- 数据分析--07:金融量化

十束多多良^_^

区块链概率论

데이터분석--07:재무수량화一、金融介绍1、金融2、金融工具1.期货2.黄金3.外汇4.投资基金5.股票股票的作用3、股票分类1.收益分类2.上市地区分类3.股票市场的构成4.影响股票的因素5.A股买卖4、金融分析1.基本面分析2.技术面分析5、金融量化投资1.为什么需要量化交易?2.量化交易3.量化交易的价值一、金融介绍1、金融金融就是对现有资源进行重新整合之后,实现价值和利润的等效流通。2、

- 【机器学习】————在金融市场分析方面的应用

爱吃蔬菜不挑食

人工智能

目录1.高频交易1.1概述1.2应用1.3实例2.风险管理2.1概述2.2应用2.3实例3.量化投资3.1概述3.2应用3.3实例4.情感分析4.1概述4.2应用4.3实例5.欺诈检测5.1概述5.2应用5.3实例结论金融市场分析是一项复杂且关键的任务,涉及大量的数据处理和分析。传统方法在面对海量数据和复杂模型时往往力不从心,随着技术的进步,机器学习在金融市场分析中的应用越来越广泛。本文将深入探讨

- 基于人工智能的期权量化交易

阿岛格

人工智能.量化投资人工智能机器学习大数据强化学习

基于人工智能的期权量化交易基于人工智能的期权量化交易基于人工智能的期权量化交易该文基于人工智能AI的深度强化学习,进行股票期权的量化投资策略研究及回测评估。作者建立了人工智能学习及交易系统。基于实时/历史期权行情大数据挖掘,通过自行开发的人工智能多agent强化学习模型及评估系统(基于Python/Linux),对接实时交易接口进行了实盘环境的交易回测和评估。专题:人工智能.量化投资纲要:一、前言

- 打开量化投资黑箱-v2-黑箱结构

zhaohui24

Reading量化金融其他

文章目录1.量化交易原则1.1研究宽客原因1.2何为宽客1.3量化交易系统的典型结构2.阿尔法模型2.1阿尔法模型:宽客如何盈利2.2理论驱动型阿尔法模型2.2.1基于价格数据的交易策略2.2.1.1趋势跟随策略2.2.1.2均值回复策略2.2.1.3技术情绪型策略2.2.2依托基本面数据的策略2.2.2.1价值型/收益型策略2.2.2.2成长型策略2.2.2.3品质型策略2.3数据驱动型阿尔法模

- 量化投资--量化干货分享

小丁丁_ddxdd

应用层-算法应用

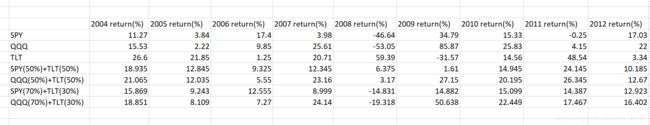

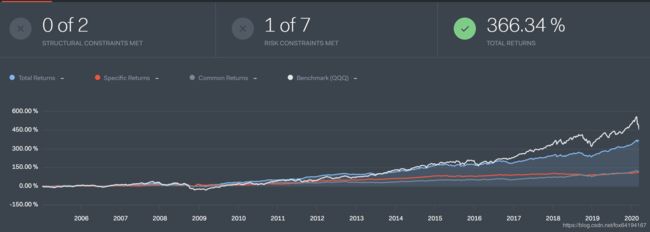

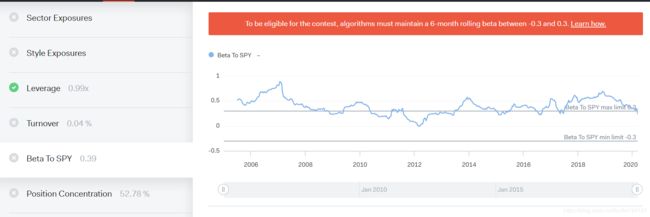

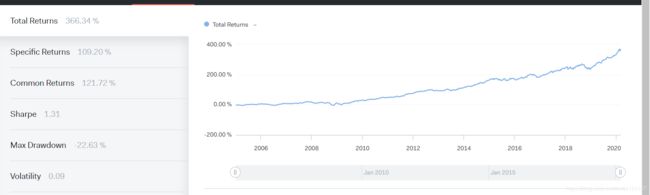

来源链接:http://blog.csdn.net/dipolar/article/details/50752839/http://www.newsmth.net/nForum/#!article/Python/128763最近程序化交易很热,量化也是我很感兴趣的一块。国内量化交易的平台有几家,我个人比较喜欢用的是JoinQuant,里面有篇干货贴分享给大家,希望对各位有帮助。==========

