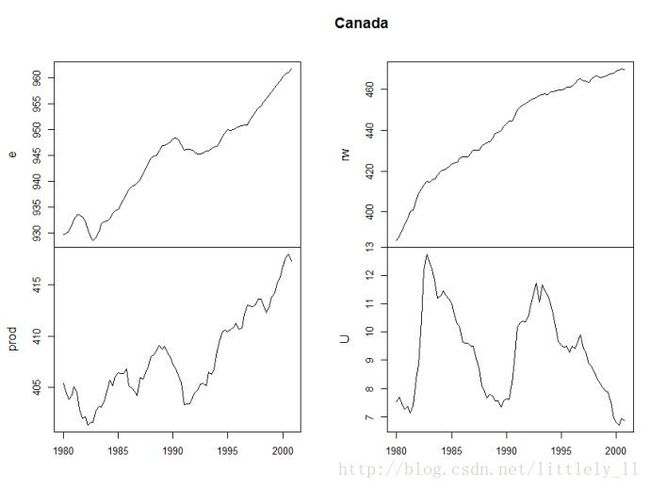

加拿大的一个宏观经济数据

prod为GDP,e为就业的对数,U为失业率,rw为实际工资水平的对数。

library(vars)

data(Canada)

summary(Canada)

e prod rw U

Min. :928.6 Min. :401.3 Min. :386.1 Min. : 6.700

1stQu.:935.4 1st Qu.:404.8 1stQu.:423.9 1st Qu.: 7.782

Median:946.0 Median :406.5 Median:444.4 Median : 9.450

Mean :944.3 Mean :407.8 Mean :440.8 Mean : 9.321

3rdQu.:950.0 3rd Qu.:410.7 3rdQu.:461.1 3rd Qu.:10.607

Max. :961.8 Max. :418.0 Max. :470.0 Max. :12.770

plot(Canada,nc=2,xlab="")

adf1<-summary(ur.df(Canada[,"prod"],type="trend",lag=2))

adf1

###############################################

# Augmented Dickey-FullerTest Unit Root Test #

###############################################

Test regressiontrend

Call:

lm(formula = z.diff ~z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-2.19924 -0.38994 0.04294 0.41914 1.71660

Coefficients:

EstimateStd. Error t value Pr(>|t|)

(Intercept) 30.415228 15.309403 1.987 0.0506 .

z.lag.1 -0.075791 0.038134 -1.988 0.0505.

tt 0.013896 0.006422 2.164 0.0336*

z.diff.lag1 0.284866 0.114359 2.491 0.0149*

z.diff.lag2 0.080019 0.116090 0.689 0.4927

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’1

Residual standard error:0.6851 on 76 degrees of freedom

Multiple R-squared: 0.1354, Adjusted R-squared: 0.08993

F-statistic: 2.976 on 4 and76 DF, p-value: 0.02438

Value of test-statistic is:-1.9875 2.3 2.3817

Critical values for teststatistics:

1pct 5pct10pct

tau3 -4.04 -3.45-3.15

phi2 6.50 4.88 4.16

phi3 8.73 6.49 5.47

adf2<-summary(ur.df(diff(Canada[,"prod"]),type="drift",lag=1))

adf2

###############################################

# Augmented Dickey-FullerTest Unit Root Test #

###############################################

Test regressiondrift

Call:

lm(formula = z.diff ~z.lag.1 + 1 + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-2.05124 -0.39530 0.07819 0.41109 1.75129

Coefficients:

Estimate Std. Error t valuePr(>|t|)

(Intercept) 0.11534 0.08029 1.437 0.155

z.lag.1 -0.68893 0.13350 -5.160 1.83e-06***

z.diff.lag -0.04274 0.11275 -0.379 0.706

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’1

Residual standard error:0.6971 on 78 degrees of freedom

Multiple R-squared: 0.3615, Adjusted R-squared: 0.3451

F-statistic: 22.08 on 2 and78 DF, p-value: 2.526e-08

Value of test-statistic is:-5.1604 13.3184

Critical values for teststatistics:

1pct 5pct10pct

tau2 -3.51 -2.89-2.58

phi1 6.70 4.71 3.86

VARselect(Canada,lag.max=8,type="both")

