时间序列分析 - AirPassenger

时间序列分析 - AirPassengers

加载pandas、matplotlib等包,处理时间序列

import pandas as pd

import numpy as np

import matplotlib.pylab as plt

%matplotlib inline

# 解决坐标轴刻度负号乱码

plt.rcParams['axes.unicode_minus'] = False

# 解决中文乱码问题

plt.rcParams['font.sans-serif'] = ['Simhei']

from matplotlib.pylab import rcParams

rcParams['figure.figsize'] = 20, 6

import warnings

warnings.filterwarnings("ignore")

data = pd.read_csv('AirPassengers.csv')

data.head()

| Month | #Passengers | |

|---|---|---|

| 0 | 1949-01 | 112 |

| 1 | 1949-02 | 118 |

| 2 | 1949-03 | 132 |

| 3 | 1949-04 | 129 |

| 4 | 1949-05 | 121 |

data.dtypes

Month object

#Passengers int64

dtype: object

data.columns

Index(['Month', '#Passengers'], dtype='object')

Month 是object类型,在时间序列分析中,我们需要现将数据转化为时间序列

第一种方法:将Month以索引读入,转化为时间格式

# 读取数据,pd.read_csv默认生成DataFrame对象,需将其转换成Series对象

df = pd.read_csv('AirPassengers.csv', encoding='utf-8', index_col='Month')

df.head()

| #Passengers | |

|---|---|

| Month | |

| 1949-01 | 112 |

| 1949-02 | 118 |

| 1949-03 | 132 |

| 1949-04 | 129 |

| 1949-05 | 121 |

df.index = pd.to_datetime(df.index) # 将字符串索引转换成时间索引

df.head()

| #Passengers | |

|---|---|

| Month | |

| 1949-01-01 | 112 |

| 1949-02-01 | 118 |

| 1949-03-01 | 132 |

| 1949-04-01 | 129 |

| 1949-05-01 | 121 |

ts = df['#Passengers'] # 生成pd.Series对象

# 查看数据格式

ts.head()

Month

1949-01-01 112

1949-02-01 118

1949-03-01 132

1949-04-01 129

1949-05-01 121

Name: #Passengers, dtype: int64

ts.head().index

DatetimeIndex(['1949-01-01', '1949-02-01', '1949-03-01', '1949-04-01',

'1949-05-01'],

dtype='datetime64[ns]', name='Month', freq=None)

第二种方法:以时间格式读入Month,并将其设置为索引(推荐)

# pd.read_csv?

dateparse = lambda dates: pd.datetime.strptime(dates, '%Y-%m')

dateparse('1962-01')

datetime.datetime(1962, 1, 1, 0, 0)

df = pd.read_csv('AirPassengers.csv', parse_dates=['Month'], index_col='Month', date_parser=dateparse)

df.head()

| #Passengers | |

|---|---|

| Month | |

| 1949-01-01 | 112 |

| 1949-02-01 | 118 |

| 1949-03-01 | 132 |

| 1949-04-01 | 129 |

| 1949-05-01 | 121 |

df.shape

(144, 1)

# 检查索引格式

df.index

DatetimeIndex(['1949-01-01', '1949-02-01', '1949-03-01', '1949-04-01',

'1949-05-01', '1949-06-01', '1949-07-01', '1949-08-01',

'1949-09-01', '1949-10-01',

...

'1960-03-01', '1960-04-01', '1960-05-01', '1960-06-01',

'1960-07-01', '1960-08-01', '1960-09-01', '1960-10-01',

'1960-11-01', '1960-12-01'],

dtype='datetime64[ns]', name='Month', length=144, freq=None)

# convert to time series:

ts = df['#Passengers']

ts.head(10)

Month

1949-01-01 112

1949-02-01 118

1949-03-01 132

1949-04-01 129

1949-05-01 121

1949-06-01 135

1949-07-01 148

1949-08-01 148

1949-09-01 136

1949-10-01 119

Name: #Passengers, dtype: int64

检索时间序列

检索特定时间的序列值

# 1. 检索特定时间的序列值

ts['1949-01-01']

112

# 2. 导入datetime的datetime模块,生成索引检索特定时间的序列值

from datetime import datetime

ts[datetime(1949,1,1)]

112

获取一定时间区间的序列值

# 1. 切片,指定区间

ts['1949-01-01':'1949-05-01']

Month

1949-01-01 112

1949-02-01 118

1949-03-01 132

1949-04-01 129

1949-05-01 121

Name: #Passengers, dtype: int64

# 2. 切片,从开始到指定时间点

ts[:'1949-05-01']

Month

1949-01-01 112

1949-02-01 118

1949-03-01 132

1949-04-01 129

1949-05-01 121

Name: #Passengers, dtype: int64

Note: ends included here

# 所有1949年的数据

ts['1949']

Month

1949-01-01 112

1949-02-01 118

1949-03-01 132

1949-04-01 129

1949-05-01 121

1949-06-01 135

1949-07-01 148

1949-08-01 148

1949-09-01 136

1949-10-01 119

1949-11-01 104

1949-12-01 118

Name: #Passengers, dtype: int64

min(ts.index), max(ts.index)

(Timestamp('1949-01-01 00:00:00'), Timestamp('1960-12-01 00:00:00'))

平稳性检验

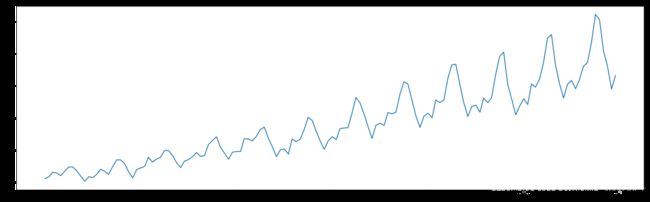

绘制时序图

plt.plot(ts);

[外链图片转存 (img-y6tQm2EE-1562729474892)(output_30_0.png)]

(img-y6tQm2EE-1562729474892)(output_30_0.png)]