- 刺猬教你量化投资(十五):自行计算复权价

刺猬偷腥

以天齐锂业为例子下面我们尝试运用此前介绍的各个知识点,尝试自行计算天齐锂业的后复权及前复权价格。编写代码importpandasaspd#pd.set_option('expand_frame_repr',False)#导入行情数据df=DataAPI.MktEqudGet(secID=u"",ticker=u"002466",tradeDate=u"",beginDate=u"",endDate

- 投机和投资到底有什么区别?

hmisty

考虑量化投资这个business和开家粥店这个business,前者通常意义上叫做投机生意(speculationbusiness),后者则是投资生意(investmentbusiness)。但是,两者都是建立一个system,把钱输入到这个系统里,然后期待输出更多的钱。只是因为前者的预期回报时间更短、倍数更大吗?好像并不是。是因为前者风险高,后者风险低吗?好像也不是。本质区别是,你获取回报是导致

- 基于第一性原理投资

曹博士

图片发自App张教授打造丹华资本,致力于用第一性原理来指导风险投资。所谓第一性原理,就是基于最基本的自然法则,而且通常是可以用数学来表达并且在物理上首先验证。比如熵法则,量子原理,概率统计框架,等。不过从实际效果来看,2013起步的丹华资本,业绩很差。基本上成了反面案例。这个类似由诺贝尔经济学获奖者组建的量化投资公司长期资本,本来希望用量化的方式做套利投资,结果一个俄罗斯的黑天鹅事件,就让其折戟沉

- 指数量化投资 #36 - 指数样本股调整

JingDC

1指数样本股调整每年6月和12月,是指数定期调整样本股的时间。日前,上海证券交易所和中证指数有限公司陆续宣布2018年第一次定期调整样本股公告,大家熟知的上证50、沪深300、中证500样本股都会发生调整。其中上证50更换5只股票,沪深300更换27只,中证500更换50只,更换股票数占总样本股数比例分别为10%,9%,10%。指数样本股调整,对估值有什么影响呢?从历史上来看,在上证50的43次样

- 基于python开发的股市行情看板

weixin_34273479

python

近期股市又骚动起来,回忆起昔日炒股经历,历历在目,悲惨经历让人黯然神伤,去年共投入4000元入市,最后仅剩1000多,无奈闭关修炼,忘记股市,全身心投入代码世界,享受代码带来的乐趣。近日,当看到别人用python进行量化投资暴富的消息,顿时振奋,立刻学习起python数据分析之道,开发了一个股市行情看板,希望借python之力,早日实现财务自由,达到人生巅峰,演示地址:https://stock.

- 如何利用python在股市赚钱?我用python开发了股市行情看板

weixin_33973600

python

个人博客:mypython.me近期股市又骚动起来,回忆起昔日炒股经历,历历在目,悲惨经历让人黯然神伤,去年共投入4000元入市,最后仅剩1000多,无奈闭关修炼,忘记股市,全身心投入代码世界,享受代码带来的乐趣。近日,当看到别人用python进行量化投资暴富的消息,顿时振奋,立刻学习起python数据分析之道,开发了一个股市行情看板,希望借python之力,早日实现财务自由,达到人生巅峰,演示地

- R语言量化投资(1)

Liam_ml

R是一门非常适合做数据的工具。不用关注时间复杂度多少,怎么把程序写漂亮。而是关注如何收集数据,提高数据质量,来解决实际的业务问题。跨界是一个很难的问题,因为不同背景的人进行沟通是一个非常困难的问题,尤其是金融行业和IT行业:一个封闭不愿意分享,一个开放崇尚开源;一种所有人都要为我服务,一种只专注自己感兴趣的事情。做跨学科的事情,你要了解项目管理的方法,产品设计的逻辑,数知识,机器学习知识,结合业务

