利用主成分分析构建个股投资者情绪指标

利用主成分分析构建个股投资者情绪指标

- 投资者情绪指标构建

-

- 数据获取

- 主成分分析

投资者情绪指标构建

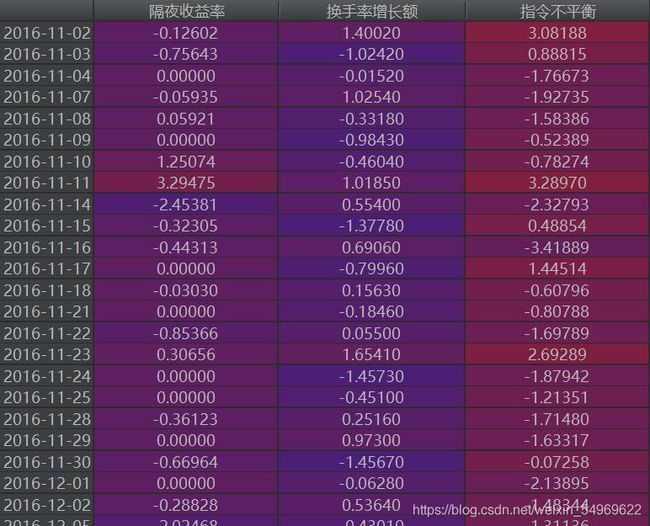

对股票的投资者情绪的研究,大部分都是通过对股票评论的内容进行情感分析来获取的,之前看到一篇论文是以隔夜收益率、个股换手率增长额、指令不平衡这 3 个指标构建投资者情绪指标,这种方法比情感分析要方便很多,所以决定用Python实现一下试试。以上三个指标的数据可以通过tushare接口获取。tushare ID:425652

数据获取

所需计算的指标为以下三个:

隔夜收益率:交易日开盘价与前一交易日收盘价的差额除以前一交易日收盘价(单位:%)

换手率增长额:交易日个股换手率与前一交易日个股换手率的差额(换手率:日度个股成交金额与日度个股流通市值的比值,单位:%)

指令不平衡:交易日个股买入总成交量与卖出总成交量的差额(单位:千万)

tushare数据接口提供的数据及说明可见:https://waditu.com/document/2

需要获取的数据包括:

股票开盘价open;股票前一交易日收盘价pre_close;股票换手率turnover_rate;净流入额net_mf_amount。

- 开盘价、昨收价数据通过daily接口获取

daily = pro.daily(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date,open,pre_close')

- 换手率数据通过daily_basic接口获取

daily_basi = pro.daily_basic(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date,turnover_rate')

3.净流入额数据通过moneyflow接口获取

moneyflow = pro.moneyflow(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date,net_mf_amount')

4.合并以上dataframe并计算相关指标

data = pd.merge(daily, daily_basic, on='trade_date', how='left')

data = pd.merge(data, moneyflow, on='trade_date', how='left')

data['date'] = pd.to_datetime(data['trade_date'], format='%Y%m%d')

data['date'] = data.date.dt.date

data = data.set_index('date')

data = data.sort_index(ascending=True)

data['inter_return'] = 100*(data['open'] - data['pre_close'])/data['pre_close']

data['turn_growth'] = data['turnover_rate'].rolling(2).apply(lambda x: x[1] - x[0])

data['net_mf_amount'] = data['net_mf_amount']/1000

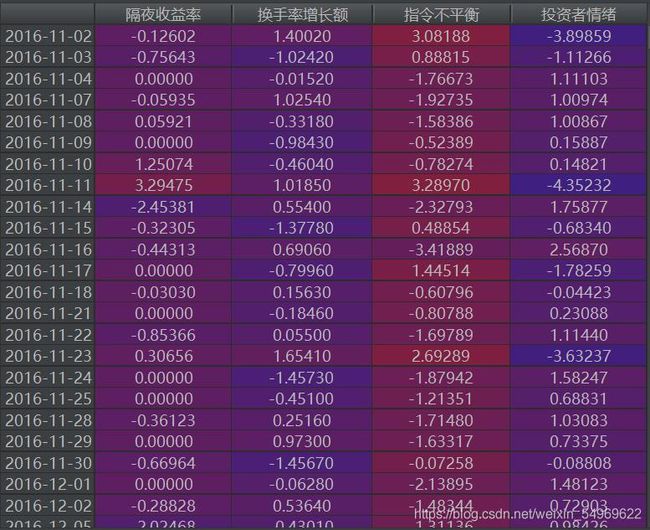

主成分分析

从sklearn包中导入主成分分析函数

from sklearn.decomposition import PCA

设置主成分个数为1个,即n_components=1,其他参数为默认值

pca = PCA(n_components=1)

训练模型,并得到投资者情绪变量

sentiment = pca.fit(data).transform(data)

data['投资者情绪'] = sentiment

完整代码如下:

import pandas as pd

import tushare as ts

from sklearn.decomposition import PCA

# 从tushare获取数据

token = '**********************************'

pro = ts.pro_api(token)

daily = pro.daily(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date, open, pre_close')

daily_basic = pro.daily_basic(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date,turnover_rate')

moneyflow = pro.moneyflow(ts_code='002149.SZ', start_date='20161101', end_date='20200831', fields='trade_date,net_mf_amount')

# 计算相应指标

data = pd.merge(daily, daily_basic, on='trade_date', how='left')

data = pd.merge(data, moneyflow, on='trade_date', how='left')

data['date'] = pd.to_datetime(data['trade_date'], format='%Y%m%d')

data['date'] = data.date.dt.date

data = data.set_index('date')

data = data.sort_index(ascending=True)

data['inter_return'] = 100*(data['open'] - data['pre_close'])/data['pre_close']

data['turn_growth'] = data['turnover_rate'].rolling(2).apply(lambda x: x[1] - x[0])

data['net_mf_amount'] = data['net_mf_amount']/1000

data = data.dropna(axis=0, how='any')

data = data[['inter_return', 'turn_growth', 'net_mf_amount']]

data.columns = ['隔夜收益率', '换手率增长额', '指令不平衡']

# 主成分分析构建投资者情绪指标

pca = PCA(n_components=1)

sentiment = pca.fit(data).transform(data)

print('各主成分贡献度:{}'.format(pca.explained_variance_ratio_))

data['投资者情绪'] = sentiment

data.to_excel('./投资者情绪.xlsx')