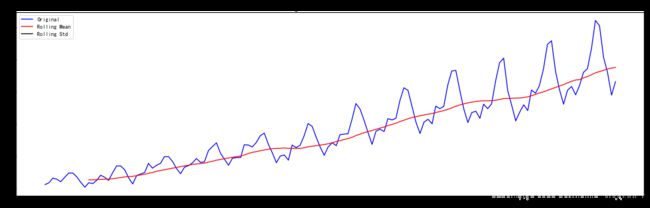

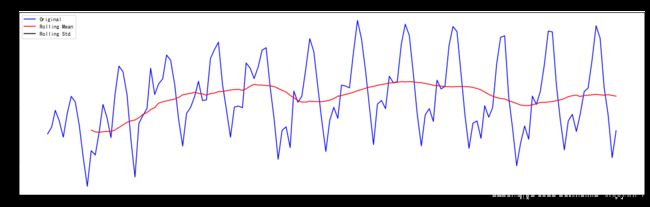

平稳性检验

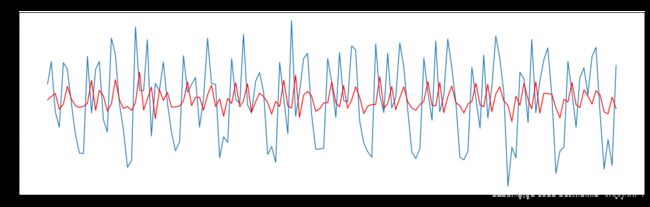

# 移动平均

# pd.rolling_mean?

from statsmodels.tsa.stattools import adfuller

def test_stationarity(timeseries):

# Determing rolling statistics

rolmean = timeseries.rolling(window=12, center=False).mean()

rolstd = timeseries.rolling(window=12, center=False).std()

# Plot rolling statistics:

orig = plt.plot(timeseries, color='blue', label='Original')

mean = plt.plot(rolmean, color='red', label='Rolling Mean')

std = plt.plot(rolstd, color='black', label = 'Rolling Std')

plt.legend(loc='best')

plt.title('Rolling Mean & Standard Deviation')

plt.show(block=False)

# Perform Dickey-Fuller test:

print('Results of Dickey-Fuller Test:')

dftest = adfuller(timeseries, autolag='AIC')

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic','p-value','#Lags Used','Number of Observations Used'])

for key,value in dftest[4].items():

dfoutput['Critical Value ({})'.format(key)] = value

print(dfoutput)

test_stationarity(ts)

[外链图片转存 (img-FSxx9adZ-1562729474893)(output_34_0.png)]

(img-FSxx9adZ-1562729474893)(output_34_0.png)]

Results of Dickey-Fuller Test:

Test Statistic 0.815369

p-value 0.991880

#Lags Used 13.000000

Number of Observations Used 130.000000

Critical Value (1%) -3.481682

Critical Value (5%) -2.884042

Critical Value (10%) -2.578770

dtype: float64

p = 0.991880 > 0.05 序列非平稳, 同时也可以注意到均值和方差很不稳定

# acorr_ljungbox?

from statsmodels.stats.diagnostic import acorr_ljungbox

# 白噪声检验:Ljung-Box test

def randomness(ts, lags=10):

rdtest = acorr_ljungbox(ts,lags=lags)

# 对上述函数求得的值进行语义描述

rddata = np.c_[range(1,lags+1),rdtest[1:][0]]

rdoutput = pd.DataFrame(rddata,columns=['lags','p-value'])

return rdoutput.set_index('lags')

randomness(ts)

| p-value | |

|---|---|

| lags | |

| 1.0 | 1.393231e-30 |

| 2.0 | 4.556318e-54 |

| 3.0 | 5.751088e-74 |

| 4.0 | 2.817731e-91 |

| 5.0 | 7.360195e-107 |

| 6.0 | 4.264008e-121 |

| 7.0 | 1.305463e-134 |

| 8.0 | 6.496271e-148 |

| 9.0 | 5.249370e-162 |

| 10.0 | 1.100789e-177 |

p = 1.3932314e-30 < 0.05,序列为非白噪声序列

平稳性处理 - 估计和消除趋势

消除趋势的第一个诀窍是对数变换。因为,能清楚地看到我们的数据呈现一个显著的上升趋势。因此,我们可以应用log变换。当然还有其他的变换方式,如:平方根,立方根等等。

[外链图片转存失败(img-lWuJFawA-1562729474893)(log 函数曲线.jpg)]

对数变换(log transform)

ts_log = np.log(ts)

# Plot original ts and log(ts):

plt.subplot(211)

plt.title('Original')

plt.plot(ts,label='Original ts')

plt.legend(loc='best')

plt.subplot(212)

plt.title('Log')

plt.plot(ts_log, label='Log(ts)')

plt.legend(loc='best')

plt.tight_layout()

[外链图片转存 (img-zYLSvexy-1562729474894)(output_44_0.png)]

(img-zYLSvexy-1562729474894)(output_44_0.png)]

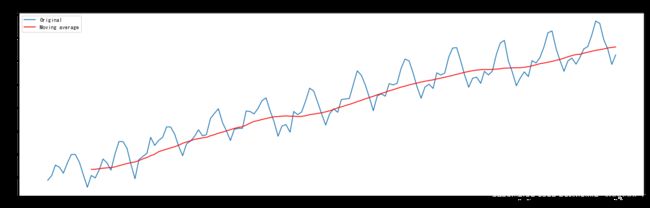

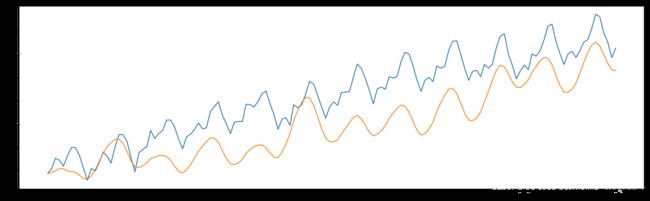

平滑法/移动平均法(Moving average)

moving_avg = ts_log.rolling(window=12,center=False).mean() # 窗口为12

plt.plot(ts_log, label='Original')

plt.plot(moving_avg, color='red', label='Moving average')

plt.title('Moving average(12)')

plt.legend(loc='best');

[外链图片转存 (img-gWMOPmSo-1562729474894)(output_46_0.png)]

(img-gWMOPmSo-1562729474894)(output_46_0.png)]