- 量化投资

华华hunter

价格扭曲是量化投资及套利的基础。先介绍几种强关联性品种,以及对应的关系。如果A是一只股票,则其对应的强关联品种B包括:A对应的可转换债券、A对应的权证、A对应的B股、A对应的H股、持有大量A股票的基金、持有大量A股票的股票。如果A是一只债券,则其对应的强关联品种B包括:持有大量A的基金;和A债券存续时间接近,信用等级接近的债券。价格扭曲通常是指强关联性的A和B之间出现了价格扭曲。强关联性的A和B之

- 持续积累分享金融知识

最笨的羊羊

日常分享专栏金融

持续积累分享金融知识一、什么是两融余额?二、什么是量化?三、散户可以进行量化投资么?一、什么是两融余额?两融余额是指投资者在融资买入和融券卖出交易中,通过向券商借入资金或证券进行交易,并且在交易结算后未归还的资金或证券的余额。融资买入是指投资者以自己的资金和借来的资金合并进行证券买入的交易方式,而融券卖出是指投资者借入证券并卖出,待价格下跌后再回购还给券商的交易方式。两融余额是一个反映投资者融资交

- 股票量化因子学习

zmjames2000

stock股票因子stock股票

看到一篇博客文章,里面阐述了很多股票的量化因子,学习了一番,但是解释的不是很细,我之后又详细查询了很多,形成了这篇文章,特此记录一下,为自己和后来人查询使用。最近在看《量化投资数据挖掘技术与实践(MATLAB版)》。学习了其中的常见的股票衍生变量,并且利用WIND金融数据终端的matlab借口windmatlab导出一些数据进行了一个简单的学习。特此记录。移动平均线移动平均线,MovingAver

- 碾压华尔街,GPT-4 选股收益超 40%

夕小瑶

人工智能

你是否想过,有朝一日利用GPT-4的决策在股市中进行量化投资?GPT-4具有先进的自然语言理解能力,可以分析大量的金融数据、市场新闻和公司信息。当它与传统的量化投资方式相结合,这意味着投资者可以借助GPT-4强大的NLP能力,深入挖掘股票市场,全面了解公司业绩、市场动态和宏观经济因素。当AI与量化投资技术组合起来,将会创造出怎样的投资决策呢?近期有篇文章研究了这个问题,他们提出了MarketSen

- whale-quant【01_投资与量化投资】(学习与笔记)

王多头发

区块链人工智能大数据

本文整体来自datawhale_whale-quant内容的学习,在基础上加了自己的总结与补充。后续将会补充笔记。内容质量很高,喜欢的盆友请给github项目点一个strar以鼓励!datawhalechina/whale-quant:本项目为量化开源课程,可以帮助人们快速掌握量化金融知识以及使用Python进行量化开发的能力。(github.com)前言:01_投资与量化投资目录1.1什么是投资

- 202401 whale-quant组队学习task01

chloe_tu

学习

Notebook环境配置试了一通还是有报错==目前requirements:tushare==1.3.7pandas==2.1.4numpy==1.26.3matplotlib==3.8.2明天尝试pandas==1.1.3numpy==1.19.5Chapter01投资与量化投资量化交易是指通过数量化的方式并使用计算机程序发出买卖指令,以获取稳定收益为目的的交易方式。通过客观的数学模型替代人为的

- 短线股票的特点介绍及短线股票买入指标

短线交易秘诀

短线股票的炒作,需要掌握很多基本的东西,并不仅仅是买入卖出那么简单。下面为你介绍一下短线股票的特点介绍以及短线股票买入指标,如果想要了解更多短线股票方面的知识,敬请关注QR量化投资社区,下面让我们了解一下短线股票方面的知识吧!短线股票的特点介绍?短炒的对象一定是有主力介入的,而主力有两种类型,一种是中期运作的主力。短线股票的特点介绍:这类主力运作的背景是公司有成长性的期望而且估值有优势,不过这种类

- 股票程序化交易-QMT入门系列(1)-QMT前期安装准备

秋天的落雨

股票程序化交易-QMT入门系列pythonmysql

目录一、QMT简介二、QMT安装包获取及下载三、python安装及配置四、QMT安装及注意事项一、QMT简介极速策略交易系统QMT是专门为机构、活跃投资者、高净值客户等专业投资者研发的智能量化交易终端,拥有高速行情、极速交易、策略交易、多维度风控等专业功能,满足专业投资者的特殊交易需求。适用人群:投资标的多,交易活跃;资金量大,换手率高,;有量化基础或者专业量化投资者。QMT系统与其他普通股票软件