$selection

AIC(n) HQ(n) SC(n)FPE(n)

3 2 1 3

$criteria

1 2 3 4 5 6 7

AIC(n) -6.272579064-6.636669705 -6.771176872 -6.634609210 -6.398132246 -6.307704843-6.070727259

HQ(n) -5.978429449 -6.146420347 -6.084827770-5.752160366 -5.319583658 -5.033056512-4.599979185

SC(n) -5.536558009 -5.409967947 -5.053794411-4.426546046 -3.699388378 -3.118280272-2.390621985

FPE(n) 0.001889842 0.001319462 0.001166019 0.001363175 0.001782055 0.002044202 0.002768551

8

AIC(n)-6.06159685

HQ(n) -4.39474903

SC(n) -1.89081087

FPE(n) 0.00306012

从以上结果可知,AIC和FPE选择3阶之后,SC选择1阶。

Canada<-Canada[,c("prod","e","U","rw")]

p1ct<-VAR(Canada,p=1,type="both")

p1ct

VAR EstimationResults:

=======================

Estimated coefficients forequation prod:

=========================================

Call:

prod = prod.l1 + e.l1 + U.l1+ rw.l1 + const + trend

prod.l1 e.l1 U.l1 rw.l1 const trend

0.96313671 0.01291155 0.21108918-0.03909399 16.24340747 0.04613085

Estimated coefficients forequation e:

======================================

Call:

e = prod.l1 + e.l1 + U.l1 +rw.l1 + const + trend

prod.l1 e.l1 U.l1 rw.l1 const trend

0.19465028 1.23892283 0.62301475 -0.06776277-278.76121138 -0.04066045

Estimated coefficients forequation U:

======================================

Call:

U = prod.l1 + e.l1 + U.l1 +rw.l1 + const + trend

prod.l1 e.l1 U.l1 rw.l1 const trend

-0.12319201 -0.24844234 0.39158002 0.06580819 259.98200967 0.03451663

Estimated coefficients forequation rw:

=======================================

Call:

rw = prod.l1 + e.l1 + U.l1 +rw.l1 + const + trend

prod.l1 e.l1 U.l1 rw.l1 const trend

-0.22308744 -0.05104397 -0.36863956 0.94890946 163.02453066 0.07142229

summary(p1ct,equation="e")#选择就业方程

VAR EstimationResults:

=========================

Endogenous variables: prod,e, U, rw

Deterministic variables:both

Sample size:83

Log Likelihood:-207.525

Roots of the characteristicpolynomial:

0.9504 0.9504 0.90450.7513

Call:

VAR(y = Canada, p = 1, type= "both")

Estimation results forequation e:

==================================

e = prod.l1 + e.l1 + U.l1 +rw.l1 + const + trend

Estimate Std. Error t value Pr(>|t|)

prod.l1 0.19465 0.03612 5.389 7.49e-07***

e.l1 1.23892 0.08632 14.353 < 2e-16 ***

U.l1 0.62301 0.16927 3.681 0.000430***

rw.l1 -0.06776 0.02828 -2.396 0.018991 *

const -278.76121 75.18295 -3.7080.000392 ***

trend -0.04066 0.01970 -2.064 0.042378 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’1

Residual standard error:0.4701 on 77 degrees of freedom

Multiple R-Squared: 0.9975,Adjusted R-squared: 0.9973

F-statistic: 6088 on 5 and 77 DF, p-value:< 2.2e-16

Covariance matrix ofresiduals:

prod e U rw

prod 0.469517 0.06767 -0.04128 0.002141

e 0.067667 0.22096 -0.13200-0.082793

U -0.041280 -0.13200 0.12161 0.063738

rw 0.002141 -0.08279 0.06374 0.593174

Correlation matrix ofresiduals:

prod e U rw

prod 1.000000 0.2101 -0.1728 0.004057

e 0.210085 1.0000 -0.8052-0.228688

U -0.172753 -0.8052 1.0000 0.237307

rw 0.004057 -0.2287 0.2373 1.000000

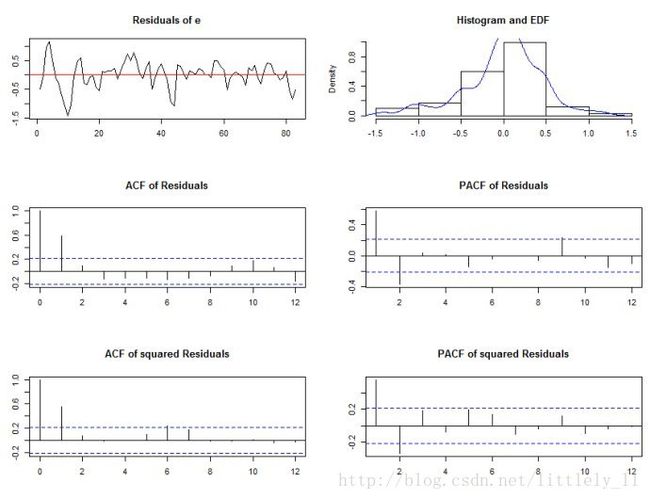

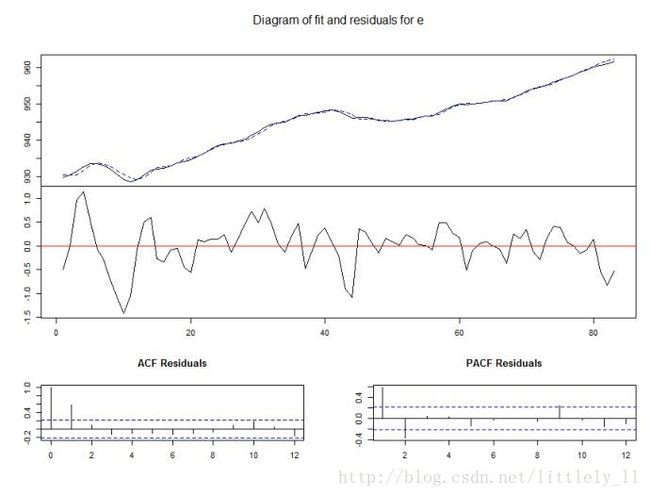

plot(p1ct,names="e")#画出就业对数的拟合、残差图和相关图

ser11<-serial.test(p1ct,lags.pt=16,type="PT.asymptotic")

ser11$serial

Portmanteau Test(asymptotic)

data: Residuals of VAR object p1ct

Chi-squared = 233.5, df =240, p-value = 0.606

norm1<-normality.test(p1ct)

norm1$jb.mul

$JB

JB-Test(multivariate)

data: Residuals of VAR object p1ct

Chi-squared = 9.9189, df =8, p-value = 0.2708

$Skewness

Skewness only(multivariate)

data: Residuals of VAR object p1ct

Chi-squared = 6.356, df = 4,p-value = 0.1741

$Kurtosis

Kurtosis only(multivariate)

data: Residuals of VAR object p1ct

Chi-squared = 3.5629, df =4, p-value = 0.4684

arch1<-arch.test(p1ct,lags.multi=5)

arch1$arch.mul

ARCH(multivariate)

data: Residuals of VAR object p1ct

Chi-squared = 570.14, df =500, p-value = 0.01606

plot(arch1,names="e")

summary(ca.jo(Canada,type="trace",ecdet="trend",K=3,spec="transitory")) #协整检验

######################

# Johansen-Procedure#

######################

Test type: trace statistic ,with linear trend incointegration

Eigenvalues(lambda):

[1] 4.505013e-011.962777e-01 1.676668e-01 4.647108e-022.632104e-17

Values of teststatistic andcritical values of test:

test 10pct 5pct 1pct

r <= 3 | 3.85 10.49 12.25 16.26

r <= 2 | 18.72 22.7625.32 30.45

r <= 1 | 36.42 39.0642.44 48.45

r = 0 |84.92 59.14 62.99 70.05

Eigenvectors, normalised tofirst column:

(These are the cointegrationrelations)

prod.l1 e.l1 U.l1 rw.l1 trend.l1

prod.l1 1.00000000 1.0000000 1.0000000 1.0000000 1.0000000

e.l1 -0.02385143 1.2946681-2.8831559 4.2418087 -8.2903941

U.l1 3.16874549 3.4036732 -7.4261514 6.8413561-12.5578436

rw.l1 1.83528156 -0.3330945 1.3978789 -0.1393999 2.4466500

trend.l1 -1.30156097-0.2302803 -0.5093218 -1.5925918 0.2831079

Weights W:

(This is the loadingmatrix)

prod.l1 e.l1 U.l1 rw.l1 trend.l1

prod.d -0.006535281-0.02763446 -0.070975296 -0.014754352 1.077469e-11

e.d -0.008503348 0.11414011-0.008156659 0.003988051 7.400296e-12

U.d -0.004718574 -0.06154306 0.020719431 -0.006557248-4.663893e-12

rw.d -0.046213350 -0.14579644 -0.016945105 0.011896044 6.952035e-12

summary(ca.jo(Canada,type="trace",ecdet="trend",K=2,spec="transitory"))

######################

# Johansen-Procedure#

######################

Test type: trace statistic ,with linear trend incointegration

Eigenvalues(lambda):

[1] 4.483918e-012.323995e-01 1.313250e-01 4.877895e-029.508809e-17

Values of teststatistic andcritical values of test:

test 10pct 5pct 1pct

r <= 3 | 4.10 10.49 12.25 16.26

r <= 2 | 15.65 22.7625.32 30.45

r <= 1 | 37.33 39.0642.44 48.45

r = 0 |86.12 59.14 62.99 70.05

Eigenvectors, normalised tofirst column:

(These are the cointegrationrelations)

prod.l1 e.l1 U.l1 rw.l1 trend.l1

prod.l1 1.0000000 1.0000000 1.00000000 1.000000 1.000000

e.l1 2.7132129 -6.3190324 0.49616472 16.333916-10.368563

U.l1 8.8369211 -15.2682881 1.48062661 25.774259 -16.048489

rw.l1 -0.3716323 3.1817254-0.04085215 -2.546391 4.927457

trend.l1 -0.4177976 -0.9335588 -0.26592659 -3.413555 -1.753060

Weights W:

(This is the loadingmatrix)

prod.l1 e.l1 U.l1 rw.l1 trend.l1

prod.d 0.023155644 -0.02832697 -0.10914770 -0.006295988-4.784701e-13

e.d 0.005602438 -0.01739149 0.08679396 -0.001019323-4.385546e-13

U.d -0.019277135 0.01381763-0.03696147 -0.002276871 4.919886e-13

rw.d -0.084618968 -0.02739056 -0.07798404 0.003985020-1.032315e-13

vecm<-ca.jo(Canada[,c("rw","prod","e","U")],type="trace",ecdet="trend",K=3,spec="transitory")

vecm.r1<-cajorls(vecm,r=1)#VEC模型

vecm.r1

$rlm

Call:

lm(formula =substitute(form1), data = data.mat)

Coefficients:

rw.d prod.d e.d U.d

ect1 -0.084815 -0.011994 -0.015606 -0.008660

constant 55.469125 8.274808 10.331308 5.687832

rw.dl1 -0.012082 0.004707 -0.078491 0.017263

prod.dl1 -0.074493 0.234441 0.200953 -0.138916

e.dl1 -0.634084 -0.246544 0.821558 -0.646846

U.dl1 0.063137 -0.979868 0.003379 -0.191125

rw.dl2 -0.157388 -0.190264 -0.095835 0.080354

prod.dl2 -0.251940 -0.029520 0.048273 -0.002909

e.dl2 0.081197 -0.580473 -0.459693 -0.019741

U.dl2 -0.230009 -0.128101 -0.103415 -0.262685

$beta

ect1

rw.l1 1.00000000

prod.l1 0.54487553

e.l1 -0.01299605

U.l1 1.72657188

trend.l1-0.70918872

vecm<-ca.jo(Canada[,c("prod","e","U","rw")],type="trace",ecdet="trend",K=3,spec="transitory")

SR<-matrix(NA,nr=4,nc=4)#根据经济理论设定短期和长期结构系数矩阵

SR[4,2]<-0

LR<-matrix(NA,nr=4,nc=4)