# 移除移动平均值

ts_log_moving_avg_diff = ts_log - moving_avg

ts_log_moving_avg_diff.head(24)

Month

1949-01-01 NaN

1949-02-01 NaN

1949-03-01 NaN

1949-04-01 NaN

1949-05-01 NaN

1949-06-01 NaN

1949-07-01 NaN

1949-08-01 NaN

1949-09-01 NaN

1949-10-01 NaN

1949-11-01 NaN

1949-12-01 -0.065494

1950-01-01 -0.093449

1950-02-01 -0.007566

1950-03-01 0.099416

1950-04-01 0.052142

1950-05-01 -0.027529

1950-06-01 0.139881

1950-07-01 0.260184

1950-08-01 0.248635

1950-09-01 0.162937

1950-10-01 -0.018578

1950-11-01 -0.180379

1950-12-01 0.010818

Name: #Passengers, dtype: float64

ts_log_moving_avg_diff.dropna(inplace=True)

ts_log_moving_avg_diff.head()

Month

1949-12-01 -0.065494

1950-01-01 -0.093449

1950-02-01 -0.007566

1950-03-01 0.099416

1950-04-01 0.052142

Name: #Passengers, dtype: float64

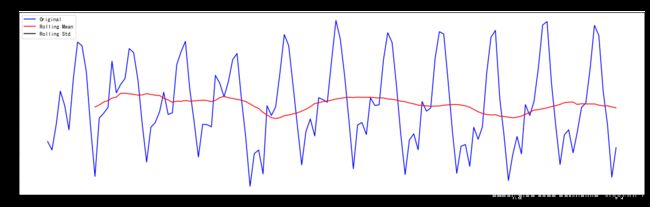

test_stationarity(ts_log_moving_avg_diff)

[外链图片转存 (img-yPo4GPsI-1562729474895)(output_49_0.png)]

(img-yPo4GPsI-1562729474895)(output_49_0.png)]

Results of Dickey-Fuller Test:

Test Statistic -3.162908

p-value 0.022235

#Lags Used 13.000000

Number of Observations Used 119.000000

Critical Value (1%) -3.486535

Critical Value (5%) -2.886151

Critical Value (10%) -2.579896

dtype: float64

p = 0.022235 < 0.05 我们可以说在95%的置信度下该序列平稳,均值和方差比平滑法相对稳定

然而,这种特殊方法的一个缺点是,必须严格定义时间周期。在这种情况下,我们可以取年平均,但在复杂的情况下,比如预测股票价格,很难通过这种方法达到平稳。所以我们取一个“加权移动平均”(weighted moving average),该方法中最近的时序值被赋予更高的权重。有很多方法可以分配权重。最常用的是指数加权移动平均,权重被分配到所有之前的值。

指数加权平滑法(exponentially weighted moving average)

# ts_log.ewm?

expwighted_avg = ts_log.ewm(min_periods=0, ignore_na=False, halflife=12, adjust=True).mean()

plt.plot(ts_log, label='Original')

plt.plot(moving_avg, color='red', label='Moving average')

plt.plot(expwighted_avg, color='green', label='Weighted Moving average')

# expwighted_avg.plot(style='k--')

plt.title('Moving Average(12) & weighted Moving Average(12)')

plt.legend(loc='best');

[外链图片转存 (img-jej2P1qZ-1562729474895)(output_53_0.png)]

(img-jej2P1qZ-1562729474895)(output_53_0.png)]

# 移除指数加权移动平均值

ts_log_ewma_diff = ts_log - expwighted_avg

test_stationarity(ts_log_ewma_diff)

[外链图片转存 (img-spwk5QIJ-1562729474895)(output_54_0.png)]

(img-spwk5QIJ-1562729474895)(output_54_0.png)]

Results of Dickey-Fuller Test:

Test Statistic -3.601262

p-value 0.005737

#Lags Used 13.000000

Number of Observations Used 130.000000

Critical Value (1%) -3.481682

Critical Value (5%) -2.884042

Critical Value (10%) -2.578770

dtype: float64

p = 0.005737 现在可以说在99%的置信度下该序列平稳,均值和方差更加稳定

并且注意这里没有产生缺失值

消除趋势和季节因素

前面提到的方法不是对所有的问题都能做到很好的解决,尤其是在有比较明显的季节性因素存在的时候。下面我们会讲到两个常用而且有效地方法来消除趋势项和季节性因素:

- 差分:以一定的时间间隔做差分

- 分解:对趋势和季节性进行建模,并将它们从模型中移除

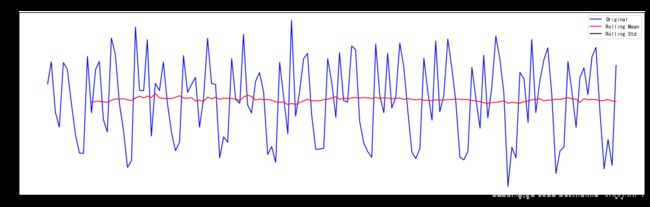

差分

# 一阶差分

ts_log_diff = ts_log - ts_log.shift()

plt.plot(ts_log_diff);

[外链图片转存 (img-OJI8GEMZ-1562729474896)(output_58_0.png)]

(img-OJI8GEMZ-1562729474896)(output_58_0.png)]

ts_log_diff.dropna(inplace=True)

test_stationarity(ts_log_diff)

[外链图片转存 (img-7tziORx9-1562729474896)(output_59_0.png)]

(img-7tziORx9-1562729474896)(output_59_0.png)]

Results of Dickey-Fuller Test:

Test Statistic -2.717131

p-value 0.071121

#Lags Used 14.000000

Number of Observations Used 128.000000

Critical Value (1%) -3.482501

Critical Value (5%) -2.884398

Critical Value (10%) -2.578960

dtype: float64

p = 0.071121 可以说在90%的置信度下该序列平稳,均值和方差很稳定

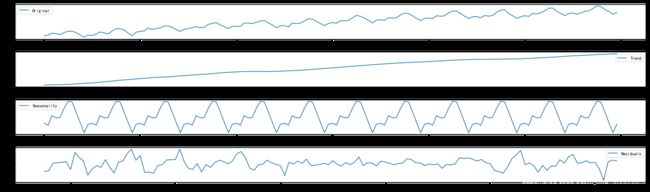

分解

from statsmodels.tsa.seasonal import seasonal_decompose

decomposition = seasonal_decompose(ts_log)

trend = decomposition.trend

seasonal = decomposition.seasonal

residual = decomposition.resid

plt.subplot(411)

plt.plot(ts_log, label='Original')

plt.legend(loc='best')

plt.subplot(412)

plt.plot(trend, label='Trend')

plt.legend(loc='best')

plt.subplot(413)

plt.plot(seasonal,label='Seasonality')

plt.legend(loc='best')

plt.subplot(414)

plt.plot(residual, label='Residuals')

plt.legend(loc='best')

plt.tight_layout()

[外链图片转存 (img-4GU2jwWs-1562729474896)(output_62_0.png)]

(img-4GU2jwWs-1562729474896)(output_62_0.png)]

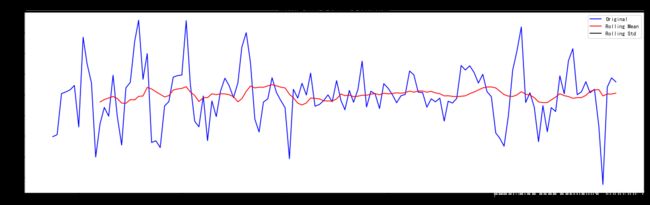

# 检验残差的平稳性

ts_log_decompose = residual

ts_log_decompose.dropna(inplace=True)

test_stationarity(ts_log_decompose)

[外链图片转存 (img-RBRWLtFc-1562729474896)(output_63_0.png)]

(img-RBRWLtFc-1562729474896)(output_63_0.png)]

Results of Dickey-Fuller Test:

Test Statistic -6.332387e+00

p-value 2.885059e-08

#Lags Used 9.000000e+00

Number of Observations Used 1.220000e+02

Critical Value (1%) -3.485122e+00

Critical Value (5%) -2.885538e+00

Critical Value (10%) -2.579569e+00

dtype: float64

模型拟合

ARMA

from statsmodels.tsa.arima_model import ARIMA

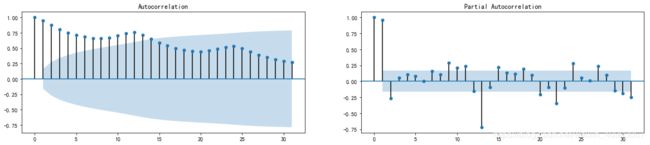

ACF & PACF Plots

# ACF and PACF plots:

from statsmodels.tsa.stattools import acf, pacf

# ts_log_diff, log变换后做一阶差分后的时序

lag_acf = acf(ts_log_diff, nlags=30)

lag_pacf = pacf(ts_log_diff, nlags=30, method='ols')

# Plot ACF:

plt.subplot(121)

plt.plot(lag_acf)

plt.axhline(y=0,linestyle='--',color='gray')

plt.axhline(y=-1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.axhline(y=1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.title('Autocorrelation Function')

# Plot PACF:

plt.subplot(122)

plt.plot(lag_pacf)

plt.axhline(y=0,linestyle='--',color='gray')

plt.axhline(y=-1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.axhline(y=1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.title('Partial Autocorrelation Function')

plt.tight_layout()

[外链图片转存 (img-v5iIBEYw-1562729474897)(output_68_0.png)]

(img-v5iIBEYw-1562729474897)(output_68_0.png)]

可以看到ACF和PACF分别在2阶的时候第一次落到置信区间内

# 其实,statsmodels提供了更加方便的话ACF,PACF的函数

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

# 自相关和偏相关图,默认阶数为31阶

def draw_acf_pacf(ts, lags=31):

f = plt.figure(facecolor='white',figsize=(20,4))

ax1 = f.add_subplot(121)

plot_acf(ts, lags=31, ax=ax1)

ax2 = f.add_subplot(122)

plot_pacf(ts, lags=31, ax=ax2)

plt.show()

draw_acf_pacf(ts)

[外链图片转存 (img-0IlJORmw-1562729474897)(output_72_0.png)]

(img-0IlJORmw-1562729474897)(output_72_0.png)]

draw_acf_pacf(ts_log_diff)

[外链图片转存 (img-zyzeAv4N-1562729474897)(output_73_0.png)]

(img-zyzeAv4N-1562729474897)(output_73_0.png)]

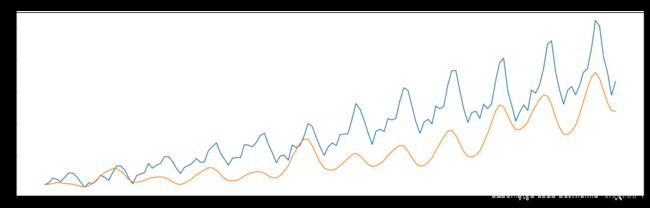

AR Model:

model = ARIMA(ts_log, order=(2, 1, 0))

results_AR = model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results_AR.fittedvalues, color='red')

plt.title('RSS: {:.4f}'.format(sum((results_AR.fittedvalues-ts_log_diff)**2)));

[外链图片转存 (img-5qz998lw-1562729474898)(output_75_0.png)]

(img-5qz998lw-1562729474898)(output_75_0.png)]

MA Model

model = ARIMA(ts_log, order=(0, 1, 2))

results_MA = model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results_MA.fittedvalues, color='red')

plt.title('RSS: {:.4f}'.format(sum((results_MA.fittedvalues-ts_log_diff)**2)));

[外链图片转存 (img-VHpE4QzO-1562729474898)(output_77_0.png)]

(img-VHpE4QzO-1562729474898)(output_77_0.png)]

ARIMA Model:

model = ARIMA(ts_log, order=(2, 1, 2))

results_ARIMA = model.fit(disp=-1)

print(results_ARIMA.summary())

ARIMA Model Results

==============================================================================

Dep. Variable: D.#Passengers No. Observations: 143

Model: ARIMA(2, 1, 2) Log Likelihood 149.640

Method: css-mle S.D. of innovations 0.084

Date: Mon, 03 Sep 2018 AIC -287.281

Time: 16:39:28 BIC -269.504

Sample: 02-01-1949 HQIC -280.057

- 12-01-1960

=======================================================================================

coef std err z P>|z| [0.025 0.975]