- GPT-4 的决策在股市中进行量化投资

AI知识图谱大本营

大模型人工智能

论文题目:CanLargeLanguageModelsBeatWallStreet?UnveilingthePotentialofAIinStockSelection论文链接:https://arxiv.org/abs/2401.03737博客地址:https://www.marketsense-ai.com/从本质上来说,股票选择是个价格发现机制,在股票投资中,市场参与者通过理解和使用各种信息做

- whale-quant 学习 part1:投资与量化投资

朔漠君

-----量化投资-----学习人工智能自动化python量化投资

投资与量化投资什么是投资投资的分类金融投资个人投资者投资品种投资-投机常见的股票投资分析流派什么是量化投资量化投资的优势量化投资的主要风险量化投资的历史发展**量化投资的一般流程常见量化投资平台参考什么是投资从经济学的广泛意义上讲,投资是为了获得一定的预期社会经济效益而进行的资金或资本物的投入及其活动过程。投资的分类实物投资或实物资产投资实物资产,又称实质资产或者有形资产,是以实物体形态存在的资产

- 基于Python的指数基金量化投资 - 指数的市盈率和市净率计算

小将前行

上一篇《基于Python的指数基金量化投资-通过市盈率和市净率对指数估值》介绍了通过市盈率和市净率对指数进行估值,然后结合具体的估值百分位来进行投资。所以指数的市盈率和市净率是两个非常重要的指标。这里就会有个问题,指数的市盈率和市净率怎么进行计算,指数不像个股,个股的市盈率计算起来比较简单:同样个股的市净率计算也比较简单:而指数是一篮子股票,例如沪深300就包含了300家上市公司,中证500包含了

- 指数量化投资 #58 - 11.11看消费指数

JingDC

1又是一年双十一,今天买买买的人只多不少,某宝某东继续捷报频传。各位大买家除了给某宝某东贡献业绩之外,也为我国的消费行业发展做出不少贡献,也不知道今天的捷报能否让明天的消费指数高开高走。今天找点时间查了消费指数的一些数据,供有兴趣的同学参考。按照国证行业分类,一级行业中有两个消费行业:主要消费和可选消费。主要消费行业是指日常生活中最基本、最必要的消费,基本上不受经济周期波动影响。可选消费行业是除了

- 1个月超10万用户,币氪App要做区块链量化投资界的权威

币氪

投资是一门学问,对于区块链领域的加密货币投资更是如此。但加密货币所背靠的项目参差不齐,项目本身的各类风险和潜在的投资机会并存。对于普通投资者而言,获得收益是最简单直接的述求,而如何让述求得到满足,是行业一直存在的痛点。我们近期接触到的币氪,就是这样一个团队——希望通过专业的数据分析和量化策略,解决传统行情资讯分析工具所解决不到的问题:内容理解难度大,风险预估不明等。针对这一问题,币氪的解决方式有两

- 消息走漏提前做空腾讯爆赚30倍?逐帧分析还原真相

数量技术宅

量化量化交易python

数量技术宅团队在CSDN学院推出了量化投资系列课程欢迎有兴趣系统学习量化投资的同学,点击下方链接报名:量化投资速成营(入门课程)Python股票量化投资Python期货量化投资Python数字货币量化投资C++语言CTP期货交易系统开发数字货币JavaScript语言量化交易系统开发12月22日,国家新闻出版署发布《网络游戏管理办法(草案征求意见稿)》。其中提到,网络游戏不得设置每日登录、首次充值

- 基于霍克斯过程的限价订单簿模型下的深度强化学习做市策略

数量技术宅

python人工智能量化交易量化

数量技术宅团队在CSDN学院推出了量化投资系列课程欢迎有兴趣系统学习量化投资的同学,点击下方链接报名:量化投资速成营(入门课程)Python股票量化投资Python期货量化投资Python数字货币量化投资C++语言CTP期货交易系统开发数字货币JavaScript语言量化交易系统开发相关研究总述最优做市(MM)是在限价订单簿(LOB)的两侧同时下达买订单和卖订单的问题,目的是最大化交易者的最终收益