LR[1,2:4]<-0

LR[2:4,4]<-0

svec<-SVEC(vecm,LR=LR,SR=SR,r=1,lrtest=F,boot=T)#构建SVEC模型

summary(svec)

SVEC EstimationResults:

========================

Call:

SVEC(x = vecm, LR = LR, SR =SR, r = 1, lrtest = F, boot = T)

Type:B-model

Sample size:81

Log Likelihood:-161.838

Number of iterations:12

Estimated contemporaneousimpact matrix:

prod e U rw

prod 0.58402 0.07434 -0.1525780.06900

e -0.12029 0.26144 -0.1550960.08978

U 0.02526 -0.26720 0.0054880.04982

rw 0.11170 0.00000 0.483771 0.48791

Estimated standard errorsfor impact matrix:

prod e U rw

prod 0.09387 0.12013 0.216520.09304

e 0.06461 0.05874 0.16346 0.04542

U 0.05479 0.05526 0.06906 0.03374

rw 0.14126 0.00000 0.65297 0.09234

Estimated long run impactmatrix:

prod e Urw

prod 0.7910 0.0000 0.0000 0

e 0.2024 0.5769 -0.4923 0

U -0.1592 -0.3409 0.1408 0

rw -0.1535 0.5961 -0.2495 0

Estimated standard errorsfor long-run matrix:

prod e Urw

prod 0.1435 0.0000 0.0000 0

e 0.2220 0.1976 0.5540 0

U 0.1096 0.1032 0.1435 0

rw 0.17580.1806 0.2544 0

Covariance matrix of reducedform residuals (*100):

prod e U rw

prod 37.4642 -2.096 -0.2512 2.509

e -2.0960 11.494 -6.9273 -4.467

U -0.2512 -6.927 7.4544 2.978

rw 2.5087 -4.467 2.978348.457

LR[3,3]<-0

svec.oi<-update(svec,LR=LR,SR=SR,lrtest=T,boot=F)#模型的优化

svec.oi

SVEC EstimationResults:

========================

Estimated contemporaneousimpact matrix:

prod e U rw

prod 0.58402 0.1199 0.11200 0.07039

e -0.12029 0.3111 0.04089 0.09159

U 0.02526 -0.2571 0.096740.05083

rw 0.11170 0.0000 -0.473610.49778

Estimated long run impactmatrix:

prod e U rw

prod 0.7910 0.0000 0.000000 0

e 0.2024 0.6768 0.238920 0

U -0.1592 -0.3688 0.000000 0

rw -0.1535 0.6456 0.003105 0

summary(svec.oi)

SVEC EstimationResults:

========================

Call:

SVEC(x = vecm, LR = LR, SR =SR, r = 1, lrtest = T, boot = F)

Type:B-model

Sample size:81

Log Likelihood:-164.876

Number of iterations:17

LR overidentificationtest:

LRoveridentification

data: vecm

Chi^2 = 6.1, df = 1, p-value= 0.01

Estimated contemporaneousimpact matrix:

prod e U rw

prod 0.58402 0.1199 0.11200 0.07039

e -0.12029 0.3111 0.04089 0.09159

U 0.02526 -0.2571 0.096740.05083

rw 0.11170 0.0000 -0.473610.49778

Estimated long run impactmatrix:

prod e U rw

prod 0.7910 0.0000 0.000000 0

e 0.2024 0.6768 0.238920 0

U -0.1592 -0.3688 0.000000 0

rw -0.1535 0.6456 0.003105 0

Covariance matrix of reducedform residuals (*100):