---------------------------------------------------------------------------------------

const 0.0096 0.003 3.697 0.000 0.005 0.015

ar.L1.D.#Passengers 1.6293 0.039 41.868 0.000 1.553 1.706

ar.L2.D.#Passengers -0.8946 0.039 -23.127 0.000 -0.970 -0.819

ma.L1.D.#Passengers -1.8270 0.036 -51.303 0.000 -1.897 -1.757

ma.L2.D.#Passengers 0.9245 0.036 25.568 0.000 0.854 0.995

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 0.9106 -0.5372j 1.0573 -0.0848

AR.2 0.9106 +0.5372j 1.0573 0.0848

MA.1 0.9881 -0.3245j 1.0400 -0.0505

MA.2 0.9881 +0.3245j 1.0400 0.0505

-----------------------------------------------------------------------------

plt.plot(ts_log_diff)

plt.plot(results_ARIMA.fittedvalues, color='red')

plt.title('RSS: {:.4f}'.format(sum((results_ARIMA.fittedvalues-ts_log_diff)**2)));

[外链图片转存 (img-ak6oboSI-1562729474898)(output_80_0.png)]

(img-ak6oboSI-1562729474898)(output_80_0.png)]

将预测值转化为变换前的值:

predictions_ARIMA_diff = pd.Series(results_ARIMA.fittedvalues, copy=True)

predictions_ARIMA_diff.head()

Month

1949-02-01 0.009580

1949-03-01 0.017491

1949-04-01 0.027670

1949-05-01 -0.004521

1949-06-01 -0.023889

dtype: float64

predictions_ARIMA_diff.tail()

Month

1960-08-01 -0.041176

1960-09-01 -0.092350

1960-10-01 -0.094013

1960-11-01 -0.069924

1960-12-01 -0.008127

dtype: float64

# 消除一阶差分的影响

predictions_ARIMA_diff_cumsum = predictions_ARIMA_diff.cumsum()

predictions_ARIMA_diff_cumsum.head()

Month

1949-02-01 0.009580

1949-03-01 0.027071

1949-04-01 0.054742

1949-05-01 0.050221

1949-06-01 0.026331

dtype: float64

ts_log.iloc[0]

4.718498871295094

# 将1949-01-01的值添加回来,并以此为基数,变换回差分前

predictions_ARIMA_log = pd.Series(ts_log.iloc[0], index=ts_log.index)

predictions_ARIMA_log = predictions_ARIMA_log.add(predictions_ARIMA_diff_cumsum, fill_value=0)

predictions_ARIMA_log.head()

Month

1949-01-01 4.718499

1949-02-01 4.728079

1949-03-01 4.745570

1949-04-01 4.773241

1949-05-01 4.768720

dtype: float64

plt.plot(ts_log)

plt.plot(predictions_ARIMA_log);

[外链图片转存 (img-U5LE6Pad-1562729474899)(output_87_0.png)]

(img-U5LE6Pad-1562729474899)(output_87_0.png)]

predictions_ARIMA = np.exp(predictions_ARIMA_log)

predictions_ARIMA.head()

Month

1949-01-01 112.000000

1949-02-01 113.078122

1949-03-01 115.073413

1949-04-01 118.301983

1949-05-01 117.768360

dtype: float64

plt.plot(ts)

plt.plot(predictions_ARIMA)

plt.title('RMSE: {:.4f}'.format(np.sqrt(sum((predictions_ARIMA-ts)**2)/len(ts))));

[外链图片转存 (img-mVcPVaXi-1562729474899)(output_89_0.png)]

(img-mVcPVaXi-1562729474899)(output_89_0.png)]

SARMAX

import statsmodels.api as sm

draw_acf_pacf(ts)

[外链图片转存 (img-EFwoHjxx-1562729474899)(output_92_0.png)]

(img-EFwoHjxx-1562729474899)(output_92_0.png)]

# Fit the model

mod = sm.tsa.statespace.SARIMAX(ts_log, order=(1,1,1), seasonal_order=(1,0,0,12), simple_differencing=True)

res = mod.fit(disp=False)

print(res.summary())

Statespace Model Results

==========================================================================================

Dep. Variable: D.#Passengers No. Observations: 143

Model: SARIMAX(1, 0, 1)x(1, 0, 0, 12) Log Likelihood 237.983

Date: Mon, 03 Sep 2018 AIC -467.965

Time: 16:39:36 BIC -456.114

Sample: 02-01-1949 HQIC -463.149

- 12-01-1960

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.4712 0.285 -1.652 0.099 -1.030 0.088

ma.L1 0.2038 0.312 0.653 0.514 -0.408 0.815

ar.S.L12 0.9275 0.028 33.439 0.000 0.873 0.982

sigma2 0.0018 0.000 9.367 0.000 0.001 0.002

===================================================================================

Ljung-Box (Q): 52.52 Jarque-Bera (JB): 2.94

Prob(Q): 0.09 Prob(JB): 0.23

Heteroskedasticity (H): 0.50 Skew: 0.22

Prob(H) (two-sided): 0.02 Kurtosis: 3.54

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

# In-sample one-step-ahead predictions, and out-of-sample forecasts

nforecast = 12

predict = res.get_prediction(end=mod.nobs + nforecast)

# 消除一阶差分的影响

pred_log = pd.Series(ts_log.iloc[0], index=ts_log[[0]].index)

pred_log = pred_log.add(predict.predicted_mean, fill_value=0).cumsum()

# 对数还原

pred_ARIMA = np.exp(pred_log)

# Graph

fig, ax = plt.subplots(figsize=(12,6))

ax.xaxis.grid()

ax.plot(ts, 'k.')

