时序分析(8) -- GARCH(p,q)模型

时序分析(8)

GARCH(p,q)模型

上篇文章我们探讨了ARCH模型对时序数据的波动性进行建模和预测,本篇文章介绍GARCH模型。 首先我们介绍GARCH模型的基本概念:

Generalized Autoregressive Conditionally Heteroskedastic Models - GARCH(p,q)

简单来说,GARCH模型就是ARMA模型应用在时序的方差上,它包含一个自回归项和一个移动平均项.

如果时序数据 { y t } \{y_t\} {yt}可以表示为

y t = σ t w t y_t=\sigma_t w_t yt=σtwt

其中 { w t } \{w_t\} {wt}是高斯白噪声,均值为0,方差为1,这里 σ t \sigma_t σt为

σ t 2 = α 0 + ∑ i = 1 q α i y t − i 2 + ∑ j = 1 p β j σ t − j 2 \sigma_t^2=\alpha_0+\sum_{i=1}^{q}\alpha_iy_{t-i}^2+\sum_{j=1}^{p}\beta_j\sigma_{t-j}^2 σt2=α0+i=1∑qαiyt−i2+j=1∑pβjσt−j2

让我们先从简单做起,考虑GARCH(1,1)模型

y t = σ t w t y_t=\sigma_tw_t yt=σtwt

σ t 2 = α 0 + α 1 y t − 1 2 + β 1 σ t − 1 2 \sigma_t^2=\alpha_0+\alpha_1y_{t-1}^2+\beta_1\sigma_{t-1}^2 σt2=α0+α1yt−12+β1σt−12

注意:这里 α 1 + β 1 < 1 \alpha_1+\beta_1 \lt 1 α1+β1<1,否则时序将会不稳定。

导入python包和数据

如前一样

我们先模拟一个GARCH(1,1)时序

# Simulating a GARCH(1, 1) process

np.random.seed(2)

a0 = 0.2

a1 = 0.5

b1 = 0.3

n = 10000

w = np.random.normal(size=n)

y = np.zeros_like(w)

sigsq = np.zeros_like(w)

for i in range(1, n):

sigsq[i] = a0 + a1*(y[i-1]**2) + b1*sigsq[i-1]

y[i] = w[i] * np.sqrt(sigsq[i])

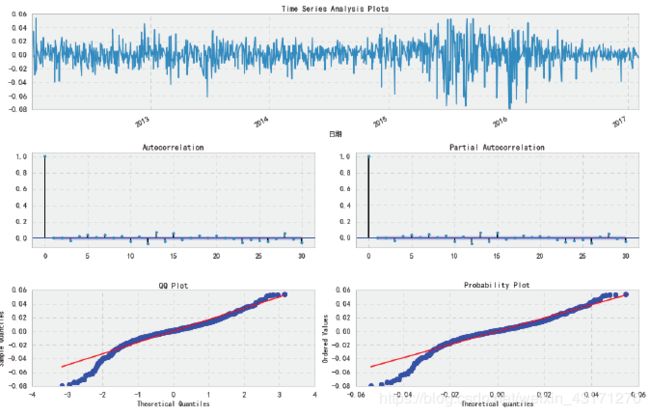

_ = tsplot(y, lags=30)

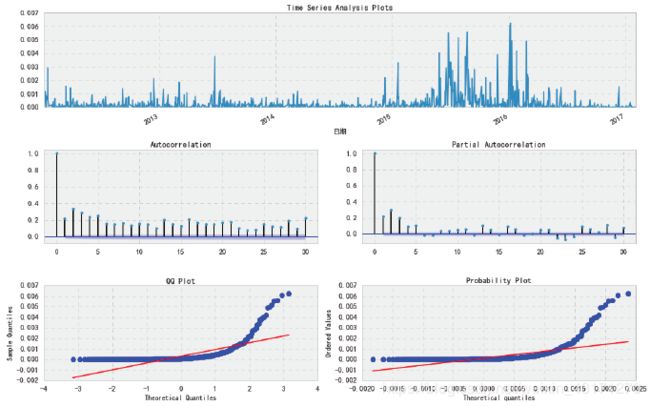

模拟时序的平方

tsplot(y*y, lags=30)

从ACF,PACF中显示出显著自相关性,我们需要AR项和MA项。

我们尝试是否可以通过模型拟合来得到模拟的参数。

# Fit a GARCH(1, 1) model to our simulated EPS series

# We use the arch_model function from the ARCH package

am = arch_model(y)

res = am.fit(update_freq=5)

print(res.summary())