prod e U rw

prod 37.2953 -2.192 -0.1664 4.723

e -2.1921 12.132 -7.4408 1.279

U -0.1664 -7.441 7.8671-1.770

rw 4.7233 1.279 -1.769748.457

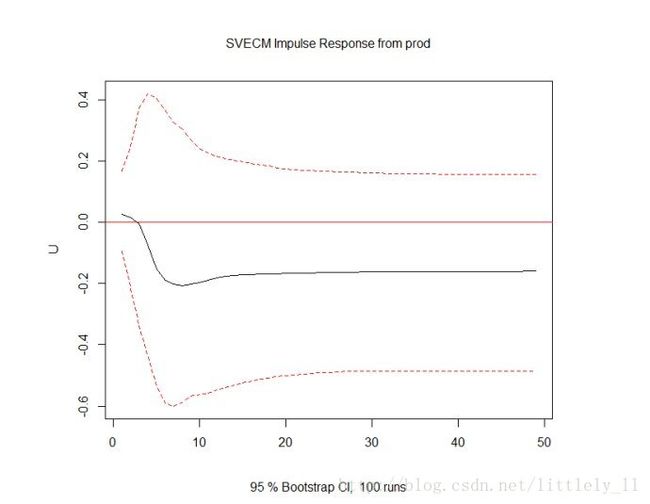

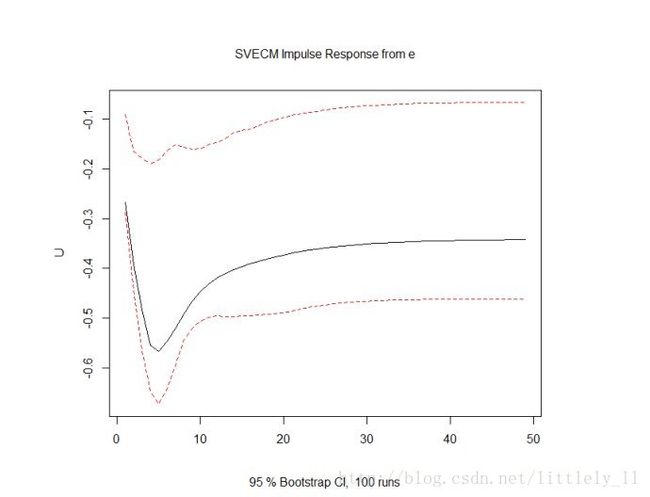

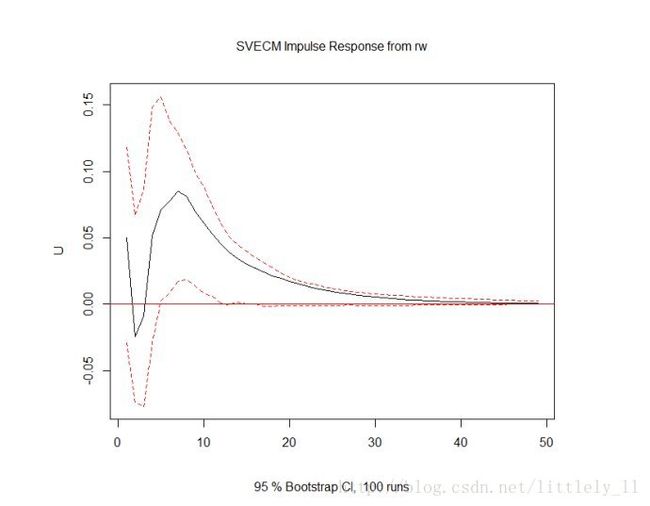

svec.irf<-irf(svec,response="U",n.ahead=48,boot=T)

plot(svec.irf)

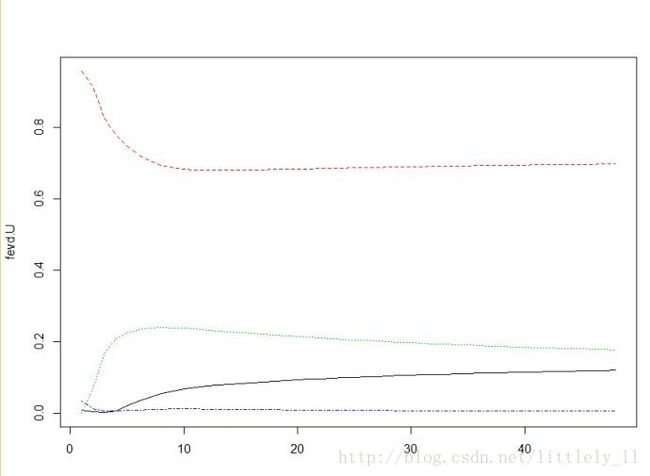

fevd.U<-fevd(svec,n.ahead=48)$U

matplot(fevd.U,type="l",lty=1:4)#失业率U的方差分解