# Plot

ax.plot(pred_ARIMA[:-nforecast-1], 'b')

ax.plot(pred_ARIMA[-nforecast-1:], 'k--', linestyle='--', linewidth=2)

ax.set(title='RMSE: {:.4f}'.format(np.sqrt(sum((pred_ARIMA[:-nforecast-1]-ts)**2)/len(ts))));

[外链图片转存 (img-5VgKJk1E-1562729474899)(output_96_0.png)]

(img-5VgKJk1E-1562729474899)(output_96_0.png)]

进一步调优

# log变换,平滑,一阶差分

ts_log = np.log(ts)

rol_mean = ts_log.rolling(window=12).mean()

rol_mean.dropna(inplace=True)

ts_diff_1 = rol_mean.diff(1)

ts_diff_1.dropna(inplace=True)

test_stationarity(ts_diff_1)

[外链图片转存 (img-NF1IHiw2-1562729474900)(output_98_0.png)]

(img-NF1IHiw2-1562729474900)(output_98_0.png)]

Results of Dickey-Fuller Test:

Test Statistic -2.709577

p-value 0.072396

#Lags Used 12.000000

Number of Observations Used 119.000000

Critical Value (1%) -3.486535

Critical Value (5%) -2.886151

Critical Value (10%) -2.579896

dtype: float64

# 二阶差分

ts_diff_2 = ts_diff_1.diff(1)

ts_diff_2.dropna(inplace=True)

from statsmodels.tsa.arima_model import ARMA

# 拟合模型

model = ARMA(ts_diff_2, order=(1, 1))

result_arma = model.fit(disp=-1, method='css')

# 预测值

result_arma.fittedvalues.head()

Month

1950-03-01 0.000536

1950-04-01 0.000283

1950-05-01 0.000801

1950-06-01 0.000844

1950-07-01 -0.001620

dtype: float64

print(result_arma.summary())

ARMA Model Results

==============================================================================

Dep. Variable: #Passengers No. Observations: 131

Model: ARMA(1, 1) Log Likelihood 548.413

Method: css S.D. of innovations 0.004

Date: Mon, 03 Sep 2018 AIC -1088.826

Time: 16:39:41 BIC -1077.356

Sample: 03-01-1950 HQIC -1084.165

- 12-01-1960

=====================================================================================

coef std err z P>|z| [0.025 0.975]

-------------------------------------------------------------------------------------

const 4.899e-06 0.000 0.028 0.977 -0.000 0.000

ar.L1.#Passengers 0.1630 0.259 0.630 0.530 -0.345 0.671

ma.L1.#Passengers -0.5404 0.229 -2.355 0.020 -0.990 -0.091

Roots

=============================================================================

Real Imaginary Modulus Frequency

-----------------------------------------------------------------------------

AR.1 6.1335 +0.0000j 6.1335 0.0000

MA.1 1.8504 +0.0000j 1.8504 0.0000

-----------------------------------------------------------------------------

# AIC,BIC

result_arma.aic, result_arma.bic

(-1088.8260693802756, -1077.3559315784532)

# AR,MA模型参数估计

result_arma.arparams, result_arma.maparams

(array([0.16304032]), array([-0.54041254]))

# 预测值

predict_ts = result_arma.predict()

predict_ts.head(), predict_ts.tail()

(1950-03-01 0.000536

1950-04-01 0.000283

1950-05-01 0.000801

1950-06-01 0.000844

1950-07-01 -0.001620

Freq: MS, dtype: float64, 1960-08-01 -0.000151

1960-09-01 0.001367

1960-10-01 0.000365

1960-11-01 -0.000800

1960-12-01 0.001147

Freq: MS, dtype: float64)

样本外预测

forecast方法(Out-of-sample forecasts):

arma_model.forecast(steps=1, exog=None, alpha=0.05)

参数:

- step:预测步长

- exog:外生变量(armax)

- alpha:预测的置信水平

返回:

- forecast:预测值,数组

- stderr:标准差,数组

- conf_int:预测值的执行区间,二维数组

# result_arma.forecast?

result_arma.forecast(1) # 1步预测

(array([0.00093721]), array([0.00356176]), array([[-0.00604371, 0.00791813]]))

result_arma.forecast(1)[0] # 1步预测

array([0.00093721])

result_arma.forecast(10)[0] # 10步预测

array([9.37208646e-04, 1.56903477e-04, 2.96822730e-05, 8.94008713e-06,

5.55827452e-06, 5.00690271e-06, 4.91700687e-06, 4.90235022e-06,

4.89996060e-06, 4.89957099e-06])

predict方法

可以用来预测任意的样本内和样本外的时间步长。

arma_model.predict(start=None, end=None, exog=None, dynamic=False)

参数:

- start:预测开始时间(可以是时间格式也可以是可以转化为时间格式的字符串)或训练数据的索引,1阶差分从1开始,以此类推

- end:预测开始时间(可以是时间格式也可以是可以转化为时间格式的字符串)或训练数据的索引,1阶差分从1开始,以此类推

- exog:外生变量(armax)

- dynamic:False,样本内滞后值会被用作预测,True,样本内预测值被用来代替滞后值

返回:

- predict : 预测值,数组

# result_arma.predict?

from pandas import datetime

start_index = datetime(1961, 1, 1)

end_index = datetime(1961, 12, 1)

pred = result_arma.predict(start=start_index, end=end_index)

pred.head(), pred.tail()

(1961-01-01 0.000937

1961-02-01 0.000157

1961-03-01 0.000030

1961-04-01 0.000009

1961-05-01 0.000006

Freq: MS, dtype: float64, 1961-08-01 0.000005

1961-09-01 0.000005

1961-10-01 0.000005

1961-11-01 0.000005

1961-12-01 0.000005

Freq: MS, dtype: float64)

# 变换过后的实际值和预测值

plt.figure(figsize=(8,5))

result_arma.plot_predict();

[外链图片转存 (img-8UGOYSwh-1562729474900)(output_115_1.png)]

(img-8UGOYSwh-1562729474900)(output_115_1.png)]

# 还原

# 一阶差分还原

diff_shift_ts = ts_diff_1.shift(1)

diff_recover_1 = predict_ts.add(diff_shift_ts)

# 再次一阶差分还原

rol_shift_ts = rol_mean.shift(1)

diff_recover = diff_recover_1.add(rol_shift_ts)

# 移动平均还原

rol_sum = ts_log.rolling(window=11).sum()

rol_recover = diff_recover * 12 - rol_sum.shift(1)