- VWAP 订单的最佳执行方法:随机控制法

数量技术宅

量化交易量化人工智能大数据python

数量技术宅团队在CSDN学院推出了量化投资系列课程欢迎有兴趣系统学习量化投资的同学,点击下方链接报名:量化投资速成营(入门课程)Python股票量化投资Python期货量化投资Python数字货币量化投资C++语言CTP期货交易系统开发数字货币JavaScript语言量化交易系统开发引言:相关研究在当今的投资领域,算法交易正迅速成为客户获取和清算股票头寸的首选方法。通常,被委托者会根据客户选择的基

- 最优订单执行算法相关论文介绍

数量技术宅

算法python量化交易量化人工智能

数量技术宅团队在CSDN学院推出了量化投资系列课程欢迎有兴趣系统学习量化投资的同学,点击下方链接报名:量化投资速成营(入门课程)Python股票量化投资Python期货量化投资Python数字货币量化投资C++语言CTP期货交易系统开发数字货币JavaScript语言量化交易系统开发随着量化交易、高频交易的竞争日益激烈,事实证明,交易执行显着影响量化策略的投资绩效。因此,许多从业者开始将交易执行视

- 关于自然科学研究与量化投资研究的关系

IFT星星之火

表现优秀的宽客共有的一个特征是,进行研究时遵循科学的方法(scientificmethod),当然也是其他研究领域研究的方法。这是非常重要的,因为科学的方法使得整个量化交易过程中重要的判断更严谨与更有纪律性。如果不严谨,宽客很容易因为痴心妄想和情绪化误入歧途而丧失逻辑一致性,而逻辑一致性在许多科学领域都有助于科学研究。第一,科学方法开始于科学家所观察的世界具有可解释性的事物。换句话说,科学家在所观

- Java实现的简单双向Map,支持重复Value

superlxw1234

java双向map

关键字:Java双向Map、DualHashBidiMap

有个需求,需要根据即时修改Map结构中的Value值,比如,将Map中所有value=V1的记录改成value=V2,key保持不变。

数据量比较大,遍历Map性能太差,这就需要根据Value先找到Key,然后去修改。

即:既要根据Key找Value,又要根据Value

- PL/SQL触发器基础及例子

百合不是茶

oracle数据库触发器PL/SQL编程

触发器的简介;

触发器的定义就是说某个条件成立的时候,触发器里面所定义的语句就会被自动的执行。因此触发器不需要人为的去调用,也不能调用。触发器和过程函数类似 过程函数必须要调用,

一个表中最多只能有12个触发器类型的,触发器和过程函数相似 触发器不需要调用直接执行,

触发时间:指明触发器何时执行,该值可取:

before:表示在数据库动作之前触发

- [时空与探索]穿越时空的一些问题

comsci

问题

我们还没有进行过任何数学形式上的证明,仅仅是一个猜想.....

这个猜想就是; 任何有质量的物体(哪怕只有一微克)都不可能穿越时空,该物体强行穿越时空的时候,物体的质量会与时空粒子产生反应,物体会变成暗物质,也就是说,任何物体穿越时空会变成暗物质..(暗物质就我的理

- easy ui datagrid上移下移一行

商人shang

js上移下移easyuidatagrid

/**

* 向上移动一行

*

* @param dg

* @param row

*/

function moveupRow(dg, row) {

var datagrid = $(dg);

var index = datagrid.datagrid("getRowIndex", row);

if (isFirstRow(dg, row)) {

- Java反射

oloz

反射

本人菜鸟,今天恰好有时间,写写博客,总结复习一下java反射方面的知识,欢迎大家探讨交流学习指教

首先看看java中的Class

package demo;

public class ClassTest {

/*先了解java中的Class*/

public static void main(String[] args) {

//任何一个类都

- springMVC 使用JSR-303 Validation验证

杨白白

springmvc

JSR-303是一个数据验证的规范,但是spring并没有对其进行实现,Hibernate Validator是实现了这一规范的,通过此这个实现来讲SpringMVC对JSR-303的支持。

JSR-303的校验是基于注解的,首先要把这些注解标记在需要验证的实体类的属性上或是其对应的get方法上。

登录需要验证类

public class Login {

@NotEmpty

- log4j

香水浓

log4j

log4j.rootCategory=DEBUG, STDOUT, DAILYFILE, HTML, DATABASE

#log4j.rootCategory=DEBUG, STDOUT, DAILYFILE, ROLLINGFILE, HTML

#console

log4j.appender.STDOUT=org.apache.log4j.ConsoleAppender

log4

- 使用ajax和history.pushState无刷新改变页面URL

agevs

jquery框架Ajaxhtml5chrome

表现

如果你使用chrome或者firefox等浏览器访问本博客、github.com、plus.google.com等网站时,细心的你会发现页面之间的点击是通过ajax异步请求的,同时页面的URL发生了了改变。并且能够很好的支持浏览器前进和后退。

是什么有这么强大的功能呢?