模拟数据GARCH残差plot

_ = tsplot(res.resid, lags=30)

以GARCH建模国内股票收益率

步骤如下:

- 以ARIMA模型迭代得到最佳参数。

- 以ARIMA模型所得到地具备最低AIC的参数来选择GARCH模型。

- 使GARCH模型适配时序数据。

- 检查模型残差和残差平方的自相关性。

def _get_best_model(TS):

best_aic = np.inf

best_order = None

best_mdl = None

pq_rng = range(5) # [0,1,2,3,4]

d_rng = range(2) # [0,1]

for i in pq_rng:

for d in d_rng:

for j in pq_rng:

try:

tmp_mdl = smt.ARIMA(TS, order=(i,d,j)).fit(

method='mle', trend='nc'

)

tmp_aic = tmp_mdl.aic

if tmp_aic < best_aic:

best_aic = tmp_aic

best_order = (i, d, j)

best_mdl = tmp_mdl

except: continue

print('aic: {:6.5f} | order: {}'.format(best_aic, best_order))

return best_aic, best_order, best_mdl

# Notice I've selected a specific time period to run this analysis

TS = indexs_logret['国内股票']

res_tup = _get_best_model(TS)

aic: -6601.86081 | order: (3, 0, 2)

得到p,d,q = 3,0,2

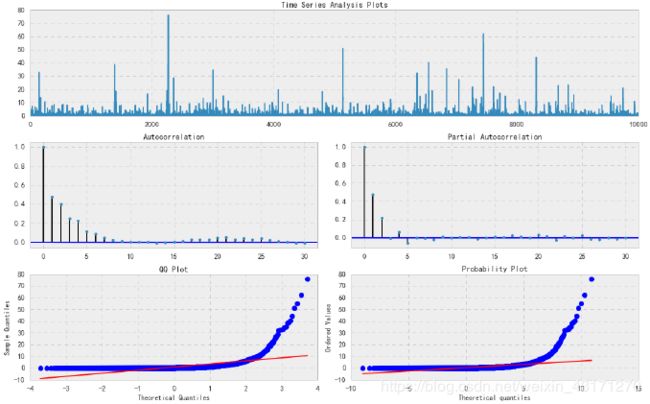

残差Plot

_ = tsplot(res_tup[2].resid, lags=30)

残差平方

_ = tsplot(res_tup[2].resid**2, lags=30)

拟合GARCH模型

order = [3,0,2]

p_ = order[0]

o_ = order[1]

q_ = order[2]

# Using student T distribution usually provides better fit

am = arch_model(10*TS, p=p_, o=o_, q=q_, dist='StudentsT')

res = am.fit(update_freq=5, disp='off')

print(res.summary())

_ = tsplot(res.resid, lags=30)

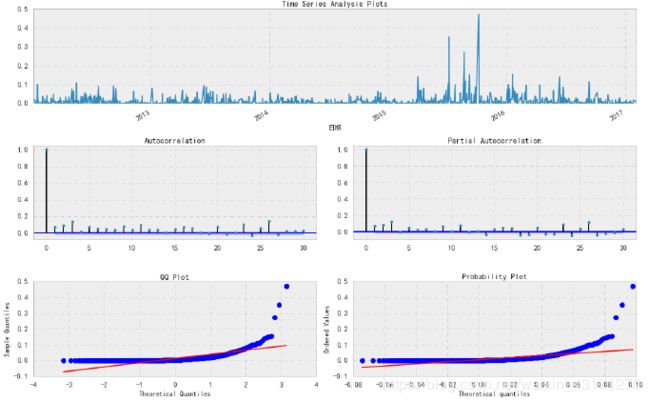

香港股票收益率GARCH拟合

过程同上

aic: -1958.01617 | order: (2, 0, 2)

得到p,d,q=2,0,2

残差Plot

残差平方Plot

拟合GARCH模型

order = [2,0,2]

p_ = order[0]

o_ = order[1]

q_ = order[2]

# Using student T distribution usually provides better fit

am = arch_model(10*TS, p=p_, o=o_, q=q_, dist='StudentsT')

res = am.fit(update_freq=5, disp='off')

print(res.summary())

总结

本文展示了采用Python语言为指数时序数据进行GARCH建模,并介绍了GARCH模型的基本概念。