# 对数还原

log_recover = np.exp(rol_recover)

log_recover.head()

1949-01-01 NaN

1949-02-01 NaN

1949-03-01 NaN

1949-04-01 NaN

1949-05-01 NaN

dtype: float64

log_recover.tail(15)

1959-10-01 406.530462

1959-11-01 350.627418

1959-12-01 388.688005

1960-01-01 425.142956

1960-02-01 397.935468

1960-03-01 467.625349

1960-04-01 426.505252

1960-05-01 478.137753

1960-06-01 531.118845

1960-07-01 619.599772

1960-08-01 633.334409

1960-09-01 510.229116

1960-10-01 448.515536

1960-11-01 406.112839

1960-12-01 442.372193

dtype: float64

log_recover.dropna(inplace=True)

log_recover.head(), log_recover.tail()

(1950-03-01 141.859017

1950-04-01 138.263428

1950-05-01 127.851420

1950-06-01 140.882557

1950-07-01 160.203376

dtype: float64, 1960-08-01 633.334409

1960-09-01 510.229116

1960-10-01 448.515536

1960-11-01 406.112839

1960-12-01 442.372193

dtype: float64)

ts1 = ts[log_recover.index] # 过滤没有预测的记录

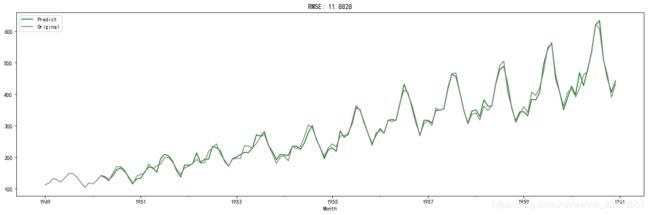

plt.figure(facecolor='white')

log_recover.plot(color='green', label='Predict')

ts.plot(color='grey', label='Original')

plt.legend(loc='best')

plt.title('RMSE: {:.4f}'.format(np.sqrt(sum((log_recover-ts1)**2)/ts1.size)));

[外链图片转存 (img-qJfRRaNQ-1562729474900)(output_119_0.png)]

(img-qJfRRaNQ-1562729474900)(output_119_0.png)]

# 差分操作

def diff_ts(ts, d):

global shift_ts_list

# 动态预测第二日的值时所需要的差分序列

global last_data_shift_list

shift_ts_list = []

last_data_shift_list = []

tmp_ts = ts

for i in d:

last_data_shift_list.append(tmp_ts[-i])

print(last_data_shift_list)

shift_ts = tmp_ts.shift(i)

shift_ts_list.append(shift_ts)

tmp_ts = tmp_ts - shift_ts

tmp_ts.dropna(inplace=True)

return tmp_ts

# 还原操作

def predict_diff_recover(predict_value, d):

if isinstance(predict_value, float):

tmp_data = predict_value

for i in range(len(d)):

tmp_data = tmp_data + last_data_shift_list[-i-1]

elif isinstance(predict_value, np.ndarray):

tmp_data = predict_value[0]

for i in range(len(d)):

tmp_data = tmp_data + last_data_shift_list[-i-1]

else:

tmp_data = predict_value

for i in range(len(d)):

try:

tmp_data = tmp_data.add(shift_ts_list[-i-1])

except:

raise ValueError('What you input is not pd.Series type!')

tmp_data.dropna(inplace=True)

return tmp_data

# 模型调优

def proper_model(data_ts, maxLag):

import sys

init_bic = sys.maxsize

init_p = 0

init_q = 0

init_properModel = None

for p in np.arange(maxLag):

for q in np.arange(maxLag):

model = ARMA(data_ts, order=(p, q))

try:

results_ARMA = model.fit(disp=-1, method='css')

except:

continue

bic = results_ARMA.bic

if bic < init_bic:

init_p = p

init_q = q

init_properModel = results_ARMA

init_bic = bic

print("最优模型的BIC为:{};p为:{};q为:{}".format(init_bic, init_p, init_q))

return init_bic, init_p, init_q, init_properModel

diffed_ts = diff_ts(ts_log, d=[12, 1])

bic, p, q, properModel = proper_model(diffed_ts, 3)

predict_ts = properModel.predict()

diff_recover_ts = predict_diff_recover(predict_ts, d=[12, 1])

log_recover = np.exp(diff_recover_ts)

[6.0330862217988015]

[6.0330862217988015, 0.06453852113757197]

最优模型的BIC为:-439.3965513369529;p为:0;q为:1

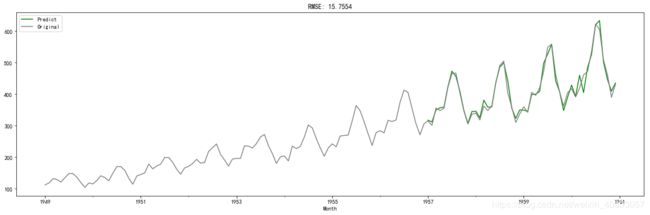

ts1 = ts[log_recover.index] # 过滤没有预测的记录

plt.figure(facecolor='white')

log_recover.plot(color='green', label='Predict')

ts1.plot(color='grey', label='Original')

plt.legend(loc='best')

plt.title('RMSE: {:.4f}'.format(np.sqrt(sum((log_recover-ts1)**2)/ts1.size)));

[外链图片转存 (img-yMDA3YDr-1562729474901)(output_122_0.png)]

(img-yMDA3YDr-1562729474901)(output_122_0.png)]

实时预测

from dateutil.relativedelta import relativedelta

def _add_new_data(ts, dat, type='day'):

if type == 'day':

new_index = ts.index[-1] + relativedelta(days=1)

elif type == 'month':

new_index = ts.index[-1] + relativedelta(months=1)

ts[new_index] = dat

def add_today_data(model, ts, data, d, type='day'):

_add_new_data(ts, data, type) # 为原始序列添加数据

# 为滞后序列添加新值

d_ts = diff_ts(ts, d)