HTML5里引用了新的API,history.pushState和history.replaceState,就是通过

- centos中文乱码

AILIKES

centosOSssh

一、CentOS系统访问 g.cn ,发现中文乱码。

于是用以前的方式:yum -y install fonts-chinese

CentOS系统安装后,还是不能显示中文字体。我使用 gedit 编辑源码,其中文注释也为乱码。

后来,终于找到以下方法可以解决,需要两个中文支持的包:

fonts-chinese-3.02-12.

- 触发器

baalwolf

触发器

触发器(trigger):监视某种情况,并触发某种操作。

触发器创建语法四要素:1.监视地点(table) 2.监视事件(insert/update/delete) 3.触发时间(after/before) 4.触发事件(insert/update/delete)

语法:

create trigger triggerName

after/before

- JS正则表达式的i m g

bijian1013

JavaScript正则表达式

g:表示全局(global)模式,即模式将被应用于所有字符串,而非在发现第一个匹配项时立即停止。 i:表示不区分大小写(case-insensitive)模式,即在确定匹配项时忽略模式与字符串的大小写。 m:表示

- HTML5模式和Hashbang模式

bijian1013

JavaScriptAngularJSHashbang模式HTML5模式

我们可以用$locationProvider来配置$location服务(可以采用注入的方式,就像AngularJS中其他所有东西一样)。这里provider的两个参数很有意思,介绍如下。

html5Mode

一个布尔值,标识$location服务是否运行在HTML5模式下。

ha

- [Maven学习笔记六]Maven生命周期

bit1129

maven

从mvn test的输出开始说起

当我们在user-core中执行mvn test时,执行的输出如下:

/software/devsoftware/jdk1.7.0_55/bin/java -Dmaven.home=/software/devsoftware/apache-maven-3.2.1 -Dclassworlds.conf=/software/devs

- 【Hadoop七】基于Yarn的Hadoop Map Reduce容错

bit1129

hadoop

运行于Yarn的Map Reduce作业,可能发生失败的点包括

Task Failure

Application Master Failure

Node Manager Failure

Resource Manager Failure

1. Task Failure

任务执行过程中产生的异常和JVM的意外终止会汇报给Application Master。僵死的任务也会被A

- 记一次数据推送的异常解决端口解决

ronin47

记一次数据推送的异常解决

需求:从db获取数据然后推送到B

程序开发完成,上jboss,刚开始报了很多错,逐一解决,可最后显示连接不到数据库。机房的同事说可以ping 通。

自已画了个图,逐一排除,把linux 防火墙 和 setenforce 设置最低。

service iptables stop

- 巧用视错觉-UI更有趣

brotherlamp

UIui视频ui教程ui自学ui资料

我们每个人在生活中都曾感受过视错觉(optical illusion)的魅力。

视错觉现象是双眼跟我们开的一个玩笑,而我们往往还心甘情愿地接受我们看到的假象。其实不止如此,视觉错现象的背后还有一个重要的科学原理——格式塔原理。

格式塔原理解释了人们如何以视觉方式感觉物体,以及图像的结构,视角,大小等要素是如何影响我们的视觉的。

在下面这篇文章中,我们首先会简单介绍一下格式塔原理中的基本概念,

- 线段树-poj1177-N个矩形求边长(离散化+扫描线)

bylijinnan

数据结构算法线段树

package com.ljn.base;

import java.util.Arrays;

import java.util.Comparator;

import java.util.Set;

import java.util.TreeSet;