# model.add_today_data(d_ts[-1], type)

return d_ts

def forecast_next(model,dta):

if model == None:

raise ValueError('No model fitted before')

fc = model.forecast(1)[0] # 1步预测

return predict_diff_recover(fc, [12, 1])

ts_train = ts_log[:'1956-12']

ts_test = ts_log['1957-1':]

diffed_ts = diff_ts(ts_train, [12, 1])

forecast_list = []

for i, dta in enumerate(ts_test):

if i % 7 == 0:

bic, p, q, properModel = proper_model(diffed_ts, 3)

forecast_data = forecast_next(properModel, dta)

forecast_list.append(forecast_data)

diffed_ts = add_today_data(properModel, ts_train, dta, [12, 1], type='month')

[5.648974238161206]

[5.648974238161206, 0.0959639882617438]

最优模型的BIC为:-258.1964284797439;p为:0;q为:1

[5.6240175061873385]

[5.6240175061873385, 0.10359840066442683]

[5.75890177387728]

[5.75890177387728, 0.08309275856153686]

[5.746203190540153]

[5.746203190540153, 0.11602895697475013]

[5.762051382780177]

[5.762051382780177, 0.10599928923432156]

[5.924255797414532]

[5.924255797414532, 0.11006640669523904]

[6.023447592961033]

[6.023447592961033, 0.12074951662147981]

[6.003887067106539]

[6.003887067106539, 0.11858981262632273]

最优模型的BIC为:-287.52098131248624;p为:0;q为:1

[5.872117789475416]

[5.872117789475416, 0.14244219056235874]

[5.723585101952381]

[5.723585101952381, 0.1292970884857345]

[5.602118820879701]

[5.602118820879701, 0.1257396779944786]

[5.723585101952381]

[5.723585101952381, 0.11819295572771082]

[5.752572638825633]

[5.752572638825633, 0.09352605801082348]

[5.707110264748875]

[5.707110264748875, 0.07637297878457439]

[5.87493073085203]

[5.87493073085203, 0.05494111803130153]

最优模型的BIC为:-316.12436720936176;p为:0;q为:1

[5.8522024797744745]

[5.8522024797744745, 0.016713480973741035]

[5.872117789475416]

[5.872117789475416, 0.0]

[6.045005314036012]

[6.045005314036012, 0.022285044789434494]

[6.142037405587356]

[6.142037405587356, 0.03034071705267216]

[6.1463292576688975]

[6.1463292576688975, 0.05440672220716447]

[6.0014148779611505]

[6.0014148779611505, 0.0782291716064627]

[5.849324779946859]

[5.849324779946859, 0.0]

最优模型的BIC为:-341.4698836569178;p为:0;q为:1

[5.720311776607412]

[5.720311776607412, 0.03399760854141931]

[5.817111159963204]

[5.817111159963204, 0.016260520871780315]

[5.8289456176102075]

[5.8289456176102075, 0.002971770389157413]

[5.762051382780177]

[5.762051382780177, 0.05715841383994835]

[5.8916442118257715]

[5.8916442118257715, 0.07275935428242786]

[5.8522024797744745]

[5.8522024797744745, 0.11470894777596108]

[5.8944028342648505]

[5.8944028342648505, 0.1292117314800061]

最优模型的BIC为:-368.1436197652257;p为:0;q为:1

[6.075346031088684]

[6.075346031088684, 0.1458518770125634]

[6.19644412779452]

[6.19644412779452, 0.0816329544968708]

[6.22455842927536]

[6.22455842927536, 0.1098311591534955]

[6.0014148779611505]

[6.0014148779611505, 0.10159104387973894]

[5.883322388488279]

[5.883322388488279, 0.13631217612508362]

[5.736572297479192]

[5.736572297479192, 0.12549079695431598]

[5.820082930352362]

[5.820082930352362, 0.1550719143465793]

最优模型的BIC为:-396.06450849453194;p为:0;q为:1

[5.886104031450156]

[5.886104031450156, 0.18380413675417717]

[5.834810737062605]

[5.834810737062605, 0.14698219034864568]

[6.0063531596017325]

[6.0063531596017325, 0.13389682292276106]

[5.981414211254481]

[5.981414211254481, 0.031517760320404875]

[6.040254711277414]

[6.040254711277414, 0.151983831742168]

[6.156978985585555]

[6.156978985585555, 0.11672427430814114]

[6.306275286948016]

[6.306275286948016, 0.12528776131045127]

最优模型的BIC为:-415.59182822959184;p为:0;q为:1

[6.326149473155099]

[6.326149473155099, 0.12666480579116346]

[6.137727054086234]

[6.137727054086234, 0.08073051291421507]

[6.008813185442595]

[6.008813185442595, 0.0927543934922479]

[5.8916442118257715]

[5.8916442118257715, 0.12458485755405402]

[6.003887067106539]

[6.003887067106539, 0.07450252729792073]

[6.0330862217988015]

[6.0330862217988015, 0.06453852113757197]

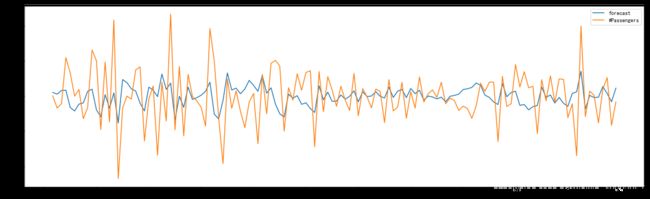

predict_ts = pd.Series(data=forecast_list, index=ts['1957-1':].index)

log_recover = np.exp(predict_ts)

# original_ts = ts['1957-1':]

ts1 = ts[log_recover.index] # 过滤没有预测的记录

plt.figure(facecolor='white')

log_recover.plot(color='green', label='Predict')

ts.plot(color='grey', label='Original')

plt.legend(loc='best')

plt.title('RMSE: {:.4f}'.format(np.sqrt(sum((log_recover-ts1)**2)/ts1.size)));

[外链图片转存 (img-PoHYPx3v-1562729474901)(output_127_0.png)]

(img-PoHYPx3v-1562729474901)(output_127_0.png)]

plt.figure(facecolor='white')

log_recover.plot(color='green', label='Predict')

ts['1957-1':].plot(color='grey', label='Original')

plt.legend(loc='best')

plt.title('RMSE: {:.4f}'.format(np.sqrt(sum((log_recover-ts1)**2)/ts1.size)));