/**

* POJ 1177 (线段树+离散化+扫描线),题目链接为http://poj.org/problem?id=1177

- HTTP协议详解

chicony

http协议

引言

- Scala设计模式

chenchao051

设计模式scala

Scala设计模式

我的话: 在国外网站上看到一篇文章,里面详细描述了很多设计模式,并且用Java及Scala两种语言描述,清晰的让我们看到各种常规的设计模式,在Scala中是如何在语言特性层面直接支持的。基于文章很nice,我利用今天的空闲时间将其翻译,希望大家能一起学习,讨论。翻译

- 安装mysql

daizj

mysql安装

安装mysql

(1)删除linux上已经安装的mysql相关库信息。rpm -e xxxxxxx --nodeps (强制删除)

执行命令rpm -qa |grep mysql 检查是否删除干净

(2)执行命令 rpm -i MySQL-server-5.5.31-2.el

- HTTP状态码大全

dcj3sjt126com

http状态码

完整的 HTTP 1.1规范说明书来自于RFC 2616,你可以在http://www.talentdigger.cn/home/link.php?url=d3d3LnJmYy1lZGl0b3Iub3JnLw%3D%3D在线查阅。HTTP 1.1的状态码被标记为新特性,因为许多浏览器只支持 HTTP 1.0。你应只把状态码发送给支持 HTTP 1.1的客户端,支持协议版本可以通过调用request

- asihttprequest上传图片

dcj3sjt126com

ASIHTTPRequest

NSURL *url =@"yourURL";

ASIFormDataRequest*currentRequest =[ASIFormDataRequest requestWithURL:url];

[currentRequest setPostFormat:ASIMultipartFormDataPostFormat];[currentRequest se

- C语言中,关键字static的作用

e200702084

C++cC#

在C语言中,关键字static有三个明显的作用:

1)在函数体,局部的static变量。生存期为程序的整个生命周期,(它存活多长时间);作用域却在函数体内(它在什么地方能被访问(空间))。

一个被声明为静态的变量在这一函数被调用过程中维持其值不变。因为它分配在静态存储区,函数调用结束后并不释放单元,但是在其它的作用域的无法访问。当再次调用这个函数时,这个局部的静态变量还存活,而且用在它的访

- win7/8使用curl

geeksun

win7

1. WIN7/8下要使用curl,需要下载curl-7.20.0-win64-ssl-sspi.zip和Win64OpenSSL_Light-1_0_2d.exe。 下载地址:

http://curl.haxx.se/download.html 请选择不带SSL的版本,否则还需要安装SSL的支持包 2. 可以给Windows增加c

- Creating a Shared Repository; Users Sharing The Repository

hongtoushizi

git

转载自:

http://www.gitguys.com/topics/creating-a-shared-repository-users-sharing-the-repository/ Commands discussed in this section:

git init –bare

git clone

git remote

git pull

git p

- Java实现字符串反转的8种或9种方法

Josh_Persistence

异或反转递归反转二分交换反转java字符串反转栈反转

注:对于第7种使用异或的方式来实现字符串的反转,如果不太看得明白的,可以参照另一篇博客:

http://josh-persistence.iteye.com/blog/2205768

/**

*

*/

package com.wsheng.aggregator.algorithm.string;

import java.util.Stack;

/**

- 代码实现任意容量倒水问题

home198979

PHP算法倒水

形象化设计模式实战 HELLO!架构 redis命令源码解析

倒水问题:有两个杯子,一个A升,一个B升,水有无限多,现要求利用这两杯子装C

- Druid datasource

zhb8015

druid

推荐大家使用数据库连接池 DruidDataSource. http://code.alibabatech.com/wiki/display/Druid/DruidDataSource DruidDataSource经过阿里巴巴数百个应用一年多生产环境运行验证,稳定可靠。 它最重要的特点是:监控、扩展和性能。 下载和Maven配置看这里: http

- 两种启动监听器ApplicationListener和ServletContextListener

spjich

javaspring框架

引言:有时候需要在项目初始化的时候进行一系列工作,比如初始化一个线程池,初始化配置文件,初始化缓存等等,这时候就需要用到启动监听器,下面分别介绍一下两种常用的项目启动监听器

ServletContextListener

特点: 依赖于sevlet容器,需要配置web.xml

使用方法:

public class StartListener implements

- JavaScript Rounding Methods of the Math object

何不笑

JavaScriptMath

The next group of methods has to do with rounding decimal values into integers. Three methods — Math.ceil(), Math.floor(), and Math.round() — handle rounding in differen